| BofA’s Michael Hartnett points out something amusing, not to mention diabolical: following the rate cuts by the BoE & RBA this week, “global central banks have now cut rates 666 times since Lehman.”

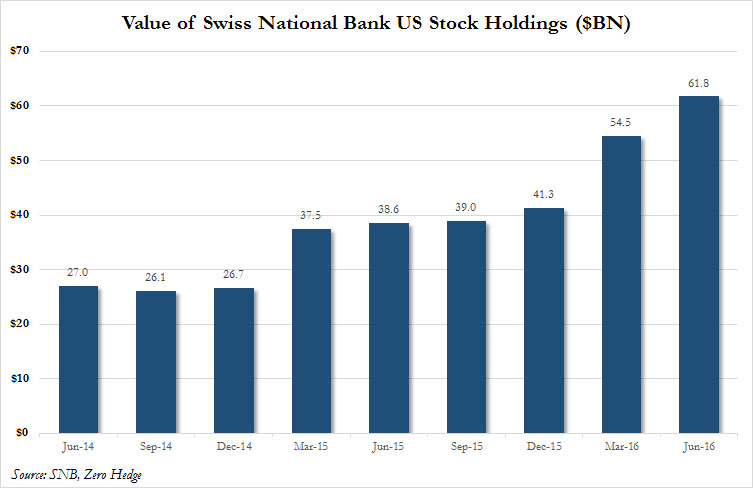

One would think this attempt by central banks to push everyone into risk assets, certainly the Swiss National Bank which as we showed yesterday has increased its US equity holdings by 50% in the first half of 2016 … … would favor flows into equities over bonds, however that is not the case at all. According to Hartnett, extreme monetary policy has proven “more positive for bonds ($1.0tn inflows since LEH) than stocks ($375bn inflows).” An explanation for this decoupling has been provided here in the past and it is quite simple: central banks (except the SNB and BOJ) are formally limited to monetizing debt. As such investors would rather not take the risk of buying the asset class which they can not see to the Fed, ECB or BOE, namely stocks, and instead are frontrunning central bank purchases directly. |

|

Narrowing the fund flow time interval, BofA shows something else surprising: in the most recent week, global fund flows have continue to leave stocks and enter bond and precious metal funds:

Indeed, as BofA dubs this move, these are “Risk-off weekly flows:”

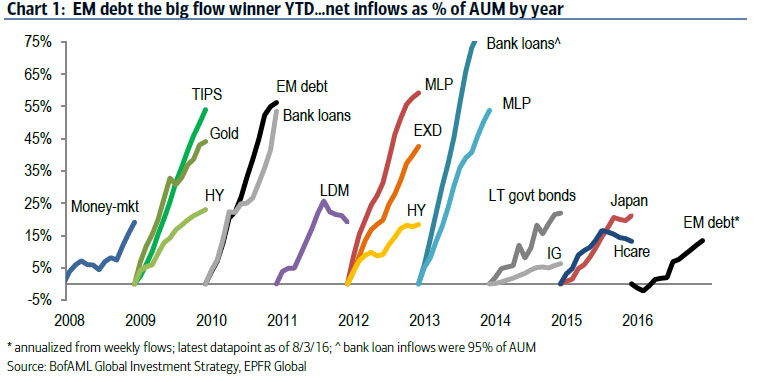

And yet the S&P is now trading at new all time highs? Luckily, there are such official “activist” institutions as the SNB and GPIF who are willing buyers for every stock seller with the added benefit that they have no concerns about the cost of purchase is irrelevant. After all, they can always just “print” more dry powder. Hartnett then summarizes the rest of the macro themse and fund flows observations as follows: Rotation to EM: despite oil/commodity pullback, lust for yield = more inflows to EM…largest 5-week inflow on record to EM debt funds ($16.6bn)…longest inflow streak to EM equity funds in two years; contrarian would take profits in EM debt…note EM debt the big flow winner YTD, inflows annualizing 13% of AUM. |

|

| IG over HY: BoE £60bn QE announcement includes £10bn corporate bond buying…coincided with largest IG bond fund inflows since Oct’14 ($9.2bn); in stark contrast to $3.3bn outflows from HY bond funds; contrarians would take some IG profits; both IG & HY trading close to all-time highs

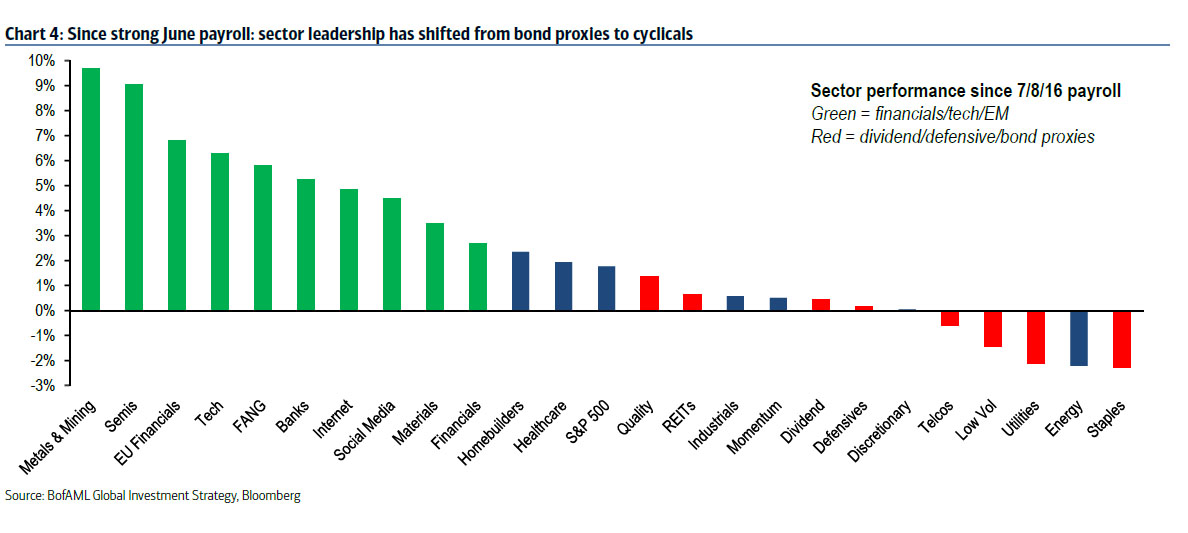

Flow fashion: tax-exempt (46 straight weeks of muni inflows) & inflation-hedged (8 straight weeks of TIPS inflows) assets in vogue (as is “yield” of IG, EM); banks out of vogue (26 straight weeks of outflows from European equity funds) Private client ETF flows: GWIM continues to accumulate barbell of deflationary assets (low-vol, high-quality, utility stocks) and inflationary assets (gold, EM, TIPS); they remain sellers of Eurozone & Japanese equities July payroll: consensus =180k; strong payroll (>225K) = banks outperform bonds & quality stocks; weak payroll (<125k) = barbell back in vogue, cyclicals sink; release important as it helps solve recent puzzle of strong payrolls & weak profits Since strong June payroll: sector leadership has shifted from defensive, high-dividend yielding bond proxies to financials/tech/EM (Chart 4); key to continued rotation from bond proxies to economic sensitivity is simple: investors must believe bond yield lows have been seen driven by macro data to induce EPS & GDP upgrades, show Fed not “one & done”, bolster belief that new regime shift to fiscal-monetary coordination in Japan/Eurozone/UK will boost corporate animal spirits. |

|

As of right now, this “shift” is working, but should the dollar rise up too much as it did last summer, the circularity of what brought down stocks in the latter part of 2015, namely a global dollar funding shortage, will promptly reemerage, dragging us back to square one, and not only rate cut # 667, but even more easing.

Tags: Animal Spirits,Bank of England,Bank of Japan,newslettersent,yield