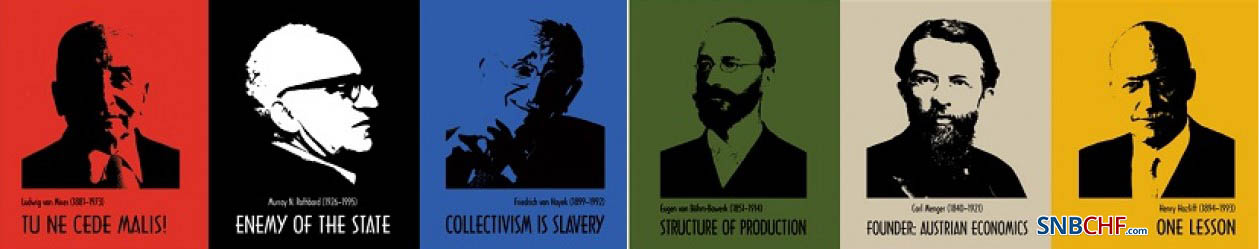

Category Archive: 6b) Austrian Economics

Scam mit Brokern – So verlieren normale Menschen jedes Jahr viel Geld

Wie du dich vor GELDABZOCKE schützt! Wichtige Warnsignale

Geldtraining: https://thorstenwittmann.com/geldsicherheit-garantiert/

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Diese Broker-Scam-Masche hat Andrea aus unserer Community viel Geld gekostet – diese Tricks musst du kennen!

Die Abzockerbranche boomt – leider! So auch bei Andrea (Name geändert), anhand deren E-Mail und Praxisbeispiel ich dir heute zeige, wie...

Read More »

Read More »

Is Economic Growth Synonymous with Ecological Destruction? The NYT Gets It Wrong (Again)

According to the New York Times (NYT) article July 17, 2022, “The pioneering economist says our obsession with growth must end,” a major threat to our living standard is the obsession with economic growth. Herman Daly—an economist that has been exploring for more than fifty years the relationship between economic growth and individuals’ living standards—is of the view that the pursuit of economic growth causing ecological harm.

Read More »

Read More »

If Mauritius is a Tax H(e)aven, Other African Countries Must be Tax Hells

It is common for commentator to point to corruption, incompetence, malicious Western meddling, and other factors as the source of Africa’s continued economic woes. One seldom hears so-called experts point to taxes as a major impediment to economic development. Even “development economists” do not repudiate Africa’s paradoxically onerous tax regimes.

Read More »

Read More »

ARD & ZDF: Korruption, Gendern, Indoktrination (Schlesinger Skandal)

Ist der öffentlich-rechtliche Rundfunk noch zeitgemäß? Brauchen wir eine Reform oder gar die Auflösung? Soll der Rundfunkbeitrag abgeschafft werden, so wie in Frankreich & Co? Der RBB Skandal um die Intendantin Schlesinger zeigt wieder einmal die Selbstbedienungsmentalität, die mangelnde Kontrolle und Verschwendung von Gebührengeldern. Ist dies nur die Spitze des Eisberges?

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021...

Read More »

Read More »

Alexander Dugin und die Philosophie hinter dem russischen Krieg

Die Russen seien „eschatologisch auserwählt“, behauptet Alexandre Dugin – der prominente russische Philosoph und vorgebliche Mentor von Präsident Wladimir Putin. Russland muss sich gegen den falschen Glauben, die Pseudoreligion des westlichen Liberalismus und die Verbreitung seines Übels stellen: Gegen Moderne, Szientismus, Postmoderne und die Neue Weltordnung. Als geographisches „Dreh- und Angelgebiet“ muss Russland seine Position im Kernland des...

Read More »

Read More »

Paving the way for a 2008 déjà vu

It would appear that the central planners of the Bank of England have very short or very selective memories. After adopting unprecedented easing measures during the covid crisis and after supporting the government in its efforts to flood the economy with fresh cash during that same period, the central bank has put itself in a particularly unenviable position.

With inflation soaring and living costs exploding for most consumers and taxpayers,...

Read More »

Read More »

Thomas Piketty Wants to Bring Back Communism in the Guise of Democratic Socialism

Thomas Piketty’s Brief History is the fourth installment of his assault on economic inequality, following as it does the best-selling Capital in the Twenty-First Century and Capital and Ideology. The third, Time for Socialism: Dispatches from a World on Fire, 2016–2021, is just a collection of popular articles based on which the New York Times dubbed Piketty a “vaguely left-of-center” economist.

Read More »

Read More »

Apokalyptisch! Dieser Wahnsinn kommt im Herbst!

Wie wird sich die aktuell kritische Lage weiter entwickeln?

Wir schauen uns regelmäßig an, was Experten wie Ernst Wollf, Dr. Markus Krall, Prof. Hans-Werner Sinn, Dirk Müller, Max Otte oder Marc Friedrich zur aktuellen Lage sagen.

Read More »

Read More »

Dr. Markus Krall im Interview – Jetzt wird´s eng! Dominosteine fallen!

Wie wird sich die aktuell kritische Lage weiter entwickeln?

Wir schauen uns regelmäßig an, was Experten wie Dr. Markus Krall, Ernst Wolff, Prof. Hans-Werner Sinn, Dirk Müller, Max Otte oder Marc Friedrich zur aktuellen Lage sagen.

Read More »

Read More »

Low Interest Rates and High Taxes Won’t Help against Inflation: The Economy Needs Savings and Real Investment

With the Consumer Price Index (CPI) hitting a forty-year high of 9.1 percent, the Bank of England has responded by raising interest rates to 1.25 percent, up by 0.25 from the previous period. This, alongside ex-chancellor and PM hopeful Rishi Sunak planning to “tackle inflation before tax cuts,” signals a poor plan for combating the rising effects of inflation.

Read More »

Read More »

Economic Causes of War

War is a primitive human institution. From time immemorial, men were eager to fight, to kill, and to rob one another. However, the acknowledgment of this fact does not lead to the conclusion that war is an indispensable form of interpersonal relations and that the endeavors to abolish war are against nature and therefore doomed to failure.

Read More »

Read More »

Taiwan-Konflikt erklärt : Was bedeutet das für Deutschland? (Wirtschaft)

Droht uns eine neue Krise zwischen China und Taiwan? Wie wahrscheinlich ist ein Konflikt und was hätte das für Folgen für uns? Warum Nancy Pelosi bzw. die USA jetzt eine wichtige Rolle spielen, was die Geschichte erzählt und wie gut Taiwan im Ernstfall aufgestellt ist, erfahrt ihr in einer neuen Folge "Finanzielle Intelligenz", viel Spaß!

Beitrag Zeihan:

https://zeihan.com/china-and-taiwan/

► Mein neues Buch

Du möchtest das...

Read More »

Read More »

Germany Can Save Itself, and Possibly the World, by Abandoning Four Failed Policies

The following is a plea to Germany—the war is over and has been for three-quarters of a century. It's time to stop prostrating yourself for the supposed "good" of Europe. It's time to take complete control of your domestic and foreign policy, without interference from haughty, busybody world elites, and do what is best for yourself. You will be pleasantly surprised that what is good for yourself is also good for your neighbors and the...

Read More »

Read More »

Africa Needs Conventional Fuels, Not Windmills and Solar Panels

The energy and climate goals that Western governments, the United Nations, and other organizations are pushing on Africa constitute a crippling blow to its economies. As the least developed region, Africa should unequivocally prioritize economic development. One would think that amid energy poverty in Africa, Western governments and “development” institutions would prioritize energy security for African countries over energy transition.

Read More »

Read More »

6 Gründe warum viele bald ihre Immobilie verlieren werden!

Wie wird sich die aktuell kritische Lage weiter entwickeln?

Wir schauen uns regelmäßig an, was Experten wie Ernst Wollf, Dr. Markus Krall, Prof. Hans-Werner Sinn, Dirk Müller, Max Otte oder Marc Friedrich zur aktuellen Lage sagen.

Read More »

Read More »

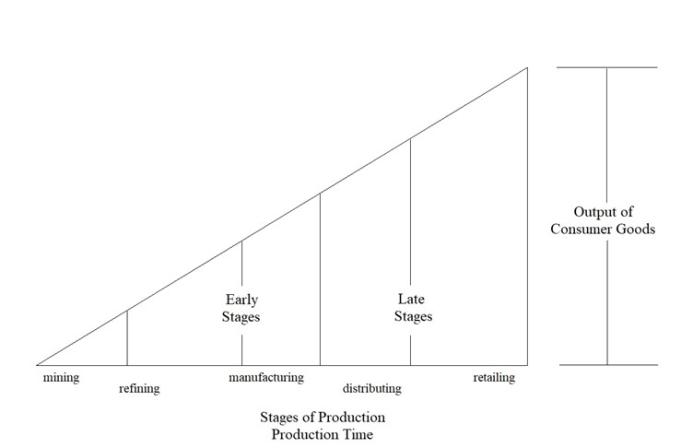

Economies Cannot Produce Wealth without Patience and Long-Term Horizons

People decrying poverty in developing countries usually overlook the fact that there is a dearth of long-term economic thinking.

Original Article: "Economies Cannot Produce Wealth without Patience and Long-Term Horizons"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Keith Weiner | Fed Policy Errors, Reverse Repo, Keynesian Illusion, Russia & China, Bitcoin, Gold

Keith Weiner PhD Economics and Founder/CEO of both Monetary Metals and the Gold Standard Institute joins us for an interview on the 5th installment of the Gold and Silver Precious Metals Twitter Spaces.

Read More »

Read More »

Dirk Müller: Ohhh, surprise! Amazon übernimmt Datenkrake iRobot

????? ??? ??? ????? ??????????? ??? ???? ?ü???? ????:

https://bit.ly/Update220809

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Tagesausblick vom 09.08.2022 auf Cashkurs.com.)

Sie sind noch kein Mitglied?

Zum Einstiegspreis anmelden und vollen Zugriff auf alle Artikel und Videos holen - Sie erhalten den ersten Monat für nur 9,90 Euro - http://bit.ly/ck-registrieren

https://www.cashkurs.com – Ihre unabhängige...

Read More »

Read More »