Category Archive: 6c) Crypto Currencies English

Gründung der Swiss Metaverse Association

Das Ziel dieses jüngst in Bern gegründeten Vereins ist es, ein breit abgestütztes Metaverse-Ökosystem zu schaffen und sich für attraktive Rahmenbedingungen in der Schweiz einzusetzen, so dass neue Geschäftsmodelle, Firmen und Arbeitsplätze entstehen können. Präsidiert wird die Swiss Metaverse Association von Tina Balzli, Partner und Leiterin der Fintech & Blockchain Abteilung bei CMS, und Alexandra Hofer, Senior Consultant bei furrerhugi....

Read More »

Read More »

Shift Crypto und Pocket Bitcoin verkünden langfristige Partnerschaft

Shift Crypto, der Schweizer Hardware-Wallet-Hersteller, geht eine Partnerschaft mit Pocket Bitcoin ein.

Pocket Bitcoin ist ein Schweizer Bitcoin-Broker, der die einfachste Möglichkeit bietet, Bitcoin direkt auf die eigene Wallet zu stacken. Beide Unternehmen haben ihren Sitz in der Schweiz und verfolgen das gemeinsame Ziel, den Zugang zu und die Verwahrung von Bitcoin einfacher und sicherer zu machen.

Die Unternehmen arbeiten zusammen, um eine...

Read More »

Read More »

Schweizer Bitcoin Startup Relai schliesst $4.5M Finanzierungsrunde ab

Relai, die Schweizer Bitcoin-App, gibt eine Investitionsrunde in Höhe von 4,5 Millionen US-Dollar bekannt, die von ego death capital angeführt wird. Weitere Investoren sind Timechain, Cabrit Capital und Lightning Ventures. An der Investitionsrunde beteiligten sich auch der Hauptinvestor von Relai, Redalpine, und der Seed-Stage-Investor Fulgur Ventures, die beide erneut investierten.

In Juni 2021 hatte Relai deren Series A (2.5Mio CHF) abgeschlossen...

Read More »

Read More »

Siemens Issues First Digital Bond on Blockchain

Siemens is one of the first companies in Germany to issue a digital bond, in accordance with Germany’s Electronic Securities Act.

Read More »

Read More »

OneSpan Inks Deal to Acquire Aussie Blockchain Tech Provider ProvenDB

Cybersecurity technology company OneSpan has inked a deal to acquire Australia-based blockchain technology provider ProvenDB for an undisclosed sum. The transaction is anticipated to close during the first quarter of 2023 and is subject to customary closing conditions.

Read More »

Read More »

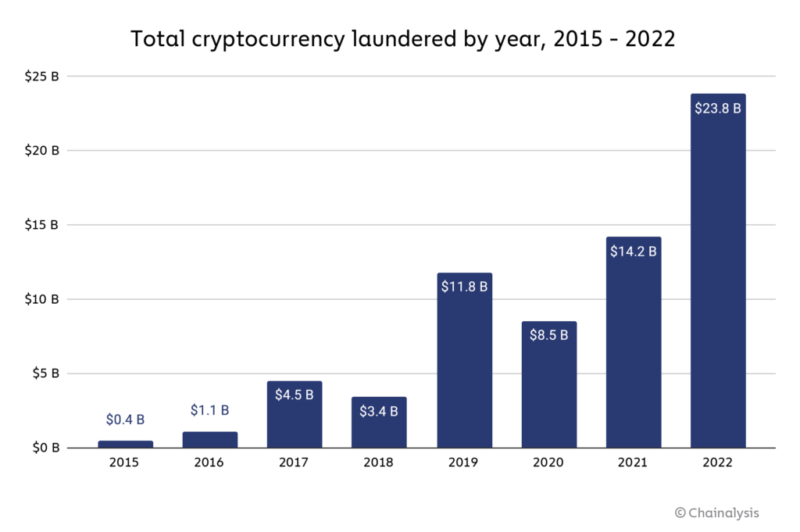

Crypto Money Laundering Reaches New Heights; Totaled US$23.8B in 2022

In 2022, cryptocurrency money laundering reached a new record, with illicit addresses sending US$23.8 billion worth of crypto, a figure which represents a 68% year-on-year (YoY) increase, new data from Chainalysis, an American blockchain analysis firm, show.

Total cryptocurrency laundered by year, 2015-2022 Source: Chainalysis, Jan 2023

Just under half of the funds sent from these addresses traveled directly to centralized exchanges, making these...

Read More »

Read More »

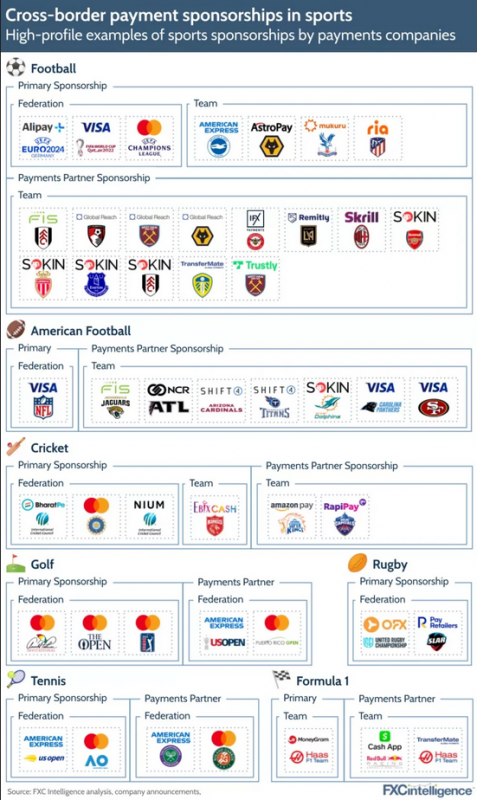

Payment, Fintech Companies Embrace Sports Sponsorships

Sports sponsorship deals from financial services and fintech companies alike have increased significantly over the past three years on the back of rising competition in the industry and amid hopes for increased brand awareness and exposure.

Read More »

Read More »

ABN AMRO Issues Digital Bond on Stellar Blockchain

ABN Amro became the first bank in the Netherlands to register a digital bond on the public blockchain, using Fireblocks. The digital bond was issued to a select group of investors to raise funds on behalf of APOC, an ABN Amro commercial client in the aerospace industry.

Read More »

Read More »

Switzerland’s Premier Crypto Conference Returns With a Two-Day Format in Zurich & Davos

Wrapped around the Annual Meeting of the World Economic Forum (WEF), the CryptoSummit.ch will kick off on Monday, 16th January 2023 at the Hyatt Circle Conference Centre at Zurich airport. The second day of the event is set to take place on Friday, 20th January 2023 in Davos.

The theme of CryptoSummit.ch 2023

The theme of the CryptoSummit.ch 2023 is regaining trust in crypto and advancing technology.

It is set to open with the keynote from...

Read More »

Read More »

Year End Message to Our Readers – Offline From 23rd December to 2nd January

Fintech News Switzerland would like to take this opportunity to wish all our readers a Merry Christmas and a very Happy New Year.

We will be taking a break from the 23rd December 2022 to the 2nd January 2023.

Until then, you can access some of our year-end articles that may be of interest to you. We look forward to seeing you all again on the 3rd January 2023!

Crypto Winter Wipes Out 72,000 Bitcoin Millionaires in 2022

BIS: New Global Bank...

Read More »

Read More »

UBS Issues USD 50 Million Tokenized Debt Securities for Asia Pacific

UBS has closed the first tokenized debt transaction for Asia Pacific investors, underlining its commitment to expand regional investment opportunities. UBS AG London branch issued USD 50 million in digital fixed rate security tokens (‘digital securities’) using blockchain technology to a series of high net worth and global family and institutional wealth investors across Hong Kong and Singapore.

Read More »

Read More »

Governments, International Bodies Ramp up Crypto Tax Regulations

Over the past year, governments and regulatory bodies from around the world have increased their focus on the taxation of the cryptocurrency industry, a trend that comes on the back of increasing investment, adoption and innovation in the space despite collapsing prices and high profile business failures, a new report by consulting firm PwC says.

PwC’s 2022 Global Crypto Tax Report, released earlier this month, looks at the state of crypto taxation...

Read More »

Read More »

New Swiss Fintech Startup Map Design for 2023

Together with their partners Lucerne University of Applied Sciences and Arts, Swisscom and Clarafinds, eForesight has revised the Swiss Fintech Map and expanded the database as well as deleted some old and inactive players.

The main business area categories contain now 130 Swiss Investment Management Fintechs, 106 Banking Infrastructure Fintechs, 48 Deposit&Lending Fintechs and 55 Payment Fintechs. On top of that, the fintechs in the main...

Read More »

Read More »

BX Swiss: Test Trades in Swiss Francs via a Decentralized Public-Blockchain.

Together with major Swiss banks, the Swiss stock exchange BX Swiss is taking the financial market infrastructure for tokenized securities to the next level. In a test, trades on BX Swiss were settled for the first time directly in Swiss francs via a decentralized public-blockchain.

Read More »

Read More »

BX Swiss: Test Trades in Swiss Francs via a Decentralized Public-Blockchain.

Together with major Swiss banks, the Swiss stock exchange BX Swiss is taking the financial market infrastructure for tokenized securities to the next level. In a test, trades on BX Swiss were settled for the first time directly in Swiss francs via a decentralized public-blockchain.

The test was conducted as part of a proof of concept under the auspices of the Capital Markets Technology Association (CMTA). In the process, structured products were...

Read More »

Read More »

EIB and Goldman Sachs Issue First Euro-Denominated Digital Bond on a Private Blockchain

The European Investment Bank (EIB) — in collaboration with Goldman Sachs Bank Europe, Santander and Société Générale — launched Project Venus, their second euro-denominated digitally native bond issue and first using private blockchain technology.

Read More »

Read More »

The State of the German Blockchain Ecosystem

Despite a global venture capital (VC) pullback, shrinking valuations and public market turmoil, Germany’s blockchain VC funding market remained stable this year, with companies in the space securing a total of US$218 million across 20 deals year-to-date (YTD), just US$37 million short of 2021’s US$255 million, a new report by CV VC, a Swiss VC and private equity firm specialized in cryptocurrency and blockchain solutions, shows.

Read More »

Read More »

A.P. Moller – Maersk and IBM to Discontinue Blockchain Trade Platform Tradelens

A.P. Moller – Maersk and IBM announced the decision to withdraw the TradeLens offerings and discontinue the platform.

Starting immediately, the TradeLens team is taking action to withdraw the offerings and discontinue the platform, and the intent is that the platform will go offline by end of quarter one, 2023. During this process all parties involved will ensure that customers are attended to without disruptions to their businesses.

Maersk will...

Read More »

Read More »

Crypto Winter Wipes Out 72,000 Bitcoin Millionaires in 2022

Crypto comparison website Bitstacker conducted a study which found that there was a 70% drop in Bitcoin millionaires in November 2022 when compared to January 2022 due to the ongoing ‘crypto winter’.

72,000 Bitcoin holders were no longer millionaires due to the drop in BTC prices from US$46,208 at the start of 2022 to US$15,759 at the time of the study in November.

Read More »

Read More »

Bitpanda Receives Full Crypto Custody and Trading License in Germany

Austrian crypto platform Bitpanda has received a full operating license from the German Federal Financial Supervisory Authority or BaFin for the custody and proprietary trading of crypto assets.

Bitpanda claims to be the first European retail investment platform to obtain the license which was introduced by BaFin in 2020, allowing it to actively market and offer services in the German market.

Founded in 2014, Bitpanda now has nearly four million...

Read More »

Read More »