Sequential growth rates since Q1 through Q3 were 1.5%, 2.0% and 2.2% respectively, or in annualised annual rate, 6.16%, 8.24%, and 9.09% respectively. Compared that with the year-on-year growth of 8.1%, 7.6% and 7.4%.

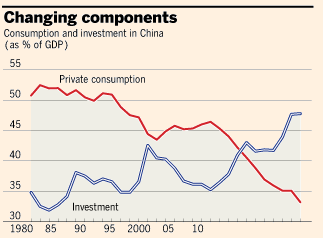

As well known, the Chinese savings rate and consequently the share of fixed asset investment in GDP growth is very high and possibly exaggerated. Moreover the investment into real estate seemed to be extremely high. Since years the government promises that China will finally consume more, but this has never happened. On the contrary the part of investment has risen even more.

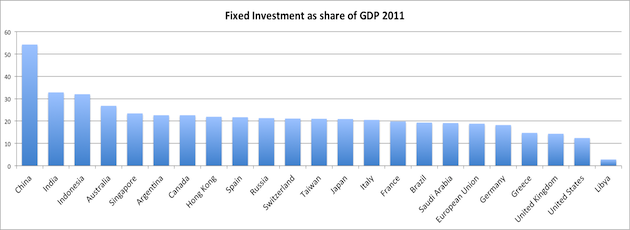

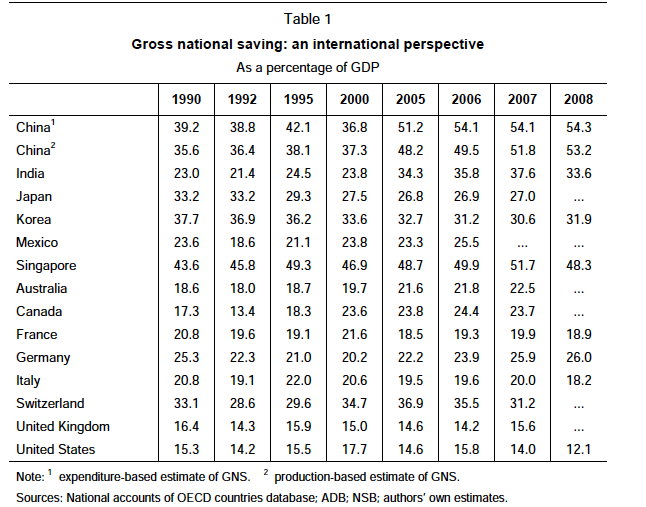

China, but also countries like India, Singapore, Switzerland, Japan or Korea have a high savings rate, but the UK or the US lack.

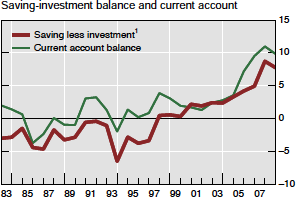

(source BIS)

Some questions that we try to answer in our upcoming series are the followings:

- To which extend a high investment share in GDP is healthy?

- Are there quick indicators based on economic data (like the famous Chinese data dump) that help to judge if Chinese growth is healthy?

- Is the Chinese Yuan undervalued?

- What is the contribution of a real estate boom/bubble to a potential over-investment?

- What are the impacts of slowing Chinese growth on trading partners like Australia, Germany or Switzerland?

- How long will China be the workbench of the entire world?

- When does China finally consume?

Solow’s Growth Model and the Golden Rule of Capital

Solow’s model delivers an explanation why a high savings rate makes sense.

Long Run Aggregate Supply Drivers

The main aim of long-term views of economics is to increase the aggregate supply, as opposed to aggregate demand, which has more emphasize on short- and medium-run.

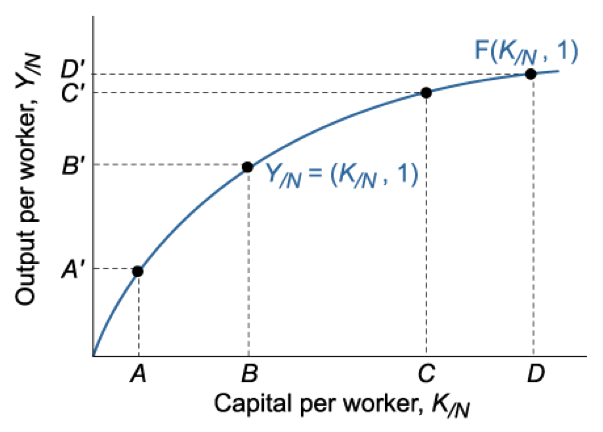

Capital per Worker: Increases in output per worker (Y/N) can come from hikes in capital per worker (K/N).

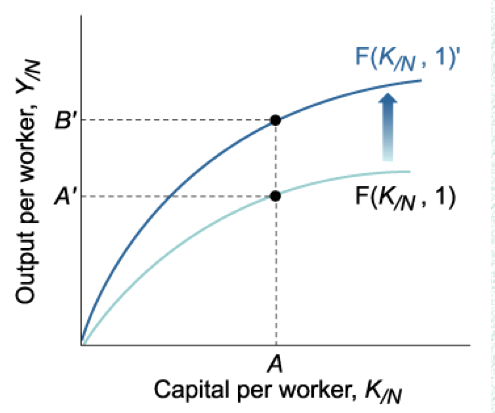

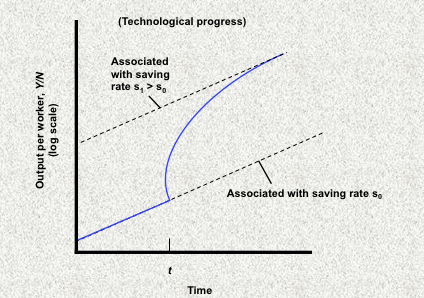

Development of Technology. In the long run development of new technology is a key factor in enabling improved productivity and higher economic growth. An economy that possesses a higher rate of technological progress will perform better than others. Improvements in technology move the production function upwards as shown below.

Saving and Investment

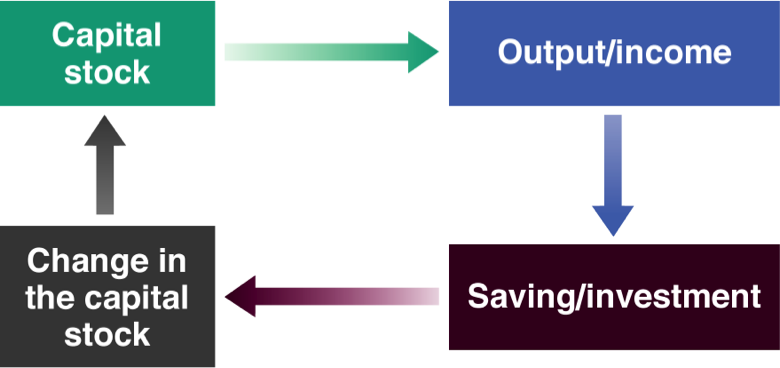

The following “virtuous circle” shows how higher income leads to higher savings and higher investment. This increases the capital stocks and raises output again via higher capital per worker.

This circle cannot be applied ad infinitum, a fact we show in the next chapter.

In the paper “China’s high saving rate: myth and reality” the Bank for international settlements (BIS) comments on the high Chinese savings rate.

The bank shows in this graph how savings and current account surplus is correlated to investments.

Solow’s Growth Model

The Solow growth model has the following setup (source World Bank):

- Aggregate Output: Yt = F(Kt,At*Lt)

- –> Output is a function of capital and technology * labor

- Exogenous (not influenced by the country) technological progress: ˙m

- Rate of population growth: n

- Law of Motion of Capital Stock: ˙Kt = It − ∂ * Kt-1

- –> Capital is investment minus depreciation * existing capital

- Savings-Investment Balance: St = sYt = It

- –> Saving is equal to savings rate * output and this is equal to investment

It has the following assumptions:

(A1) Diminishing returns to K for a given state of technology

(A2) Exogenous (from outside) technological progress, rate: m

(A3) All countries share the same technology

If labor becomes scarce, n < S* Y/K – m

- then wage rates increase and firms will substitute capital for labor (the multiplicator Y/K falls)

If labor becomes abundant, n > S* Y/K – m,

- then wage rates decrease, firms will substitute labor for capital (Y/K rises)

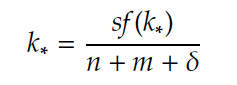

The steady-state equilibrium is the amount of savings sf(k*) necessary to cover depreciation, labor growth and technological progress.

The followings are further results:

- The farther away the economy is from its long run equilibrium the faster is the rate of growth of the capital stock and output.

- Rich countries have higher saving (investment) rates relative to population growth than poor countries.

- Permanent differences can only be due to differences in rate of technological progress. If everyone has access to the same technology then growth rates must be the same. Temporary differences are due to transition dynamics.

- Variability of growth rates over time for a given country can be explained by transition dynamics and/or shocks to the parameters.

“Policy pessimism”: - In the (very) long run, growth is driven by technological progress, not by saving rate.

- In the (very) long run, the growth rate of output per worker is zero.

- Differences in per-capita GDP reflect differences in rates of saving and population growth. Before reaching the steady state, the

- Cross-country convergence in growth rates in the (very) long run.

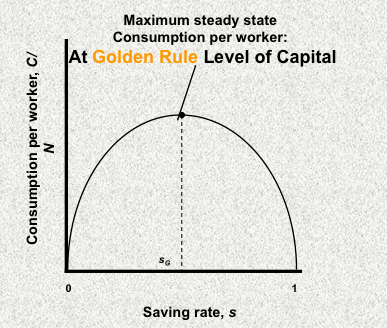

The Golden Rule of Capital

Solows model states that the farther away the economy is from its long run equilibrium the faster is the rate of growth of the capital stock and output. This can be translated into the fixed investment component of the GDP, claiming that developing countries need a strong GDP growth in investment, probably more than in consumption.

An increase in the savings rate implies lower consumption for some time, but higher consumption later. China follows this model.The level of capital associated with the saving rate that yields the highest level of consumption in steady state is the golden-rule level of capital.

Blanchard explains the longer period of slower US growth with the low savings rate.

In his chapter about Solow’s growth model, he maintains that the golden-rule level of capital is 50%.

Summary

According to one the most recognized growth models, namely the one of Solow and the resulting golden rule of capital, the Chinese savings rate is not too high. The level of capital associated with the saving rate that yields the highest level of consumption in steady state is around 50%.

China was in 2011 the only country that invested more than these 50%. Especially for developing countries a high savings rate is important. Moreover many other countries show a savings rate that come close to the Chinese one.

Bibliography

Bank for International Settlement:Guonan Ma and Wang Yi: “China’s high saving rate: myth and reality”, BIS working paper, No 312, Online

Robert Merton Solow: A Contribution to the Theory of Economic Growth. In: Quarterly Journal of Economics, Band 70, 1956, S. 65–94 (doi:10.2307/1884513).

The World Bank, Eduardo Ley: “Growth Models, Helicopter Tour”, September 2011, Online

[gview file=” https://snbchf.com/wp-content/uploads/2012/10/Growth-Models.pdf” height=”630″ width=”700″]

Check here to see more details. chapter 11

See more for