The Commitment of Traders reporting period ending March 8 showed little position adjusting ahead of the ECB meeting two days later. A little more than 3/4 of the gross positions we track saw less than 5k contract change and only two were above 6k.

The gross long speculative sterling position was cut by a quarter or 9.6k contracts to 29.4k. Speculators also built a larger gross long Australian dollar position, adding 9.7k contracts to 86.1k.

The conventional focus on net positions does not reveal the extent of market positioning going into the ECB meeting. The net speculative position is short 71.9k contracts. However, gross short position was 176k contracts. That was larger than the gross speculative short position in yen, sterling, Swiss francs combined.

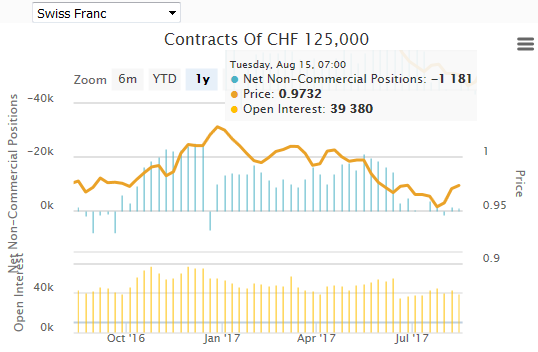

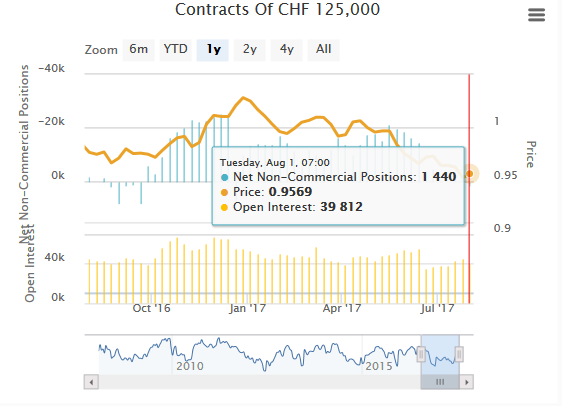

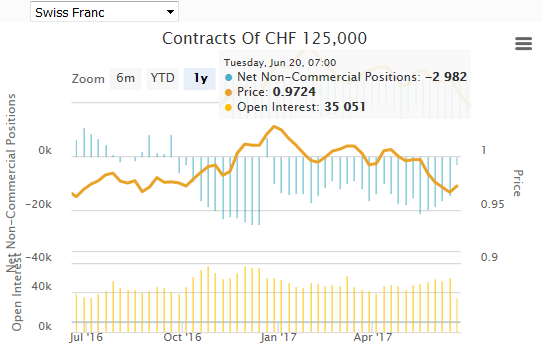

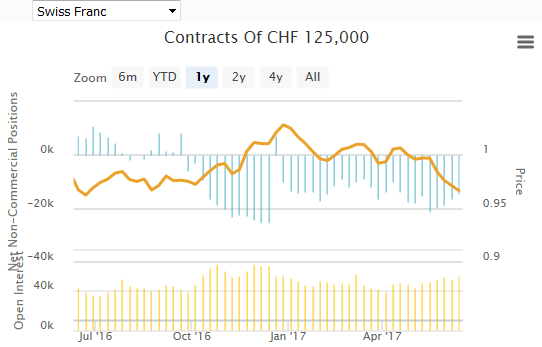

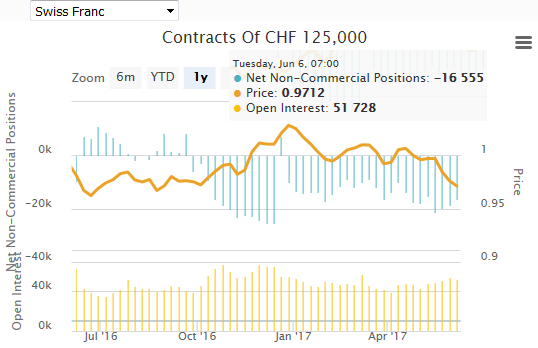

The net level is important but in a different context. Speculators are gradually turning what was an extremely long net position. The net yen and Australian dollar futures position has already swung long. The net speculative long position is about to turn in the Swiss franc and New Zealand dollar. Given the risk-on mood, with gains in oil and the S&P 500 for a fourth week, and the price action since the end of the reporting period, the wave looks set to continue. Speculators have substantial gross short sterling (78.4k contracts) and peso positions (78.0k contracts).

Speculators did not seem to expect the US Treasury yields to continue to rise. The bulls extended their gross long position by 35.4k contracts (to 510.6k contracts). The shorts cut their gross position by 30.1k contracts to 442.5k contracts. These adjustments resulted in the net long position rising to 68.1k contracts from 2.6k.

Speculators continued to gradually increase their net long light sweet crude oil position. It rose by 32.7k contracts to 244.3k. The bulls were cautious about buying into strength and added a minor 5.8k contracts to lift the gross long position to 535.6k contracts. The bears are reducing exposure. They covered 25.9k contracts, leaving them with 291.3 contracts.

| 8-Mar | Commitment of Traders | |||||

| Net | Prior | Gross Long | Change | Gross Short | Change | |

| Euro | -71.9 | -68.5 | 104.2 | 0.2 | 176.1 | 3.6 |

| Yen | 64.3 | 59.6 | 93.9 | -0.2 | 29.5 | -4.9 |

| Sterling | -49.0 | -39.4 | 29.4 | -9.6 | 78.4 | 0.0 |

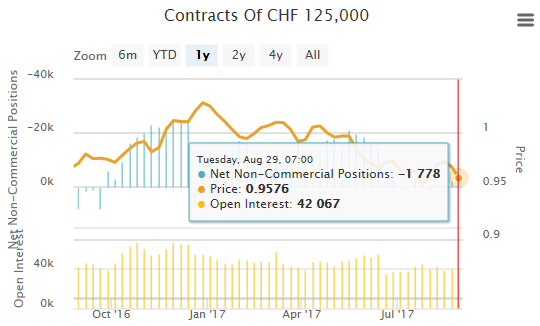

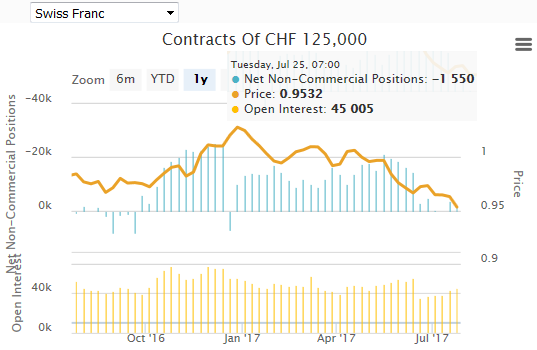

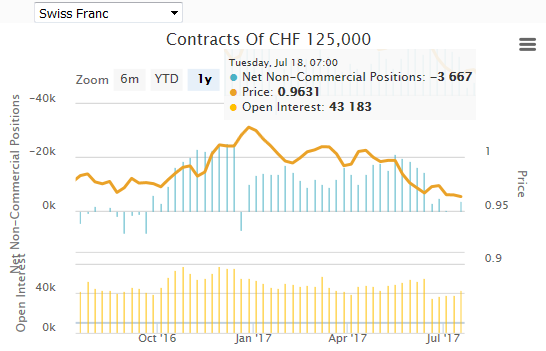

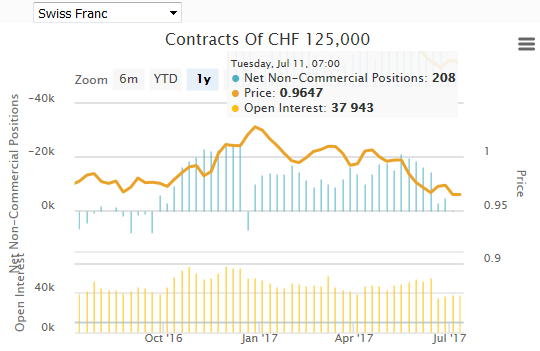

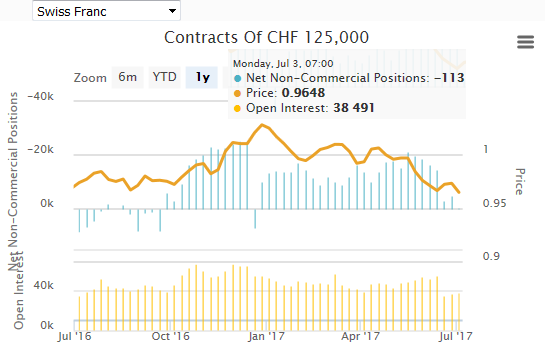

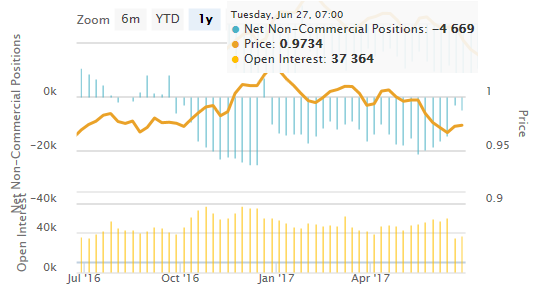

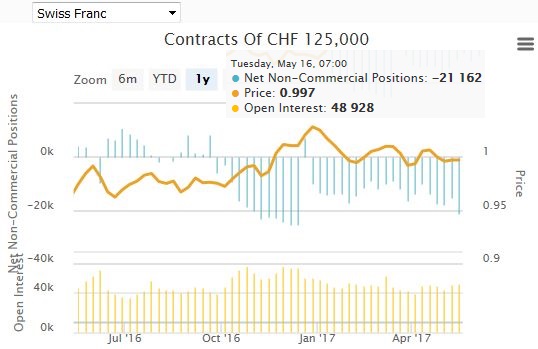

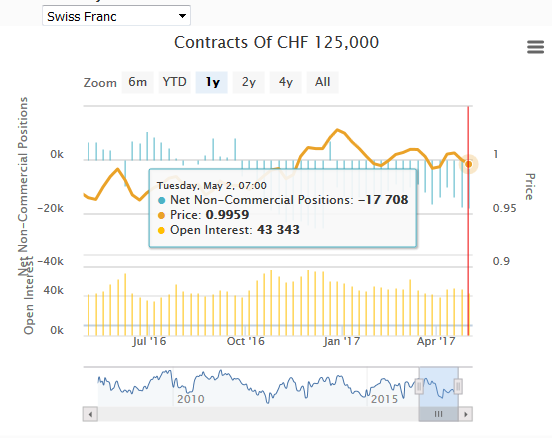

| Swiss Franc | -0.1 | -1.5 | 19.7 | 0.0 | 19.9 | -1.4 |

| C$ | -25.8 | -30.5 | 30.6 | -0.5 | 56.3 | -5.2 |

| A$ | 29.2 | 16.9 | 86.1 | 9.7 | 56.9 | -2.7 |

| NZ$ | -2.0 | -4.2 | 20.4 | 3.8 | 22.4 | 1.7 |

| Mexican Peso | -57.6 | -56.5 | 20.4 | -4.8 | 78.0 | -3.7 |

| (CFTC, Bloomberg) Speculative positions in 000's of contracts | ||||||

Tags: Commitments of Traders,Speculative Positions