Lance Roberts

My articles My offerMy siteAbout meMy videosMy books

Follow on:TwitterSeeking AlphaFacebookAmazon

| The Fed sees inflation easing and believes policy is already restrictive, making rate hikes very unlikely and keeping cuts as the more probable next move. In this short video, @michaellebowitz and I break down what Powell actually said, what the Fed is signaling on growth and labor, and what to expect next for markets. 📺Full episode: Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow |

You Might Also Like

1-5-26 Don’t Just Bet on Upside — Prepare for Any Outcome

1-5-26 Don’t Just Bet on Upside — Prepare for Any Outcome

2026-01-05

The outlook for 2026 hinges on how valuations and economic growth play out.

In this Short video, I cover multiple $SPX year-end scenarios and explain why managing ranges matters more than betting on a single target.

📺Full episode: -Z7mJI

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Electricity Prices Could Become a Structural Inflation Problem

Electricity Prices Could Become a Structural Inflation Problem

2025-12-30

Most Americans are paying higher electricity prices, and the pressure is unlikely to ease anytime soon. According to the Wall Street Journal, electricity prices have risen meaningfully across much of the country since 2022, and the drivers extend well beyond the frequently cited surge in data-center demand. While electricity prices had historically tracked inflation, that …

12-29-25 The Hidden Logic Behind Dollar Weakness

12-29-25 The Hidden Logic Behind Dollar Weakness

2025-12-29

The U.S. doesn’t want a permanently strong dollar because it would choke the global economy and destabilize trade.

In this short video, Brent Johnson and I discuss why the U.S. has historically managed the dollar to stay range-bound and how dollar strength or weakness shapes global liquidity and growth.

📺Full interview: -SDg

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Repo Market: Critical Warning Or Bullish Signal

Repo Market: Critical Warning Or Bullish Signal

2025-11-08

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you’d like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

The Fed Cuts Rates: What Comes Next?

The Fed Cuts Rates: What Comes Next?

2025-09-18

Not surprisingly, the Fed cut rates by 25 basis points at yesterday’s meeting. With the cut, the Fed Funds rate sits at 4.00-4.25%. While the market was nearly certain of a 25bps cut, it is less clear about what the road ahead holds for Fed policy. To help us start thinking about how policy may change at the upcoming meetings, we share a few comments from yesterday’s FOMC meeting.

9/12/25 Pullback Cancelled? We’re Setting Up For Year-End Rally

9/12/25 Pullback Cancelled? We’re Setting Up For Year-End Rally

2025-09-12

A correction in September would’ve set up a healthier base, but if it doesn’t happen soon, the odds of one fade as corporate buybacks return, funds stay underweight, and the seasonal push kicks in – setting $SPY / $QQQ up for a year-end rally.

In this Short video, I break it all down for you.

📺 Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

#StockMarket #YearEndRally #SPY #QQQ #MarketOutlook

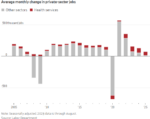

Healthcare Jobs Keep Labor Market Afloat: But For How Long?

Healthcare Jobs Keep Labor Market Afloat: But For How Long?

2025-09-09

The August jobs report clarified what many investors already suspect: the U.S. labor market is stalling. Outside of healthcare and social assistance, private-sector job creation has nearly flatlined this year. So far in 2025, the economy has added an average of 74,000 private-sector jobs per month. Stripping out the ~64,000 monthly additions from healthcare jobs, …

Tags: Featured,newsletter

1 pings