Category Archive: 6b.) Mises.org

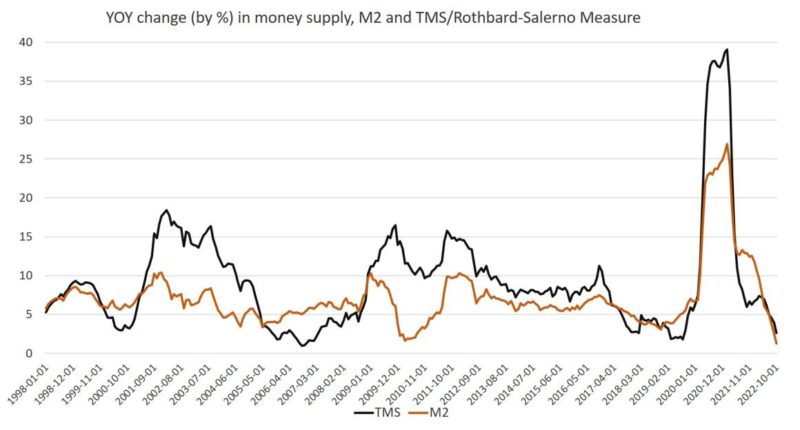

Money-Supply Growth in October Fell to a 39-Month Low. A Recession Is Now Almost Guaranteed.

Money supply growth fell again in October, dropping to a 39-month low. October's drop continues a steep downward trend from the unprecedented highs experienced during the thirteen months between April 2020 and April 2021. During that period, money supply growth in the United States often climbed above 35 percent year over year, well above even the "high" levels experienced from 2009 to 2013.

Read More »

Read More »

College Loans and Hazlitt’s Lesson: Ignoring the Larger Picture

As of 2022 the national student debt reached $1.6 trillion with the average student loan debt at about $28,000. Many former college students are discovering it is difficult to pay back such a large amount of debt. This is especially true of students that graduate with fruitless degrees like sociology, for example.

Read More »

Read More »

The Great Gold Robbery of 1933

[Originally published August 13, 2008]

It's been 75 years since the federal government, on the spurious grounds of fighting the Great Depression, ordered the confiscation of all monetary gold from Americans, permitting trivial amounts for ornamental or industrial use.

Read More »

Read More »

The Near Collapse of the UK Pension Sector Exposes Failures by Financial Regulators

In an earlier article, I explained that the collapse in the long-dated UK government bond (or gilts) market on September 28 that followed the ill-fated Kwarteng “mini budget” of a few days earlier had exposed a hitherto underappreciated problem: UK pension schemes were massively exposed to changes in long-dated gilts rates.

Read More »

Read More »

The REAL Solution to the Coming Economic Crisis

My previous article demonstrated how the free market solves a boom-bust crisis and is the only solution, its effectiveness depending upon the magnitude of the crisis and, more importantly, how much the government intervenes in response. The bigger the problem created by the Fed, the greater the crisis and the more government intervenes, and the slower the economy recovers.

Read More »

Read More »

Relying on Experts: A Proven Path to Failure

The warning lights on the dashboard of your car suddenly light up. You naturally take it to a mechanic to diagnose and repair. Cars are complex. You don’t have the time or accumulated expertise to figure out what is happening or to fix it.

We rely on experts daily.

Read More »

Read More »

The Housing Boom Is Already Over. Get Ready for Even Higher Prices.

As mortgage rates have risen this year, the demand for home purchases has fallen. That has spelled trouble for the home construction business. Homebuilder confidence dropped for the 10th straight month in October.

Read More »

Read More »

What I Learned from my Grandfather about Money

When I was a child, my mother and I would take the Long Island Railroad to Brooklyn to see relatives a few times a year. My grandfather was always outside in front of the apartment house in Park Slope, where he and my aunts and uncles lived. Upon seeing him, I would run down the sidewalk to greet him, but before I could say “Hi, Grandpa!,” he would without fail press a shiny silver dollar into my hand.

Read More »

Read More »

World War I: The Great War Was also the Great Enabler of Progressive Governance

Commentaries about World War I frequently discuss causes and consequences but almost never mention the enablers. At best, they might mention them approvingly, as if we were fortunate to have had the Fed and the income tax, along with the ingenuity of the liberty bond programs, to finance our glorious role in that bloodbath.

Read More »

Read More »

Why “Greedflation” Isn’t Real

Even as price inflation slows and we move past June’s peak, progressives continue to push the concept of “greedflation”—that this year’s price inflation is caused by corporate greed and price gouging. This is inaccurate, based on bad economics, and it blames a consequence of the problem rather than the problem itself.

Read More »

Read More »

Economic Calculation and the Great Reset

A grand plan is advanced by the World Economic Forum (WEF). Its name, “The Great Reset,” conveys the scope of this undertaking. Among its many audacious goals, it will “offer insights to help inform all those determining the future state of global relations, the direction of national economies, the priorities of societies, the nature of business models and the management of a global commons.”

Read More »

Read More »

Joe Biden and the “Transformational” Presidency

Much is made of the failure of Republicans to make predicted gains in the recent midterm elections, but, as Ryan McMaken has pointed out, Congress plays a much-diminished role in national governance to the point that even had the so-called Red Wave actually occurred, it is doubtful that much would have changed regarding Joe Biden’s presidency.

Read More »

Read More »

The Rise and Fall of Trussonomics

On July 8 this year, UK prime minister Boris Johnson resigned as Conservative Party leader after a Cabinet revolt over a series of ethics scandals had made his position untenable. A leadership election was then set in motion to allow party members to elect the next party leader who would succeed Johnson as PM.

Read More »

Read More »

Tom Malengo on Brandjectory, An Innovative New Platform for Launching and Growing Entrepreneurial Businesses

A great benefit of the internet age is the capacity to accumulate, accelerate, and intensify connections between entrepreneurs, knowledge sources, investors, mentors, collaborators, and service providers. Businesses with a valid value proposition who are in the launch and early expansion phases can interconnect a network of powerful and qualified resources to support their growth.

Read More »

Read More »

Nationality and Statelessness: The Kuwaiti Bidoon

In his Nations by Consent, Murray Rothbard reminds us that the concept of a nation “cannot be precisely defined; it is a complex and varying constellation of different forms of communities, languages, ethnic groups, or religions.”

Read More »

Read More »

“Antidemocratic” Just Means “Something the Regime Doesn’t Like.”

In the old Marxist regimes, anything that displeased the ruling communist regime was said to be contrary to "the revolution." For example, in the Soviet Union, national leaders spoke regularly of how the nation was in the process of "a revolutionary transformation" toward a future idealized communist society.

Read More »

Read More »

The End of World Dollar Hegemony: Turning the USA into Weimar Germany

In a recent essay, I explained how over time the US abused its responsibility to control the supply of dollars, the world’s premier reserve currency for settling international trade accounts among nations. This abrogation of its duties is leading to the likely adoption of a new reserve currency, commodity based and controlled not by one nation but by members, all watchful that the currency is not inflated.

Read More »

Read More »

Jeff Bezos, Charity, and Economic Well-Being: Wealth Creation Reduces Poverty

Billionaire Jeff Bezos has become a target of ridicule because his ex-wife MacKenzie Scott has been doling out colossal sums to charity. Compared to Scott, Bezos’s donations are quite slim and many are painting him as stingy. But are critics misguided in how they perceive the utility of philanthropy?

Read More »

Read More »

Declining Prices Do Not Destroy Wealth; They Enable Its Creation

Most economists believe that a general decline in the prices of goods and services is bad news because it is associated with major economic slumps such as the Great Depression. In July 1932, the yearly growth rate of US industrial production stood at –31 percent whilst in September 1932 the yearly growth rate of the US Consumer Price Index (CPI) stood at –10.7 percent.

Read More »

Read More »