Category Archive: 6b.) Mises.org

Anatomia do Estado, Murray N. Rothbard (1926-1995) #indicação de leitura 28.

#DURecorder

Este é meu vídeo gravado com DU Recorder. É fácil gravar sua tela e fazer transmissão ao vivo. Link de download:

Android: https://goo.gl/s9D6Mf

iOS: https://goo.gl/nXnxyN

https://www.amazon.com.br/anatomia-do-estado/s?k=anatomia+do+estado

https://www.mises.org.br/Ebook.aspx?id=69

Read More »

Read More »

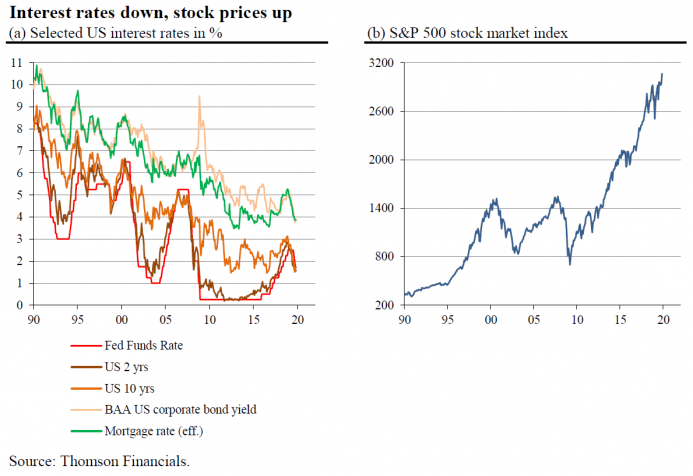

Why Central Banks Aren’t Really Setting Interest Rates

Mainstream thinking considers the central bank a key factor in the determination of interest rates. By setting short-term interest rates, the central bank, it is argued, can influence the entire interest rate structure by creating expectations about the future course of its interest rate policy.

Read More »

Read More »

Anatomia do Estado, Murray N. Rothbard (1926-1995) #indicação de leitura 28.

#DURecorder Este é meu vídeo gravado com DU Recorder. É fácil gravar sua tela e fazer transmissão ao vivo. Link de download: Android: https://goo.gl/s9D6Mf iOS: https://goo.gl/nXnxyN https://www.amazon.com.br/anatomia-do-estado/s?k=anatomia+do+estado https://www.mises.org.br/Ebook.aspx?id=69

Read More »

Read More »

A possibilidade de uma justiça privada – Robert P. Murphy

Conheça todo meu trabalho e formas de apoia-lo http://etoempire.ctcin.bio/ A liberdade é inevitável!! Esse vídeo foi apoiado por : Allan Ricardo,Nicola Occhipinti Magalhães, Douglas Otoni, Átila Balzer Piekarski, Patrick Tracanelli, Artur Pereira de Lima, Vinícius Perini, Ricardo Ariel Nasatto, Thiago Carneiro Ribeiral, Luis Otavio Oliveira da Matta, Lucas Terass, Lucas Terassi, Carlos Oliveira, Leonardo José …

Read More »

Read More »

Central Banks May Be Driving Us Toward More Waste, More Carbon Emissions

Christine Lagarde, the new president of the European Central Bank (ECB), has added a new green dimension to monetary policymaking. The charming Frenchwoman signaled that the ECB could buy green bonds, possibly as part of the reanimated bond purchase program (a form of QE). This could reduce the financing costs of green investment projects.

Read More »

Read More »

Why this Boom Could Keep Going Well Beyond 2019

The Austrian business cycle theory offers a sound explanation of what happens with the economy if and when the central banks, in close cooperation with commercial banks, create new money balances through credit expansion. Said credit expansion causes the market interest rate to drop below its "natural level," tempting people to save less and consume more.

Read More »

Read More »

Professor Dr. Thorsten Polleit: „Die antikapitalistische Mentalität. Ein Psychogramm“

Vortrag von Professor Dr. Thorsten Polleit im Rahmen der 7. Jahreskonferenz des Ludwig von Mises Institut Deutschland am 19. Oktober 2019. Das Thema der Konferenz lautete: „Logik versus Emotion. Warum die Welt so ist, wie sie ist“. Mehr Informationen gibt es auf www.misesde.org Wir weisen darauf hin, dass unsere Kommentarfunktion dazu dient, sachlich fundierte Beiträge …

Read More »

Read More »

How California’s Government Plans to Make Wildfires Even Worse

Not every square inch of the planet earth is suitable for a housing development. Flood plains are not great places to build homes. A grove of trees adjacent to a tinder-dry national forest is not ideal for a dream home. And California's chaparral ecosystems are risky places for neighborhoods.

Read More »

Read More »

Blue Laws: Consumers, Not Capitalists, Are the Reason We’re Working on Sunday

It has now become commonplace for politicians and media pundits to casually assert that "everyone" — to use Alexandria Ocasio-Cortez's term — is now working more and more hours — and perhaps two or three jobs — just to attain the most basic, near-subsistence standard of living.

Read More »

Read More »

#14 Grüne Geldpolitik: Die Globalisten erobern jetzt die EZB – Golden Times

EZB-Präsidentin Christine Lagarde will in Zukunft „grüne Geldpolitik“ betreiben – was könnte das für mögliche Folgen haben? Chefvolkswirt des Degussa, Dr. Thorsten Polleit erklärt, welche Gefahren hier für die Wirtschaft lauern. Außerdem: Der Aufwärtstrend beim Goldpreis bleibt intakt – in einem Interview mit Daniel Kuckelkorn erklärt Polleit, warum Gold auch in Zukunft mächtig anziehen wird. …

Read More »

Read More »

The Cultural Consequences of Negative Interest Rates

Negative interest rates are now entrenched reality in Europe, and not just for buyers of sovereign or corporate debt – even retail savings accounts are affected. What does this mean for real people trying to save for retirement? And more broadly, what does it mean for Europe culturally? Not to mention America, since Alan Greenspan tells us negative rates are coming here soon?

Read More »

Read More »

Marktbericht Mi. 04.12.2019 – DAX erholt sich, Halver, Thieme, Schmitz, Polleit im Interview

Was macht der DAX nach der Talfahrt in dieser Woche? Er erholt sich wieder und zwar ein ganzes Stück: 1,2 % Plus auf 13.141 Punkte sehen doch gleich schon wieder etwas besser aus. Der Handelskrieg spielt weiterhin eine wichtige Rolle, brachte heute aber keine neuen Verwerfungen hervor. Die Einkaufsmanagerindizes aus China waren erneut sehr gut. …

Read More »

Read More »

Exports: Currency Devaluation Won’t Grow the Economy

A visible weakness in economic activity in major world economies raises concern among various commentators that world economies have difficulties recovering despite very aggressive loose monetary policies. The yearly growth rate of US industrial production stood at minus 1.1 % in October, against minus 0.1% in September, and 4.1% in October last year.

Read More »

Read More »

Per Bylund on the Economics of Value versus Economies of Scale

Good economic theory predicts effective, cutting edge business practices. For example, the dynamic flexibility of capital resource allocation predicted by Austrian Capital Theory is being realized today via digitization, dematerialization and agile organizational innovations. Entrepreneurs who fully embrace Austrian theory can be leaders in the field of business implementation. At the same time, economic theory …

Read More »

Read More »

Politicians Want Thanksgiving To Be Political. Ignore Them.

Often, government-created holidays begin with a good premise — i.e., Independence Day, Armistice Day — and get worse from there. On Independence Day, instead of celebrating armed rebellion and secession, we now sing the praises of the government. Similarly, Armistice Day — a day designed to commemorate the end of a war — became Veterans Day, a day designed to honor government employees.

Read More »

Read More »

The Hidden Link Between Fiat Money and the Increasing Appeal of Socialism

What causes the seemingly unfounded confidence in socialism we encounter more and more in the news media and among political activists? In the Extinction Rebellion movement, for example, activists are quite certain they have learned that there is an alternative to markets as the means to economic prosperity. It's a means that does not involve meeting the legitimate needs of one's fellow men in the marketplace.

Read More »

Read More »

Capital Accumulation, Not Government, Is the Key To Technological Innovation

According to Mariana Mazzucato, the RM Phillips Professor in the Economics of Innovation at the University of Sussex, government is an important factor in the promotion of innovation and thus economic growth. In particular, she challenges the popular view that innovation happens in the private sector, with governments playing a limited role. Many commentators regard her as a revolutionary thinker that challenges the accepted dogma regarding the...

Read More »

Read More »

Money-Supply Growth Accelerates to 28-Month High

The money supply growth rate rose in October, climbing to a twenty-eight-month high. The last time the growth rate was higher was during July of 2017, when the growth rate was 5.07 percent. During October 2019, year-over-year growth in the money supply was at 4.95 percent. That's up from September's rate of 3.10 percent, and was up from October 2018's rate of 3.49 percent.

Read More »

Read More »

There Is No End to History, No Perfect Existence

All doctrines that have sought to discover in the course of human history some definite trend in the sequence of changes have disagreed, in reference to the past, with the historically established facts and where they tried to predict the future have been spectacularly proved wrong by later events.

Read More »

Read More »