Restless PeasantsFirst, a few quick words on Brexit. Being the always positive and optimistic person that I am (big grin), I see one very positive outcome of Brexit – it is a revolution without bloodshed. For once, I’m not digressing. Brexit has a lot of parallels with housing affordability in the US. Brexit is a clear illustration of how politicians, policy makers and the establishment have lost touch with the peasants, and the peasants are getting restless. Allow me to elaborate. |

First, a few quick words on Brexit. Being the always positive and optimistic person that I am (big grin), I see one very positive outcome of Brexit – it is a revolution without bloodshed. For once, I’m not digressing. Brexit has a lot of parallels with housing affordability in the US. - Click to enlarge |

The State of Affordability

No need to go any further, you see what I am getting at. In theory, housing could not be any more affordable than it is today. Take away high priced areas such as coastal California or NY City, which have never been considered affordable, and the national median is still below $200,000. That can get you a house in cities like Phoenix, Charlotte, Vegas, Houston and the central valleys of California. A $200,000 purchase is nothing more than $10,000 down and $1,200-$1,500 per month. That should be very comfortable for households earning the median income of around $50,000. Putting $50,000 in the proper perspective, a California couple making minimum wage will soon be making $62,400 once the minimum wage is raised to $15/hour. |

First, a few quick words on Brexit. Being the always positive and optimistic person that I am (big grin), I see one very positive outcome of Brexit – it is a revolution without bloodshed. For once, I’m not digressing. Brexit has a lot of parallels with housing affordability in the US. - Click to enlarge |

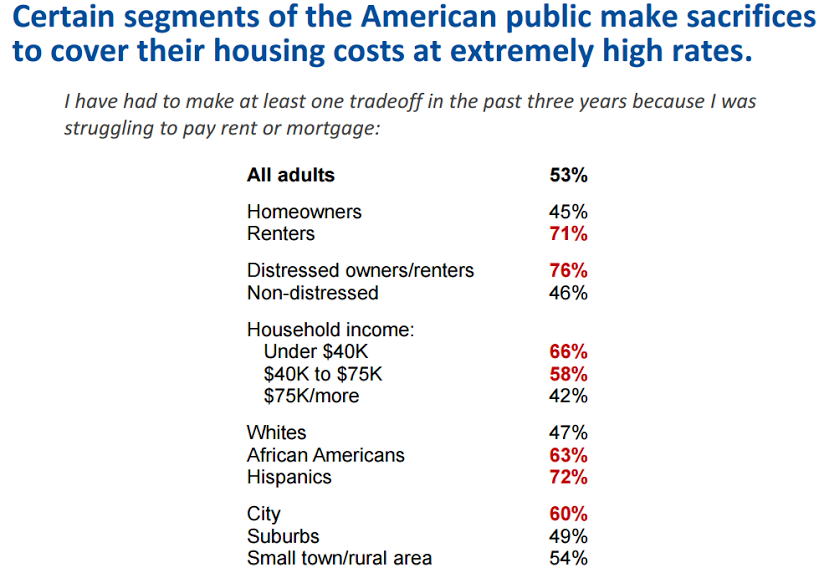

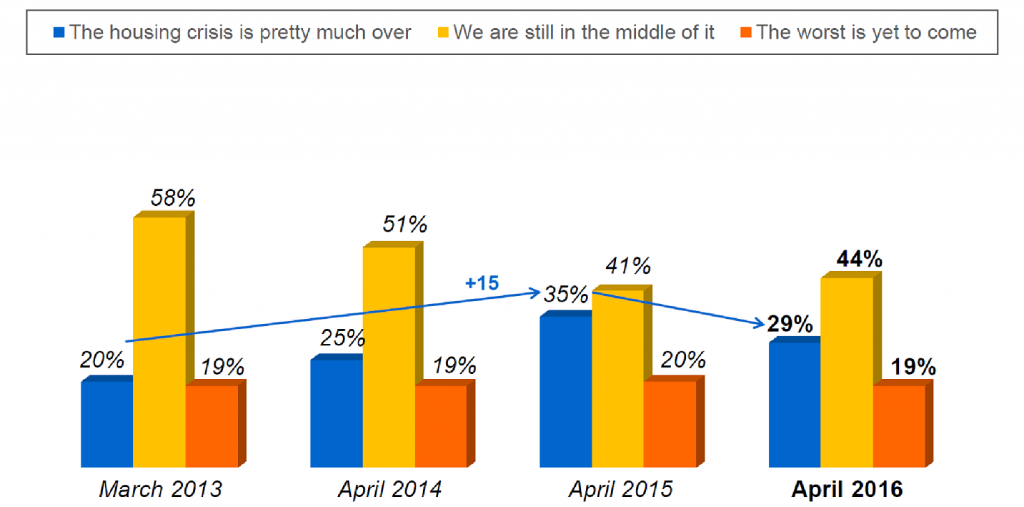

A Dose of RealityThe MacArthur Foundation recently released its 2016 How Housing Matters Survey. The report is short and to the point, well worth glancing over. Here are some key points:

The MacArthur survey also has many thought provoking charts. It has received little media coverage but I urge you to take a look (only 36 slides). To me, the survey illustrates that affordability is a symptom, the underlying problem is household finances, which are stressed to the max. Why are sacrifices needed? Because these households have chosen a lifestyle that they cannot afford and therefore have to juggle expenses to make ends meet. Unlike the governments of this world, just printing more money is not an option. Households should budget according to the resources they have, with reserves, then everything is as planned and affordable. |

First, a few quick words on Brexit. Being the always positive and optimistic person that I am (big grin), I see one very positive outcome of Brexit – it is a revolution without bloodshed. For once, I’m not digressing. Brexit has a lot of parallels with housing affordability in the US. - Click to enlarge |

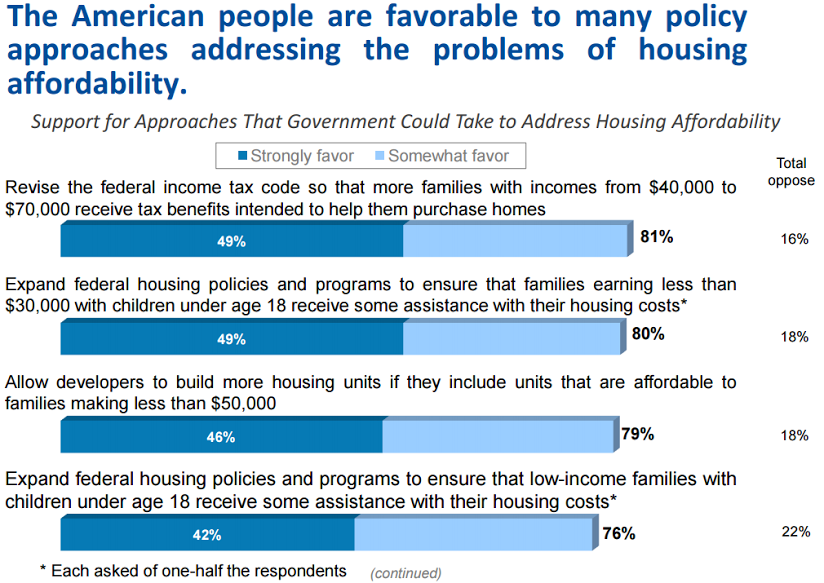

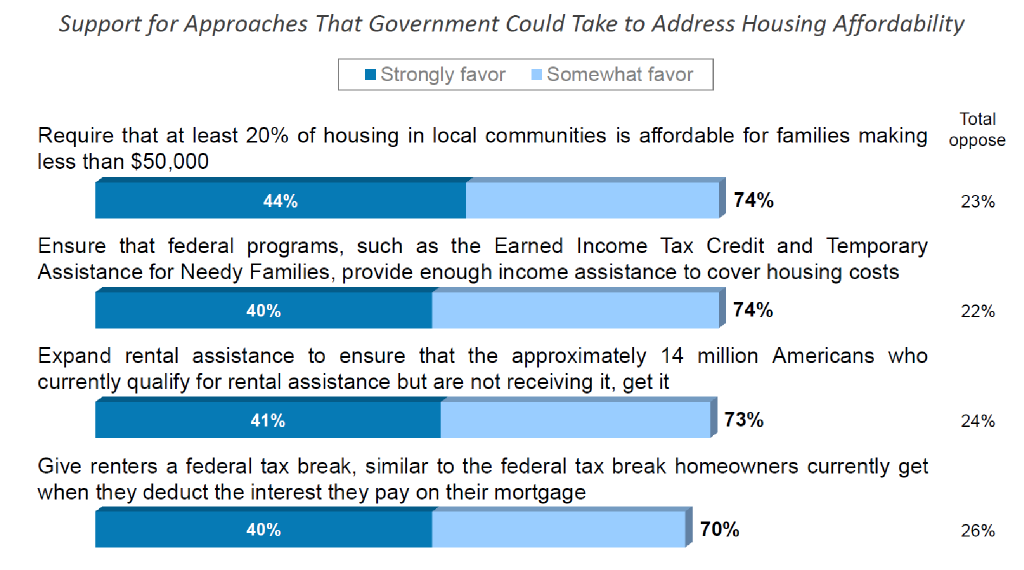

Hand to MouthThe survey results show that the masses believe affordable housing is important, and the government is not doing enough about it. So the following table lists the policy approaches to addressing the problem. No wonder Bernie Sanders managed to hang on in the presidential campaign for so long, we are a nation of socialists. Missing from the list above are the things consumers can easily do to help themselves. Cut expenses such as a new car lease every 2-3 years, when there is nothing wrong with the old car. Maybe a big screen TV in every room is excessive. Are vacations funded by credit card debt really necessary? |

First, a few quick words on Brexit. Being the always positive and optimistic person that I am (big grin), I see one very positive outcome of Brexit – it is a revolution without bloodshed. For once, I’m not digressing. Brexit has a lot of parallels with housing affordability in the US. - Click to enlarge |

More free stuff please, continued…Now imagine a financial stress test for every household, with the results grouped into tiers. Pertaining to real estate, the high end has plenty of cushion to absorb any form of economic downturn. Conservative savers with little or no mortgage debt can also hang in there, even though their life style may have to be tweaked. It is the bottom tier that is most at risk. The loss of a job or a similar calamity may cause them to default. Any decline in property values may push them into negative equity status. |

First, a few quick words on Brexit. Being the always positive and optimistic person that I am (big grin), I see one very positive outcome of Brexit – it is a revolution without bloodshed. For once, I’m not digressing. Brexit has a lot of parallels with housing affordability in the US. - Click to enlarge |

| Now how big is this lower tier? How big a blow can it absorb? I know of no study that provides a quantified answer. My guess is that there are not only lower income households in this lower tier, but that many middle class households are also at risk. They may have decent income, but many have taken on too much debt.

Adding to my worries is the exhaustion of government stimulus. The central banks of US, Japan, China and EU have pushed the envelope to the limit already. Their credibility is seriously in doubt and any future bailouts may backfire. The Fed has over $4 trillion in assets on its balance sheet. The ECB’s QE is running out of qualified assets to purchase. The BoJ is approaching majority ownership of Japan’s government debt. China, according to some gurus such as Kyle Bass, has a monstrous debt bubble. Over $11 trillion, or a quarter of all sovereign debt in the world pays negative interest. |

First, a few quick words on Brexit. Being the always positive and optimistic person that I am (big grin), I see one very positive outcome of Brexit – it is a revolution without bloodshed. For once, I’m not digressing. Brexit has a lot of parallels with housing affordability in the US. - Click to enlarge |

ConclusionIn conclusion, many consumers are living a lifestyle they cannot afford, all because policy makers are flooding them with cheap credit, hence the consumption economy. Housing is the largest household debt item. Is this sustainable? Brexit is supposedly going to pop the UK housing bubble, especially the London bubble. Maybe we can sit back, watch and learn.

Charts by: Hart Research Associates / MacArthur Foundation Chart and image captions by PT |

Full story here Are you the author? Previous post See more for Next post

Tags: negative equity,newslettersent,Real Estate