- The dollar rebound continues; odds of a near-term stimulus bill in the US are falling; ahead of inflation readings later this week, the US holds a 10-year auction today

- Bank of Canada is expected to keep policy steady; Mexico reports August CPI; Brazil reports August IPCA inflation

- The Brexit fallout widens; UK will have trouble striking new trade deals if it can’t be counted on to honor its past agreements; no surprise then that sterling remains under pressure

- Australia September Westpac consumer confidence rose to 93.8 from 79.5 in August; New Zealand 3-year bond yields turned negative for the first time ever

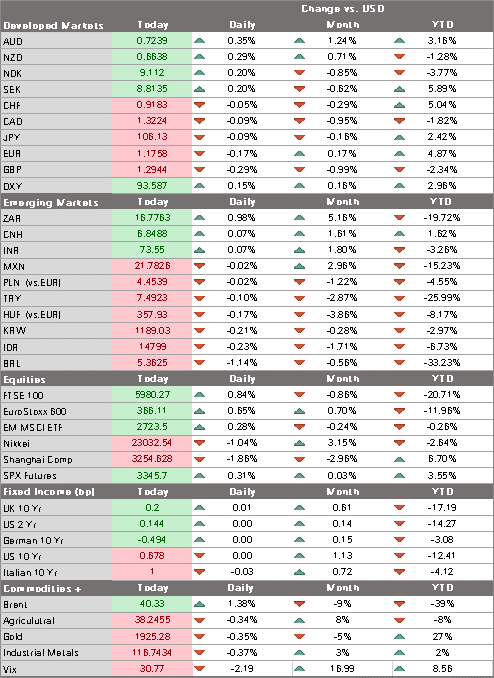

The dollar rebound continues. DXY is trading at the highest level since August 12. However, for us to get more constructive on the greenback, DXY would have to break above the 94.00 area, which represents some highs from August as well as the 38% retracement objective of its fall from the June 30 peak. This corresponds with the $1.17 area for the euro and the $1.30 area for sterling. Sterling is leading this move, having already broken below that level on negative Brexit developments. Much will depend on whether US equity markets can regain some traction this week. If not, continued stock market losses could morph into a more broad-based risk-off trading environment that gives the dollar another boost higher. US stock futures are pointing to a higher open today but sentiment is likely to remain fragile. Stay tuned.

AMERICAS

Odds of a near-term stimulus bill in the US are falling. As noted yesterday, Senate Leader McConnell plans to pass a “skinny” bill worth $500-700 bln this week but needs Democratic support to get the 60 votes. It would restore $300 per week of enhanced jobless benefits, as well as provide $100 bln for schools, $10 bln for the Postal Service, and $258 bln for the Paycheck Protection Program for small businesses. What’s missing is another round of $1200 stimulus checks and any state and local aid. As such, House Speaker Pelosi called this smaller package “fraudulent” and so we assume it will be dead in the water.

Ahead of the August PPI and CPI readings later this week, the US Treasury holds a 10-year auction today. $35 bln will be on offer. Tomorrow, it will sell $23 bln of 30-year bonds. The sales come after a largely lackluster showing at the quarterly refunding last month. Back then, the 3-year leg went fine but the 10- and 30-year legs did not as bid to cover ratios fell to 2.41 and 2.14, respectively, and high yields rose to 0.677% and 1.406%, respectively. The only US data report today is July JOLTS job openings , which are expected at 6000 vs. 5889 in June.

Bank of Canada is expected to keep policy steady. The bank has been on hold since its last 50 bp cut March 27. At its last policy meeting July 15, Governor Macklem noted that the bank’s economic forecasts suggest that rates will remain at current levels for at least two years. Note that the Loonie tends to gain on BOC decision days. In four of the past five, the currency has strengthened. USD/CAD is trading at the highest level since August 17 after finding strong support near the 1.30 area last week. The 1.3245 area is key, as a clean break above would set up a test of the August 7 high near 1.34.

Mexico reports August CPI. Headline inflation is expected to accelerate to 4.04% y/y from 3.62% in July. If so, it would be the highest since May 2019 and above the 2-4% target range. Banco de Mexico has cut rates at every meeting this year. At its last meeting August 13, it cut rates 50 bp to 4.5% and signaled further easing was likely. Next policy meeting is September 24 and rising inflation makes this a tough call. While we had thought another 50 bp cut to 4.0% was likely, the bank may be forced by rising inflation to do a more cautious 25 bp move then.

Brazil reports August IPCA inflation. It is expected to accelerate to 2.44% y/y from 2.31% in July. If so, it would be the third straight month of acceleration and the highest since March and just below the 2.5-5.5% target range. At the last COPOM meeting August 5, it cut rates 25 bp to 2.0% and left the door open for further easing. Next meeting is September 16 and no change is expected then as we believe the easing cycle has ended.

| EUROPE/MIDDLE EAST/AFRICA

The Brexit fallout widens. Two of the UK government’s most senior legal advisors quit over professed plans to abrogate portions of the Brexit Withdrawal Agreement. More specifically, the UK plans to revoke its agreement to keep Northern Ireland aligned with EU customs rules. Northern Ireland Minister Lewis admitted to Parliament that an attempt to rewrite any portion of the deal would “break international law, in a very specific and limited way.” UK will have trouble striking new trade deals if it can’t be counted on to honor its past agreements. Ireland Deputy Prime Minister, Varadkar put it best when he said that “A country either abides by the rule of law or it does not, it honors international treaties and obligations or it does not.” Many of the staunchest critics come from Johnson’s own Tory party, with former Prime Minister May asking “How can the government reassure future international partners that the UK can be trusted to abide by the legal obligations of the agreements it signs?” While some are chalking this up to mere brinksmanship, there is more to this than meets the eye. Either way, it is a very risky gamble to take at such a crucial juncture in the Brexit talks. No surprise then that sterling remains under pressure. Cable is trading below $1.30 and at the lowest level since July 29. The break below $1.2965 sets up a test of the July 22 low near $1.2645, with intermediate support seen at the 200-day moving average currently near $1.2740. Elsewhere, the EUR/GBP cross traded above .9100 today and is on track to test the July 27 high near .91482 and then the June 29 high near .91759. ASIA Australia September Westpac consumer confidence rose to 93.8 from 79.5 in August. Yesterday, August NAB business conditions came in at -6 vs. 0 in July and business confidence came in at -8 vs. -14 in July. The economic outlook remains mixed as the RBA left rates steady last week but expanded its Term Funding Facility for banks. The RBA also signaled willingness to ease further, noting that it “continues to consider how further monetary measures could support the recovery.” Rising tensions with China has weighed on the Aussie. AUD found some support today just below the .7200 level, the lowest since August 26. New Zealand 3-year bond yields turned negative for the first time ever. This largely reflects rising market expectations that the RBNZ will eventually take its policy rate negative. This has gathered steam after the bank acknowledged that it would consider negative rates at its August 12 meeting. It also unexpectedly expanded QE then. Next policy meeting is September 23 and no change is expected. However, the bank will likely address the issue of negative rates in greater detail now that the market is doing the heavy lifting for it. NZD found some support near the .66 area but the near-term direction will still depend largely on the broader USD trend. |

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Daily News,Featured,newsletter