| There is nothing that a human mind can’t conceive. It can shoot for the stars or dive in the ocean which twinkles in the shadows of stars and ascend back with sparkling mind bearing uncanny ambition only to float contended.

Today, we live in fear of losing wealth, we worry what economic consequences would do to our cash, we look through a microscope and scrutinize every word, every policy, every regulation or find something to put above ‘every’ and list out the glaring negatives with a slight trace of approval. If only one could notice the lens of the microscope, would then one could tell reel and real apart. Such is the case of negative interest rates. It is dealt differently by different flock of loaded individuals, generally in ways which would not only prevent losses but essentially gain cash. This flock stands on one side of the transaction contemplating means to win regardless of the loss that still deliberating other doomed flock endures. Well, this is how the world works. It is a Bernoulli trial. But there exists a splash of humble wit folks floating beneath the starry sky delighted by the victory of each one and beaten down none. Theory? Without thinking too much, negative rates indicate that the economy is unable to generate sufficient income to service its debt. Almost always, all roads leads us back to debt sustainability levels. In order for an economic system to reduce debt, it requires growth or inflation or currency devaluation. For an economic system to exercise one of the two (growth not included), capital transfer is to be facilitated. This capital movement in negative rates environment is from the savers to the borrowers. Your invested value, the money you gave to borrowers would have a value lower than the face value. Barbaric! Savers should be the winners not the borrowers! So each flock as per their liking would act in a way that makes them the gaining side. In real world scenario, one flock could be investors who when yields falls even deeper into negative territory scoop a profit through capital gain. Flock of foreign investors may try to earn through currency appreciation. Another flock would focus on real rates even though they are negative as that would preserve their capital under deflationary conditions when nominal yields would decrease their capital. Who would want that! Investopedia gave an example, “In 2014, the European Central Bank (ECB) instituted a negative interest rate that only applied to bank deposits intended to prevent the Eurozone from falling into a deflationary spiral.” |

|

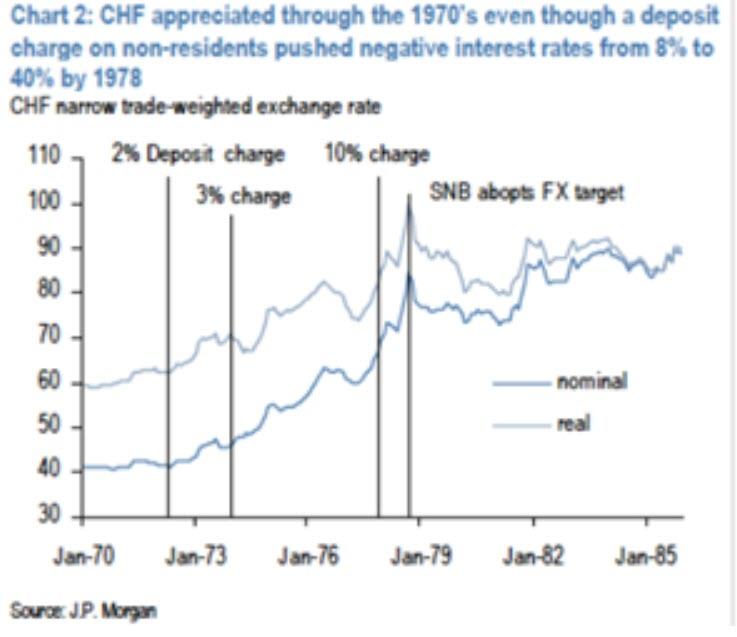

Let’s recall a real practical example. The case of Switzerland.

|

CHF narrow trade-weighted exchange rate, 1970-1985 |

|

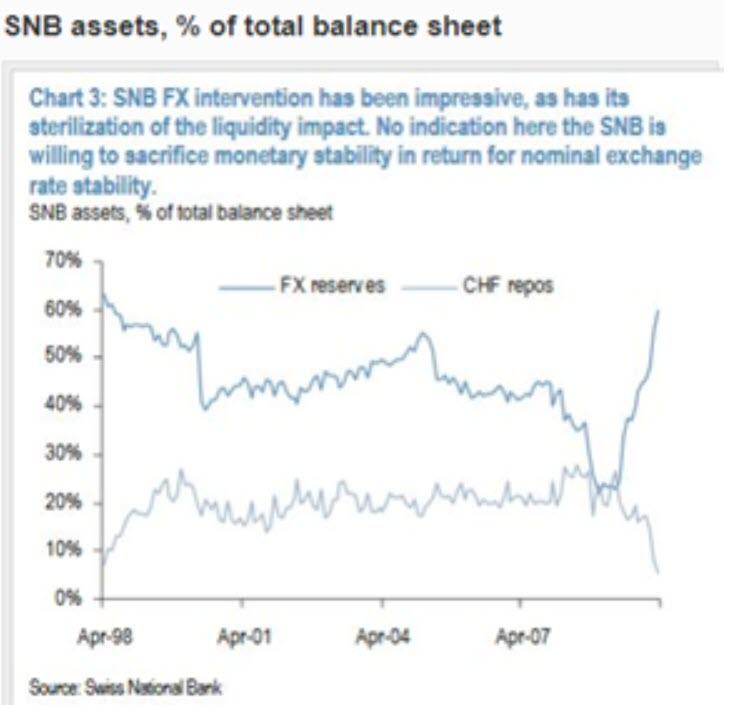

SNB Assets, Percent of total Balance Sheet, 1998-2007 |

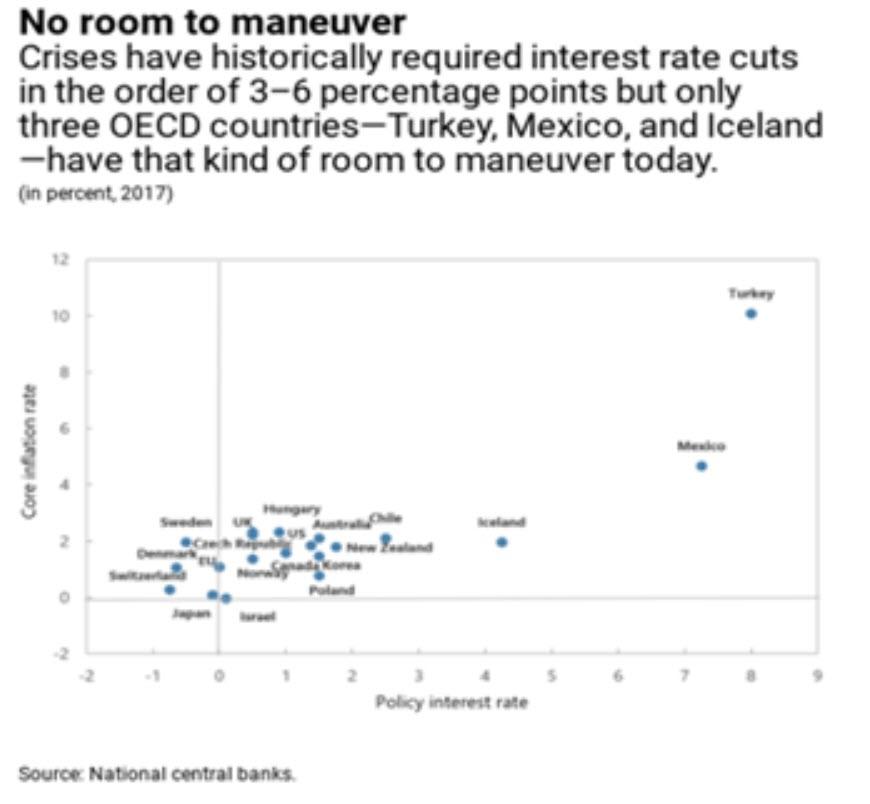

| In fact, during global financial crisis many central banks reduced their policy interest rates to zero. A decade later, today, still many countries are recovering and have kept interest rates low. Severe recessions in the past have required 3 – 6 percent point cuts in interest rates to revive the economy. If any crisis were to happen today, only a few countries could respond to the monetary policy. For countries with already prevailing low or negative interest rates, this would be a catastrophe. |

No room to maneuver |

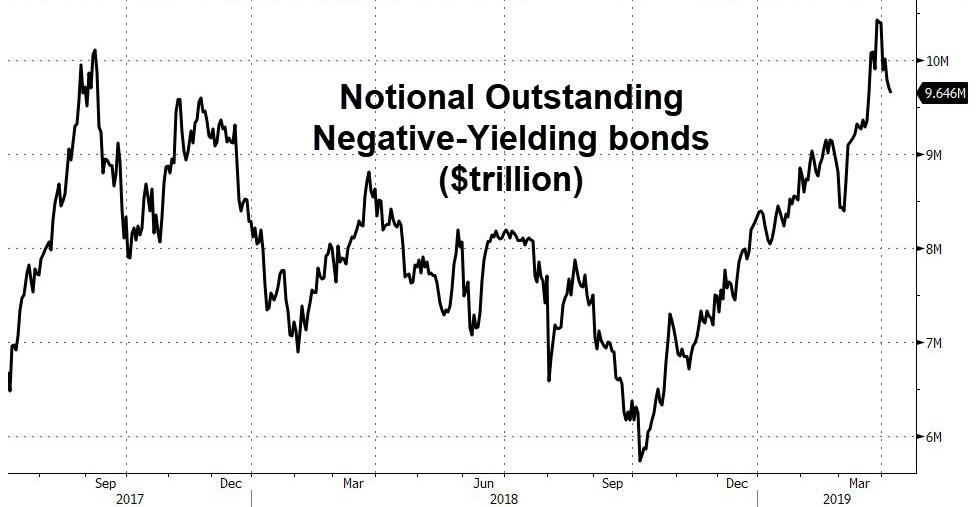

| Today, around $10 trillion of bonds are trading at negative yields mainly in Europe and Japan as per Bloomberg.

Poisons have antidotes, and sometimes one need to gulp down the poison to witness the mystique surrounding the life and glide with accidental possibilities, the possibilities which one wouldn’t seek if they remain wary of novel minted cure. Here enters a splash of humble wit folks! They want a win – win. So these folks came up with an idea, an idea with legal and operational complication but they have swamped themselves with research to find ways to not stumble in future and yes they do have a long way to go but we have a start. These folks are our very adored IMF Staff.! They are exploring an option that would help central banks make ‘deeply negative interest rates’ feasible option. |

Notional Outstanding Negative-Yielding Bonds, 2017-2019 |

Excerpt from their article ‘Cashing In: How to make Negative Interest Rates Work’:

|

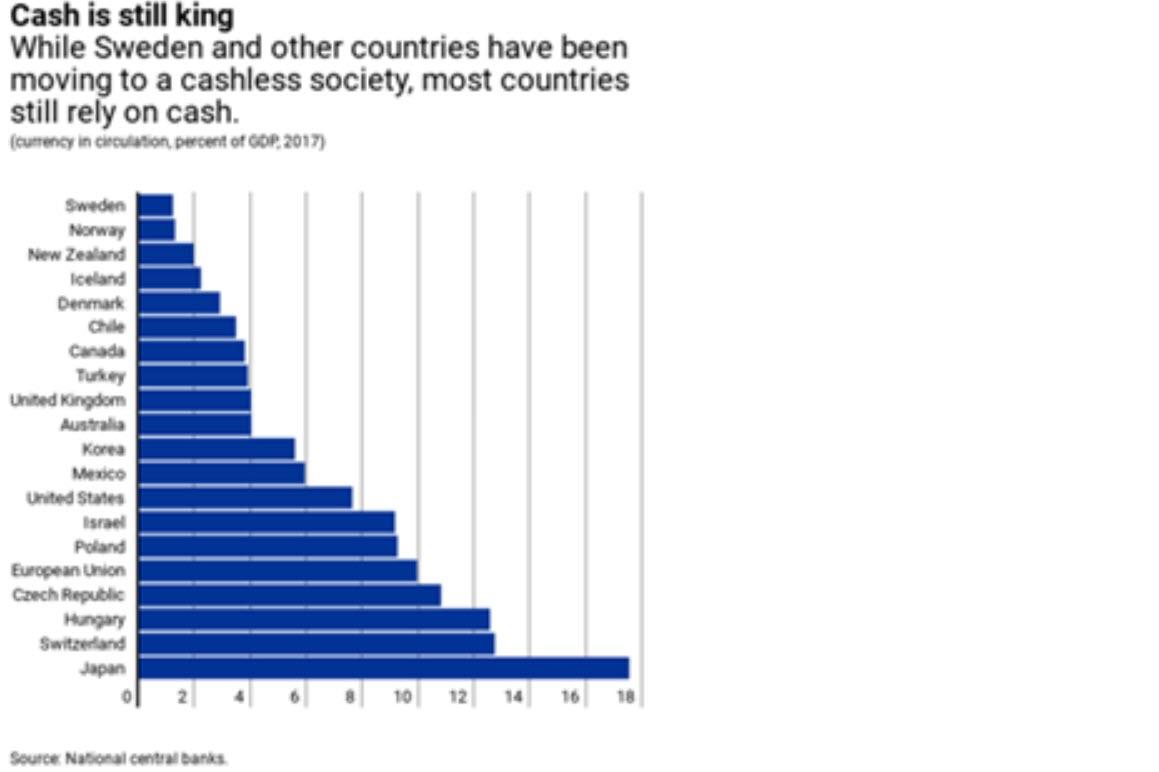

Cash is Still king |

Negative rates are coming whether we like it or not. There is only so much growth we can get in steady state among rising debt levels. The only hurdle to implementing negative rates is currency in circulation and that’s why more and more countries are trying to outlaw cash. Interesting and profitable times ahead for those who understand the brave new world.

Full story here Are you the author? Previous post See more for Next postTags: newsletter