Category Archive: 6b.) Mises.org

How Marxism Abuses Ethics and Science to Deceive Its Followers

In his 1922 book on socialism, Die Gemeinwirtschaft, Ludwig von Mises attributes socialism’s attractiveness to the claim that Marx’s doctrine would be both ethical and scientific. In truth, however, Marxism represents a metaphysical dogma that promises an earthly paradise yet threatens civilization itself.

Thesis of the Inevitability of Socialism

Marxism explains that immoral capitalist economies will necessarily be replaced by socialist systems...

Read More »

Read More »

Money Laundering: Another Noncrime Pursued by Criminal Authorities

Money laundering is illegal in the USA, but like so many other federal crimes, it is difficult to identify and define. That is the perfect recipe for government abuse of innocent people.

Original Article: "Money Laundering: Another Noncrime Pursued by Criminal Authorities"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Budget Deficit Hits Monthly Record Due to Biden’s Policies

America’s “monthly federal deficit hit a record $249 billion in November—$57 billion more than the same month last year—with federal spending also hitting new heights in consecutive months, while tax revenues dropped,” reports the London Daily Mail.

The deficit is $57billion higher than it was in November of 2021—which is a record-breaking year-on-year change. Federal spending is up $28billion from last year to $501billion in November 2022,...

Read More »

Read More »

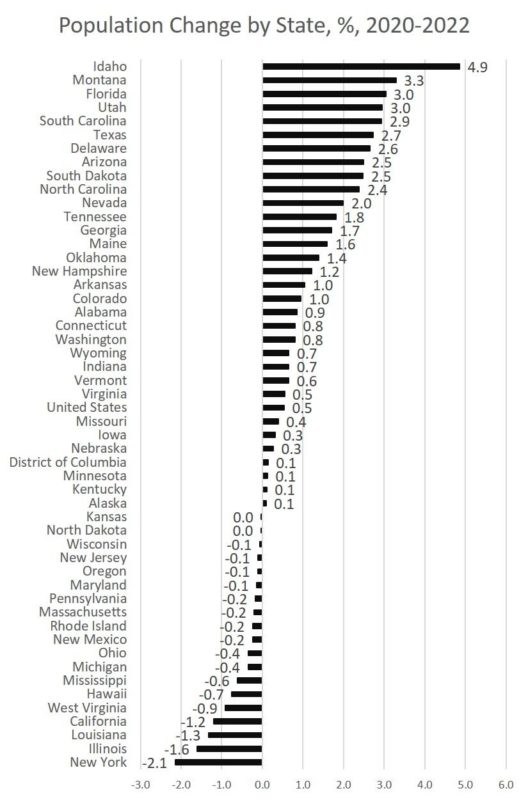

Since Covid Lockdowns, New York Lost More of Its Population than Any Other State

Florida Governor Ron DeSantis has frequently bragged that Florida is in high demand among people looking to relocate. In a new report released this week from the Census Bureau, it seems that he's been correct. According to the Bureau's report:

After decades of rapid population increase, Florida now is the nation’s fastest-growing state for the first time since 1957, according to the U.S. Census Bureau’s Vintage 2022 population estimates released...

Read More »

Read More »

R.G. Collingwood on the Collapse of Civilization

R.G. Collingwood, a philosopher, historian, and archaeologist who taught at Oxford in the first half of the twentieth century, was much esteemed by Ludwig von Mises, especially for his essay “Economics as a Philosophical Science” and, more generally, for his work in the philosophy of history. In this week’s column, I’d like to consider a point that Collingwood makes in his “Fascism and Nazism,” published in Philosophy in 1940, that helps us answer...

Read More »

Read More »

Jeff Deist on What 2023 Portends

This week's show features a bare-knuckle discussion between Jeff and José Niño of "El Niño Speaks" on the biggest political, economic, and cultural events of 2022—and what they portend for 2023.

You don't want to miss Jeff's unvarnished thoughts on the Left, the Right, the economy, and what is sure to be a turbulent New Year.

Read José's Substack: josbcf.substack.com

[embedded content]

Read More »

Read More »

The Reichsbank: Germany’s Central Bank Lays Foundation of Monetary Disaster

Long before there was the infamous German inflation of 1923, the Reichsbank created the scenario of monetary debasement.

Original Article: "The Reichsbank: Germany's Central Bank Lays Foundation of Monetary Disaster"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Notes from the Digital Gulag

As the author of Google Archipelago: The Digital Gulag and the Simulation of Freedom, I guess I should not be surprised to find myself squarely in the digital gulag—banished, perhaps permanently, from Twitter and Facebook. Twitter permanently suspended my account several weeks ago, mere days before Elon Musk took over the helm. Although I cannot be sure, I may have been banned because I suggested that the transgender movement is part of a...

Read More »

Read More »

Grover Cleveland Presented the Best Example of a True Liberal Populist

Six years after the election of Donald Trump, the Republican Party is still adrift. On the one hand, the GOP has embraced an antiestablishment and populist message. On the other hand, Republicans have not quite figured out how to balance populism with classically liberal values like constitutionalism and free markets. Indeed, populism and classical liberalism seem to be in direct conflict.

Read More »

Read More »

Student Debt: It Is and Has Been a Personal Choice

The Supreme Court of the United States will hear plaintiff and defendant oral arguments for Biden v. Nebraska in February 2023. That case will determine whether the Biden administration has the constitutional authority to forgive student loan debt and thereby make taxpayers responsible for the debts that students have incurred.

Read More »

Read More »

Secession: Why the Regime Tolerates Self-Determination for Foreigners, but Not for Americans

Opponents of secession in the United States often choose from several reasons as to why no member state of the United States should be allowed to separate from the rest of the confederation. Some antisecessionists say it’s bad for national security reasons. Others oppose secession for nationalistic reasons, declaring that “we”—whoever that is—shouldn’t “give up on America.”

Read More »

Read More »

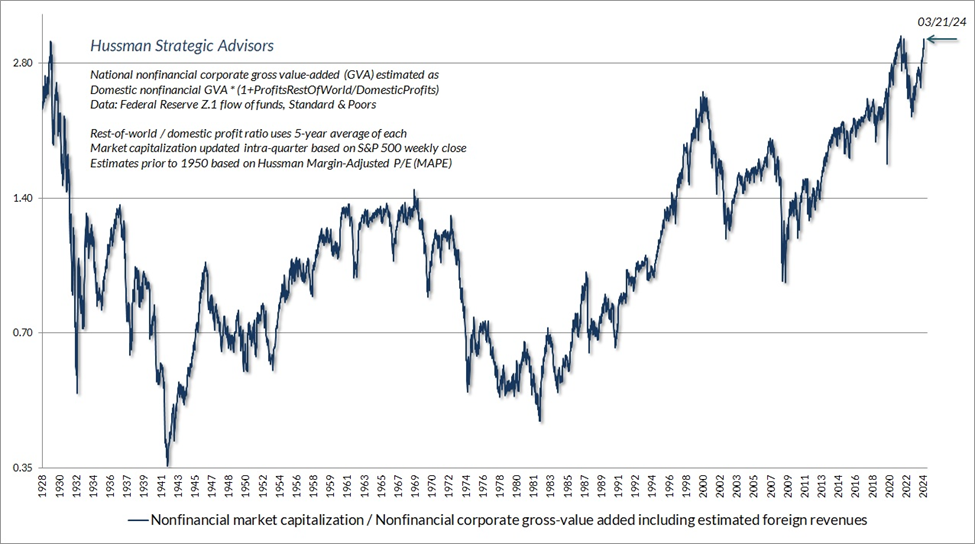

Why Central Banks Will Choose Recession Over Inflation

While many market participants are concerned about rate increases, they appear to be ignoring the largest risk: the potential for a massive liquidity drain in 2023. Even though December is here, central banks’ balance sheets have hardly, if at all, decreased. Rather than real sales, a weaker currency and the price of the accumulated bonds account for the majority of the fall in the balance sheets of the major central banks.

Read More »

Read More »

Austerity: A Real Solution to Help Heal the U.S. Economy

Austerity works. We know what it is and don’t like it, but it works. It usually means cutting your consumption and spending, paying down your debts, pawning assets, and working more hours to restore your economic situation.

Read More »

Read More »

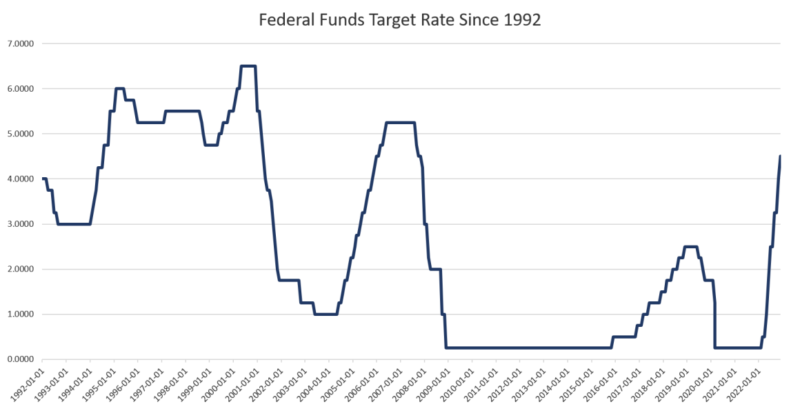

The Fed’s Powell Admits “I Don’t Know What We’ll Do” in 2023

The Federal Reserve's Federal Open Market Committee (FOMC) on Wednesday announced it will raise the target federal funds rate by 50 basis points, bringing the target rate to 4.5 percent. Wednesday's rate hike followed four hikes in a row of 75 basis points, and is the smallest rate hike since March.

Read More »

Read More »

Keynesian Policies Gave Us High Debt, Inflation, and Weak Growth

The evidence from the last thirty years is clear. Keynesian policies leave a massive trail of debt, weaker growth and falling real wages. Furthermore, once we look at each so-called stimulus plan, reality shows that the so-called multiplier effect of government spending is virtually nonexistent and has long-term negative implications for the health of the economy.

Read More »

Read More »

Decentralization, Freedom, and Peace Are the Pillars of a Free Society

[This article is the foreword to Breaking Away: The Case of Secession, Decentralization, and Smaller Polities, by Ryan McMaken, available in PDF, at the Mises store, and on Amazon.] Classical liberal tradition defends the right of secession on many grounds.

Read More »

Read More »

Global Rate Hikes Hit the Wall of Debt Maturity

More than ninety central banks worldwide are increasing interest rates. Bloomberg predicts that by mid-2023, the global policy rate, calculated as the average of major central banks’ reference rates weighted by GDP, will reach 5.5%. Next year, the federal funds rate is projected to reach 5.15 percent.

Read More »

Read More »

Economic Growth Requires Savings, Not Money Pumping

The U.S. personal savings rate eased in September to 3.1 percent from 3.4 percent in August. In September 2021 the savings rate stood at 7.9 percent. By popular thinking, a decline in the savings rate during an economic slowdown is regarded as supporting economic activity.

Read More »

Read More »

Father Time vs. Central Bankers

An excellent new book from Edward Chancellor, The Price of Time, sets out to explain both the theory and history of interest rates across five millennia and countless cultures. The theory is frequently bungled by economists; the history is frequently glossed over by historians. But thankfully Mr. Chancellor is up to the task. He is an excellent and engaging writer, owing presumably to his long career as a financial journalist.

Read More »

Read More »

And So It Begins: Digital Currency Becomes Possible in our Future

In mid-November, while the whole world was focused on the Ukraine crisis, the US midterms or whatever other “big story” the media decided was more important, a truly momentous shift took place in the global financial system. It might seem like a small step on the surface, but it has the potential to bring about a real and possibly irreversible sea change in the way we use money; or better said, the way it uses us.

Read More »

Read More »