“Like watching paint dry,” is how The Fed describes the beginning of the end of its experiment with massively inflating its balance sheet to save the world. As former fund manager Richard Breslow notes, however, Yellen’s decision today means the risk-suppression boot is on the other foot (or feet) of The SNB, The ECB, and The BoJ; as he writes, “have no fear, The SNB knows what it’s doing.”

As we reported previously, In the second quarter of the year, one in which unlike in Q1 fund flows showed a persistent and perplexing outflow from US stocks, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a “mystery” central bank was quietly bidding up risk assets by aggressively buying stocks.

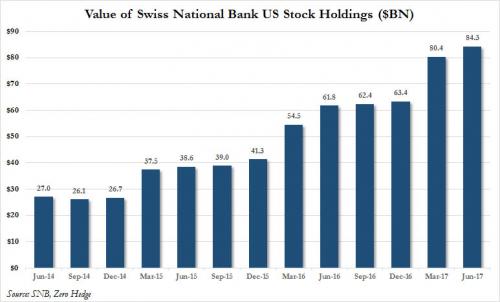

| The answer was revealed this morning when the hedge fund known as the “Swiss National Bank” posted its latest 13-F holdings. What it showed is that, as rumored, the Swiss National Bank had gone on another aggressive buying spree in the second quarter, and following its record purchases in the first quarter, the central bank boosted its total equity holdings to an all time high $84.3 billion, up 5% or $4.1 billion from the $80.4 billion at the end of the first quarter. |

Value of SNB US Stock Holdings(see more posts on SNB US Stock Holdings, )Via Bloomberg, |

| So here we go with the latest installment of the Fed’s will they or won’t they show. It seems from reading all the insights that we’re meant to expect a dovishly spun hawkish move.

We get the balance sheet announcement, tempered by a Summary of Economic Projections that acknowledges what inflation hasn’t been up to. And maybe a small decrease in the slope of the dot plot curve showing the longer-term rate hike path. Presto chango, everyone is happy. Any frayed nerves out there will be soothed. The market is expected to take it well, the FOMC can tick off the box of another “normalization” milestone and we’ll see what happens between now and December.

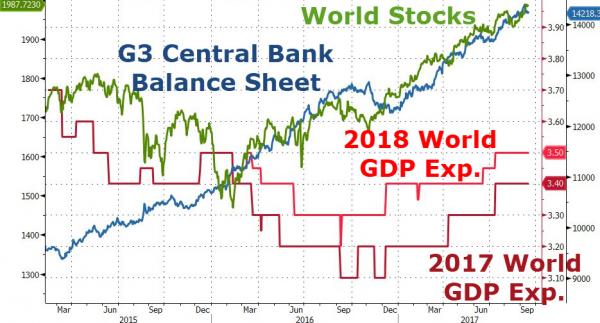

As Breslow concludes, rates can go up, down or nowhere. Balance sheet run-off can be done at most any speed. But as long as U.S. equities remain the AAPL of sovereign wealth funds’ eyes, the Fed has a lot more room to maneuver than we think and they should take advantage of that fact. |

SNB AAPL Holdings, Q2 2014 - 2017(see more posts on SNB Apple Holdings, ) |

| Simply put – for now – nothing else matters… |

Central Bank Balance Sheet and World Stocks, GDP, Mar 2015 - Sep 2017(see more posts on Central Bank, ) |

Full story here Are you the author? Previous post See more for Next post

Tags: Bank of Japan,Banking,Business,Central Bank,central banks,Congress,economy,European central bank,Federal Reserve,Federal Reserve System,Financial services,fixed,Global Economy,Monetary Policy,money,newslettersent,Quantitative Easing,Reserve Bank of Australia,SNB Apple Holdings,SNB US Stock Holdings,Swiss National Bank