🔎 At a Glance

- Investment Risk Is Underappreciated

- Market Brief & Technical Review

- From Lance's Desk: The South Park Market Of 2026 - RIA

- Market stats, screens, and risk indicators

🏛️ Market Brief - The "Greenland" Impact

This week's markets were driven by headline risk, economic uncertainty, and the early innings of earnings season. With the markets closed last Monday for the Martin Luther King holiday, U.S. equities sold off sharply on Tuesday. President Trump’s tariff threats against key European allies, tied to a controversial push for Greenland, triggered that selloff across global equity markets. The S&P 500 dropped more than 2%, while the Dow and Nasdaq logged their worst single‑day percentage losses in three months, stoking fears of renewed trade conflicts just as markets were trying to stabilize after year‑end weakness. European equities slid sharply, with major indices such as Germany’s DAX and France’s CAC 40 falling over 1% amid the tariff shock.

However, that narrative shifted sharply on Wednesday as President Trump addressed the world at the annual "Davos Confab," where the elite mingle to decide the fate of the world. The White House later confirmed that the scheduled tariffs on several European nations would not proceed. Furthermore, Reuters reported that President Trump said a “framework of cooperation” had been reached regarding Greenland, and tariff plans set for February were nixed. That pivot sparked a relief rally, with the S&P 500 climbing over 1% on Wednesday, its largest single‑day percentage gain in several weeks, as all 11 sectors advanced, led by energy stocks.

Notably, earnings season ramped up, with reports from many notable companies delivering mixed signals. Investors showed little tolerance for anything short of strong results and clear forward guidance.

- Netflix added 13.1 million subscribers, beating estimates, but the stock dropped over 6% after pausing its buyback program and issuing soft Q1 guidance.

- Procter & Gamble missed on revenue and reported sluggish volume growth, especially in grooming and fabric care, as sticky input costs weighed on margins.

- Kinder Morgan met earnings expectations but missed revenue targets, citing lower natural gas volumes and a softer demand outlook. The stock drifted lower amid market questioning of midstream energy’s 2026 growth story.

- Johnson & Johnson posted strong pharmaceutical sales and raised its full-year guidance, helping the stock hold gains.

Across the board, results made it clear that high valuations leave little room for error. Markets want clean beats, firm guidance, and evidence of margin control.

Economic data remained in focus ahead of the Federal Reserve’s late‑January meeting. GDP came in 4.4% above estimates, and while the headline was strong, it remains a function of the ongoing tariff battle and its impact on net exports. Furthermore, very few mentioned the boost to GDP from an enormous drawdown in personal savings.

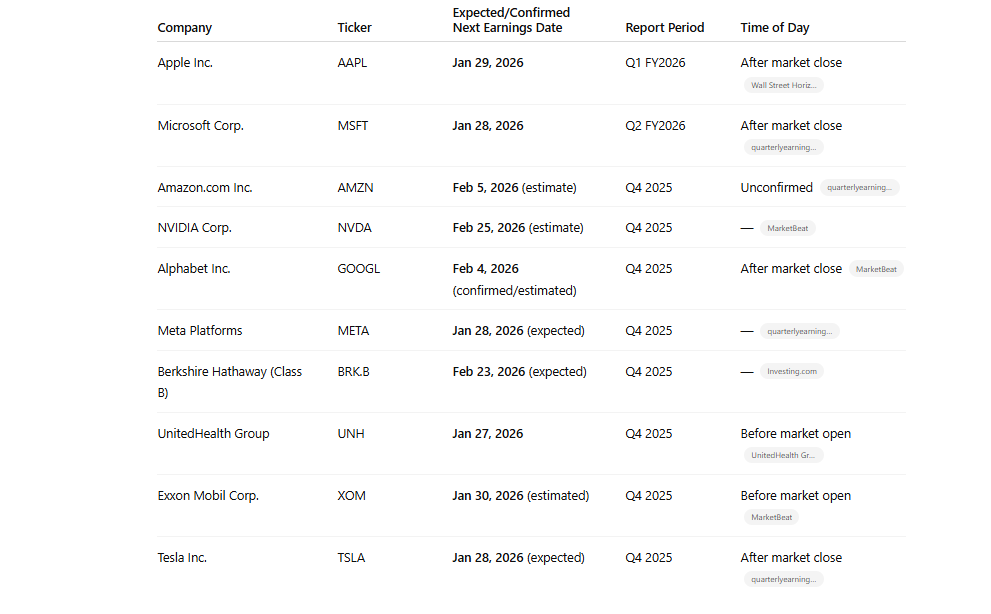

In brief, market behavior reflected a tug‑of‑war between headline noise and economic fundamentals. Geopolitical risk reprieve provided short‑term support, but lingering inflation and policy uncertainty keep volatility elevated. Investors now pivot toward more earnings next week from many of the "Magnificent 7," beginning with Microsoft, Meta, and Tesla on Wednesday, followed by Apple on Thursday.

Which brings us to the market.

📈Technical Backdrop - Bulls Remain In Control

This week’s price action reflected growing short‑term volatility and technical signals that traders use to gauge potential risk and reward. After a politically driven selloff early in the week, market internals weakened before recovering mid‑week. The CBOE Volatility Index (VIX) surged above 20.0 on Tuesday, then quickly retraced back toward 17.0 by Friday, highlighting swings in fear and complacency among traders. A high, then rapid drop in VIX suggests short‑term traders may be reducing hedges after the headline shock passed, but volatility could remain elevated in the weeks ahead. As MarketWatch observed, “a recent spike in the fear gauge was swiftly erased after tariff threats were softened,” yet analysts warn that sustained volatility remains likely.

Breadth measures are also telling a mixed story. Major indexes like the S&P 500 and Nasdaq closed the week with only modest net movement, but many breadth indicators remain tepid. Recent market breadth data showed that a smaller proportion of S&P 500 stocks are making new highs even as the index approaches record levels, signaling a more narrow leadership. This pattern often precedes a larger corrective phase if broader participation does not improve, and recent analysis pointed to ongoing breadth weakness despite headline strength.

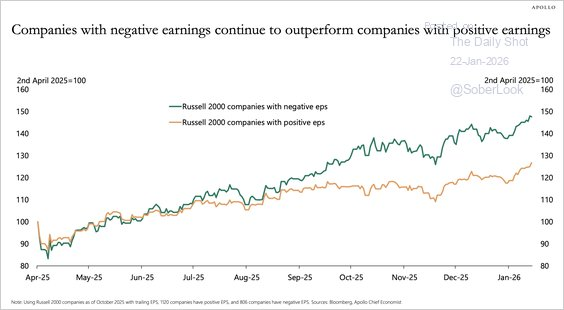

Rotation is evident beneath the surface. Small‑cap stocks and cyclical sectors have outperformed as of late, pushing the Russell 2000 to a series of record highs and outperforming megacaps year‑to‑date. However, small-caps are now very overbought and extended, suggesting a near-term rotational risk is becoming more likely. Furthermore, this shift away from the largest, momentum tech names, which generate a significant share of earnings growth, to more economically and non-profitable companies is a risk if economic "reflation" fails to mature. Such a rotation into small capitalization companies can be constructive, but only if it broadens rather than temporarily lifts market averages.

With the market closing at 6,915 on Friday, here are key technical support and resistance levels to watch going into next week:

Resistance Levels

• Primary resistance: 7,000 — First initial resistance following any attempt to break out to new all-time highs.

• Secondary resistance: 7,100 — First initial Fibonacci extension level.

• Extended resistance: 7,200 — Third Fibonacci extension level

Support Levels

• Primary support: 6,913 — 20-day moving average.

• Secondary support: 6,836 — 50‑day moving average and recent lows.

• Key support: 6,378 — 100-day moving average

These levels are critical guides. A breakout to new all-time highs on strong volume could signal continuation of the broader uptrend, whereas a break below 6,836 would shift short‑term momentum toward deeper correction risk. Traders should continue to monitor portfolio risk and rebalance as needed until the market provides better direction with a trend in one direction or the other.

🔑 Key Catalysts Next Week

The market arrives at a turning point as January wraps up into a week that will define near‑term risk appetite. Volatility remains elevated, and the narrative has shifted decisively from political headline swings to earnings and economic fundamentals. Last week’s tariff tensions triggered sharp moves across major tech names and drove the CBOE Volatility Index back above 20 before it retraced. Investors now turn to hard data and earnings from key bellwethers on whether the growth and inflation story supporting 2026 valuations can hold up. The backdrop is a market pricing in expectations of continued strength in consumer and business demand, but also significant sensitivity to guidance and Fed policy signals.

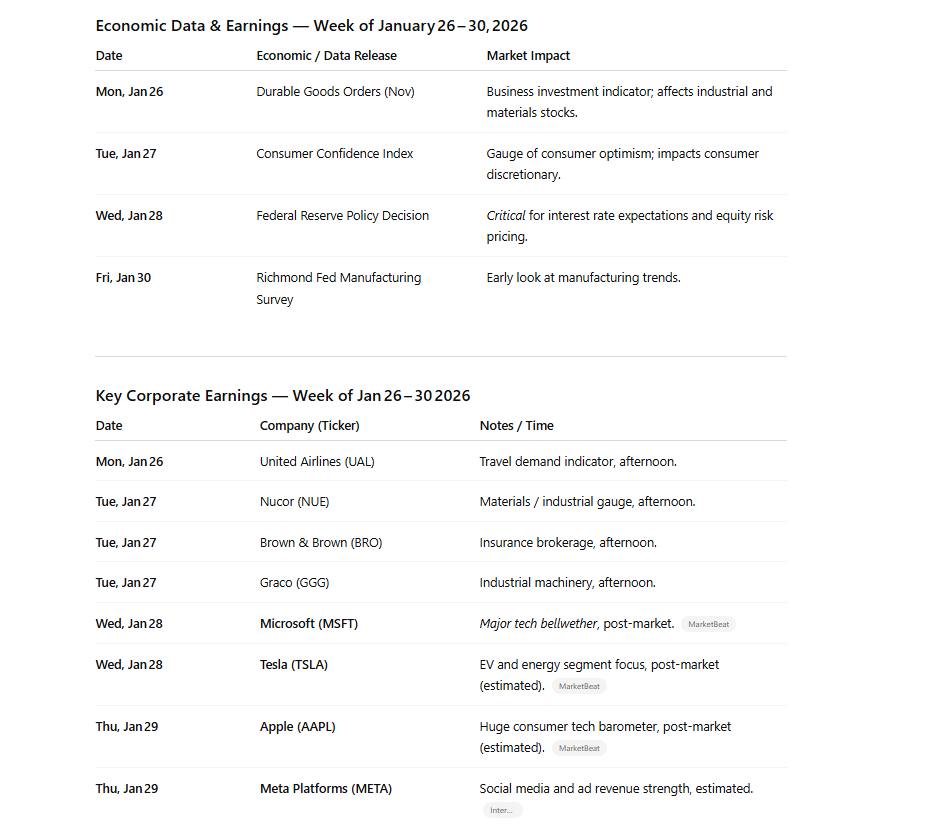

The Fed’s January meeting on the 28th looms large as a pivotal catalyst. With inflation still above target and short‑term yields higher, any shift in language on rate cuts or growth expectations could move stocks and bonds sharply. Early-week economic reports, such as durable goods orders and consumer confidence, will set the tone, but it is the big tech earnings mid‑week that have traders bracing for impact. Microsoft, Tesla, Apple, and Meta Platforms are reporting results that will deeply influence the narrative on sector rotation, growth sustainability, and the pricing of risk assets. Stocks with wide exposure to consumer demand, cloud and AI adoption, and discretionary spending will be heavily scrutinized, with guidance statements likely to matter more than quarterly beats or misses. Given the market’s recent sensitivity to earnings guidance, any signs of softening demand or caution in capex could quickly alter the technical landscape.

Need Help With Your Investing Strategy?

Are you looking for comprehensive financial, insurance, and estate planning services? Need a risk-managed portfolio management strategy to grow and protect your savings? Whatever your needs are, we are here to help.

💰 Investment Risk Is Underappreciated

There’s an old parable worth remembering, especially when it comes to investment risk and the markets. Once upon a time, there was a young shepherd who was tasked with watching over a flock of sheep. Eventually, bored and craving attention, he runs into the village shouting, “Wolf!” The villagers drop everything to help, only to find there’s no danger. He laughs, amused by everyone's reaction. Later, he does it again. Once again, the villagers fall for it. Unfortunately, when a wolf does indeed appear, he cries for help. But not wanting to be fooled again, the villagers ignore him, and the flock is quickly slaughtered.

The lesson is simple: lie often enough, and no one believes you when it matters. In investing, we see this regularly with pundits and YouTubers who continually claim that market crashes and devastation are imminent as the bull market continues its climb. Eventually, those individuals get tuned out. It is the same with permabulls who see upside in every dip. When the real turning point comes, few are listening. That’s how risk blindsides the crowd.

The financial markets do one thing very well: lull investors into a false sense of security and complacency. Rallies stretch longer than logic allows, optimism builds on hope rather than data, and eventually risk becomes ignored, just as the boy who "cried wolf." Today, investors are leaning hard into a bullish narrative, while ignoring key warning signs, from slowing earnings to inflated valuations. The market's investment risk profile is rising, but few are listening.

Earnings and Profit Margin Expectations Are Very Optimistic

Recent quarters have delivered strong earnings surprises, but much of that upside came from aggressive cost-cutting and financial engineering rather than organic revenue growth. We can see this in the breakdown of earnings between accounting gimmicks and actual revenue growth.

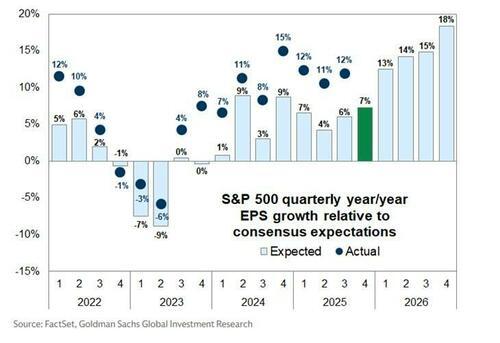

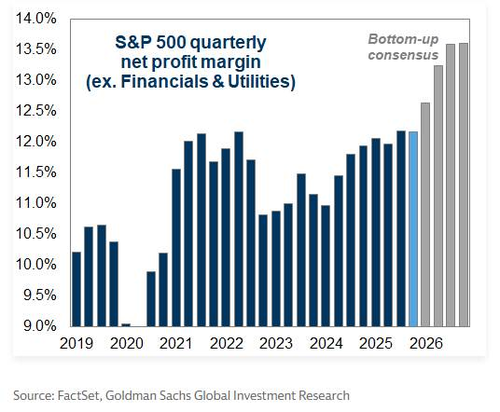

As shown below, Wall Street is increasingly confident of earnings growth in 2026, with a faster growth rate than in any of the last several years.

However, consumer demand is softening, input costs are sticky, savings rates are declining, and employment remains weak. Furthermore, the post-pandemic pricing power that companies once enjoyed is now fading. That certainly isn't the recipe for a rather exuberant surge in earnings, particularly when earnings are already very deviated above the historical growth trend.

Despite the obvious risk, investors are treating earnings as a certainty rather than a variable. However, that assumption breaks down quickly when growth slows and margins compress. Currently, many Wall Street analysts have been slow to lower earnings estimates. While that is typical, the investment risk to individuals is that by the time revisions hit the wires, markets have already adjusted. This lag creates a false sense of security. Therefore, if earnings begin to disappoint in the next few quarters, stocks priced for perfection will get punished.

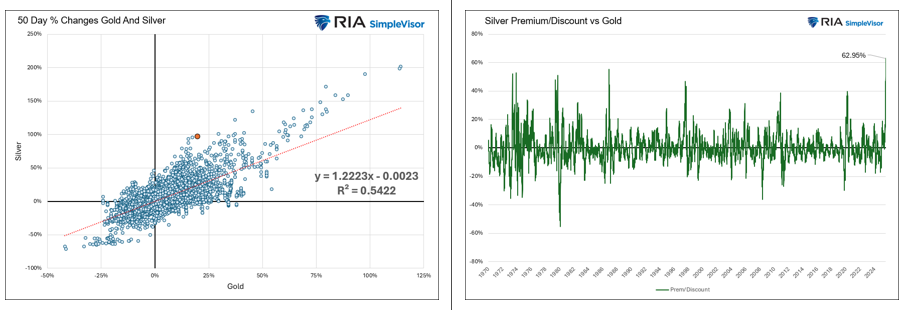

The same analysis applies to corporate profit margins, which expanded massively during the stimulus-driven recovery. However, despite the reversal of that stimulus, Wall Street expects profit margins to surge to record levels in 2026. While during the pandemic, companies could raise prices while holding labor and input costs low, that cycle is reversing. Wage inflation remains sticky, and commodity costs (silver, copper, and other metals) are surging. With companies now competing more on price again, profit margins are an investment risk that shouldn't be dismissed.

While the bullish consensus is, well, very bullish, companies can't maintain wide margins if they can't pass along cost pressures. Is this guaranteed to happen? No. However, investors betting on sustained profitability could be caught offside given that the markets are priced for perfection. Of all the investment risks, this is one of the clearest red flags being ignored right now.

The Reflation Narrative Is Built on Assumptions

As I discussed at the 2026 Investment Summit last weekend, the prevailing market narrative is simple: inflation is falling, the economy is growing, and central banks will continue to cut rates. In other words, 2026 is a year of "reflation." However, none of these assumptions is guaranteed. Inflation is proving sticky, central banks are closer to pausing rate cuts, and, most importantly, economic growth is currently a function of one-off issues, as David Rosenberg recently noted.

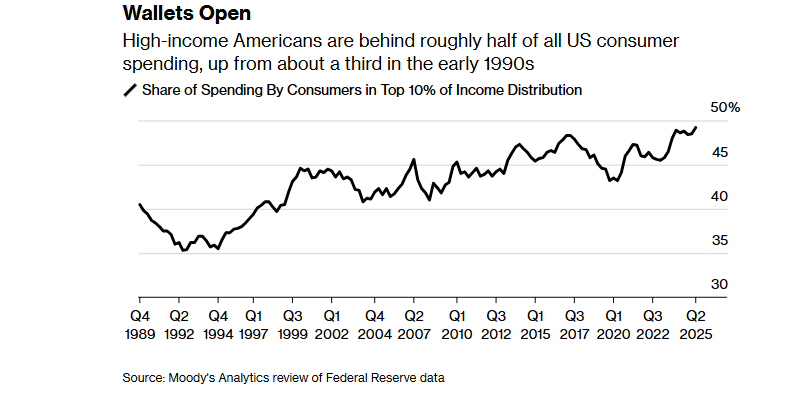

Furthermore, the labor market remains tight, and consumer spending is uneven, with the top 10% of income earners accounting for nearly 50% of spending.

While markets tend to move ahead of policy, the investment risk arises when policy doesn't match the forecast. If the reflation narrative takes hold and economic growth increases, inflation will likely rise. Such would put the Federal Reserve in a difficult position. If the Fed pauses, or worse, lifts rates as a response, the equity risk premium shrinks. That means valuations must adjust downward, and investors believing in a smooth landing and a quick pivot to rate cuts are leaning too far into hope.

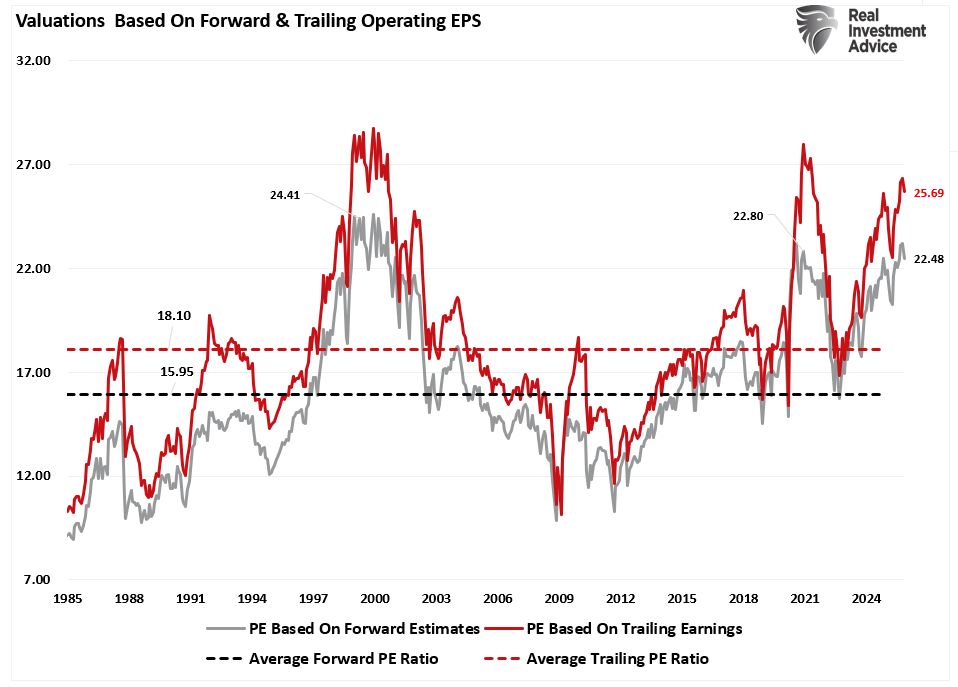

Valuations Are Still Stretched

Of course, this ties back to the one investment risk that is well known, and currently ignored: Valuations. Valuations are the "boy who cried wolf." For several years, Wall Street, YouTubers, and the media have all decried valuations as expensive, predicting an imminent correction. Unfortunately, valuations don't work that way. Now, after several years of false alarms, investors feel valuations are "the boy who cried wolf."

However, valuations are the one investment risk that should not be ignored, but understood. As discussed previously, valuations are a terrible timing indicator, but rather a measure of sentiment in the near term. The current trailing twelve-month price-to-earnings ratio sits at 26, near historic extremes. The Shiller CAPE ratio, which adjusts for inflation and smooths cycles over a decade, stands near 39. Forward P/E estimates for 2026 earnings are in the 23 range. By almost every measure, equities are priced at levels that historically limit future returns.

However, this is also the investment risk that investors need to prepare for. At current valuation levels, stocks don’t need a crisis to fall; they only need disappointment. If growth falls short, or if the Fed doesn’t deliver the cuts the market expects, equities face pressure. In other words, a “recession” is not the risk; it is just anything that is “less than perfect.”

The Risks Are Interconnected

Each of these risks, earnings, margins, the reflation narrative, and valuations feeds into the others. If earnings disappoint, margin assumptions fall apart. If inflation re-accelerates, the Fed stays hawkish, hurting valuations. These feedback loops increase the risk to investors, leaving them exposed to negative outcomes. With the market currently built on "narratives," rather than fundamentals, when the story changes, price will follow. It’s not a matter of if sentiment will shift, but when. Therefore, positioning yourself ahead of that shift is critical.

There’s no magic bullet, but there are steps you can take to reduce risk without giving up opportunity.

- Diversify across asset classes. That means holding stocks, bonds, and cash.

- Tilt your equity exposure toward quality. Look for companies with strong balance sheets, consistent earnings, and pricing power.

- Reduce exposure to over-valued names. Focus on valuation. History tells us that buying "cheap" protects capital in downturns.

- Use defensive sectors like healthcare and consumer staples as ballast.

- Review your position sizes. Don’t let a few names dominate your portfolio.

- Lastly, raise some cash. Not as a market call, but as a tool to take advantage of lower prices later.

Most importantly, the key to navigating investment risks this year will be remaining data-driven. Ignore the headlines, disregard narratives, and watch real indicators like earnings revisions, margin trends, inflation reports, and Fed guidance. Don’t forecast. React to changes as they occur.

Risk doesn’t disappear. Investors ignore it at their peril. If you want to survive the next market shock, prepare now. Hope is not a strategy. Discipline is.

🖊️ From Lance’s Desk

This week's #MacroView blog explores the structural and fundamental risks that face the more optimistic outlooks from Wall Street analysts.

Also Posted This Week:

- Fibonacci In Mona Lisa And Markets - RIA - by Michael Lebowitz

- AI Productivity, Employment, and UBI - RIA - by Lance Roberts

📹 Watch & Listen

The Tuesday selloff was a good reminder of why you should not make sudden panic moves based on headlines.

Subscribe To Our YouTube Channel To Get Notified Of All Our Videos

📊 Market Statistics & Analysis

Weekly technical overview across key sectors, risk indicators, and market internals

💸 Market & Sector X-Ray: Pullback To Support

As noted last week, 2026 has started with a massive surge in the "economic reflation" story. Basic Materials and Energy are up over 10% since the beginning of the year. Staples, an area that was hated last year, has also risen as investors expect a resurgence in economic activity. These sectors are now very overbought, so profit-taking and rebalancing make sense.

📐 Technical Composite: 74.58 – Weakness Appears

The overall technical condition remains bullish, but has weakened slightly over the last month. After hitting more extreme overbought conditions heading into October, the market has continued to consolidate, working off some of that state. While not bearish, some further weakness early next week would be unsurprising, providing a better entry point for a rally at some point.

🤑 Fear/Greed Index: 81.26 – Extreme Greed Remains

Positioning in equities remained strong this week, despite the Tuesday selloff. Retail investors stepped in and bought broad market exposure as the market rallied back above near-term support. With the "economic reflation" narrative gaining traction across sectors, investors remain extremely bullish, with allocations to equities at historically high levels.

🔁 Relative Sector Performance

This week saw volatility on Tuesday, but it swiftly reversed as markets moved higher into the end of the week. Transportation, Materials, and Energy are the most overbought, suggesting investors should consider rebalancing risk exposures accordingly. Financials are the most oversold on a relative basis, and offer a potential catch point for any near-term rotation.

📊 Most Oversold Sector Holdings

As noted above, the most oversold sector is Financials. BRK.B, MA, V, and JPM are currently the most out-of-favor in the sector, with JPM offering a more compelling opportunity given its positioning in the financial sector overall.

📊 Sector Model & Risk Ranges

As noted above, the "reflation trade" marked the beginning of the New Year. The sharp advance in Basic Materials, Industrials, Energy, Transportation, Small and Mid-Cap, and Gold and Gold Miners has sent deviations from long-term means toward extremes that are ultimately unsustainable. However, these extremes can persist for a while, so it is important to maintain exposure while also managing risk along the way. Price changes across numerous sectors and factors are well outside of norms. Trade accordingly.

Have a great week.

Lance Roberts, CIO, RIA Advisors

The post Investment Risk Is Underappreciated appeared first on RIA.

Full story here Are you the author? Previous post See more forTags: Featured,newsletter