Monetary Metals specialist Keith Weiner will give a weekly update on price movements of gold and silver. We will try to explain the movements and the background.

Latest Content on Monetary Metals

China: Pure Gold and Soggy Dollars

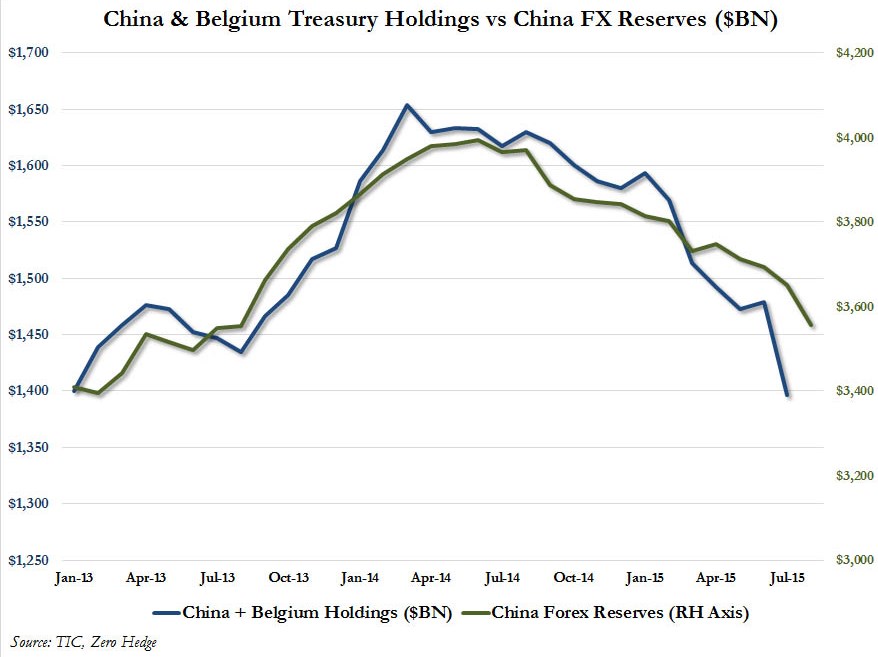

The headline reads, “China Bought Gold With Proceeds From Record Sale Of US Treasuries”. It’s been in the news for a while: China is selling Treasuries (i.e. dollars). The PBoC is forced to sell dollars and buy yuan, to prevent a yuan crash as people are selling yuan.

Monetary Metals Report September 27, 2015

Monetary Metals Report September 27, 2015

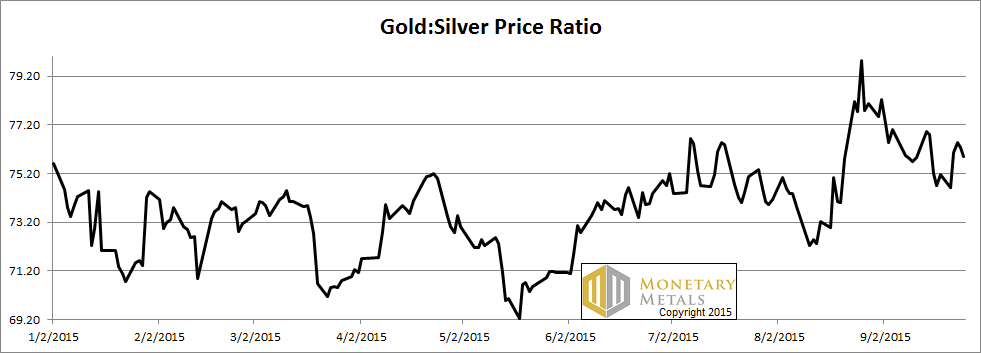

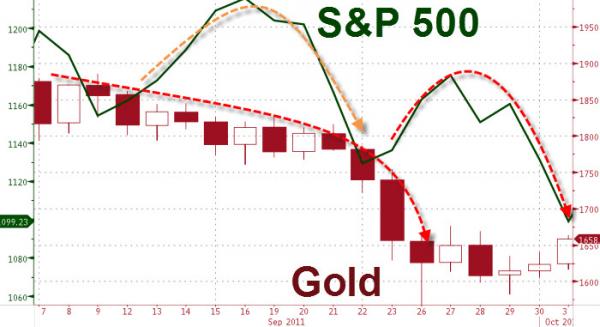

The price of gold moved up moderately, and the price of silver moved down a few cents this week. However, there were some interesting fireworks in the middle of the week. Tuesday, the prices dropped and Thursday the prices of the metals popped $23 and $0.34 respectively.

Monetary Metals Report September 20, 2015: Gold moves to Backwardation

Monetary Metals Report September 20, 2015: Gold moves to Backwardation

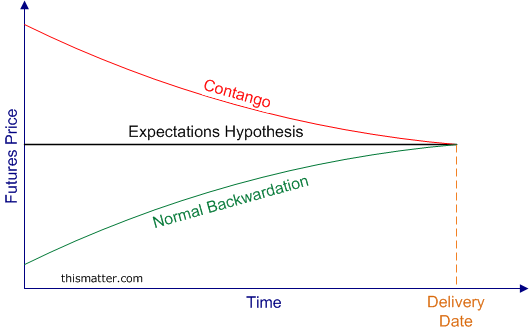

The prices of the metals moved up a bunch this week, with gold + $32 and silver +$0.55. We have seen some discussion of gold backwardation in the context of scarcity, and hence setting expectations of higher prices. That’s good, as the swings from contango to backwardation and back are the only way to understand changing supply and demand in the market. Gold Moves to Backwardation You should be cautious about trading news. With Fed’s meeting, gold and silver prices moved to backwardation.

Monetary Metals Report September 13, 2015: Gold, Silver, and Horse Betting

Keith Weiner compares the gold price with the sport of horse racing.

First, there is the manic-depressive crowd. Same as in horse riding, the “house” focuses on spread.

Posts by George Dorgan

The Six Major Fundamental Factors that Determine Gold and Silver Prices

Gold and silver are the most complicated assets to price. Stocks, currencies, commodities mostly depend on their fundamental data, supply and demand. Gold and silver, however, are priced indirectly.

After 2013: Why Have Gold Prices Plummeted?

Why was the gold price so low in 1999/2000?

Why was the gold price so low in 1999/2000?

To find further explanations as to why the gold price was weak in the late 1990s we analyze sector balances. Effectively private spending and private debt went in two different directions

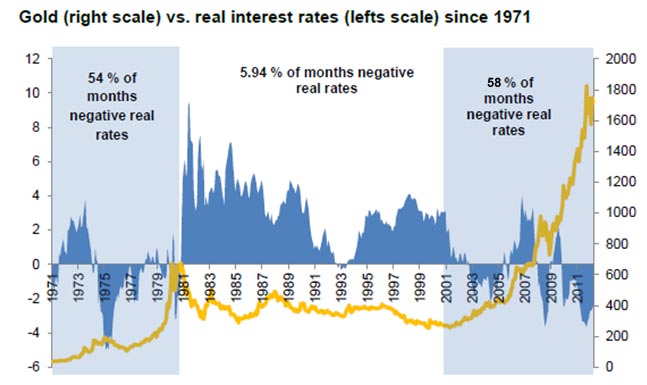

a heavy increase in private spending and debt in the US against less growth in private spending and less debt in the rest of world. This combination fostered GDP growth and stock markets in the US and weakened it in other countries. Real interest rates were positive. Markets thought that the debt-financed growth could continue for years; they created the dot com bubble on top of it that strengthened technology stocks and the related currency, the dollar. This rare situation led to excessively weak oil and gold prices

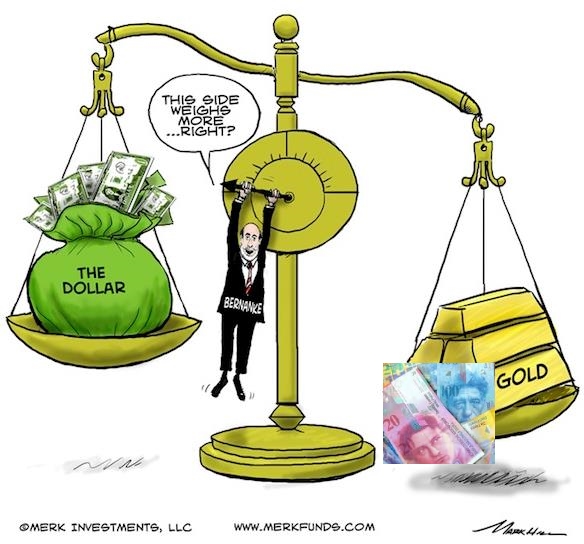

The Fed Will Remain Gold’s Strongest Supporter For Years

In the early 1980s the Fed stopped the wage-price spiral and destroyed the gold price. Today main-stream economists have discovered that rising company profits compared to stagnating wages could an issue for the U.S. economy. For us this implies that the ultimate Fed goal will be to increase wages and inflation. Consequently the Fed has become the biggest supporter of gold and silver prices.

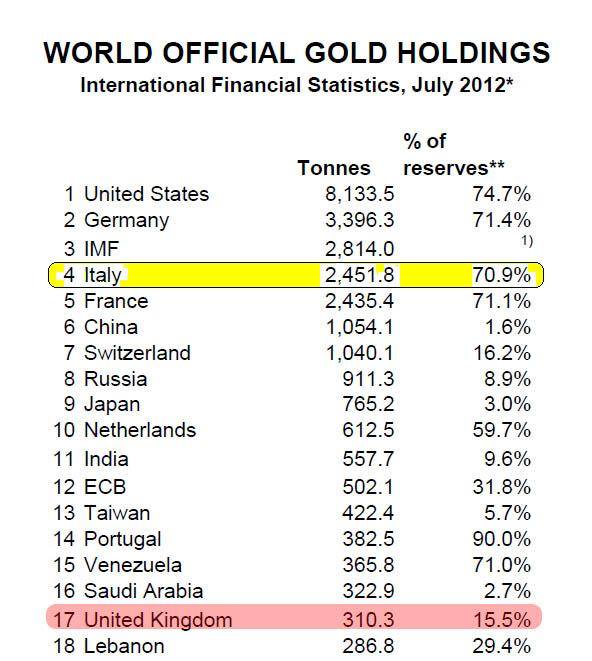

Gold Holdings by country 2012 Italy - Click to enlarge

How Long Will the Dollar Be the Major World Reserve Currency? A Look at Wealth

We examine how long the U.S. Dollar will remain the unique world reserve currency. The most important criterion for being a reserve currency is wealth. While China has recently overtaken the U.S. as for inflation-adjusted GDP, in the next step, it will overtake the U.S. as for wealth

Seasonal Factors on Gold

The List German Gold Transactions 1951-2012

George Dorgan: On Reserve Currencies

- How Long Will the Dollar Be the Major World Reserve Currency? A Look at Wealth

- When Will the Renminbi Become a Reserve Currency?

George Dorgan: Germany, Europe and Gold

- Gold Tells the History of the 20th Century

- The List German Gold Transactions 1951-2012

- The Collapse of the Bretton Woods System, the German Current Account and Gold Reserves