updated August 05,2012

We publish a detailed analysis of global PMIs and compare them with the main risk indicators S&P500, Copper, Brent and AUD/USD some days after most PMIs came out.

Abstract:

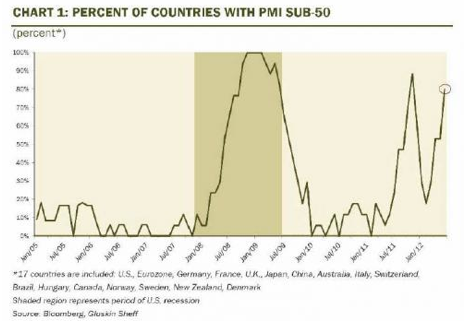

Thanks to positive US consumer confidence, stock markets are highly valued, whereas the Purchasing Manager Indices (PMIs) for the manufacturing industry are contracting for the third month in a row. The PMIs are weaker than last year September, but now markets and all risk indicators are stronger. Stock markets seem to be clearly overvalued.

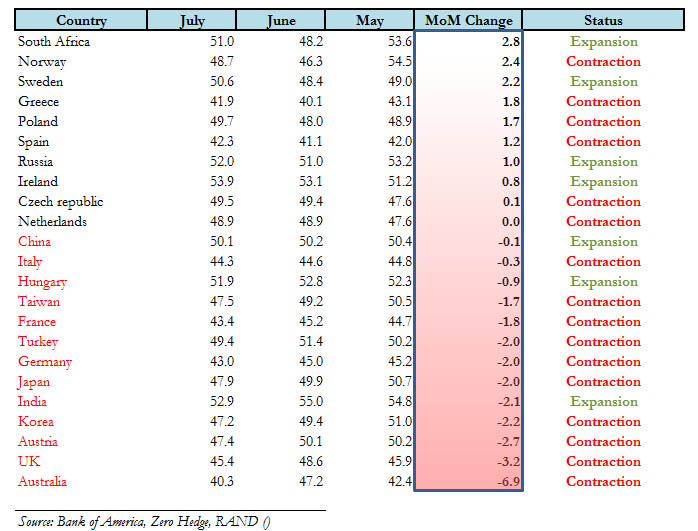

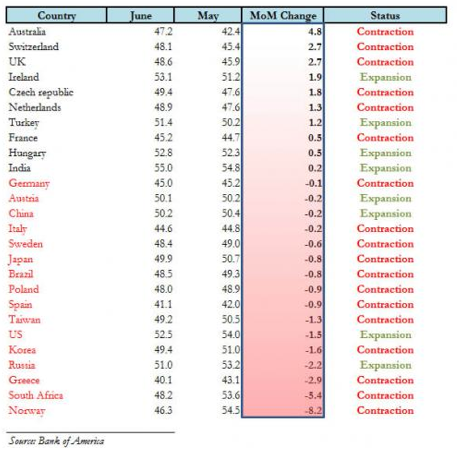

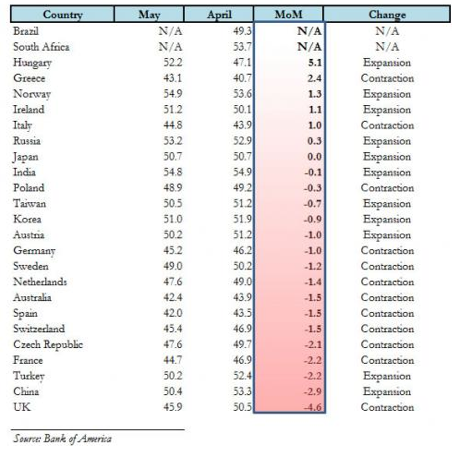

The expansion/contraction ratio for the manufacturing PMIs is still weakening. Only 7 countries are expanding, 20 contracting.

Composite or services PMIs are not that strongly hit as the manufacturing ones. The divergence between services and manufacturing PMIs is getting bigger. The reason for the divergence might be that 2010 and 2011 were strongly driven by Quantitative Easing and investments into construction and manufacturing, especially in China. The strong depreciation of “Dr Copper” since February 2011 is a sign. Manufacturing purchasing managers got used to better data in 2011, therefore they look more negatively into the future this year. The consumer, especially the US consumer, is better reflected in the services PMIs (reasons see below). It seems that the US consumer currently sees no difference or even feels better than in 2011. One main reason for his/her positive feeling is the global slowing which drives funds back in the US and seem to help the US housing market.

JP Morgan’s Global PMIs vs. different risk indicators:

| Month | Manu factur. | Services | Com posite | Michigan Consumer Confidence | S&P 500 | Copper | Brent Oil | AUD/ USD | Reference date |

|---|---|---|---|---|---|---|---|---|---|

| August 2013 | 51.7 | 56.1 | 55.2 | 82.1 | 1645 | 3304 | 115.70 | 0.9053 | Sep 3, 2013 |

| July | 50.8 | 54.9 | 54.1 | 85.1 | 1703 | 3168 | 108.93 | 0.8903 | August 2, 2013 |

| June | 50.6 | 51.3 | 52.9 | 84.1 | 1615 | 3176 | 105.85 | 0.9116 | July 3, 2013 |

| May | 50.6 | 53.7 | 53.1 | 84.5 | 1640 | 3297 | 99.92 | 0.9750 | June 3, 2013 |

| April | 50.4 | 52.1 | 51.9 | 76.4 | 1582 | 3126 | 102.85 | 1.0253 | May 3, 2013 |

| March | 51.2 | 53.2 | 53.1 | 77.6 | 1554 | 3354 | 107.17 | 1.0424 | April4,2013 |

| February | 50.8 | 53.3 | 53.0 | 73.8 | 1525 | 3508 | 110.08 | 1.0202 | March4,2013 |

| January | 51.5 | 53.4 | 53.3 | 71.3 | 1503 | 3658 | 113.46 | 1.0427 | Feb4,2013 |

| December 2012 | 50.2 | 54.8 | 53.7 | 74.5 | 1461 | 3700 | 111.42 | 1.0481 | Jan 5, 2013 |

| November | 49.7 | 54.9 | 53.7 | 82.7 | 1407 | 3656 | 110.92 | 1.0432 | Dec 3 |

| October | 49.2 | 52.1 | 51.3 | 82.6 | 1423 | 3557 | 105.75 | 1.0338 | Nov 3 |

| September | 48.9 | 54.0 | 52.5 | 78.3 | 1437 | 3775 | 108.07 | 1.0231 | Oct 3 |

| August | 48.1 | 52.3 | 51.1 | 74.3 | 1406 | 3485 | 108.07 | 1.0239 | Sep 3 |

| July | 48.4 | 52.7 | 51.7 | 72.3 | 1361 | 3307 | 106 | 1.0465 | Aug 2 |

| June | 48.9 | 50.6 | 50.3 | 73.2 | 1357 | 3466 | 97 | 1.0230 | Jul 2 |

| May | 50.6 | 52.5 | 52.1 | 79.3 | 1263 | 3289 | 98 | 0.9640 | Jun 3 |

| April 2012 | 51.4 | 52.0 | 52.3 | 76.4 | 1402 | 3782 | 116 | 1.0260 | May 2, 2012 |

| September 2011 | 49.9 | 52.6 | 52.0 | 55.7 | 1123 | 3132 | 102 | 0.9634 | Sep 2, 2011 |

| February 2011 | 57.8 | 59.3 | 57.0 | 77.5 | 1331 | 4498 | 115 | 1.0127 | Mar 2, 2011 |

Detailed Manufacturing Global PMIs:

July:

PMI Positive/negative change ratio: 12:15

Expansion/Contraction ratio: 7:20

Risk Indicators

August 2:

S&P500 1361

Copper 3307

Brent 106

AUDUSD 1.0465

EURUSD 1.2179

DAX 6606

SMI 6407

Switzerland: 48.6 (June 48.1, May 45.4)

Brazil: 48.7 (June 48.5)

Poland: 49.7 (June 48.0)

United States/ISM: 49.8 (June 52.5, May 54.0) (ISM is listed in June/May below)

additionally: United States/Markit: 51.4 (June 51.9, May 52.5)

June:

PMI Positive/negative change ratio: 10:17

Expansion/Contraction ratio: 8:19

Risk indicators per July 2:

S&P500 1357

Copper 3466

Brent 97

AUDUSD 1.023

EURUSD 1.2580

DAX 6578

SMI 6109

May:

PMI Positive/negative change ratio: 6:16

Expansion/Contraction ratio: 12:13

Risk indicators per June 3:

S&P500 1263

Copper 3289

Brent 98

AUDUSD 0.964

EURUSD 1.2398

DAX 5978

SMI 5713

Which indicators are the most leading ones ?

Manufacturing PMIs are considered to be the most leading and important economic indicators. They are often driven by exporters, especially in countries with strong trade balances and currencies, whereas Services PMIs are determined more by local consumers. In most countries these ones follow the Manufacturing PMIs with a delay of some months, at least historically this was the case.

During a global downturn or slowing (like now), the Services PMIs might be stronger than the Manufacturing PMIs. Examples are Germany and the UK, where Services PMIs (July: 50.3 and 51.0) are far higher than Manufacturing PMIs (June: 43.0 and 45.4). Generally Services PMIs show less volatility, because the manufacturing counterparts depend more strongly on investment, which slows during downturns.

For the US, however, we consider the Non-Manufacturing PMI (the main component are services) and the Chicago Manufacturing PMI to be the most leading indicators. The reason is that the US consumer is still the main driver of the global economy. The ISM Non-Manufacturing PMI reflects future spending better than the University of Michigan or theConference Board indicators.

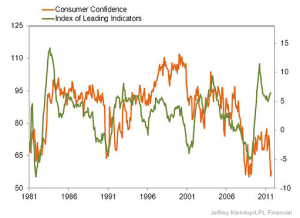

In September/October 2011 the Non-Manufacturing PMI was in positive territory whereas both consumer sentiment numbers saw very bad values. Stock prices were down because they often correlate more with consumer sentiment and less with the leading indicators.

Commodities are more strongly correlated with leading indicators. As suggested by the leading indicators, the US came later into a recovery phase, last but not least thanks to cheaper gas (GAS) prices. The Chicago PMI is strongly associated with the Chicago car producers. The indicator often ticks upwards after a strong fall of gas prices, like seen recently. The ISM Manufacturing PMI (here on Bloomberg) follows the Chicago PMI, often with a lag of one month. As opposed to the Chicago PMI, that reflects the US consumer demands for cars, the ISM Manufacturing PMI depends more strongly on global demand and exports.

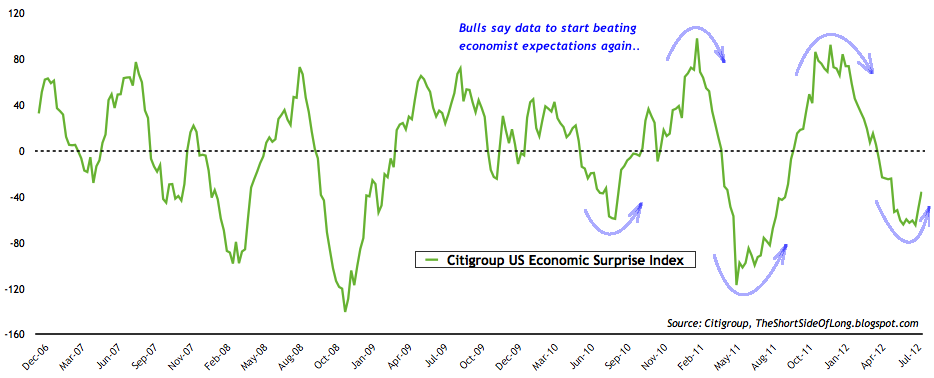

The Citibank Economic Surprise Index compares economic data with investor expectations. It turned upwards from October 2011 on, when data was actually better than what investors expected.

After a downturn in June 2012, the surprise index is moving upwards again. More on seasonality effects and the implications for the SNB can be found here.

Investment Recommendations

We recommend closing or shorting especially German stock positions (EWG) which have risen too strongly despite the Chinese and European economic slowdown. Investors should short the Aussie Dollar (FXA), because of the potential further Chinese slowing. It should effect in a couple of months also the Australian employment situation, despite the current strong consumer spending. Currently the Aussie Dollar functions mistakenly as a safe haven (compare this to the weak Australian PMI of 40.3!).

Even if we do not believe in a big Chinese stimulus program, we recommend hedging the positions partially via Copper long positions (JJC) because copper has already followed the leading indices, stocks haven’t yet.

Further Links

Manufacturing PMIs historically:

History JPM global composite PMI,

History JPM global services PMI

This post appeared in Seeking Alpha.

Are you the author? Previous post See more for Next post

Tags: Brent Oil,China,JP Morgan,Keynes,PMI,Purchasing Manager,Seeking Alpha,Surprise Index,Switzerland,U.S. Chicago PMI,U.S. Consumer Confidence,U.S. ISM Manufacturing PMI,U.S. ISM Non-Manufacturing PMI