| This press release presents the results for a Swiss National Bank (SNB) survey on turnover in foreign exchange and derivatives markets. The request for data was sent to 30 banks that operate in Switzerland and have a sizeable share in the foreign exchange and over-the-counter (OTC) derivatives markets. These banks reported the turnover of their domestic offices.

The survey is part of a global survey coordinated by the Bank for International Settlements (BIS) on foreign exchange and derivatives market activity. It is conducted every three years and in over 50 countries. This is the tenth time that the SNB has taken part. |

|

| The survey consists of two parts, with the first on turnover (reference month: April 2016) and the second on amounts outstanding of contracts and on replacement values (reference date: 30 June 2016). The results of the first part of the survey pertaining to Switzerland are presented in this press release. Simultaneously, the BIS is presenting the global results of the survey on turnover in the global foreign exchange and derivatives markets. It also plans to publish the global results of the second part of the survey in the fourth quarter of 2016. | |

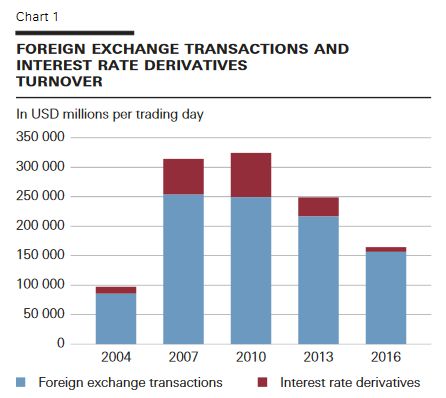

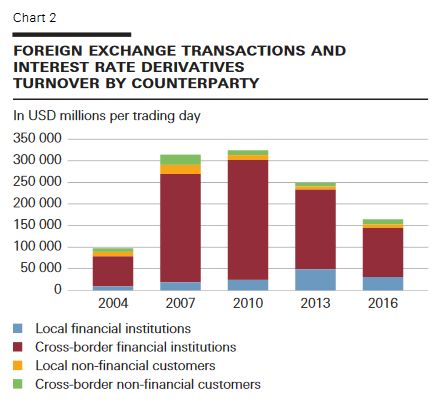

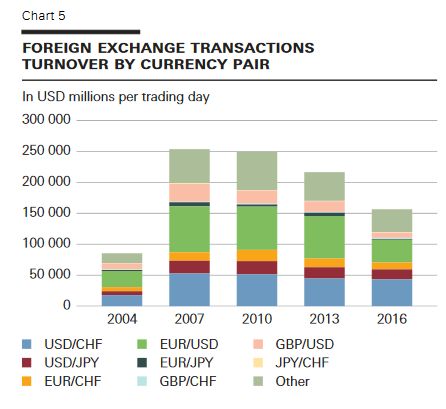

Summary of resultsOn each of the trading days in April 2016, the 30 reporting banks recorded an average turnover of USD 156 billion in foreign exchange transactions and USD 8 billion in interest rate derivatives transactions.Compared with the previous survey in 2013, the trading volume in foreign exchange transactions decreased by USD 60 billion (28%), and in interest rate derivatives by USD 24 billion (75%).

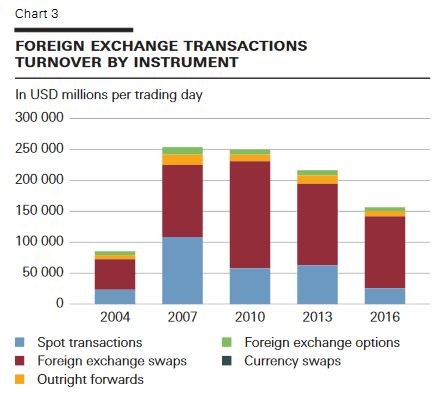

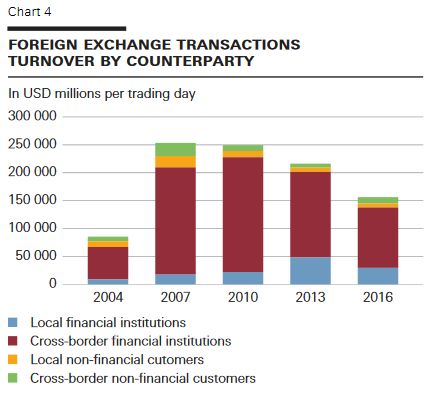

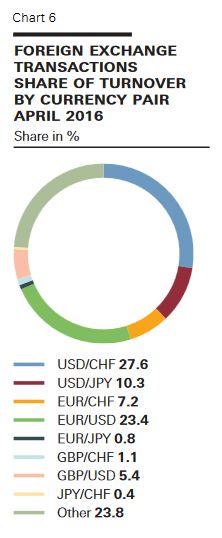

Regarding foreign exchange transactions, all instruments recorded a decline compared to 2013. Although fewer foreign exchange swaps and spot transactions, in particular, were concluded, they still remained proportionately the two most important instruments. Once again, the most frequently traded currency was the US dollar. At the same time, the Swiss franc replaced the euro as the second most important currency in foreign exchange transactions.

|

|

| Turnover in interest rate derivatives was again dominated by swaps and forward rate agreements; however, the turnover for both was considerably below the values recorded for the previous survey in 2013. Trading in interest rate derivatives denominated in euros receded in particular. As a result, the Swiss franc became the most important currency in interest rate derivatives trading for the first time since the 1998 survey. | |

Turnover in foreign exchange transactionsIn April 2016, average daily turnover in foreign exchange transactions amounted to USD 156 billion, which was 28% lower than in April 2013. With a share of 74%, foreign exchange swaps remained the most important instrument, followed by spot transactions with a share of 16%.

Once again, almost two-thirds of foreign exchange transactions were settled via electronic trading platforms and the remainder by telephone.

|

|

InstrumentsAverage daily turnover in foreign exchange swaps fell by 12% to USD 116 billion from USD 132 billion in 2013. Turnover in spot transactions saw a considerable decline of 60% to USD 25 billion (2013: USD 63 billion).

Outright forwards and foreign exchange options retained their relatively minor position, with USD 8 billion and USD 6 billion respectively. Currency swaps were barely used any more.

|

Full story here Are you the author? Previous post See more for Next post

Tags: newslettersent