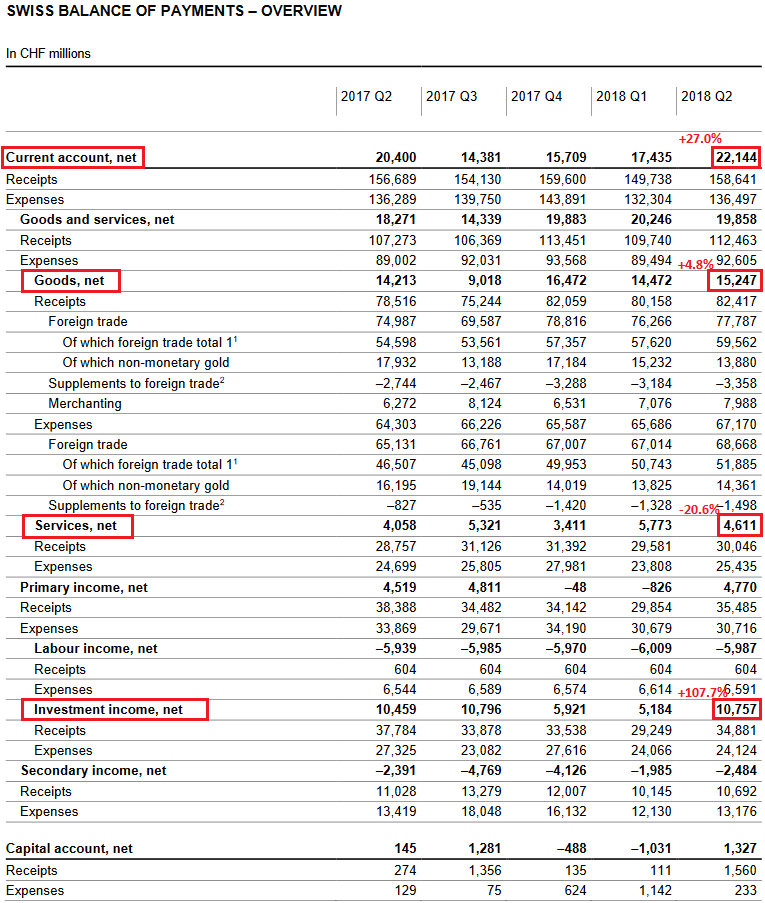

Current AccountKey figures:Current Account: Up 27.0% against Q1/2018 to 22.1 bn. CHF

|

Current Account Switzerland Q2 2018(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge |

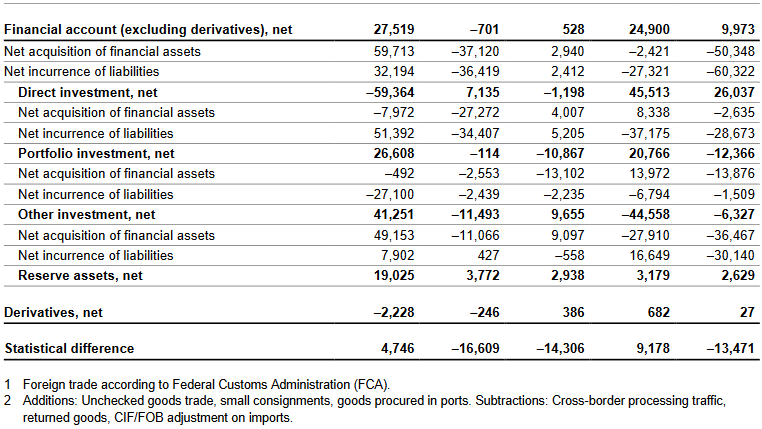

Financial accountNet acquisition of financial assetsThe assets side of the financial account registered a net reduction of CHF 50 billion (Q2 2017: net acquisition of CHF 60 billion). With the exception of reserve assets, all components recorded a net reduction. The assets side was dominated by other investment transactions, which recorded a net reduction of CHF 36 billion (Q2 2017: net incurrence of CHF 49 billion). This reduction was mainly driven by resident, foreign finance and holding companies, which scaled back their intragroup lending to non-residents in light of the tax reforms in the US. The net reduction in portfolio investment came to CHF 14 billion (in Q2 2017, transactions balanced each other out). Resident investors sold both equity securities and debt securities of non-resident issuers. Direct investment recorded a net reduction of CHF 3 billion (Q2 2017: net reduction of CHF 8 billion), due to the fact that resident parent companies withdrew equity capital from their non-resident subsidiaries. These transactions were partly offset by reinvested earnings and intragroup lending. Reserve assets registered a net acquisition of CHF 3 billion (Q2 2017: net acquisition of CHF 19 billion).

Net incurrence of liabilitiesOn the liabilities side, a net reduction of CHF 60 billion was recorded (

Q2 2017: net incurrence of CHF 32 billion); this was mainly attributable to direct investment and the other investment item. Direct investment saw a net reduction of CHF 29 billion (Q2 2017: net incurrence of CHF 51 billion) as a result of parent companies withdrawing equity capital from their resident finance and holding companies. These transactions took place against the backdrop of tax reforms in the US. The other investment item registered a net reduction of CHF 30 billion (Q2 2017: net incurrence of CHF 8 billion). This was due partly to resident banks reducing their liabilities towards both non-resident customers and non-resident banks (interbank market), and partly to companies reducing their loan commitments to non-residents. Portfolio investment showed a net reduction of CHF 2 billion (Q2 2017: net reduction of CHF 27 billion).

Financial account balanceThe financial account balance came to CHF 10 billion (Q2 2017: CHF 25 billion). This figure is calculated as the sum of all net acquisitions of assets minus the sum of all net incurrences of liabilities plus the balance from derivatives transactions. The financial account balance corresponds to the change in the net investment position resulting from cross-border investment.

|

Switzerland Financial Account(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Extract from the Balance of Payments Q2 2018 Source: snb.ch - Click to enlarge |

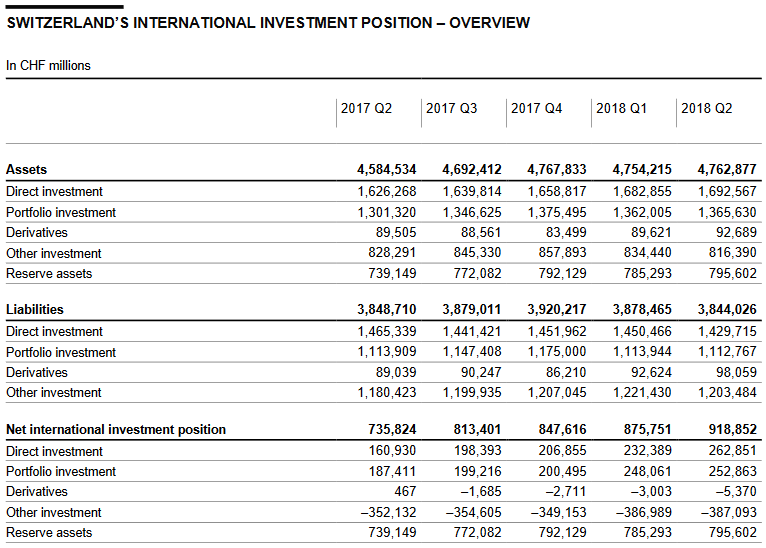

Switzerland’s International investment positionAssetsStocks of assets in the international investment position rose by CHF 9 billion to CHF 4,763 billion, although transactions in the financial account recorded a decrease (CHF 50 billion). The increase was due to significant valuation gains, largely as a result of the stronger US dollar. Direct investment stocks rose by CHF 10 billion to CHF 1,693 billion. Portfolio investment increased by CHF 4 billion to CHF 1,366 billion. Reserve assets grew by CHF 10 billion to CHF 796 billion. By contrast, other investment decreased by CHF 18 billion to CHF 816 billion. Derivatives were up by CHF 3 billion to CHF 93 billion.

LiabilitiesStocks of liabilities contracted by CHF 34 billion to CHF 3,844 billion. This was mainly attributable to transactions recorded in the financial account (net reduction in liabilities). As with the assets side, valuation gains resulting from US dollar appreciation were partly offset by this transaction-driven net reduction. However, these valuation gains did not have as much of an impact as on the assets side, since US dollar-denominated stocks on the liabilities side are comparatively low. Direct investment stocks fell by CHF 21 billion to CHF 1,430 billion. Other investment declined by CHF 18 billion to CHF 1,203 billion. Portfolio investment fell by CHF 1 billion to CHF 1,113 billion. Conversely, derivatives rose by CHF 5 billion to CHF 98 billion.

Net international investment positionThe net international investment position came to CHF 919 billion, exceeding the previous year’s figure by CHF 43 billion as a result of the increase in assets (up by CHF 9 billion) and the simultaneous decline in liabilities (down by CHF 34 billion).

|

Switzerland International Investment Position(see more posts on Switzerland International Investment Position, ) Switzerland International Investment Position - Q2 2018 Source: snb.ch - Click to enlarge |

Tags: newsletter,Switzerland Balance of Payments,Switzerland Capital Account,Switzerland Current Account,Switzerland Financial Account,Switzerland International Investment Position