Category Archive: 1) SNB and CHF

Banknoten können künftig unbegrenzt umgetauscht werden

Der Bundesrat hat am Mittwoch beschlossen, die Teilrevision des Bundesgesetzes über die Währung und Zahlungsmittel (WZG) auf den 1. Januar 2020 in Kraft zu setzen. Das Parlament hatte diese im Juni verabschiedet.

Read More »

Read More »

SNB’s Jordan: Swiss franc remains highly valued

Foreign exchange market remains fragile. Negative rates, readiness for intervention still necessary. Danger of a worsening international situation remains large. Imbalances in Swiss real estate market still persist.

Read More »

Read More »

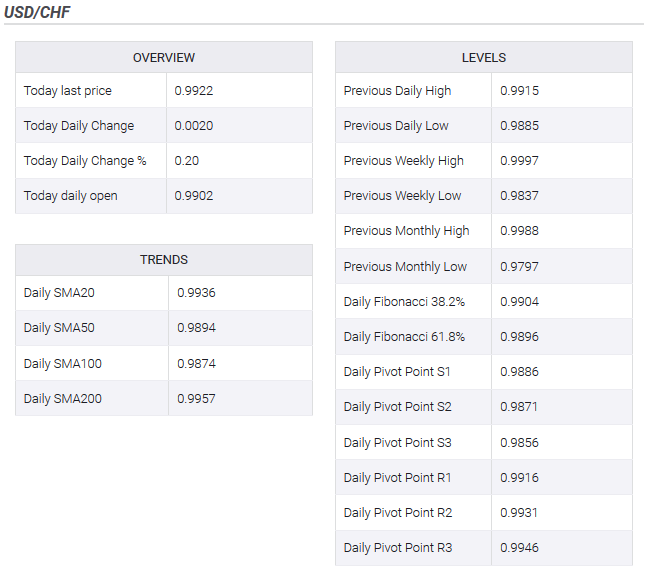

USD/CHF technical analysis: Greenback loses steam against Swissy, trades near 0.9930 level

USD/CHF erased its intraday gains, settling near the 0.9930 level. Support is seen at the 0.9920 level. On the daily chart, USD/CHF is trading in a range below its 200-day simple moving average (DMA). The spot is holding just above the 50 SMA today at the 0.9921 level.

Read More »

Read More »

Avenir Suisse erteilt Schweizer Staatsfonds klare Absage

Kein Sparschweinchen aus SNB-Pfründen. (Bild: Shutterstock.com/ valeriiaarnaud)Das Vermögen von Norwegens erfolgreichem Staatsfonds hat die Billionen-Franken-Schwelle geknackt und erntet entsprechende mediale Aufmerksamkeit. Dies lässt auch in der Schweiz Forderungen nach einem ähnlichen Konstrukt aufleben, um vorhersehbare AHV-Finanzierungslücken dereinst zu decken.

Read More »

Read More »

Negativzinsen: Für KMU überwiegen weder Kosten noch Nutzen

Schweizer Unternehmen sind wenig abhängig vom Wechselkurs, da nur die wenigsten exportieren. (Bild: Shutterstock.com/guruxox)Auch fünf Jahre nach der Einführung von Negativzinsen zur Schwächung des Frankenwechselkurses durch die Schweizerische Nationalbank (SNB) deutet nichts darauf hin, dass diese Phase der Geldpolitik bald dzu Ende gehen wird.

Read More »

Read More »

Negative rates might go lower, says Swiss National Bank chairman

Thomas Jordan, chairman of the Swiss National Bank (SNB), told the NZZ am Sonntag newspaper recently that central bank interest rates might need to go further into negative territory. Responding to growing criticism of negative central bank interest rates, Jordan said negative interest rates could continue and a further reduction is possible.

Read More »

Read More »

USD/CHF extends rally to 0.9975, highest since mid-October

Swiss Franc amid the worst performers on Thursday amid positive trade headlines. US dollar rises supported by higher US yields; Wall Street hits a new record. The USD/CHF pair broke to the upside after trading sideways around 0.9925 for hours. It climbed to 0.9975, reaching a three-week high. Near the end of the session, it is consolidating gains, holding above relevant short-term technical levels.

Read More »

Read More »

UBS: “Negative interest rates harm Swiss economy”

A survey of Swiss companies commissioned by UBS bank concludes that negative interest rates are harming the wider economy. Switzerland’s largest bank, UBS, asked 2,500 companies about the impact of negative interest rates. “Nearly two-thirds of respondents said that the cost…for the economy outweighed their benefits overall,” UBS said in a press releaseexternal link on Thursday.

Read More »

Read More »

USD/CHF technical analysis: Greenback hanging near the November highs against CHF

USD/CHF is trading flat on the day, consolidating the gains of the last two days. The level to beat for bulls is the 0.9940/0.9956 resistance zone. On the daily chart, USD/CHF is trading in a range below its 200-day simple moving average (DMA). The market is holding just above the 50 SMA today at the 0.9916 level.

Read More »

Read More »

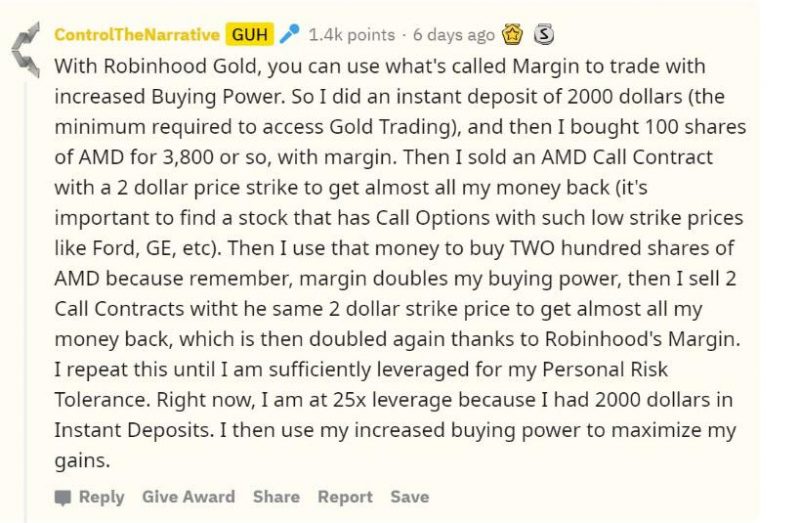

Robinhood’s “Infinite Money Cheat Code” Gives Traders Access To Unlimited Funds

If one is a central bank - such as the SNB and BOJ - life is easy: you just print as much money as you need out of thin air, and buy whatever you want, without regard for price. For those who are not central banks, having access to unlimited borrowed money may be the next best thing.

Read More »

Read More »

Gretchen-Parlament: Für Thomas Jordan ein Segen

„Gretchen-Parlament“ – diesen Ausdruck wählte ich in Anlehnung an die grüne Greta und ihre Jünger und Jüngerinnen europaweit. Kann von einem legalen Wahlkampf die Rede sein? Grüne Frauen wurden gewählt aufgrund sexueller Übervorteilung. Ich selber war Ständeratskandidat in Basel, wurde aber an keine einzige Podiumsdiskussion zugelassen. Women only.

Read More »

Read More »

SNB’s Jordan: Without negative rates, CHF would be more attractive and rise in value

In his prepared remarks delivered to pension managers on Thursday, Swiss National Bank Chairman Thomas Jordan said negative interest rates and readiness to intervene in the forex market was still essential to ease the pressure on the Swiss Franc.

Read More »

Read More »

USD/CHF technical analysis: Greenback nearing the October lows, consolidating near 0.9870 level

USD/CHF is consolidating its losses this Thursday. The level to beat for bears is the 0.9855 support. On the daily chart, USD/CHF is trading in a range below its main daily simple moving averages (DSMAs). The market is approaching the October low, currently at the 0.9837 price level.

Read More »

Read More »

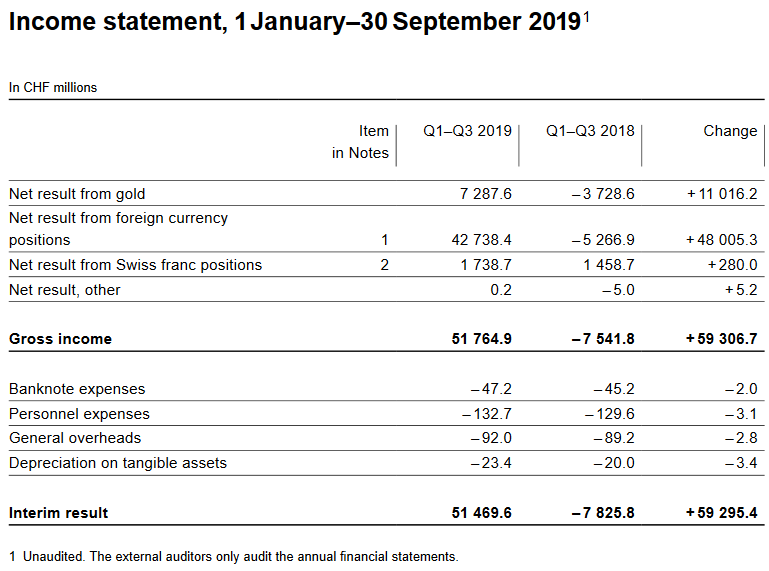

The Swiss National Bank reports a profit of CHF 51.5 billion for the first three quarters of 2019

The Swiss National Bank reports a profit of CHF 51.5 billion for the first three quarters of 2019. The profit on foreign currency positions amounted to CHF 42.7 billion. A valuation gain of CHF 7.3 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.7 billion.

Read More »

Read More »

SNB erzielt in den ersten 9 Monaten 2019 Gewinn von über 50 Milliarden Franken

Insgesamt verdiente die Nationalbank in der Periode von Januar bis September 2019 51,5 Milliarden Franken, wie sie am Donnerstag mitteilte. Nach einem Plus von 38,5 Milliarden in der ersten Jahreshälfte kamen damit im dritten Jahresviertel nochmals 13,0 Milliarden dazu.

Read More »

Read More »

EUR/CHF technical analysis: Bounces up from key support, eyes Oct. 17 high

EUR/CHF is looking north, having bounced up from key MA support. The 4-hour chart indicators are also reporting bullish conditions. EUR/CHF is better bid at 1.1030 press time and could challenge the Oct. 17 high of 1.1059 in the next 24 hours.

Read More »

Read More »

Swiss central bank makes 388 million from negative interest rates

The Swiss National Bank (SNB), Switzerland’s central bank, has earned CHF 388 million from negative interest rates since introducing them in 2014 to tame the rising strength of the Swiss Franc, according to the newspaper SonntagsBlick.

Read More »

Read More »

USD/CHF technical analysis: Jumps back closer to over 1-week tops

The intraday pullback finds decent support ahead of 0.9900 handle. Move beyond 0.9935 will set the stage for additional near-term gains. The USD/CHF pair did witness some intraday pullback but showed some resilience below 38.2% Fibonacci level of the 1.0028-0.9837 recent downfall. The pair managed to find decent support near 200-hour SMA and has now moved back closer to over one-week tops set earlier this Friday.

Read More »

Read More »

USD/CHF rises to one-week highs at 0.9930

US Dollar strengthens during the American session after US data. Swiss Franc fails to benefit from the demand for safe-haven assets. The USD/CHF pair rebounded at 0.9890 and climbed to 0.9930, the highest level since October 17. As of writing, trades at 0.9920, up almost 20 pips for the day, on its way to the fourth daily gain in-a-row.

Read More »

Read More »

2019-10-22 – Swiss National Bank opens SNB Forum for interested expert audience

Today, the Swiss National Bank is opening the SNB Forum on the ground floor of its premises at Fraumünsterstrasse 8 in Zurich. This has been created as part of the mult i-yearrenovation of this building, and is open to the public.

Read More »

Read More »

-637078290921470787-800x326.png)

-637076048529841650-800x391.png)