Category Archive: 6b) Austrian Economics

Yet Another Month of Questionable Federal Jobs Data as 310,000 Fewer People Report Having Jobs

In 2023, self-employment has collapsed again with year-over-year self-employment growth dropping by 6.5 percent. That's the largest drop since December 2007, when the Great Recession officially began.

Original Article: "Yet Another Month of Questionable Federal Jobs Data as 310,000 Fewer People Report Having Jobs"

Read More »

Read More »

Myth #4: Every Time the Fed Tightens the Money Supply, Interest Rates Rise (Or Fall)

Recorded by the Mises Institute in the mid-1980s, The Mises Report provided radio commentary from leading non-interventionists, economists, and political scientists. In this program, we present another part of "Ten Great Economic Myths". This material was prepared by Murray N. Rothbard.

The financial press now knows enough economics to watch weekly money supply figures like hawks; but they inevitably interpret these figures in a...

Read More »

Read More »

Is Social Justice the Progressive Equivalent of Rent-Seeking Behavior?

The term “rent seeking” is a derogatory term that implies companies and people seek to take more than they earn. It hearkens to some Marxist ideology as well. However, especially when combined with regulatory capture and bureaucratic corruption, rent seeking is a valid concept. What happens when the shoe is on the other foot and people and organizations engage in rent seeking from a social justice perspective? Is it rent seeking or corruption for...

Read More »

Read More »

A conversation with Prince Michael of Liechtenstein

On November 15th, 2021, almost 20 months ago, I once again had the rare and delightful opportunity to have a conversation with Prince Michael. His insights, and especially his directness and unequivocal honesty, have frequently provided me with a lot of food for thought in the past. This interview was no different. His candid and unfiltered responses to a wide variety of questions and topics made this conversation as illuminating as it was...

Read More »

Read More »

My Long Journey to Rothbardian Sobriety

Everything possible is done to prevent the fraud of the monetary system from being exposed to the masses who suffer from it.

—Rep. Ron Paul (R-TX), before the US House of Representatives, February 15, 2006

In the mid-sixties, having read about gold in Atlas Shrugged, I decided to find out something about inflation and wrote to the United States Treasury Department to request a brochure that purported to lay inflation out in terms anyone could...

Read More »

Read More »

The Eurozone Falls into Recession as “Stimulus” Fails

Investor sentiment is clearly bullish. The CNN Fear and Greed Index for June 18th, 2023, stood at 82, which signals “extreme greed”. This is a drastic optimistic move after closing at “greed” (56 over 100) a month before and “extreme fear” (17 over 100) only one year ago. However, in the same period, the Citi global economic surprise index has declined twelve points, with the euro area component collapsing 123 points. The US economic surprise index...

Read More »

Read More »

The Carbon Capture Pipeline: The Latest Bridge to Nowhere

The carbon capture pipeline is the result of the latest gift to rent-seeking “titans of industry” and interestingly, may be used on some existing projects that came to be, years ago, due to rent seeking. More on this below.

As we’ve heard for years and years now, sometimes delivered in memorable ways, the continuing elevation of atmospheric levels of carbon dioxide, and other greenhouse gases, and the rising global temperatures that follow, is the...

Read More »

Read More »

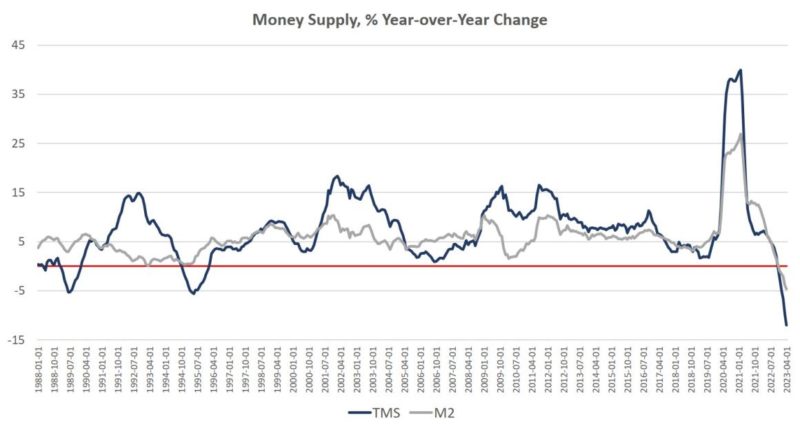

The Money Supply Keeps Falling After Its Biggest Drop Since the Great Depression

Money supply growth fell again in April, plummeting further into negative territory after turning negative in November 2022 for the first time in twenty-eight years. April's drop continues a steep downward trend from the unprecedented highs experienced during much of the past two years.

Since April 2021, money supply growth has slowed quickly, and since November, we've been seeing the money supply repeatedly contract—year-over-year— for six months...

Read More »

Read More »

Rich Country, Poor Country. Why the Differences?

The scourge of poverty wounding citizens in the developing world has provoked much discussion in affluent countries. Quite unreasonably, rich countries have been indicted for inciting poverty in poor countries. Unfortunately, the assumption that prosperity stems from exploitation is still widely popular in academia and politics. However, the historical record casts serious doubt on this argument.

Imperialism was the standard in the ancient world,...

Read More »

Read More »

MMT Says Government Debt Makes Private Saving Possible

Mises Institute Fellow Patrick Newman joins Bob to discuss a recent tweet from Stephanie Kelton, which argued that the government's "red ink makes our black ink possible." Patrick and Bob point out that these MMT tautologies are very misleading at best. Patrick also lays out the argument in his journal article, saying that MMT's debt monetization won't cause a boom-bust cycle, but will still reduce living standards....

Read More »

Read More »

Deneen on Elitism

Last week, I discussed the way in which Patrick Deneen misreads John Stuart Mill in his book Regime Change. I’d like to continue the assault on Regime Change this week by looking at an argument he makes against libertarianism. Libertarians, Deneen alleges, are elitists. They think that ordinary people need to be ruled by an elite class of experts. They favor restrictions on democracy in order to entrench laws about property rights that benefit the...

Read More »

Read More »

Why Barbados Advanced Economically While Jamaica’s Growth Lagged

Even though Barbados and Jamaica had more similarities than differences when they became independent of Great Britain, Barbados developed its economy much more quickly.

Original Article: "Why Barbados Advanced Economically While Jamaica's Growth Lagged"

Read More »

Read More »

Unleashing the Power of Greed: How the Free Market Propels Progress

The free market system has faced its fair share of criticism, often being labeled as a breeding ground for greed and self-interest. However, let’s take a closer look and see how greed, when properly channeled and regulated within a free market framework, can actually bring about positive outcomes for society.

One fascinating thought experiment that showcases the positive role of greed in the free market is Adam Smith’s concept of the “invisible...

Read More »

Read More »

Why Governments Love Secrecy and Hate Whistleblowers

Ryan and Tho take a look at the legacy of Daniel Ellsberg's heroic leak of the Pentagon Papers and the evils of government secrecy. Modern leakers like Snowden, Manning, and Assange do important work educating voters and making the state more accountable.

New Radio Rothbard mugs are now available at the Mises Store. Get yours at Mises.org/RothMug

PROMO CODE: RothPod for 20% off

Read More »

Read More »

Fiat Food and Its Consequences with David Gornoski

On this episode of Good Money with Tho Bishop, David Gornoski of A Neighbor's Choice joins to discuss how government policies have impacted American diets. From the subsidization of certain crops to anti-science propaganda campaigns about diet, to the consolidation of the agricultural industry, the politicization of the economy still shapes not only their wallet but their plates.

Good Money listeners can order a special $5 book bundle that...

Read More »

Read More »

To Avarice No Sanction

What many people call government generosity Leonard Read called avarice.

Original Article: "To Avarice No Sanction"

Read More »

Read More »

Banks Create Money out of Thin Air. What Could Possibly Go Wrong?

You might rightfully wonder: How can a bank, like the neighborhood bank down the street, “create money out of thin air”?

To answer that question, we must enter the magical kingdom of “fractional-reserve banking,” where deposits are turned into loans, loans are turned into money, and so on. For every old dollar that goes in, nine new dollars come out, created with the stroke of a pen or the click of a mouse. As you may be aware, general deposits are...

Read More »

Read More »

Is The Federal Reserve Already Done Raising Rates?

Ryan and Robert Aro take a look at the Fed's unconvincing explanation of why it has chickened out on interest rate hikes. This only makes sense if the economy is much weaker than the Fed claims.

Be sure to follow the Fed Watch Podcast at Mises.org/FedPod.

Read More »

Read More »

China Calls Out the USA for Instigating the Infamous Color Revolutions

As geopolitical tensions rise, the Chinese political leadership tells the US government to desist pushing its "color revolutions."

Original Article: "China Calls Out the USA for Instigating the Infamous Color Revolutions"

Read More »

Read More »

The FTC Should Answer Its Call of Duty to Gamers

All too often, unscrupulous businesses weaponize the United States’ antitrust laws—which are only supposed to be utilized to protect consumers against higher prices and other consequences of monopoly power—for their own self-serving purposes. Professor Thomas DiLorenzo explained this problem more than a third of a century ago in a piece titled “The Rhetoric of Antitrust.” He wrote that “In theory antitrust regulation promotes competition in the...

Read More »

Read More »