Category Archive: 6b.) Mises.org

How Government Makes a Pandemic More Deadly

In the early days of the outbreak, pundits rushed to the ramparts of Twitter to proclaim that “there are no libertarians in a pandemic.” However, this glee at the apparent failure of markets was soon dashed as more evidence accumulated showing that government intervention was actually the main impediment to success.

Read More »

Read More »

How to Think About the Fed Now

[This text is excerpted from the introduction to The Anatomy of the Crash, a Mises Institute ebook to be released in April 2020.] The Great Crash of 2020 was not caused by a virus. It was precipitated by the virus, and made worse by the crazed decisions of governments around the world to shut down business and travel. But it was caused by economic fragility.

Read More »

Read More »

Builders in Denial

The year 2006 seems like a lifetime ago. The housing boom seemed to be going full throttle, but danger lurked. I wrote on LewRockwell.com in March of that year, concerning a Las Vegas real estate seminar, that “nary a discouraging word was spoken.”

Read More »

Read More »

Why This Bubble Economy Keeps Going and Going

Quite a few people may wonder why the global fiat money system has not yet collapsed. The fiat money system did not crash in the financial and economic crisis of 2008/2009, when a great many people feared the debt pyramid would come crashing down.

Read More »

Read More »

In an Age of Pandemics We Need More Freedom to Trade, Not Less

There are many who use the coronavirus crisis to blame freedom to trade for the current epidemic. And, of course, there are those who are already arguing for autarky, closing our borders, and producing everything locally.

Read More »

Read More »

Thanks to Lockdowns, State and Local Tax Revenues Are Plummeting

Unlike the federal government, state and local governments in America can't just create money out of thin air. So when tax revenues go down, that money is simply not available to the state legislatures and city councils anymore. These governments either have to borrow the money or raise taxes and hope the tax hike itself doesn't cause total revenue to fall.

Read More »

Read More »

Danish State Plans to Pay the Salaries of Private Sector Workers

The ongoing coronavirus pandemic has halted economies across the globe. With various countries on lockdown and companies unable to continue production, an economic downturn is inevitable. In light of this, the government of Denmark has come up with a strategy to avoid recession—paying 75 percent of private employees’ salaries.

Read More »

Read More »

What Is Entrepreneurship?

We shall concentrate on the capitalist-entrepreneurs, economically the more important type of entrepreneur. These are the men who invest in "capital" (land and/or capital goods) used in the productive process….

Read More »

Read More »

Keynes Called Himself a Socialist. He Was Right.

In 1997 Ralph Raico published an article titled “Keynes and the Reds.” Raico’s article highlighted John Maynard Keynes’s review of a 1936 book by the British socialists Sidney and Beatrice Webb called Soviet Communism. In his review, Keynes discusses Joseph Stalin’s USSR and concludes: “The result is impressive.”

Read More »

Read More »

Government Overreach in the Age of COVID-19

In times of crisis, governments have a tendency to overcompensate for risk. This tendency may be in the public’s best interest, but it could also serve broader governmental interests. The public and government’s interest are not always one and the same.

Read More »

Read More »

Why Mexico Is Reluctant to Shut Down Its Economy to Combat COVID-19

Mexico's president Andrés Manuel López Obrador has been reluctant to impose mandatory "social distancing" orders on the Mexican population. According to USNews, López Obrador "has maintained a relaxed public attitude" toward COVID-19, and the Mexican government did not impose a ban on "non-essential" work until March 30, long after health officials in other countries insisted Mexico must do so.

Read More »

Read More »

How Risk-Based Healthcare Could Make Us Healthier

It is generally the case that simple concepts in nature produce incredible complexity. This applies to the genome, where simple base pairs have evolved to express complex and multifunctional instructions that would take thousands of lines of code for any human to create. This applies to the economy, where simple ideas such as the price system become infinitely complex at scale.

Read More »

Read More »

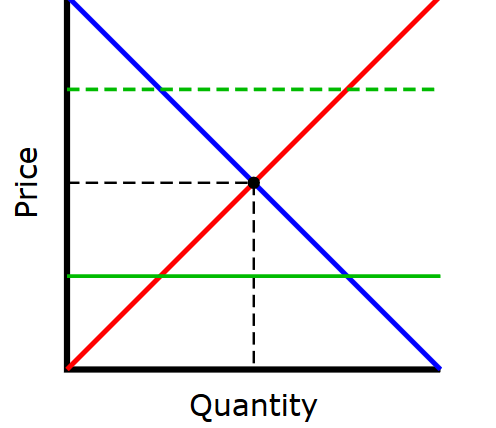

The Real Cost of Anti-Price-Gouging Laws

As has happened before with many natural disasters, the COVID-19 panic is leading to complaints of shortages and “gouging,” which about two-thirds of US states have passed laws against (often in terms so vague that it makes any enforcement discretionary, and thus discriminatory). But rather than complaining of shortages and gouging, critics should realize that “gouging” is the solution to shortages, not a cost in addition to them.

Read More »

Read More »

All Crises Are Local

South Dakota is not New York City. A seemingly innocuous statement, made last Wednesday by Governor Kristi Noem in response to calls for her to issue a coronavirus shutdown across a state with the motto "Under God the People Rule." South Dakota, after all, is one of the least densely populated states in the vast American West.

Read More »

Read More »

Rory Sutherland: How The Austrian Approach Helps Entrepreneurs Multiply Value

Key Takeaways And Actionable Insights. In episode 60, we are joined by Rory Sutherland, Vice Chairman of Ogilvy, one of the world’s largest advertising and marketing agencies, one with a long tradition of customer insights. His latest book is titled Alchemy, which explores how a deep understanding of subjective value can lead to outstandingly effective creative marketing.

Read More »

Read More »

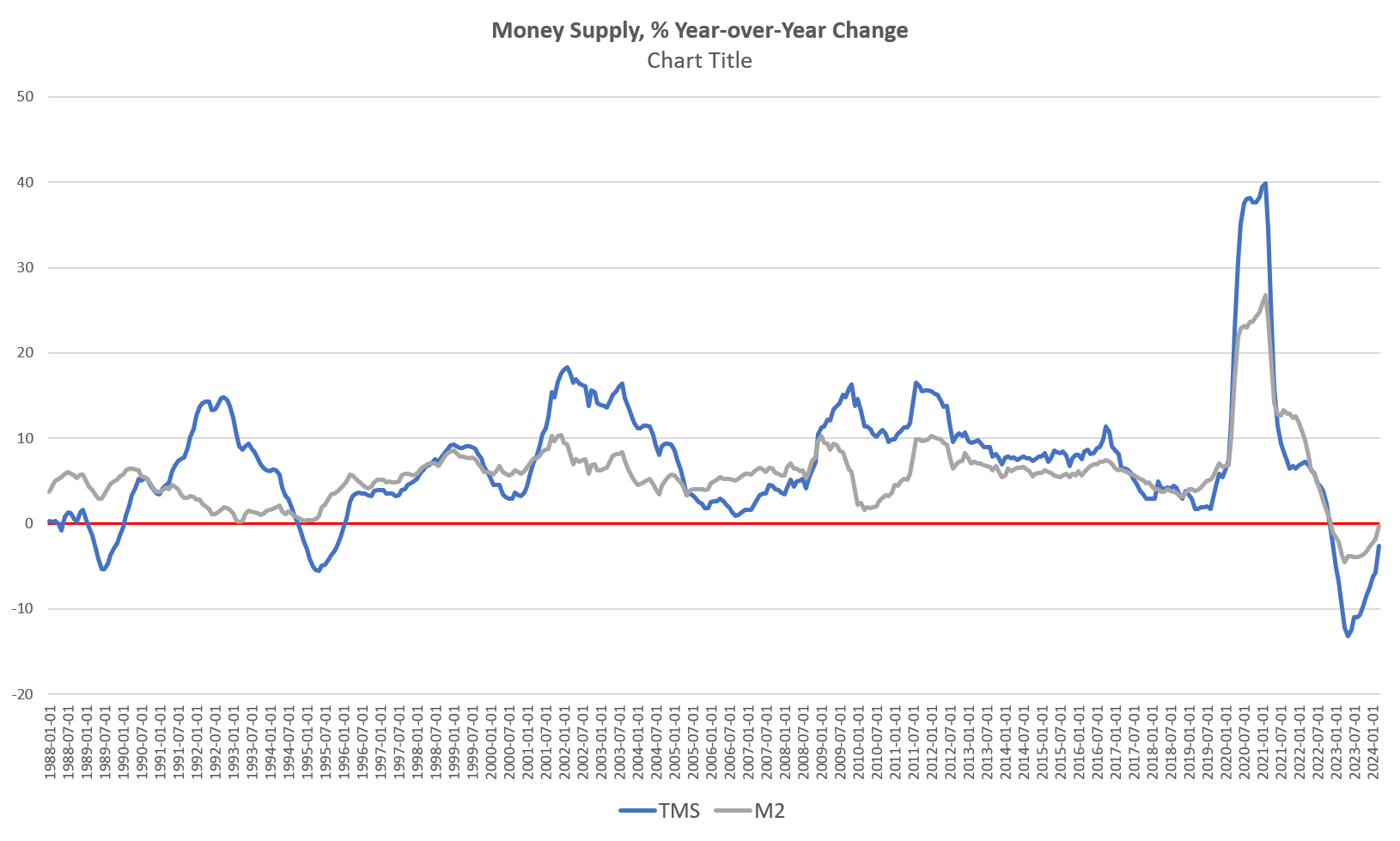

Creating More Money Won’t Revive the Economy

In response to the coronavirus, central banks worldwide are currently pumping massive amounts of money. This pumping, it is held, is going to arrest the negative economic side effects that the virus-related panic inflicts on economies. As appealing as it sounds we suggest that this view is erroneous.

Read More »

Read More »

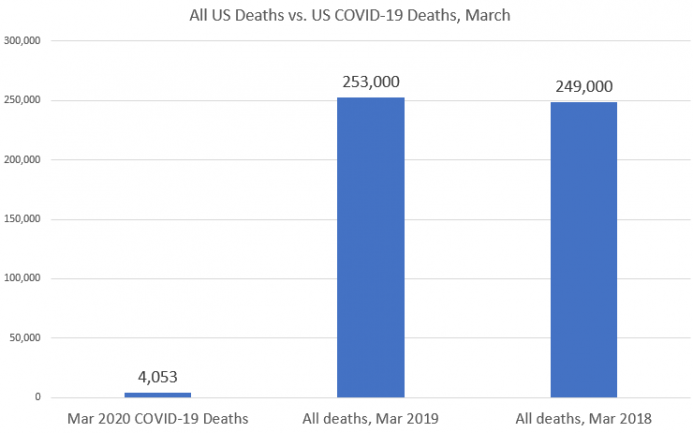

In March, US Deaths From COVID-19 Totaled Less Than 2 Percent of All Deaths

About 2.9 million people die in the United States each year from all causes. Monthly this total ranges from around 220,000 in the summertime to more than 280,000 in winter. In recent decades, flu season has often peaked sometime from January to March, and this is a major driver in total deaths. The average daily number of deaths from December through March is over eight thousand.

Read More »

Read More »

What “Lender of Last Resort” Is Supposed to Mean

Modern central banks have already moved far beyond what was once considered the proper role for a central bank as a "lender of last resort." Now Keynesians and MMTers (modern monetary theorists) want to take things even further.

Read More »

Read More »

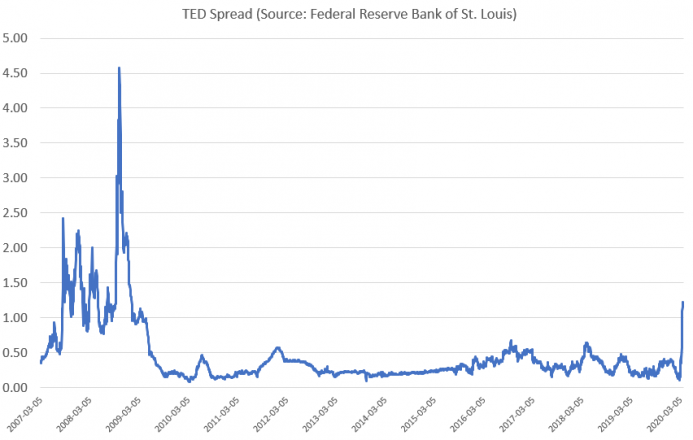

The Pandemic Exposed the Frailty of the Financial System

Despite the more optimistic claims of political pundits and Federal Reserve officials (Jerome Powell, specifically), things are far from being under control. Notwithstanding archetypal Austrian objections to “loose” monetary and fiscal policies on the grounds that they create production structures that ultimately deplete the pool of real savings, the operational failures of central banks cross-globally are largely nested in faulty axioms.

Read More »

Read More »

What Is the Good Entrepreneur to Do?

In a January 2020 Forbes Magazine article titled “Why Doing Good Is Good For Business” clearly left out critical information: who is the good or bad entrepreneur? According to the author, good entrepreneurs are doing good if their primary objective is not to make a profit. And bad entrepreneurs are doing bad if their primary objective is to make a profit.

Read More »

Read More »