Category Archive: 5.) Charles Hugh Smith

The Black Swan Is a Drone

What was "possible" yesterday is now a low-cost proven capability, and the consequences are far from predictable. Predictably, the mainstream media is serving up heaping portions of reassurances that the drone attacks on Saudi oil facilities are no big deal and full production will resume shortly.

Read More »

Read More »

What a Relief that the U.S. and Global Economies Are Booming

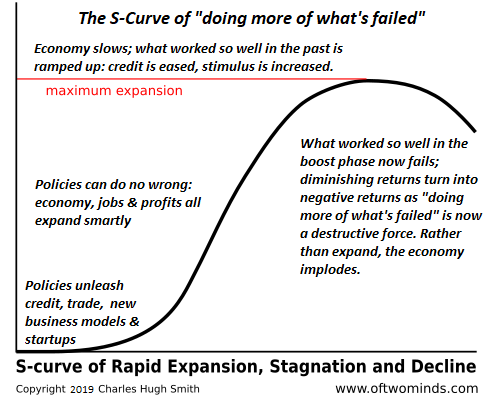

Doing more of what's failed for ten years will finally fail spectacularly.. It was a huge relief to see the charts of the Baltic Dry Index (BDI) and the U.S. retail sector ETF (RTH): both have soared to the moon, signaling that both the U.S. and global economies are booming: the BDI is widely regarded as a proxy for global shipping, which is a proxy for global trade and economic activity.

Read More »

Read More »

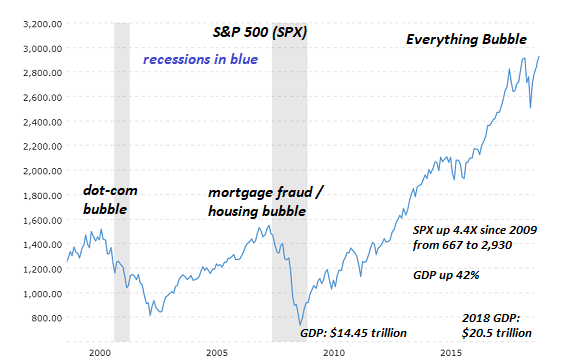

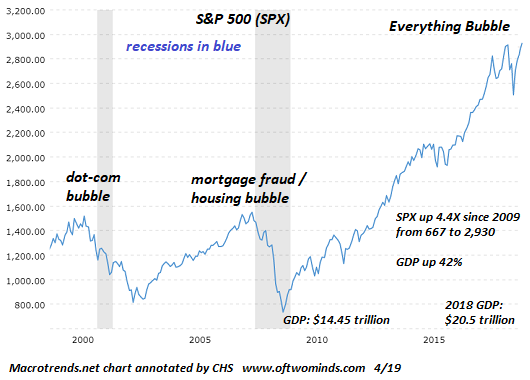

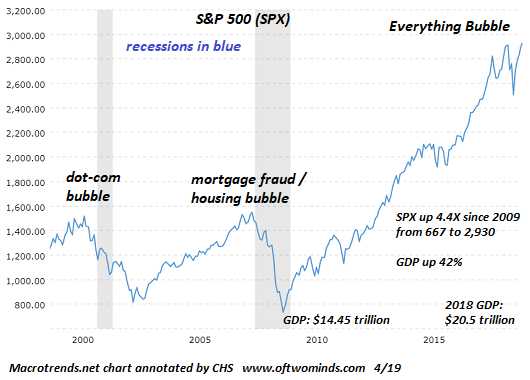

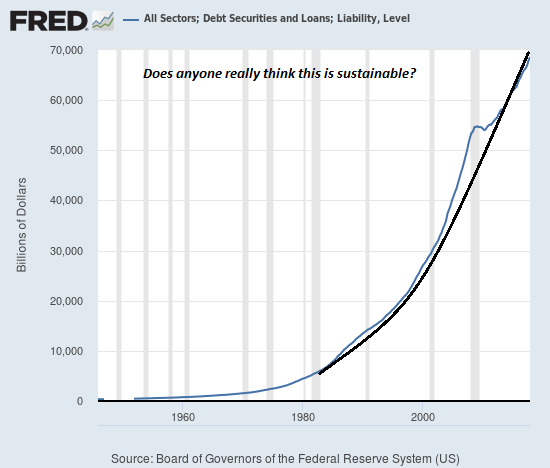

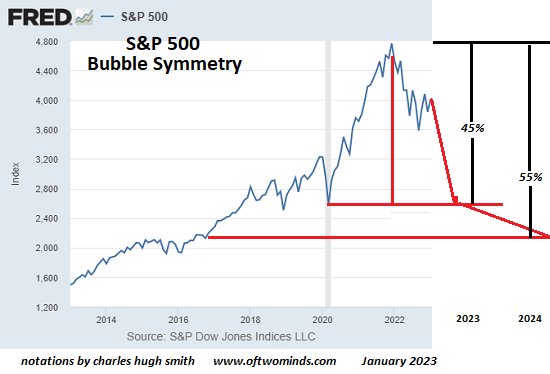

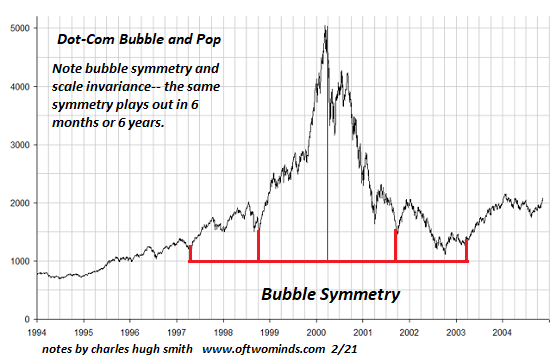

The Inevitable Bursting of Our Bubble Economy

All of America's bubbles will pop, and sooner rather than later. Financial bubbles manifest three dynamics: the one we're most familiar with is human greed, the desire to exploit a windfall and catch a work-free ride to riches. The second dynamic gets much less attention: financial manias arise when there is no other more productive, profitable use for capital, and these periods occur when there is an abundance of credit available to inflate the...

Read More »

Read More »

The Era Of Central Banks Pushing The Economy Forward Is Ending w/ Charles Hugh Smith

Thanks for watching this Silver Doctors Interview. Share your thoughts below and make sure to click the subscribe button to join the Silver Doctors Community. Today’s guest, Charles Hugh Smith, shares his thoughts on how capitalism as we have know it is being challenge. During our discussion he shares his thoughts on how monetary policy …

Read More »

Read More »

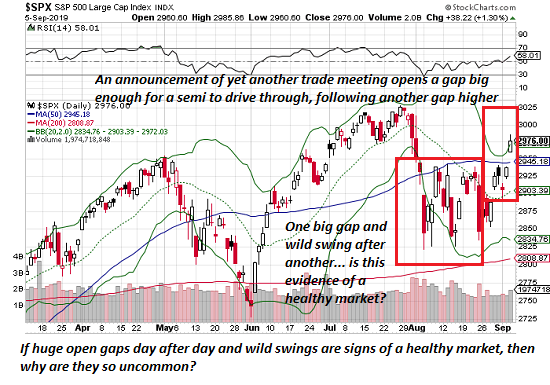

These Are Not Signs of a Healthy Market

The implicit narrative of the latest rally in stocks is that this is just another normal rally in the ongoing 10-year long Bull market. Nice, but do these three charts look "normal" to you? Let's take a quick glance at a daily chart of the S&P 500 (SPX), a weekly chart of TLT, the exchange-traded fund of the US Treasury 20-year bond, and silver.

Read More »

Read More »

CHARLES HUGH SMITH – Having A Recession Is Healthy For Us

SUBSCRIBE For The Latest Issues About ; #FINANCIAL CRISIS #OIL PRICE #PETROL #GLOBAL ECONOMIC COLLAPSE #DOLLAR COLLAPSE #GOLD #SILVER #BITCOIN #ETHERIUM #CRYPTOCURRENCY #LITECOIN #FINANCIAL CRASH #GLOBAL RESET #FINANCIAL CRISIS #ECONOMIC COLLAPSE #NYSE #NASDAQ

Read More »

Read More »

Will Everything Change in 2020-2025 or Will Nothing Change?

Any domino-like expanding crisis will unfold in a status quo lacking any coherent response. Longtime readers know I've often referenced The Fourth Turning, the book that makes the case for an 80-year cycle of existential crisis in U.S. history.

Read More »

Read More »

Labor Day Reflections on Retirement and Working for 49 Years

What happens when these monstrous speculative bubbles pop? Let's start by stipulating that if I'd taken a gummit job right out of college, I could have retired 19 years ago. Instead, I've been self-employed for most of the 49 years I've been working, and I'm still grinding it out at 65.

Read More »

Read More »

Dear Trump Advisors: Prop the Market Up Now and Lose in 2020, or Let the Market Crash and Win in 2020

One of the more reliable truisms is that Americans vote their pocketbook: if their wallets are being thinned (by recession, stock market declines, high inflation/stagnant wages, etc.), they throw the incumbent out, even if they loved him the previous year when their wallets were getting fatter. (Think Bush I, who maintained high approval ratings but ended up losing the 1992 election due to a dismal economic mood.)

Read More »

Read More »

The Fantasy of Central Bank “Growth” Is Finally Imploding

It was such a wonderful fantasy: just give a handful of bankers, financiers and corporations trillions of dollars at near-zero rates of interest, and this flood of credit and cash into the apex of the wealth-power pyramid would magically generate a new round of investments in productivity-improving infrastructure and equipment, which would trickle down to the masses in the form of higher wages, enabling the masses to borrow and spend more on...

Read More »

Read More »

The Benefits of a Profoundly Shattering Recession

Does anyone really think The Everything Bubble can just keep inflating forever? What do I mean by a profoundly shattering recession? I mean, a systemic, crushing recession that can't be reversed with central bank magic, a recession that only deepens with time. The last real recession was roughly two generations ago in 1981; younger generations have no experience of a profound recession, and perhaps older folks have forgotten the shock, angst and...

Read More »

Read More »

WARNING!?Charles Hugh Smith: We’re seeing a general uprising against the neo-liberal elites

WARNING!?Charles Hugh Smith: We’re seeing a general uprising against the neo-liberal elites WARNING!?Charles Hugh Smith: We’re seeing a general uprising against the neo-liberal elites WARNING!?Charles Hugh Smith: We’re seeing a general uprising against the neo-liberal elites...

Read More »

Read More »

Charles Hugh Smith on Advice for Millennials: Low Cost Education and Where the Jobs Are!

Charles Hugh Smith on Advice for Millennials: Low Cost Education, Affordable Housing and Where the Jobs Are! Click here for the full transcript: http://financialrepressionauthority.com/2019/08/22/the-roundtable-insight-charles-hugh-smith-on-advice-for-millennials-low-cost-education-affordable-housing-and-where-the-jobs-are/

Read More »

Read More »

Our Wile E. Coyote Federal Reserve

Whatever the Fed chooses to do, it's already failed.. Wile E. Coyote has gotten a bad rap: in all fairness, his schemes are ingenious, if overly complicated, and it's not his fault that the Acme detonator misfires or the Road Runner doesn't respond as predicted. Every set-up to nail the Road Runner should work. That it fails and leaves him suspended over the cliff for a woefully brief second to intuit his impending doom really isn't his fault.

Read More »

Read More »

Market Huddle Episode 41: Harry McLovin (guest: Charles Hugh Smith)

To receive our emails with the charts and links each week, please register at: https://markethuddle.com/ In episode #41, Patrick Ceresna and Kevin Muir welcome Charles Hugh Smith to the show to talk about negative interest rates and Charles explains why the past is not a guide. Then more on the hot topic: GE fraud. Fast …

Read More »

Read More »

Charles Hugh Smith Parallels Between The Decline of the Roman Empire and America

Here’s an excellent analysis for any history enthusiast on the comparison between the Roman empire in decline and the American empire.

Read More »

Read More »

The Internal War in the Deep State Claims Its High Profile Casualty: Jeffrey Epstein

The "traditionalist" Neocons are going to have to decide to fish or cut bait. I've been writing about the fracturing Deep State for the past five years: The conflict has now reached the hot-war stage where bodies are turning up, explained away by the usual laughable covers: "suicide," "accident" and "heart attack." That Jeffrey Epstein's death in a secure cell is being labeled "suicide" tells us quite a lot about the desperation of the faction...

Read More »

Read More »

The Gulag of the Mind

Befuddled and blind, we wander toward the cliff without even seeing it, focusing on our little screens of entertainment and self-absorption. There are no physical barriers in the Gulag of the Mind--we imprison ourselves, and love our servitude. Indeed, we fear the world outside our internalized gulag, because we've absorbed the narrative that the gulag is secure and permanent.

Read More »

Read More »

Nothing Is Guaranteed

There are no guarantees, no matter how monumental the hubris and confidence. The American lifestyle and economy depend on a vast number of implicit guarantees-- systemic forms of entitlement that we implicitly feel are our birthright. Chief among these implicit entitlements is the Federal Reserve can always "save the day": the Fed has the tools to escape either an inflationary spiral or a deflationary collapse.

Read More »

Read More »