Category Archive: 6b.) Mises.org

Totalitarian Ideals and Not Living by Lies

More than forty years ago, Aleksandr Solzhenitsyn urged his fellow Russians “not to live by lies.” In our politicized age, his words ring truer than ever.

Original Article: Totalitarian Ideals and Not Living by Lies

Read More »

Read More »

Living Libertarian: Brief Biographies

Libertarian Autobiographies: Moving toward Freedom in Today’s Worldedited by Jo Ann Cavallo and Walter E. BlockPalgrave Macmillan, 2023; xx + 533 pp.

Jo Ann Cavallo and Walter Block have done those interested in libertarianism a great service, but they have set the reviewer of their book an impossible task. They have gathered together eighty short accounts in which well-known libertarians describe their various paths toward their political and...

Read More »

Read More »

The Problem With “Classical Liberals”

On this episode of Radio Rothbard, Ryan McMaken and Tho Bishop take a look at "classical liberalism," a term that has come to mean a variety of different things in recent years. What is the history of classical liberalism? Is classical liberalism distinct from radical libertarianism? Is it ultimately a moderate form of leftism? Ryan and Tho address these questions and more during the Mises Institute's Fall Fundraising Campaign....

Read More »

Read More »

The Fed Holds the Fed Funds Rate Steady—Because it Doesn’t Know What Else To Do

If we read between the lines, it is apparent that the Fed is hoping that price inflation will fall to politically acceptable levels without any additional tightening, and without a recession. But "hope" is all the Fed has.

Original Article: The Fed Holds the Fed Funds Rate Steady—Because it Doesn't Know What Else To Do

Read More »

Read More »

The Partnership from Hell

But once a commodity is established as a money on the market, no more money at all is needed.

—Murray Rothbard, Taking Money Back

The Fed’s distinguishing characteristic is its grant of privilege to buy assets with money it doesn’t have. No other person or institution can legally do this; those that tried would be indicted for counterfeiting.

At the very least you might think this would raise eyebrows, but it doesn’t except in fringe quarters. It...

Read More »

Read More »

Three Cheers for Mises

Today marks the birthday of Ludwig von Mises, and day 5 of our annual Fall Campaign.

The intellectual achievements of Ludwig von Mises make him one of the greatest minds in human history. His contributions to Austrian economics inspired new generations of scholars, from Murray Rothbard and F.A. Hayek to current leaders like Joe Salerno, Ron Paul, and Patrick Newman. He is the most powerful intellectual opponent to socialism the world has ever...

Read More »

Read More »

Why Stabilization Policy is Destabilizing

The call for "price stabilization" was part of the recent Republican debate. Despite its attractive appearance, having the Fed try to "stabilize prices" is a very bad idea.

Original Article: Why Stabilization Policy is Destabilizing

Read More »

Read More »

Stop Trying to “Contain” China in Southeast Asia

It was a laughable moment when President Joe Biden said at a press conference during his visit to Hanoi that the United States wasn’t seeking to contain China. Despite efforts by the Biden administration to send its top officials to quell any suspicion that Washington, DC, was trying to contain China, Beijing has realized that the efforts were merely a cover-up. By restricting access to chips and their manufacturing components as well as spending...

Read More »

Read More »

The State versus Entrepreneurs: Prosperity Always Loses

Governments prioritize economic growth as a national policy to win elections. Economic growth is a concern for all citizens because increasing economic growth improves living standards. There are more opportunities for self-advancement and leisure in a booming economy, so people endorse politicians who demonstrate that they know how to transform a sluggish economy into a booming one. Voters usually benefit from government policies when they...

Read More »

Read More »

The Corrupt Political Influence on Military Intelligence and Its Fundamental Role in State Propaganda

Recorded in Nashville, Tennessee, on September 23, 2023.

The Corrupt Political Influence on Military Intelligence | Karen Kwiatkowski

Video of The Corrupt Political Influence on Military Intelligence | Karen Kwiatkowski

Read More »

Read More »

The Economic Coercion and ‘Repressive Tolerance’ of the Woke Regime

Recorded in Nashville, Tennessee, on September 23, 2023. Includes audience Q&A period.

The Economic Coercion and ‘Repressive Tolerance’ of the Woke Regime | Michael Rectenwald

Video of The Economic Coercion and ‘Repressive Tolerance’ of the Woke Regime | Michael Rectenwald

Read More »

Read More »

Toward a Heideggerian Libertarianism?

Can there be a bridge between Heideggerian metaphysics and practical political philosophy?

Original Article: Toward a Heideggerian Libertarianism?

Read More »

Read More »

The False Framing of Protectionism

The argument over trade is one that has been foisted back onto America by the likes of Bernie Sanders and Donald Trump. While most hold to the notion that Adam Smith ended the debate on trade policy in the 1770s, the issue has always been a prominent one in American history. The Hamiltonian Whigs and Lincoln Republicans have long stood opposed to the Jacksonian Democrats and their policy of laissez-faire capitalism. Perhaps the one shining light of...

Read More »

Read More »

Donate $5, Get Rothbard’s Greatest Myths!

Rothbard destroys the greatest myths of our time.

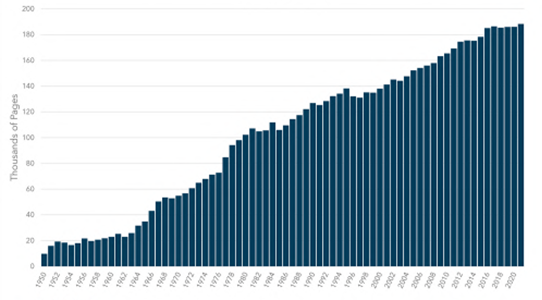

America has been captured by economic denialism. The political class has driven the debt to a point that was once thought unimaginable. Inflation continues to eat away at the paychecks of everyone. The weaponization of the dollar has driven other countries to seek to abandon it.

In 1984, Murray Rothbard wrote Ten Great Economic Myths, a succinct attack on the fallacies perpetrated by the...

Read More »

Read More »

Why the “Just Wage” Theory Doesn’t Make Much Sense

Just-wage theory tells us that an employer cannot reduce his workers' wages below some presumed "cost of living." Yet, that same employer can be permitted to reduce the worker's wage to zero if the worker has been replaced by a machine.

Original Article: Why the "Just Wage" Theory Doesn't Make Much Sense

Read More »

Read More »

The Dangerous Myth of a “Soft Landing”

If we search the news from 2007, we can find plenty of headlines with the IMF and the Federal Reserve predicting a soft landing. No one seemed to worry about rising imbalances. The main reason is that market participants and economists like to believe that the central bank will manage the economy as if it were a car. The current optimism about the U.S. economy reminds us of the same sentiment in 2007.

Many readers will argue that this time is...

Read More »

Read More »

Real Economic Growth Depends on Savings

The US consumer sentiment index, compiled by the University of Michigan, fell to 69.5 in August from 71.6 in July. A weakening consumer sentiment index is seen as indicating a potential downturn in consumer spending and the economy in general.

Most economic commentators agree that individual consumption rather than saving is the key to economic prosperity. Saving, they believe, hinders economic growth because it coincides with weakening demand for...

Read More »

Read More »

Mises Club Carolinas

Join the Mises Club Carolinas for their next Meetup on Saturday, October 7 in Spartanburg, SC. Timothy and Sarah Terrell will host the event at Initial Q Smokehouse from 4:00 - 8:00 p.m. The topic is "Education and Career Preparation from an Austrian Perspective."

To register or for more information, please contact Kent Misegades, [email protected].

Read More »

Read More »

Rothbard Graduate Seminar 2024

Rothbard Graduate Seminar is an intense study of Misesian and Rothbardian economic analysis with applications to current research and related fields. Participants discuss a common set of readings with each other and Mises Institute faculty, who give advanced lectures on the material.

The goal is to equip graduate students with a solid understanding of the ideas of Mises and Rothbard, so that they may apply it to their graduate studies and...

Read More »

Read More »

Limitless Money and the Limitless Fed

Recorded in Nashville, Tennessee, on September 23, 2023.

Limitless Money and the Limitless Fed | Jonathan Newman

Video of Limitless Money and the Limitless Fed | Jonathan Newman

Read More »

Read More »