Category Archive: 1) SNB and CHF

Börse – Zinsen, Dividenden, Wachstum: Diese Schweizer Bank-Aktien ziehen starkes Interesse auf sich

Die Chefs von Schweizer Banken dürften am 16. Juni aufgeatmet haben. Was auch immer über die Pros und Cons von Zinserhöhungen gesagt wird, der Zinsschritt der Schweizerischen Nationalbank (SNB) hilft der Branche. Wie eine Auswertung von cash.ch zeigt, liegen in der Jahres-Performance 12 der 16 besonders zinssensitiven Kantonal- und Regionalbanken in der Schweiz und Liechtenstein im Puls (siehe Tabelle).

Read More »

Read More »

Swiss National Bank President Jordan warned of persistently higher inflationary pressure

Swiss National Bank President Thomas Jordan spoke at the Federal Reserve’s annual Jackson Hole symposium on Saturday.“Structural factors such as the transition to a greener economy, rising sovereign debt worldwide, the demographic transition and ultimately also the fact that globalization appears to have peaked -- at least temporarily -- could lead to persistently higher inflationary pressure in the coming years”

Read More »

Read More »

Thomas Jordan: Monetary policy under new constraints: challenges for the Swiss National Bank

The pandemic and the war in Ukraine have fundamentally changed the constraints on monetary policy. Uncertainty has increased strongly in many respects, and there has been a sharp rise in inflation.

Read More »

Read More »

Swiss National Bank Crime Syndicate THOMAS JORDAN – GOLDFINGER – MARTIN SCHLEGEL FBI Scotland Yard

MAINSTREAM NEWS MEDIA EXTRACTS: I

British Royal Family well seasoned commentators are known to have remarked that the genesis of the Gerald 6th Duke of Sutherland identity theft case lies in the forging of the birth certificate which effectively brought about a wide cadre of public figures who took advantage following the death of his mother and father respectively HRH The Princess Marina Duchess of Kent and George 5th Duke of Sutherland later...

Read More »

Read More »

Heads up for ECB, SNB, BoK speakers over the weekend

On Saturday at the Jackson Hole symposium there will be speakers from the European Central Bank, Swiss National Bank and Bank of Korea.

Read More »

Read More »

EUR/CHF forecast to 0.93 (Swiss National Bank to hike rates in September and December)

"We expect the SNB to hike by 50bp again in September and December to curtail underlying inflation pressures bringing the policy rate to 0.75%. With the SNB broadly following the ECB, we see relative rates as an inferior driver for the cross," Danske notes.

Read More »

Read More »

SNB Losses in the News

My written statement for 20minuten:

Anlageverluste der SNB sind schlecht für den Schweizer Steuerzahler, denn ihm gehört die SNB. Sie können aber auch Entwicklungen widerspiegeln, die ihre guten Seiten haben. Jetzt zum Beispiel führt die Frankenstärke zu Anlageverlusten, bremst aber auch die importierte Inflation.

Read More »

Read More »

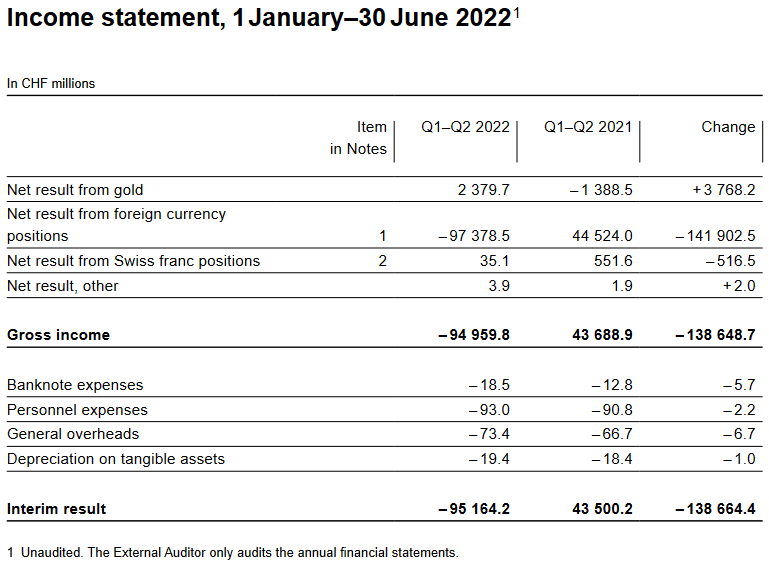

SNB Results Q2/2022: 95 Billion Loss, Close to my Predictions

I was predicting for many years that the SNB will suffer a big loss when inflation comes. The time of reckoning has come. I expected some 150 billion loss in one year: at half time we are 95 billion CHF.

Read More »

Read More »

Swiss National Bank reports massive losses

The Swiss National Bank (SNB) has taken a hit of CHF95.2 billion ($100 billion) for the first half of this year, mainly owing to losses on foreign currency positions.

Read More »

Read More »

The SNB’s Financial Result, Currency Reserves, and Distribution Reserve

How are SNB profits and losses distributed and what issues are debated? Annual Result Funds two “Reserves” The annual result (Jahresergebnis) of the Swiss National Bank (SNB) is split into two parts.

Read More »

Read More »

Inflation ‘back with a vengeance’ in Switzerland

The price of household goods for Swiss consumers rose 3.4% in June compared to the same month last year, led by the surging cost of fuel and heating oil. “Inflation, which has de facto been absent for more than a decade, is back with a vengeance,” said economic forecast group BAK Economics.

Read More »

Read More »

Persönliche Finanzen – Wie betreffen die steigenden Hypothekarzinsen die Vorsorge?

Die Finanzierung von Wohneigentum und das Sparen fürs Alter sind Bestandteile der Finanzplanung. Manche Sparerinnen und Sparer verknüpfen Hypotheken mit Vorsorgeprodukten. Was hier bei steigenden Zinsen zu beachten ist. Angetrieben durch die Inflation respektive deren Folge, der Geldpolitik der Notenbanken, sind die Hypothekarzinsen in der Schweiz 2022 deutlich gestiegen.

Read More »

Read More »

Swiss franc worth more than the euro

This week, the Swiss franc rose to beyond parity with the euro as traders sought safe haven assets as concerns about risks to global growth grew.

Read More »

Read More »

Foreign currencies going off Swiss central bank menu

Switzerland’s central bank is buying lower volumes of foreign currencies to support the franc as it balances the needs of exporters with the rising cost of goods.

Read More »

Read More »

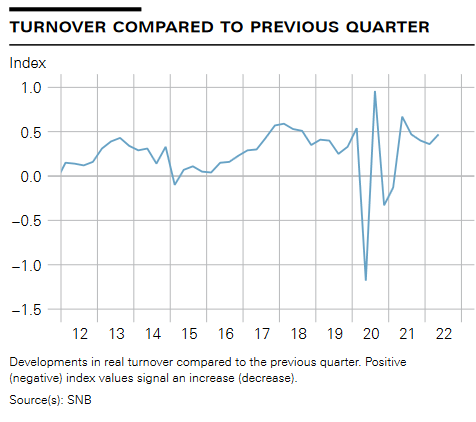

Business cycle signals: SNB regional network

Report submitted to the Governing Board of the Swiss National Bank for its quarterly monetary policy assessment. The appraisals presented here are based on discussions between the SNB’s delegates for regional economic relations and company managers throughout Switzerland.

Read More »

Read More »

Quarterly Bulletin 2/2022

Report for the attention of the Governing Board of the Swiss National Bank for its quarterly assessment of June 2022. The report describes economic and monetary developments in Switzerland and explains the inflation forecast.

Read More »

Read More »

Confederation and SNB facilitate exchange of Ukrainian currency at Swiss commercial banks

Together with the Federal Department of Finance (FDF) and Swiss commercial banks, the SNB has developed a solution to enable individuals with protection status S to exchange Ukrainian banknotes for Swiss francs up to a limited amount.

Read More »

Read More »

SNB-Entscheid treibt Hypozinsen auf Zehnjahreshoch

Hypotheken sind bereits massiv teurer geworden. (Bild: Shutterstock.com/Michael Dechev)Die Inflation und die Leitzins-Erhöhung durch die Schweizerische Nationalbank (SNB) am 16. Juni 2022 (investrends.ch berichtete) haben Auswirkungen auf den Hypothekarmarkt.

Read More »

Read More »

Personalbestand in der Bankbranche nimmt zu

Der Anteil der weiblichen Beschäftigten in der Schweizer Bankbranche bleibt mit knapp 38% im Vergleich zum Vojahr unverändert. (Bild: Shutterstock.com/Fizkes)Wie die am Donnerstag veröffentlichte Publikation "Die Banken in der Schweiz" der Schweizerischen Nationalbank (SNB) zeigt, stieg der Personalbestand bei den Banken in der Schweiz um 619 Beschäftigte in Vollzeitäquivalenten auf 90'577 (+0.7%; 2020: 89'958).

Read More »

Read More »