Category Archive: 6b.) Mises.org

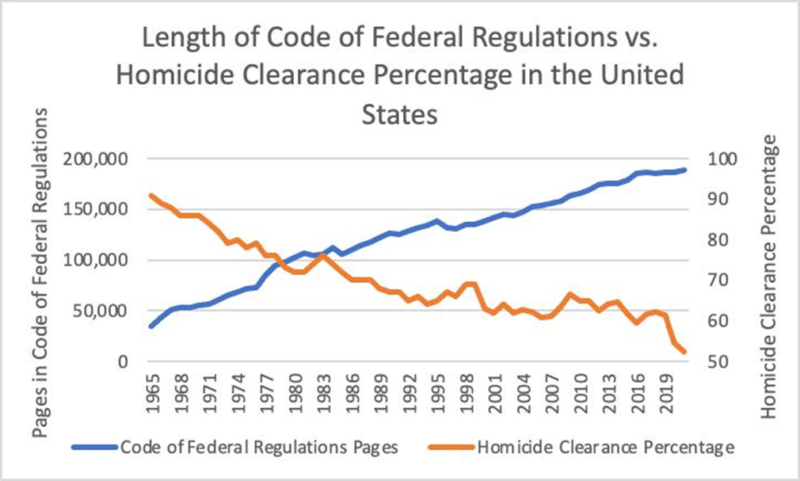

Reimagining Public Safety – The Case for Privatizing Security

Since the conclusion of World War II, each biennial session of Congress has ushered in a staggering 4-6 million words of additional legislation.

Read More »

Read More »

States Rights and Anti-Interventionism is Rising

Super Tuesday saw Donald Trump sweep all possible state delegates except for the state of Vermont. However, hovering just below the surface were a series of propositions that were voted on by the Texas Republican Party. Various propositions touched on topics of gold as legal tender, border security, and school choice, but the most interesting was Proposition 6. Proposition 6 reads as follows: “The Texas Legislature should prohibit the deployment of...

Read More »

Read More »

Video: Alex Pollock Chairs a Panel Discussion on “Better Money: Gold, Fiat, Or Bitcoin?”

Video: Mises Institute Senior Fellow Alex Pollock moderates a panel discussion on Lawrence White's new book Better Money: Gold, Fiat, Or Bitcoin?. The event is sponsored by the Federalist Society. White delves into the timely debate surrounding alternative currencies amidst the backdrop of constant inflation in the fiat currency world. Better Money explains and analyzes gold, fiat dollars, and Bitcoin standards to evaluate their relative merits...

Read More »

Read More »

Getting the Great Depression (Almost) Right — And Totally Wrong

There are others, besides the Austrians, who acknowledge the crucial role of monetary policy and even blame the Federal Reserve for the Great Depression.

Read More »

Read More »

Covid Showed Us Who Really Rules America

This month marks the fourth anniversary of one of the most disastrous assaults on human rights in American history. It was on March 16, 2020 that the President Trump issued "guidelines" for "15 days to slow the spread" which stated that "Governors of states with evidence of community transmission should close schools in affected and surrounding areas." The administration instructed all members of the public to...

Read More »

Read More »

Krugman: Low Unemployment Causes Inflation, Not Monetary Expansion

In an article in the New York Times on March 27, 2018, Paul Krugman argues that economists who believe increases in money supply cause inflation are wrong. According to Krugman, the key factor that sets inflation in motion is unemployment. While a decline in the unemployment rate is associated with an increase in the rate of inflation, an upsurge in the unemployment rate is associated with a decline in the rate of inflation.Krugman believes...

Read More »

Read More »

The New Manhattan Toll Rates: Efficient Policy, or Just Another Boondoggle?

The Metropolitan Transportation Authority in New York (MTA) has announced a set of tolls for vehicles on streets south of Central Park.Passenger vehicles: $15Small trucks: $24Large trucks: $36Motorcycles: $7.50Taxi drivers: $1.25 per rideUber, Lyft, other ride-shares: $2.50 per rideThe economic reasoning for charging tolls in Manhattan is simple; open access to the roads of Manhattan leads to a Tragedy of the Commons. The ability of everyone to use...

Read More »

Read More »

Bailing Out For A Buck

Further evidence of the crash in office property values comes from news that the Canadian Pension Plan Investment Board (CPPIB) with $436.9 billion in capital sold its 29% stake in Manhattan’s 360 Park Avenue South for $1 to its partner Boston Properties Inc., which agreed to assume CPPIC’s share of the property’s debt. It was only in the third quarter of 2022, CPPIB committed $83.6 million as part of a tri-party venture with Boston Properties and...

Read More »

Read More »

Help Us Celebrate Human Action’s 75th Anniversary!

Investor and author Doug Casey recently wrote that most economists “are political apologists masquerading as economists.” He says they are like witch doctors pretending to be neurosurgeons.

Read More »

Read More »

Federal Reserve Responsibility for Consumer and Government Debt Crises

According to the Federal Reserve, credit card delinquencies increased by 50 percent in 2023, while consumer debt grew to 17.5 trillion dollars. A recent survey by Clever Real Estate found that three in five Americans have credit card debt and that 23 percent of Americans increase their credit card debt every month. The survey also found that 48 percent of Americans (including 59 percent of millennials) use credit cards for essential living...

Read More »

Read More »

How Would US States Actually Declare Bankruptcy?

Stephen Anderson, in his Mises Wire essays of February 1 (“Are Bankruptcies of Some US States in the Future?”) and February 23 (“US States Have a Long History of Defaulting”), worries that some US states may be on the precipice of bankruptcy.

Read More »

Read More »

The Heroic Joe Sobran

In these times of war in the Middle East, I often think of my late friend, the great and brilliant Joe Sobran. If Joe could be with us today, it’s clear what he would be saying. Why does the US support Israel uncritically? How is doing so in our national interest? What about the rights of Palestinians to their land?How do we know he would say these things? Because this is exactly what he did said in 2002.“In my 21 years at National Review, I had a...

Read More »

Read More »

Hayek Explains Emergency Powers

In this morning's Mises Wire article, I mentioned that the true nature of the ruling class tends to be revealed in times of emergency. Moreover, it is during declared "emergencies" that it becomes clear that ordinary constitutional limits on state powers—such as the much touted "balance of powers" tend to do little to actually restrain regime power. Not all constitutional systems are equally bad in these situations, of course,...

Read More »

Read More »

The Paramedic who Helped Police Kill Elijah McClain Is Sentenced to Five Years

On Monday, Aurora, Colorado paramedic Peter Cichuniec was sentenced to five years in prison (for criminally negligent homicide) for his part in the killing of Elijah McClain. McClain was an Aurora resident who had been walking home on the night of August 24, 2019. After police received a call about an unarmed person who looked "sketchy," police stopped and confronted McClain. McClain was doing nothing illegal and had given police no...

Read More »

Read More »

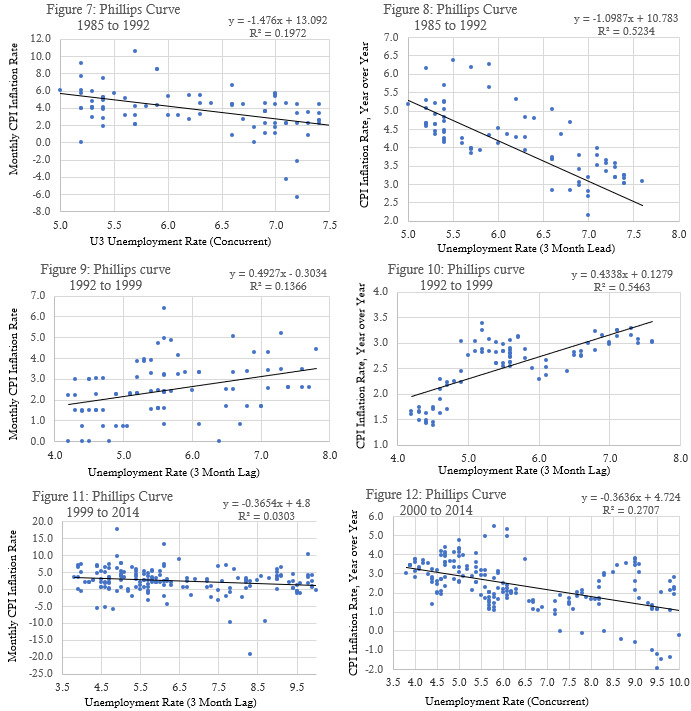

The Folly of Federal Reserve Stabilization Policy: Part II 1985-2023

Many economists think the Federal Reserve can use Phillips Curve tradeoffs between inflation and unemployment to guide Fed macro stabilization policy. Inflationary Fed policies may act as a monetary stimulus, to regulate unemployment. Data from 1948 to 1985 indicates that the Phillips Curve doesn’t actually exist. Does the data since 1985 reveal stable Phillips Curve tradeoffs- estimates of the effects of inflation on unemployment that may guide...

Read More »

Read More »

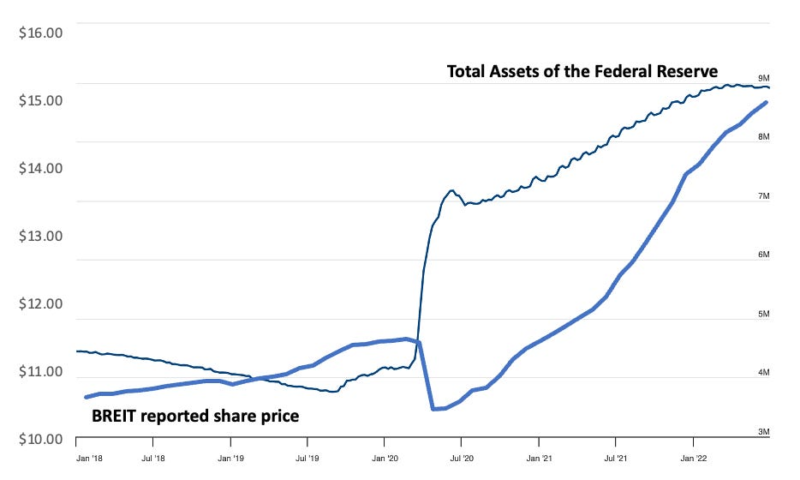

Private REITs Hide Commercial Real Estate Distress While Begging for Bailouts

During the most recent commercial real estate bubble, two things happened in tandem. First, due to the Federal Reserve’s zero interest rate policy, savers were unable to invest their cash at a decent rate of return.

Read More »

Read More »

Elon’s Boring Line of Bull

Something’s rotten under the Las Vegas Convention Center and it turns out it’s a chemical sludge with the “consistency of a milkshake,” reports Bloomberg Businessweek. This sludge is a byproduct of Elon Musk’s Boring Company tunneling from the Las Vegas Convention Center to the Encore and Westgate hotels. These tunnels don’t feature rapid transit but instead individual Teslas ferrying carloads of convention goers at just 40 mph. Workers are being...

Read More »

Read More »

To the European Union: Don’t Tread on Us

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

The War of 1812 and the Panic of 1819: The Unholy Alliance between Government and Banking

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

The Right Is Wrong to Pursue Term Limits

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »