Due to high inflation, high borrowing rates and some capital outflows, the purchasing manager indices (PMIs) for emerging markets remain restricted. India’s HSBC PMI fell down to 50.10.

China is still hampered by the strong yuan, compared to the yen. Consequently ‘s HSBC manufacturing fell even to 49.20.

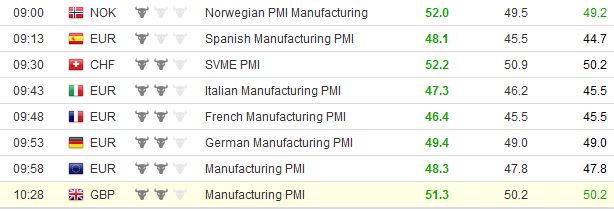

After the first rise in European car sales in April for many months, European PMIs start to move upwards.

The Swiss, Norway, the UK and Germans are in the lead, while, despite improvements, France, Italy and Spain are still lagging This afternoon’s ISM PMI of 49 shows that the U.S. have always problems between May and September.

While inflation fears continue to weaken stocks, the EUR/CHF is improving again, because traders get more confident that there won’t be an ECB rate cut. Hence they pile on the carry trade between EUR or AUD against CHF. On the other side the dollar is weakening against the yen and gold is moving upwards because better European data should be positive for Asia (understand the FX movements).

Are you the author? Previous post See more for Next postTags: PMI