|

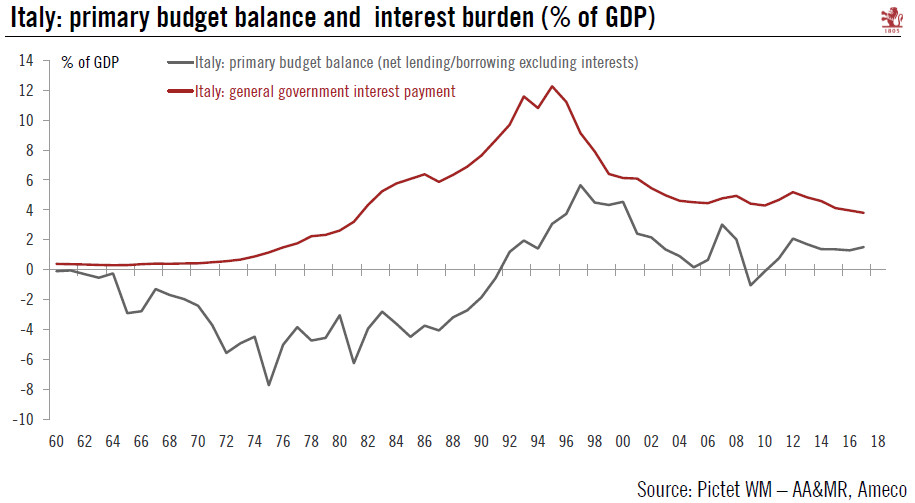

The incoming government’s fiscal plans could result in a sharp deterioration of Italy’s public finances. However, broader fiscal metrics are better than they were during the euro sovereign crisis. The M5S-League coalition has committed to a significant degree of fiscal easing and to the reversal of some structural reforms. Such policies will put Italy on course for confrontation with Brussels over deficit reduction targets, although at this stage we still expect negotiations to result in compromises. For all the political and economic risks facing Italy, the difference in macro fundamentals between the situation today and the 2011 sovereign debt crisis cannot be stressed often enough. Italy has managed to run a primary surplus in 24 of the past 26 years, estimated at +1.5% of GDP in 2017. Meanwhile, the total public deficit has been reduced from -5.3% of GDP in 2009 to -2.1% in 2017, and it was expected to decrease further this year. The policy measures included in the government agreement, if implemented in full, would result in a massive increase in the fiscal deficit of the order of EUR109bn-126bn, according to the Osservatorio CPI. A full implementation of those measures could therefore add between 6% and 7% to the public deficit, to over 8% of GDP, before any impact on growth is factored in. Importantly for debt sustainability, interest payments on the past stock of debt and the implied interest rate on debt (currently 2.8%) are at their lowest levels since the launch of the euro. Average debt maturity has been rising to close to seven years. Meanwhile, the share of public debt in the hands of foreign investors and Italian banks has decreased, to 32% and 47% respectively. The high level of Italy’s public debt (132% of GDP in Q4 2017) must therefore be put in perspective with those buffers, although they are unlikely to be sufficient in the event of a more systemic crisis. |

|

Full story here Are you the author? Previous post See more for Next post

Tags: Macroview,newslettersent