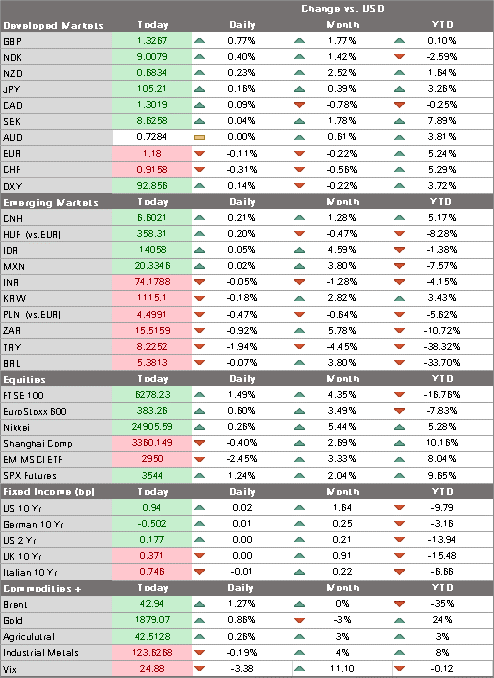

- Despite rising infections worldwide, the virus news stream has turned positive; the dollar is consolidating its gains today

- With the 10-year yield rising to near 1.0%, US financial conditions are tightening; the Fed released its Financial Stability report yesterday and it pulled no punches; with the Fed media embargo over, many officials will speak today

- UK House of Lords altered the Internal Market Bill; UK employment numbers were slightly better than expected; eurozone data were largely disappointing; Turkish President Erdogan appointed Lutfi Elvan as the new Treasury and Finance Minister

- Japan reported September current account data; China unveiled new regulations to rein in its big tech companies and reported October CPI and PPI; Philippine Q3 GDP came in weaker than expected at 8.0% q/q

Despite rising infections worldwide, the virus news stream has turned positive. Aside from yesterday’s big Pfizer vaccine news, we also learned that Eli Lilly’s antibody medication received emergency-use authorization in the US. Early data showed it was effective in treating infected patients. Still, President-elect Biden reminded us that it will be “many months before there is widespread vaccination.” Indeed, the Pfizer vaccine comes with several logistic challenges, not least because it needs to be stored and transported at -70C and mass production will take time. Separately, the Fed’s Financial Stability Report, published (see below) highlighted the downside risks to the current scenarios, including that of a “extended delays in the production or distribution of a successful vaccine.”

The dollar is consolidating its gains today. It’s worth noting that yesterday’s gains were driven largely by the yen and Swiss franc, as these havens weakened the most on the positive vaccine news. While we are heartened by the vaccine news as well as Biden’s efforts to limit infections by encouraging mask wearing and appointing a new COVID task, all these efforts will take time to bear fruit. As such, we continue to believe that the US economy and the dollar will underperform in Q4 before (hopefully) carving out a bottom in Q1. Dollar weakness should resume and so DXY should eventually test the September low near 91.746, while the euro should test $1.2010 and sterling should test $1.3480.

AMERICAS

With the 10-year yield rising to near 1.0%, US financial conditions are tightening. What about the surging equity market? Won’t that lead to looser financial conditions? To an extent, yes. But many consumer loans are tied to the 10-year yield and so higher rates will be a headwind. That’s what QE and YCC are supposed to do, suppress long-dated yields. We still think the Fed will start to push back a bit if the 10-year goes much above 1.0%. Break above the .98% area would set up a test of the March 19 high near 1.27%.

The Fed released its Financial Stability report yesterday and it pulled no punches. It warned that asset markets may see big declines if the virus isn’t controlled. The Fed also warned that delays in a vaccine could derail the economic recovery and strain financial markets, noting that “Some segments of the economy, such as energy as well as travel and hospitality, are particularly vulnerable to a prolonged pandemic.” The report also noted that hedge fund leverage has remained elevated and that life insurers are reaching debt levels not seen since the Great Financial Crisis.

With the Fed media embargo over, many officials will speak today. Kaplan, Rosengren, Bostic, Quarles, Rosengren, and Brainard all speak. Of note, Brainard has been tipped as the likely Treasury Secretary in the Biden administration. She is well-respected by the markets and would likely enhance cooperation between Treasury and the Fed. We saw a similar dynamic when New York Fed President Geithner moved over to head up Treasury during the first Obama term. September JOLTS job openings will be reported and is expected at 6500 vs. 6493 in August.

Looking further ahead, it’s worth noting that Biden will have even more Fed posts to fill. If Brainard leaves, that leaves three vacancies in the Board of Governors. We do not expect Trump’s nominees Shelton and Waller to be confirmed during the lame duck session and so their nominations will expire when the new Congress takes over. Looking even further ahead, Vice Chair Quarles’ term ends October 2021, Chair Powell’s term ends February 2022, and Vice Chair Clarida’s ends September 2022. Typically, first-term Fed Chairs are given a second term by an incoming administration, but Trump threw out that playbook when he declined to reappoint Yellen in 2018 and instead named Powell.

EUROPE/MIDDLE EAST/AFRICA

UK House of Lords altered the Internal Market Bill, delivering an expected blow to Prime Minister Johnson. Legislators voted 433-165 to remove the controversial clause that would give ministers the ability to unilaterally change the Withdrawal Agreement. Johnson responded by doubling down on his effort to get the bill approved, which now goes back to the House of Commons. This severely limits Johnson’s position in ongoing Brexit talks but at the same time it may allow the EU to take a slightly less aggressive approach. Time will tell but time is also running out.

UK employment numbers were slightly better than expected. Looking ahead, they should remain (artificially) supported by the extension of government support programs. The unemployment rate rose three ticks to 4.8% on a 3m/3m basis as employment fell -164k vs. -150k expected . On the bright side, average weekly earnings surprised on the upside at 1.3%. But the true state of the UK’s employment market will remain hard to assess given the extension of the furlough scheme to March next year.

Eurozone data were largely disappointing. France and Italy reported mixed October IP data. France rose 1.4% m/m vs. 0.7% expected, while Italy plunged -5.6% m/m vs. -2.0% expected. Last week, German IP rose 1.6% m/m vs. 2.5% expected. Eurozone reports September IP Thursday and is expected to rise 0.7% m/m, same as August. The recent country data suggest potential for a downside surprise. France also reported that unemployment jumped to 9.0% in Q3 vs. 7.5% expected and 7.1% in Q2, while the November ZEW survey for the eurozone dropped for a second straight month to 32.8. This is the weakest since April and clearly reflects the rising virus numbers and the resulting lockdowns.

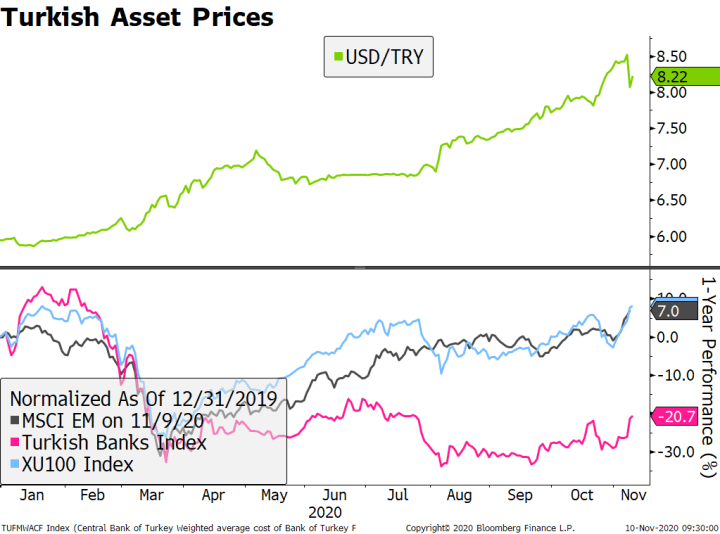

| Turkish President Erdogan appointed Lutfi Elvan as the new Treasury and Finance Minister. In addition, local reports suggest a wider cabinet reshuffling is in the works. Elvan is seen as a technocrat, who was previously Deputy Prime Minister. While a mining engineer by training , he has a master’s degree in economics from the University of Delaware. He should fall in line nicely with the new central bank Governor Naci Agbal, but it remains to be seen if we will have a decisive policy shift. We think a shift will happen, but we assume it will be just enough to put out the current fire, and not the structural changes needed to set the Turkish financial-economic system on a sustainable path. The lira is down -2% on the day, giving up a substantial part of yesterday’s gains, but local equities continue to perform well. |

Turkish Asset Prices, 2020 |

| ASIA

Japan reported September current account data. The adjusted surplus came in at JPY1.345 trln vs. JPY1.794 trln expected, while the trade balance was JPY918.4 bln vs. JPY802.7 bln expected. Policymakers are breathing a sigh of relief as the yen weakened sharply this week. Despite claims to the contrary, the price action shows that the yen remains a haven of choice and with the virus outlook improving, USD/JPY may avoid a test of the March low near 101.20. Elsewhere, Prime Minister Suga ordered his cabinet to draft a third supplemental budget, as widely expected. Chief Cabinet Secretary Kato would not comment on the budget’s likely size, but LDP officials have floated figures ranging from JPY10-30 trln. In addition, JPY7.3 trln remains unspent from previous budgets, according to the Finance Ministry. China unveiled new regulations to rein in its big tech companies. The new rules seek to limit the monopolistic practices of companies such as Alibaba and Tencent, and comes after regulators delayed the IPO of Ant last week. Reports suggest regulators are seeking feedback on its new rules that seek to curb anti-competitive practices, set standards on sharing consumer data, limit collusion to squeeze out smaller rivals, and address subsidies that eliminate competitors. Sound familiar? China reported October CPI and PPI. CPI fell sharply to 0.5% y/y vs. 0.8% expected and 1.7% in September, while PPI was steady at -2.1% y/y vs. -1.9% expected. Consumer inflation is the lowest since 2009 and falling pork prices are the main culprit, falling y/y for the first time in 19 months. October money and loan data sometime this week. Both money and new loans are expected to ease from the previous month. While policymakers are talking about exiting stimulus, there should be no sense of urgency given the deflationary risks. Indeed, we suspect there is growing concern in this regard and may keep the stimulus taps open for longer than anticipated. |

|

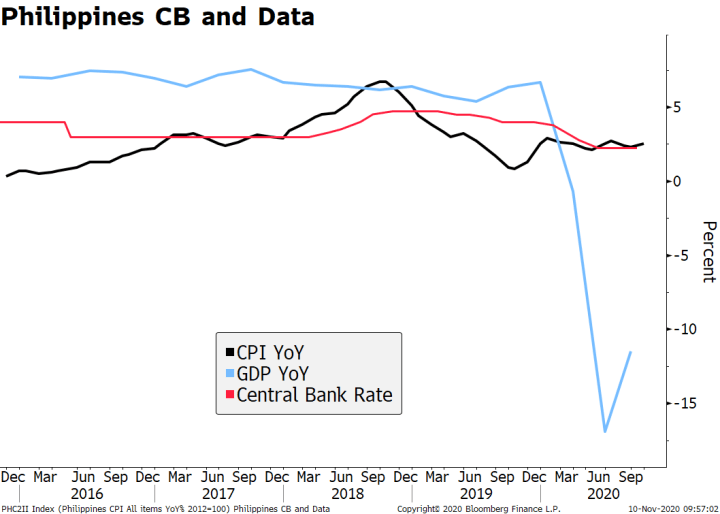

| Philippine Q3 GDP came in weaker than expected at 8.0% q/q vs. 8.9% expected and a revised -14.9% (was -15.2) in Q2. The y/y rate came in at -11.5% vs. -9.6% expected and a revised -16.9% (was -16.5%) in Q2. Of note, fixed capital investment fell by a whopping -37.1% y/y, though private consumption held up a bit better at -9.3% y/y. Exports fell at a slower pace (–14.7% y/y) suggesting that external demand – along with government spending at +5. 8% y/y – remain supportive for now. This shouldn’t change the steady path of central bank policy, with rates currently at 2.25%. |

Philippines CB and Data, 2016-2020 |

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Daily News,Featured,newsletter