Category Archive: 6c) Crypto Currencies English

Eurex Launches Ether Derivatives

Eurex expands its crypto derivatives portfolio with the launch of FTSE Ethereum Index Futures and Options as of 12 August 2024. Following the launch of FTSE Bitcoin Index Futures and Options in 2023, this is another major milestone in Eurex’s ambition to offer secure access to cryptocurrencies in a regulated market environment.

Read More »

Read More »

Maerki Baumann Cooperates With Bitcoin Suisse

The Zurich-based private bank Maerki Baumann has entered into a cooperation with Bitcoin Suisse. The collaboration will allow the private bank to utilize the proven crypto expertise of Bitcoin Suisse in managing its crypto investment solutions, and to expand its existing offering in the area of digital assets under the “ARCHIP” brand.

Read More »

Read More »

Robinhood to Acquire Bitstamp For $200 Million in Cash

Robinhood has entered into an agreement to acquire Bitstamp, a global cryptocurrency exchange. Bitstamp was founded in 2011 and has offices in Luxembourg, the UK, Slovenia, Singapore, and the US.

Acquiring a global exchange will significantly accelerate Robinhood Crypto’s expansion worldwide. Bitstamp holds over 50 active licenses and registrations globally and will bring in customers across the EU, UK, US and Asia to Robinhood.

This acquisition...

Read More »

Read More »

Schweizer Retailbanken im Krypto-Anlage-Fieber

Trotz breiter Skepsis, immer mehr Retailbanken bieten Kryptowährungen als vollwertige Anlageklasse an. Während einige Banken gezielt eigenes Know-how rund um Blockchain aufbauen, greifen die meisten auf Drittanbieter zurück. Dies zeigt eine neue Studie der Hochschule Luzern.

Nach Rekordwerten im Jahr 2021 und einem darauffolgenden Einbruch sind die Preise von Kryptowährungen in den letzten Monaten wieder deutlich gestiegen. Verschiedene...

Read More »

Read More »

World Bank Issues Digital Bond in Switzerland on the Blockchain

The World Bank priced the first CHF digital bond by an international issuer, which will settle using Swiss Franc wholesale Central Bank Digital Currency (wCBDC) provided by the Swiss National Bank (SNB).

This 7-year CHF 200 million digital bond, the largest World Bank CHF bond issuance since 2009, uses Distributed Ledger Technology (DLT) and advances the digitalization of capital markets while also supporting the financing of World Bank’s...

Read More »

Read More »

Launch of the Swiss4 Application, Combining Financial Services and Lifestyle

Swiss4, a financial player founded in Geneva in 2020, announces the launch of its application combining financial services and high-end lifestyle management services.

Entirely designed, developed and hosted in Switzerland, the app guarantees security and ease of use for its customers, deposits in CHF held with the Swiss National Bank (SNB).

The multi-currency account (CHF, EUR, GBP, AED, and SGD), alongside the MasterCard World Elite card, allows...

Read More »

Read More »

Swiss Fintech Awards 2024 Announce Top 10 Swiss Fintech Startups

A jury of 20 experts from the Swiss fintech space have reviewed over 60 applications (out of a total of 100 submissions) of fintech startups and have picked the five most promising companies in the categories “Early Stage Start-up of the Year” and “Growth Stage Start-up of the Year” for their 2024 edition.

Reducing Friction And Adding Value With AI And Blockchain Applications

While being diverse in its use cases, this year’s top 10 of the Swiss...

Read More »

Read More »

Blackrock Launches Its First Tokenized Fund on Ethereum

BlackRock unveils its first tokenized fund issued on a public blockchain, the BlackRock USD Institutional Digital Liquidity Fund (“BUIDL”)

BUIDL will provide qualified investors with the opportunity to earn U.S. dollar yields by subscribing to the Fund through Securitize Markets, LLC.

Robert Mitchnick

“This is the latest progression of our digital assets strategy,”

said Robert Mitchnick, BlackRock’s Head of Digital Assets.

“We are focused on...

Read More »

Read More »

Luzerner KB steigt in den den Handel und die Verwahrung von Kryptowährungen ein

Die Luzerner Kantonalbank AG (LUKB) ermöglicht ihren Kundinnen und Kunden seit Anfang März 2024 den Handel und die Verwahrung von Kryptowährungen.

Das neue Angebot ist technisch nahtlos in das Kernbankensystem und das E-Banking (Mobile und Desktop) der LUKB integriert. Aktuell stehen drei Kryptowährungen zur Wahl: Bitcoin, Ethereum und USD Coin.

Die LUKB hat sich seit dem Jahr 2020 mit dem Thema Digital Assets bzw. Kryptowährungen befasst und nach...

Read More »

Read More »

US Spot Bitcoin ETFs Daily Trading Volume Soars to 6 Billion USD

Ten newly launched US spot bitcoin exchange-traded funds (ETFs) broke their daily volume records on February 28, 2024, totaling nearly US$7.7 billion worth of assets being traded on that day alone, data shared on X by James Seyffart, an ETF analyst at Bloomberg Intelligence, reveal.

Read More »

Read More »

SNB Study: Results of the Swiss Payment Methods Survey

In spring 2023, the Swiss National Bank conducted its second payment methods survey of companies in Switzerland. Around 1,750 companies, across all sizes, language regions and industries, participated in this survey on payment method topics. In-depth knowledge of these topics helps the SNB to fulfil its statutory tasks in relation to the supply and distribution of cash and to cashless payments.

Read More »

Read More »

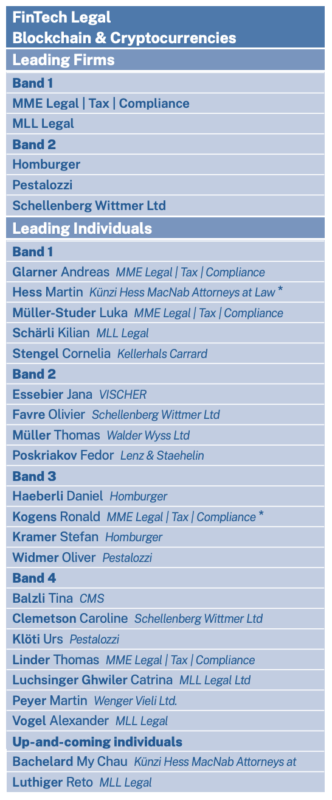

The Top Swiss Law Firms for Fintech and Blockchain Practice

Chambers and Partners, a legal research company, has released its Chambers Fintech 2024 guide, an annual report which recognizes the top fintech advisors and litigators worldwide.

In this year’s Swiss edition, Chambers and Partners ranked MME Legal | Tax | Compliance, MLL Legal, Baer and Karrer, and Lenz and Staehelin as the top Swiss law firms in the fintech legal category, recognizing them for their expertise, diligence and customer service.

MME...

Read More »

Read More »

UBS Issues Hong Kong’s First Investment-Grade Tokenised Warrant on Ethereum

UBS has launched Hong Kong’s first investment-grade tokenised warrant, leveraging the Ethereum public blockchain. This product is part of the bank’s UBS Tokenise initiative, aimed at advancing its in-house tokenisation services.

Read More »

Read More »

Bank Frick vergibt Stipendium für Blockchain-Studium

Das Bank-Frick-Stipendium in Höhe von 9800 Franken für den Zertifikatsstudiengang Blockchain und FinTech 2024 geht an Sven Lagger. Der Masterstudent hat durch sein fundiertes Verständnis der vernetzten Blockchain-Technologie überzeugt.

Die Bank Frick hat zum wiederholten Mal ein Stipendium in Höhe von 9800 Franken für den zertifizierten Studiengang Blockchain und Fintech an der Universität Liechtenstein vergeben. Träger des Bank-Frick-Stipendiums...

Read More »

Read More »

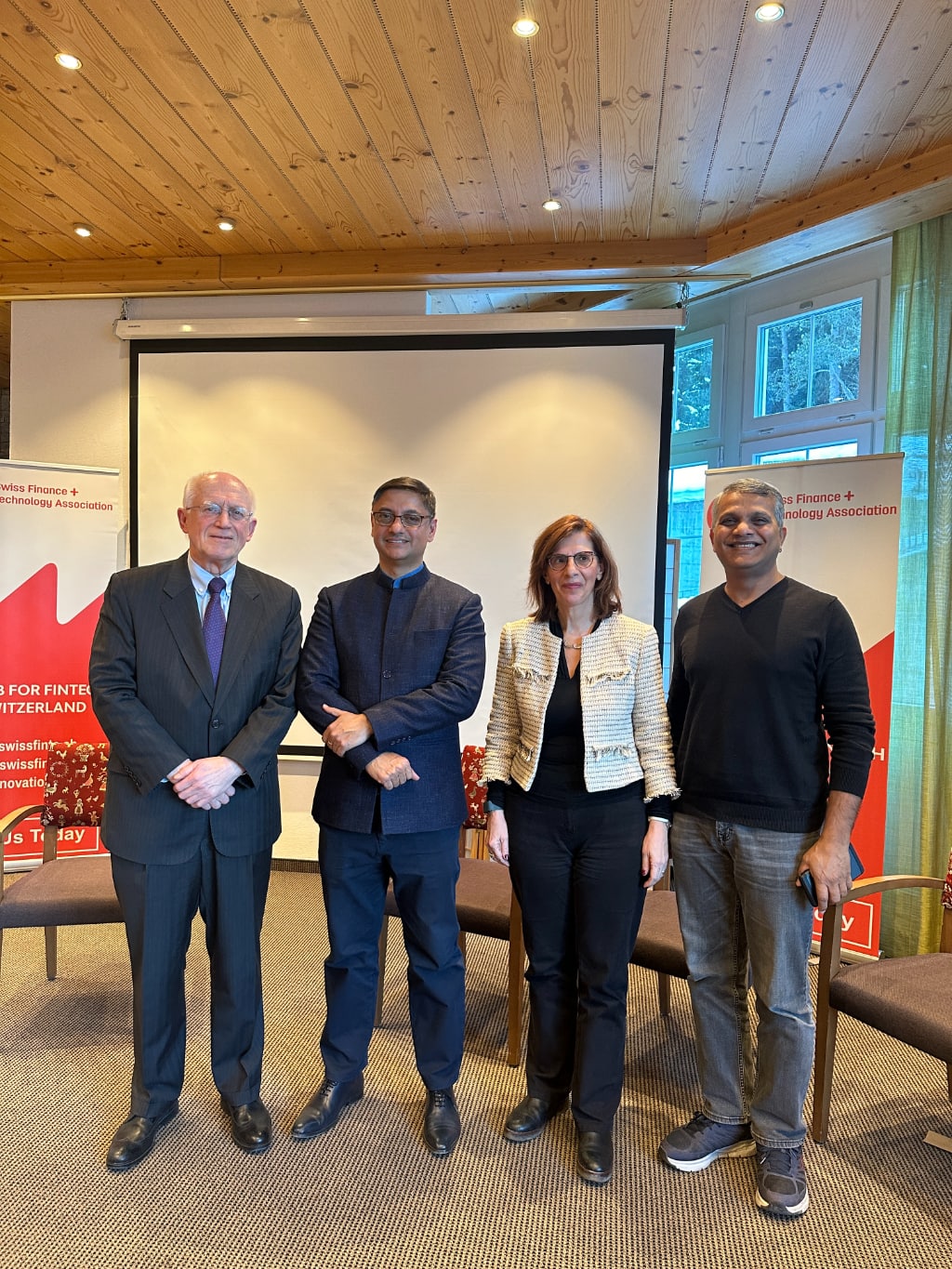

Experts Meet in Davos to Discuss How India’s UPI and Digital Public Infrastructure Has Helped Reduce Inequalities

On 16th January, during the Davos Innovation Week hosted by World Innovation Economics Limited, a panel discussion was held on the above topic.

The panel discussion was graced by Mr. Sanjeev Sanyal (Economic advisor to PM Modi), Mr. Phillip Weights (renowned Swiss banking leader), Mrs Efi Pylarinou (Swiss fintech influencer), Mr Ashok Ranadive (Ex Indian Navy, Ex Google, Entrepreneur and Investor).

Phillip Weights, Sanjeev Sanyal, Efi Pylarinou,...

Read More »

Read More »

BIS, Swiss National Bank and World Bank Launch Token Project Promissa

Today, many international financial institutions (including multilateral development banks) are partly funded by financial instruments known as promissory notes, most of which are still paper-based.

While the current system provides the operational controls for member nations to make subscription and contribution payments to institutions like the World Bank, the custody of outstanding promissory notes can be digitised to address operational...

Read More »

Read More »

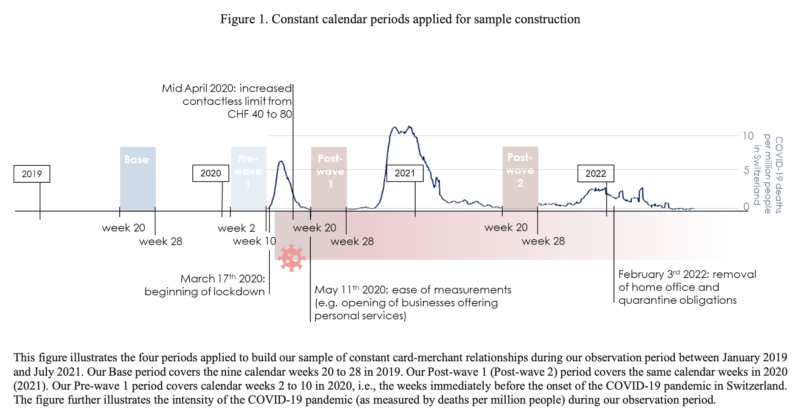

New SNB Study Reveals Critical Role of Card Schemes and Banks in the Contactless Payment Usage

Financial intermediaries, including card schemes and issuing banks, are playing a critical role in the use and promotion of new payment methods in Switzerland. A 2023 research by the Swiss National Bank (SNB) revealed that the rules and standards set by these intermediaries are impacting usage and frequency of contactless payments.

The findings, shared in a new report titled “Consumer adoption and use of financial technology: “tap and go”...

Read More »

Read More »

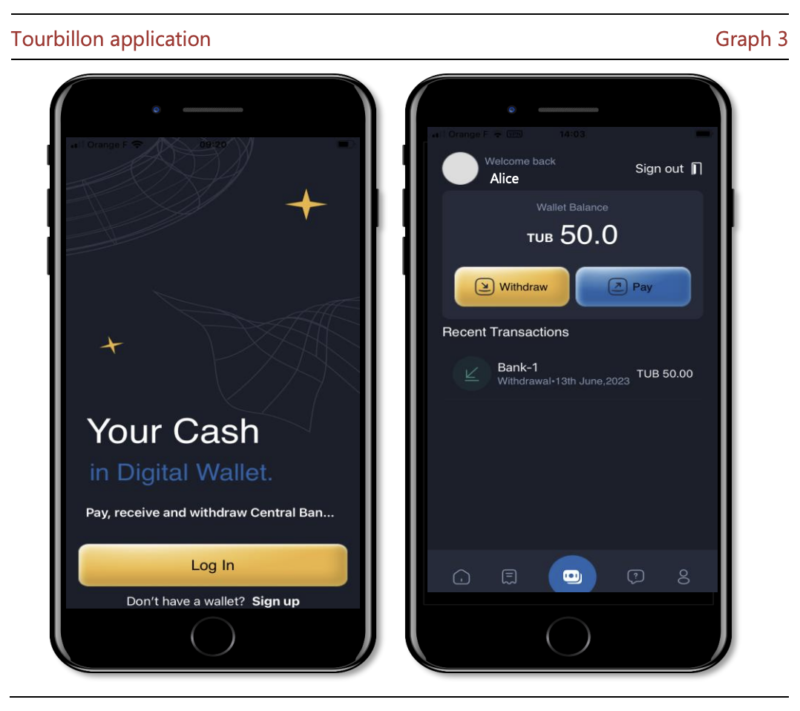

Swiss-Backed CBDC Project Explored Feasibility of Cash-Like, Anonymous Digital Currency

Project Tourbillon, an initiative led by the Bank for International Settlements (BIS) Innovation Hub Swiss Centre and supported by the Swiss National Bank (SNB), explored the feasibility of a retail central bank digital currency (CBDC), finding that it is possible to implement a CBDC design that provides anonymity to the payer and which is scalable and secure.

In a new report released in November 2023, BIS shares details of the project, outlining...

Read More »

Read More »

Miles & More and qiibee Transform Loyalty Rewards with Blockchain

Miles & More, the loyalty program of the Lufthansa Group, has partnered with blockchain-based B2B marketplace qiibee to allow small and mid-size enterprises (SMEs) to join the program easily.

The key highlight of this collaboration is the integration of blockchain technology, which simplifies the onboarding process for SMEs while ensuring the secure and efficient management of loyalty rewards.

qiibee’s blockchain-based marketplace offers...

Read More »

Read More »

Robinhood Crypto Trading App Arrives in EU, Offers Bitcoin Rewards

Robinhood is set to make a significant stride in the European Union by launching the Robinhood Crypto app for all eligible customers in the region. The company claims that the app is the only custodial crypto platform in the EU where customers can earn a portion of their trading volume back every month in Bitcoin (BTC).

In an effort to drive new users, Robinhood Crypto is offering a unique opportunity for both new and existing customers. New...

Read More »

Read More »