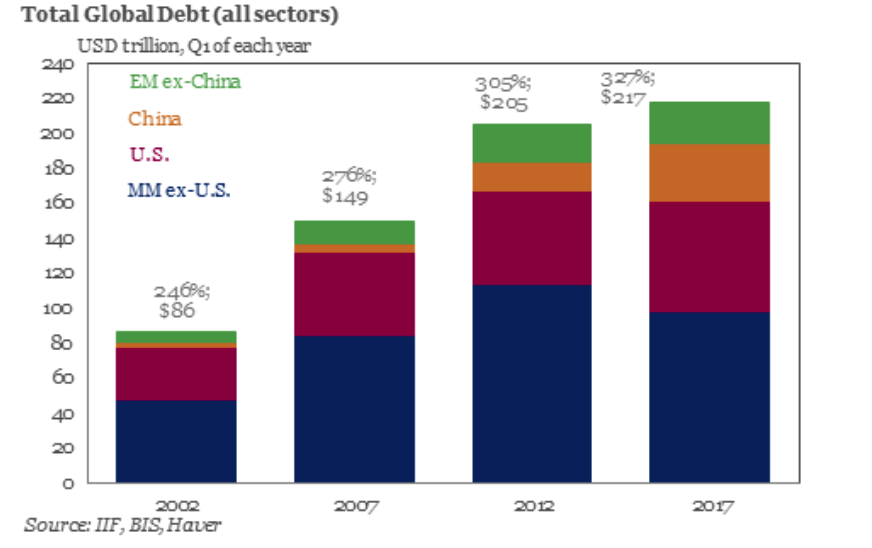

| The World is $233 Trillion In Debt: It’s Time to Rebalance To Gold

– Record level global debt level hit $233 trillion in Q3 2017 |

Total Global Debt, 2002 - 2017 |

| Global debt levels have soared to a record high of $233 trillion, according to the Institute of International Finance (IIF).

Since the end of 2016 to the end of Q3 2017, the total debt incurred by the household, government, financial and non-financial corporate sectors increased by $16 trillion. A major increase in just nine months. The institute reported that the rise was split between $63tn in government debts, $58tn in financial, $68TN in non-financial and $44tn in household sectors. Just consider for one moment that prior to the financial crisis global debt was “only” around $150 trillion. How have we managed to add over $80 trillion in less than a decade?! On a country-by-country basis both the UK and US saw worrying data when it came to their own levels of consumer debt. Here in the UK personal borrowing on credit cards, loans and car finance, is now outpacing the rate of growth in UK pay five-times over. In the US consumer credit jumped by its highest in two years, by 8.8% in November to $3.83 trillion. Countries that saw a major increase in non-financial debt were Canada, France, Hong Kong, South Korea, Switzerland and Turkey, all saw all-time highs. Debt is increasing not because low-earners are borrowing more, but data is showing that increasing numbers of middle-class earners are driving up levels of leverage. Why would those in usually stable jobs and comfortable earning levels be driving themselves into debt? UK middle-class pushing up borrowing levels UK personal debt is now rising at almost five times the rate of growth in UK pay. According to debt charities, many families are now living on the colloquially termed ‘never-never’ i.e. they rely on the prayer that they can keep transferring debt and therefore never repay it. These are not all people who have directly suffered from the financial crisis by losing their jobs or losing their homes. Many are suffering from the repercussions of the ‘solutions’ to the downturn. According to StepChange the majority of those they help are employed, some even have senior roles and one in five are homeowners. Last year credit card debt levels grew at their fastest rate in 11 years. In April alone £606 million was put on plastic. Previously the Bank of England and other organisations have not expressed too much concern about the ability of households to pay this back. Until now that is. |

Percent of Consumer Credit Debt Balances, Dec 2014 - Nov 2016 |

| This week a report by the Bank of England and FCA, stated that British consumers are trapped by credit card debt for longer than previously thought.

The Guardian reports on the study:

US consumers feel confident to borrow more The US Federal Reserve had a notable 2017 given their actions to both reduce their balance sheet and increase interest rates. One would have thought that an increase in the cost of borrowing would have given consumers pause for thought when it came to taking out loans. This was not the case. In November 2017 consumer credit grew rapidly by $28.0bn in November. This was the largest gain in 16 years, according to Nomura. In the month previous it had climbed by $20.5bn. Nomura, reporting on the data, pointed to the figures as if they are a sign of strength in the economy ‘This appears consistent with a strong labor market with low unemployment and elevated consumer confidence, which we expect will continue in the near term.’ In the US consumer spending accounts for roughly 7-0% of the economy’s activity. Last month surveys showed that American shoppers are feeling increasingly confident in the state of the country’s future. Early holiday reports suggest spending did not take a hit. However it was big loans such as student and auto which accounted for the major leap in debt levels. |

|

| So, if student loans accounted for a near $16.8 billion leap in the country’s spending, can one really argue that the increase is thanks to confidence levels. To me that sounds like a form of borrowing which is thanks to necessity rather than confidence.

Soon those student loans will need to be paid back, in an economy which is not currently creating that many jobs for graduates. The student debt bubble is not a new phrase. It is something that has been reported on widely but with the logic that if we talk about it loud enough it might just skulk away and not rear its head. We should be so lucky.

This is not something that can be magicked away by economic growth. Investors are worrying about their portfolios thanks to a financial crisis caused by rising, unsustainable debt levels. We appear to be in the same, if not worse, position that got us here in the first place. Rebalance to combat global imbalance These raging debt levels, whether government or consumer, are clearly unsustainable. These figures should serve as an indicator to investors that now is the time to look at their portfolios and rebalance them for this unbalanced world. A shift from risk assets to safe haven assets such as gold and silver bullion seems to be a timely move, right now. The concern with debt-levels such as these is that they end up scuppering the period of accelerated growth in global GDP, that we are currently witnessing. At the moment this high growth is the only way central banks and governments can justify the high levels of debt. Central banks are obviously keen to start reigning in their balance sheets as well as increase interest rates. Unsustainable levels of debt could force them to park these plans should debtors begin to struggle with repayments. This is quite the vicious circle. As we all know it was low interest rates which propelled such a highly-leveraged situation in the first place. This is an unsustainable path, something the central banks have become aware of all too late but now it seems they’ve buried themselves in real deep red hole. Needless to say the future of global growth has been built on the Emperor’s New Clothes of foundations. There is little value really propping up an economy when it relies on its citizens drowning itself in debt in order to keep the charade going. There’s little we can do to prevent individuals wracking up credit card debts or buying cars on finance. All we can do is prepare our portfolios for when the world realises that it’s standing on thin air. Gold that is held in a segregated, allocated portfolio is a key way to protect your savings from counter-party risk in the financial system. Gold’s performance in 2017, along with low gold liquidations, increased demand for gold coins and bars and central bank purchases suggests that gold buyers have identified that this really is all a mirage. It is obvious from both political and economic events that the global economic crisis is not over. Data shows that we are fast approaching circumstances worse than those seen prior to 2008. Sadly no one is acknowledging them and solutions and preparations are not being considered. |

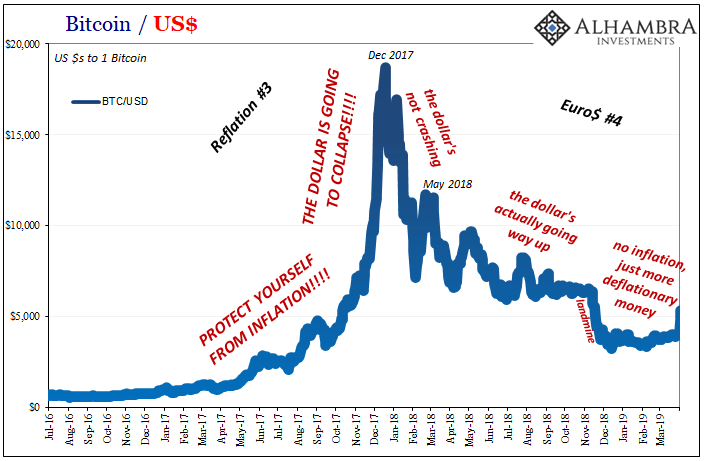

EU Bitcoin Tracker - Dec 2017 - Jan 2018(see more posts on Bitcoin, ) |

Full story here Are you the author? Previous post See more for Next post

Tags: Bitcoin,newslettersent