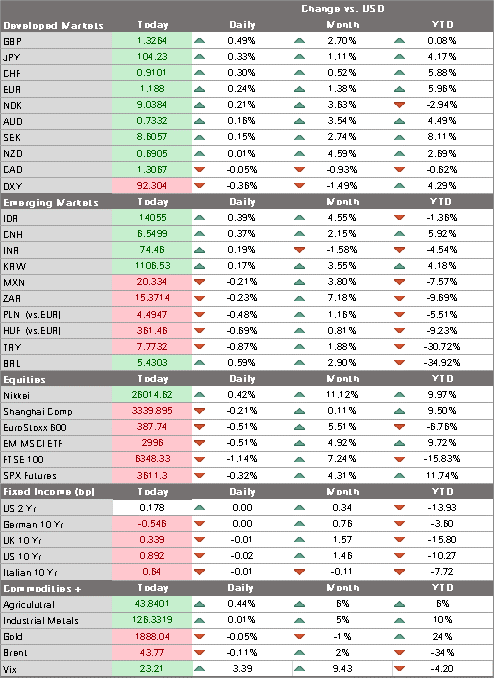

- The dollar continues to soften

- October retail sales will be the US data highlight; Fed manufacturing surveys for November have started to roll out; Republican Senator Alexander opposes Judy Shelton’s nomination to the Fed

- Newswires reported (again) that a Brexit deal is at hand; Hungary and Poland will veto the EU budget and recovery fund; ECB signaled that they are focused on asset purchases and long-term funding for the next round of stimulus; Hungary is expected to keep the base rate steady at 0.60%

- RBA released its minutes; concerns over credit risk in China are weighing on local assets, but not the yuan; the Korean won remains unfazed by official verbal intervention

The dollar continues to soften. After peaking near 93.208 last week, DXY is down for the fourth straight day. The break below the 92.542 area today sets up a test of the November 9 low near 92.13. After that is the September 1 low near 91.746. Likewise, the clean break above the $1.1855 area for the euro sets up a test of its recent high near $1.1920. After that is the September 1 high near $1.2010. Sterling remains bid and is on track to test the November high near $1.3310 on Brexit optimism(see below), while USD/JPY remains heavy. The pair traded at another new low for this move today and a break below the 104.15 area would set up a test of that day’s low near 103.20.

AMERICAS

October retail sales will be the US data highlight. Headline sales are expected to rise 0.5% m/m vs. 1.9% in September, while sales ex-autos are expected to rise 0.6% m/m vs. 1.5% in September. The so-called control group used for GDP calculations is expected to rise 0.5% m/m vs. 1.4% in September. With oncomes falling due to the loss of unemployment benefits, recent strength in consumption will be impossible to sustain. Yet whatever the October readings are, we know that November will be worse in light of widening lockdowns across the country. Credit card data from a major US bank suggests consumption is contracting y/y in the first half of November. October import/export prices, September business inventories (0.6% m/m expected), and TIC data will also be reported. Elsewhere, Canada reports October housing starts and September wholesale trade sales (0.4.% m/m expected).

Fed manufacturing surveys for November have started to roll out. Empire survey started the ball rolling Monday and came in at 6.3 vs. 13.8 expected and 10.5 in October, the lowest reading in three months. New orders fell while employment and prices paid rose. This is the first snapshot for November and it’s not a great one. Philly Fed survey is up next on Thursday. Meanwhile, October IP will be reported today and is expected to rise 1.0% m/m vs. -0.6% in September. While manufacturing may hold up in Q4, it’s the service sector that will be hit hardest by the widening lockdowns here.

Republican Senator Alexander opposes Judy Shelton’s nomination to the Fed Board of Governors. He joins Collins and Romney as the only Republicans opposed, but he won’t be in DC for the vote. Neither will Republican Senator Scott, who is quarantining in Florida. Her confirmation now hinges on all remaining Republicans being in favor and showing up to produce a 49-49 vote, with Pence then casting the tiebreaker. If one more Republican Senator opposes or is not present for the vote, that would mean Shelton’s nomination is dead (assuming all 47 Democrats and 2 independents are present to vote no). A vote is scheduled for this week. If the vote is delayed long enough, Democratic Senator-elect Kelly will replace outgoing Republican Senator McSally at the end of the month since he won in a special election in Arizona. Elsewhere, Powell and Barkin speak while Bostic, Daly, Kaskhari, and Rosengren take part in a conference on racism and the economy.

EUROPE/MIDDLE EAST/AFRICA

Newswires reported (again) that a Brexit deal is at hand. This time the headlines came from the Sun, which claim that UK negotiator David Frost told Prime Minister Johnson that a deal could be agreed by next Tuesday. Both sides have supposedly found a “a possible landing zone.” This would be in line with our base case of a skinny deal and we think that next week probably is the “real” final deadline. Whatever they agree on must still get through lawmakers on both sides. Even with the EU’s special parliamentary session scheduled for December 28, the timeline is getting very tight. There are no details about which direction the talks are going. We think the path of least resistance is for the French to soften its position on the fishing issues, the UK to drop the Internal Markets Bill, and for both sides to make concessions on the “level playing field” issue (with the UK probably giving more ground).

Despite reports of a compromise earlier this month, both Hungary and Poland said they will veto the EU budget and recovery fund. The two oppose the deal that Germany struck last week with EU lawmakers over the so-called rule of law clause that they say unfairly stigmatizes them. Officials familiar with the matter said EU leaders will now have to discuss the deadlock during a scheduled video summit Thursday that was originally meant to focus on the pandemic. That said, the lack of any significant reaction in the euro or European financial markets to the threatened vetoes suggests that most view these moves as brinksmanship and that both countries will eventually sign on at the right price.

The ECB signaled that they are focused on asset purchases and long-term funding for the next round of stimulus. Thus, an expansion of the PEPP and providing ultra-cheap funding for lenders via TLTROs and PELTROs are likely to be seen at the next meeting December 10. Policymakers remain reluctant to take rates more negative and we understand why. Yet more stimulus is needed. The Bundesbank warned yesterday that the German economy could stagnate or even shrink in Q4 due to renewed restrictions from rising virus numbers. However, it said the slowdown would be less severe than the one from this spring.

National Bank of Hungary is expected to keep the base rate steady at 0.60%. For now, the bank appears to be relying on the 1-week deposit rate (set every Thursday) to help support the forint when needed. That rate was last hiked 15 bp to 0.75% in mid-October as EUR/HUF was rising. With the forint stabilizing somewhat, we see steady rates for the time being.

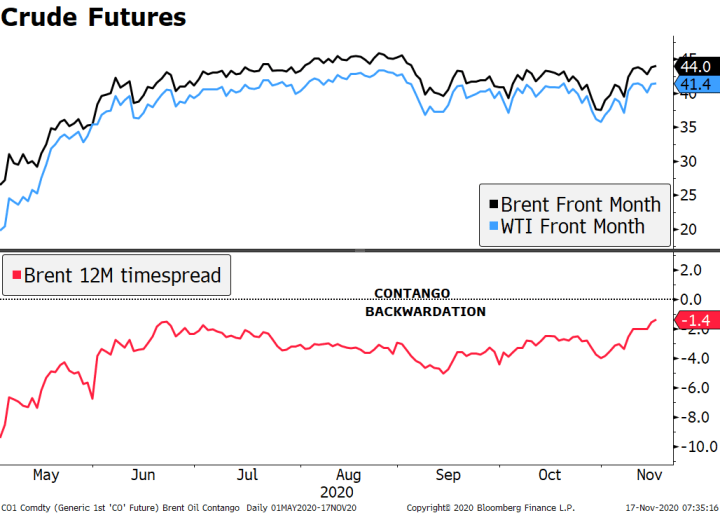

| Oil futures continue their strong rebound with Brent up some 3% over the last two sessions due to supportive OPEC+ headlines. Signals coming from the cartel are confirming their inclination to extend production cuts by three to six months. Brent is trading at $44, up 18% this month and more than double the April lows. Perhaps more importantly, the futures curve has been steepening. This suggests a more optimistic outlook for solving the imbalances after the pandemic second wave hitting the US and Europe pass, giving way towards a potential vaccine. |

Crude Futures, 2020 |

| ASIA

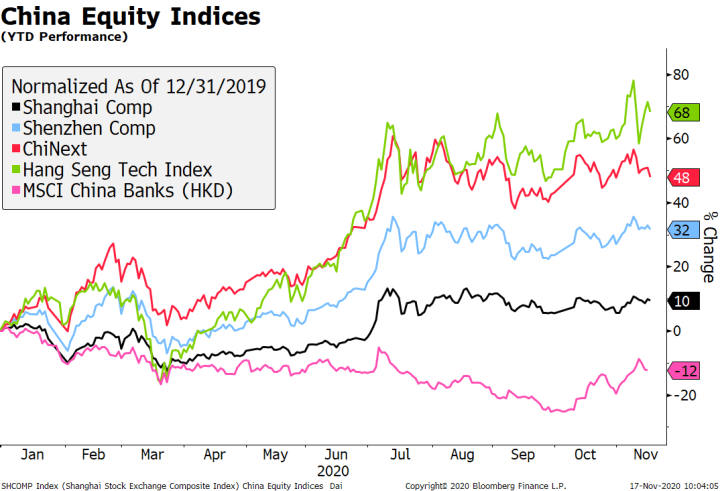

Reserve Bank of Australia released its minutes. At that meeting, the bank delivered a 15 bp cut to 0.10% in both the cash rate and the 3-year yield target. However, policymakers debated holding off on easing then due to the impact on savers, risk-taking and leverage, perceptions about government financing, and improved economic data. The RBA went ahead and eased after determining that unemployment was likely to rise further due to an uneven economic recovery. The bank raised the possibility of buying even longer-dated bonds but decided to keep the focus on the short end as “”Members judged that a yield target is most effective when its maturity is consistent with the board’s forward guidance on the cash rate.” Lastly, the bank reiterated that the cash rate would remain low for at least three years and would likely remove the yield curve target before hiking, and that negative rates were “extraordinarily unlikely.” Concerns over credit risk in China are weighing on local assets, but not the yuan. Two state-linked corporates defaulted on their bonds. One of the defaulting companies was Tsinghua Unigroup, a large technology player in the chip industry, which was unable to make good on its roughly $200 mln bond payment. This is surprising to us given the big push by the Chinese company to reduce its dependence on US technology components. Other recent defaults include a coal miner (Yongcheng Coal) and automaker (Huachen Auto). The immediate macro concern here is the negative feedback loop coming from banks that may hold these risky bonds, which may force them to further restrict credit. The events have helped sour sentiment in local equity markets, but the yuan continues to appreciate, now about 6% stronger against the dollar YTD (see below). |

China Equity Indices, 2020 |

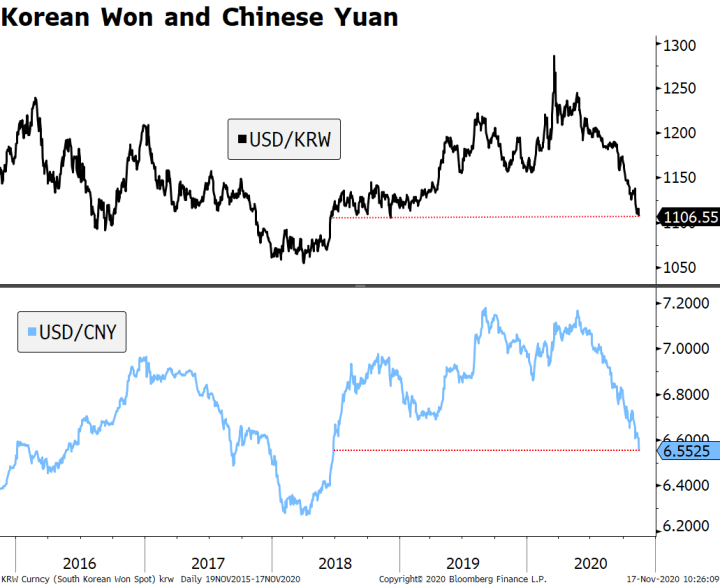

| The Korean won remains unfazed by official verbal intervention. Yesterday, officials issued the generic comment that FX moves were seen as excessive and that action can be taken to dampen volatility. The warning comes as USD/KRW threat to break below the key KRW1,100 level after appreciating 11% over the last six months. The won has been the best performing currency in the region over this period, but directionally in line with much of the region. In any case, we doubt the BOK of MOF will decide to deploy the firepower necessary to create anything more than a few speedbumps. |

Korean Won and Chinese Yuan, 2016-2020 |

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Daily News,Featured,newsletter