Category Archive: 6b) Austrian Economics

Keith Weiner – Only Gold and Silver Can Stave off the Zombie Apocalypse

Get a two-week free trial of my precious metals newsletter The End Game Investor: https://seekingalpha.com/mp/1347-the-end-game-investor

Join my Patreon for Biblical commentary on economics, monetary policy and government. https://www.patreon.com/endgameinvestor

Get the Monetary-Metals.com Gold Outlook 2023 Report for free https://bit.ly/3StWPAJ

Check out https://monetary-metals.com

Don't follow me on Twitter @RafiFarber

Read More »

Read More »

Klartext zur Politik in Deutschland!

Die ganze Sendung hier:

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3WePFAu oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram:...

Read More »

Read More »

Lifting the Debt Ceiling Is Not a Social Policy

Every time the United States reaches its debt limit, we read that it is important to reach an agreement to lift it. The narrative is that the debt ceiling must be raised, or the US economy will suffer a severe contraction. There is even an episode of a TV series, “Designated Survivor”, where the character played by Kiefer Sutherland places lifting the debt ceiling as the priority to get the U.S. economy on track. The debt ceiling is viewed as an...

Read More »

Read More »

Does Government Create a “Level Playing Field” or Does It Make the Field More Uneven?

Anticapitalist politicians claim intervention can "level the playing field," but when we look closely, we realize that government itself creates the imbalances.

Original Article: "Does Government Create a "Level Playing Field" or Does It Make the Field More Uneven?"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Why You Should Fear “Bipartisan” Agreements in Congress

After the recent midterm election, when it became apparent that Americans would have a divided new Congress, it wasn’t long before the word bipartisan started showing up as an adjective to modify a whole host of legislative proposals and discussions. While in many cases the word has been aspirational rather than descriptive—as in, “the other side should follow our lead in agreeing to this”—it has often also been used as a magic modifier in an...

Read More »

Read More »

How Markets Are Better than Government Regulators at Fighting Corporate Corruption

Can private markets only be regulated by government? Hindenburg Research's successes against corporate corruption suggest otherwise.

Original Article: "How Markets Are Better than Government Regulators at Fighting Corporate Corruption"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Wow! Die Ländergrenzen Europas in den letzten 900 Jahren

Abonniert meinen Kanal für spannende Videos zu Finanzen, Geopolitik und Wirtschaft!

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3WePFAu oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter:...

Read More »

Read More »

Poor People in Developing Countries Find Alternatives to Commercial Banking

Banking is a complicated process for working-class people who fail to comply with anti–money laundering regulations. Know your customer (KYC) requirements mandate prospective clients to provide their source of funding and possible employment history. Such policies make it difficult for working-class entrepreneurs to formalize and access funding. By restricting poorer people to informality, KYC requirements sap the growth potential of small...

Read More »

Read More »

Be Ready: Markets To Takeover GOLD Pricing SOON! – Keith Weiner | Gold Price Prediction

Be Ready: Markets To Takeover GOLD Pricing SOON! - Keith Weiner | Gold Price Prediction

#gold #silver #fed #financedaily

--------------

⬇ Inspired By: ⬇

Financial Crisis Is Already Here, Don’t Let the Market Exuberance Fool You Warns Lynette Zang

-tnozmGa4

Fed’s Credibility is Destroyed, Why Cash, Gold and Silver Will Be Best Lifeline | Outlook 2022

Silver spikes through $27 level in early trading, up $.83

_U

Those Who Don't Own Gold &...

Read More »

Read More »

Experte deckt auf: Die Wahrheit über Corona (Martin Haditsch)

Drei Jahre Corona - drei Jahre voller Lügen, Hetze, Manipulation und politischen Versagen. Prof. Dr. Dr. Martin Haditsch (Facharzt für Hygiene und Mikrobiologie, Infektiologie und Tropenmedizin, sowie Virologie und Infektions-Epidemiologie) hat hierzu einen sehr umfangreichen Rückblick erstellt und haut die Fakten auf den Tisch.

Deshalb möchte ich diesen Rückblick gerne mit euch teilen und darf ihn mit Absprache hier in leicht abgewandelter...

Read More »

Read More »

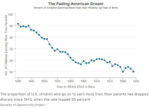

Subsidizing Higher Education Is Not Creating Widespread External Benefits

Contrary to the claim that taxpayer subsidies for higher education provide great social benefits, these subsidies actually are a wealth transfer from the less-well-off to wealthy people.

Original Article: "Subsidizing Higher Education Is Not Creating Widespread External Benefits"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

MÁS INFLACIÓN Y POBRE RECUPERACIÓN

#economia #crisis #macroeconomía #mercados #inflación

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Is Capitalism to Blame for the Ohio Train Disaster?

On this episode of Radio Rothbard, Ryan McMaken and Tho Bishop address whether the Ohio train disaster is an example of "capitalism gone amuck". They discuss Murray Rothbard's views on pollution, the secondary consequences of the regulatory state, and the decaying qualities of modern financialization.

Read More »

Read More »

Dr. Markus Krall deckt auf – Schlimmste Wendung aller Zeiten! Sie fahren alles GNADENLOS an die WAND

Wie wird sich die aktuell kritische Lage weiter entwickeln? Wir schauen uns regelmäßig an, was Experten wie Ernst Wollf, Dr. Markus Krall, Prof. Hans-Werner Sinn, Dirk Müller, Max Otte oder Marc Friedrich zur aktuellen Lage sagen.

Read More »

Read More »

The Global Currency Plot

Democratic socialism—the ideology that dominates the world today—aspires to become a world state. The route toward it requires a single world currency to be created. That would undoubtedly create a dystopia. Might this become a reality? And if so, how can it be averted? This book aims to find answers to these questions.

Read More »

Read More »

Andreas Popp: 2035 ist Schluss

#andreaspopp #evaherman #verbrennermotorvordemaus #b2035keineverbrennermehr #2035istschlussmitauspuff

Read More »

Read More »

The Fed’s Portfolio Is Nonexistent: The Fed Does Not Invest. It Destroys Investments

Economists and pundits mistakenly call the Federal Reserve System's security holdings a portfolio. It is anything but.

Original Article: "The Fed’s Portfolio Is Nonexistent: The Fed Does Not Invest. It Destroys Investments"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Why Madison and Hamilton Were Wrong about Republics

The debate between the Federalists and the Anti-Federalists in the late eighteenth century was fundamentally a debate over whether or not Americans wanted or needed a large national state. Thus, in their effort to push ratification of the new constitution, the Federalists employed a wide variety of arguments designed primarily to convince the public that the United States, as it stood in 1787, was not politically centralized enough.

We often find...

Read More »

Read More »

How Fast Should the Money Supply Grow?

As Murray Rothbard wrote, inflation is not an increase in prices. It is, instead, an increase in the supply of money in circulation. The distinction is important.

Original Article: "How Fast Should the Money Supply Grow?"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

The Fed’s 2% Inflation Target

Mark Thornton explains the target as another smokescreen that was originally intended to stabilize monetary policy, currencies, and exchange rates, but has become a justification for inflation and central bank manipulation.

Be sure to follow Minor Issues at Mises.org/MinorIssues.

Read More »

Read More »