In the Swiss financial services sector, formal blockchain strategies have become standard practice and cryptocurrency services are now live, a new study by the Center for Financial Services Innovation at the University of St. Gallen, ACK, mintminds, PwC and vision&, found.

This underscores the country’s transition from blockchain experimentation to operational maturity.

The study, which polled 28 banks and financial service providers in Switzerland in Q3 2025, found that blockchain projects are no longer isolated innovation projects. Instead, they are now embedded into corporate strategies, governance, and budgeting processes, reflecting a shift from innovation hubs to core business functions.

In 2025, 86% of the banks surveyed have a blockchain strategy in place or in progress, up 28 points from the 2024 edition of the study. This formalization is further evidenced by the increased priority at the highest levels of management: 64% of banks now classify blockchain as a “high” or “medium” priority, a significant rise from 42% in the previous year.

Crypto offerings as the most available blockchain products

As blockchain adoption matures, Swiss financial institutions have moved into commercial execution, especially in the areas of cryptocurrencies and tokenized assets, which are now the most developed and commercially viable application.

Overall, 61% of respondents have launched crypto offerings, primarily custody and trading services, while 25% have launched tokenized asset products.

Among institutions that have not yet launched such offerings, many plan to do so. About 15% of surveyed banks intend to introduce crypto services, while 33% plan to launch tokenized asset products.

These findings indicate that Swiss banks initially prioritized crypto offerings, successfully bringing products to market. They are now working on products related to tokenized assets, with most of these initiatives remaining in development.

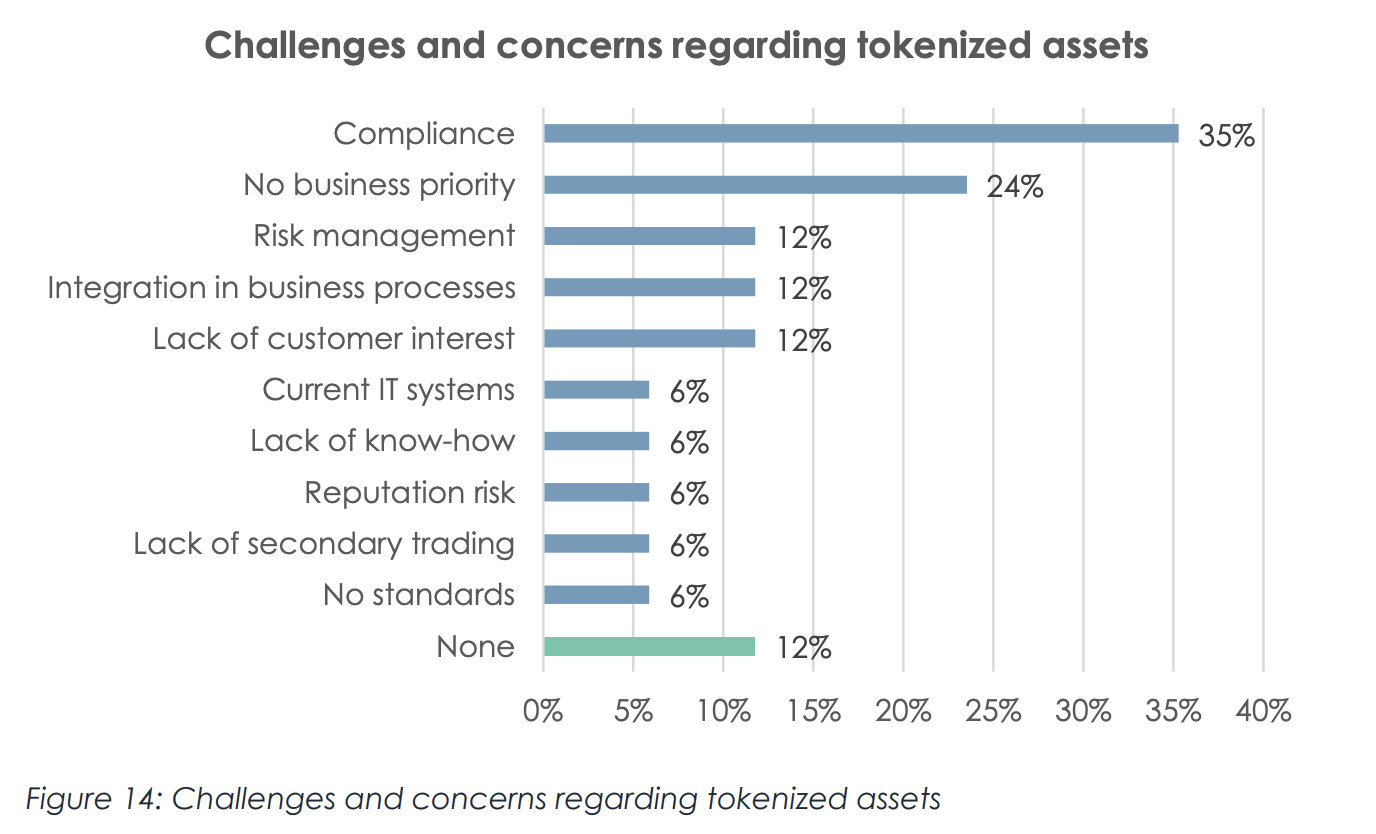

While Swiss banks are eagerly embracing tokenized assets, institutions reported several challenges hindering development. Compliance and regulations are currently the leading obstacle, cited by 35% of respondents in 2025. This suggests that institutions are no longer questioning the relevance of tokenization but are working to ensure that the technology fits within existing governance, reporting, and risk frameworks.

The second most cited challenge was the lack of business priority (24%), indicating that tokenization has not yet reached the top of the strategic agenda for many institutions.

Other key obstacles include the lack of customer interest (12%), highlighting the fact that demand from end-clients remains moderate, as well as integration into business processes (12%), reflecting ongoing technological challenges and the fact that many banks are still working on harmonizing their internal systems and data flows to support tokenized issuance, settlement, and reconciliation.

Stablecoins become the new strategic priority

As crypto and tokenization initiatives advance, Swiss financial institutions are increasingly turning their attention to stablecoins.

The study shows that approximately 55% of respondents with a productive or planned crypto offering intend to offer stablecoin services. These organizations are prioritizing settlement mechanisms (65%), programmable payments (36%), collateral in digital financial markets (35%), and retail applications (14%).

Swiss banks believe that an urgent, clearly structured, and proactive regulatory framework for a DLT-based Swiss franc is no longer merely a “nice to have”. Instead, it is a critical issue of national competitive advantage.

In fact, 75% of respondents believe that Switzerland is “acting too cautiously”, potentially eroding its innovation leadership. This places Switzerland at a competitive disadvantage relative to the passportable Markets in Crypto-Assets Regulation (MiCA) framework in the European Union (EU).

In addition, 61% cited insufficient regulatory or political support to stablecoins, further raising concerns about long-term legal certainty, scalability, and Switzerland’s ability to remain a leading hub for digital-asset innovation.

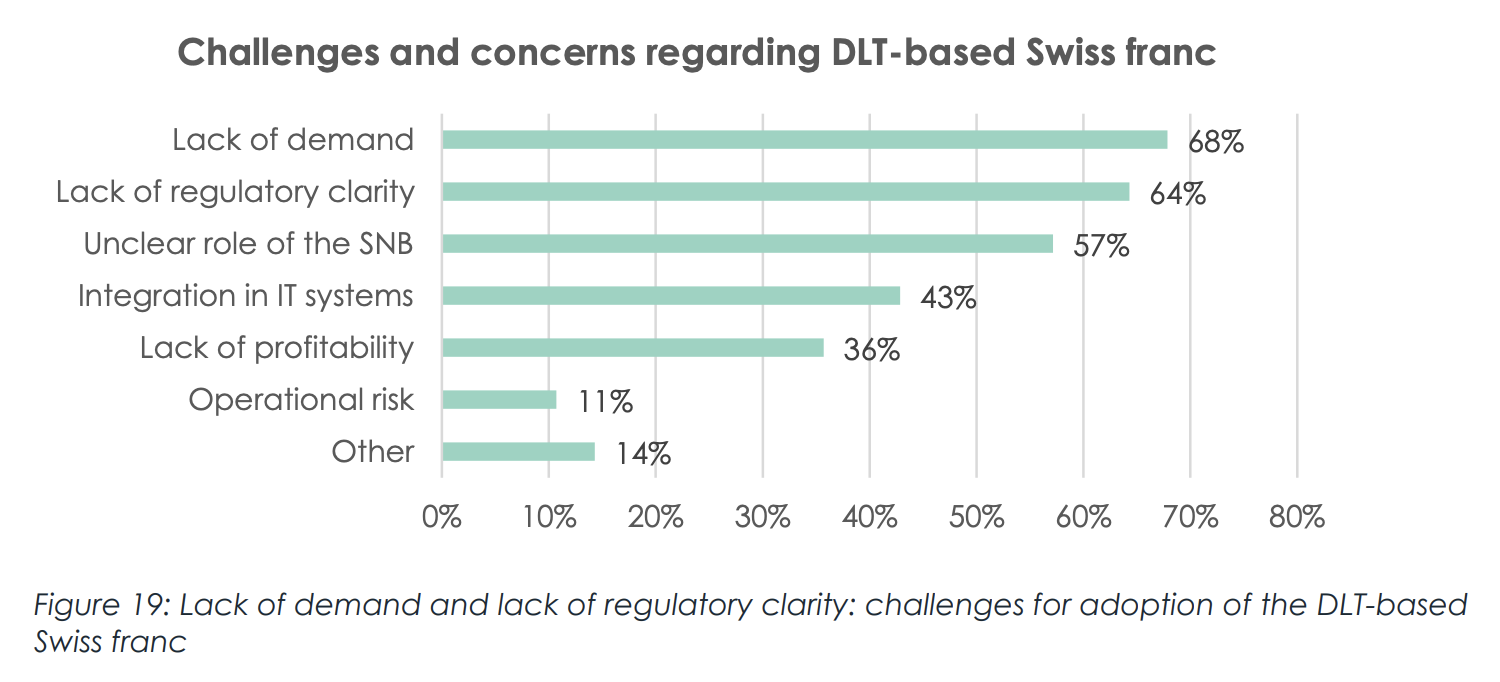

Despite strong supply-side interest, doubts remain regarding market adoption. 68% of respondents cited the lack of demand for stablecoins as the top challenge regarding a DLT-based Swiss franc, highlighting a disconnect between institutional readiness and potential adoption by Swiss consumers and businesses.

Regulatory uncertainty is another major obstacle, cited by 64% of respondents. This suggests that despite existing DLT legislation, uncertainty persists, most likely around issuance models, supervision, and cross-border usability.

Demand for blockchain talent surges

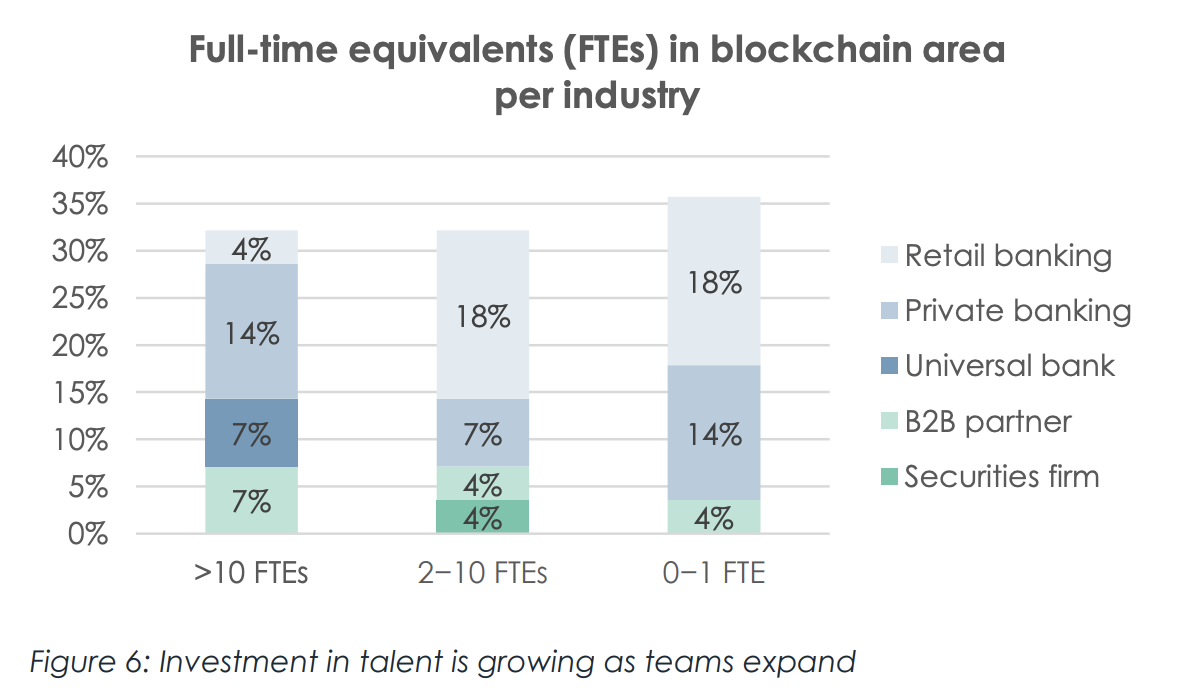

Evidence of accelerated commitment to blockchain within the Swiss financial services industry is the growth in dedicated personnel. One-third of all surveyed institutions now employ more than ten full-time equivalents (FTEs) in blockchain-focused roles.

This shows increased investment in specialized talent compared. In 2024, about 26% of the banks surveyed for the study had more than 10 FTEs positions dedicated exclusively to blockchain topics. This marks a remarkable 7-point year-over-year (YoY) increase.

However, the study shows a concentration of expertise within a few larger institutions, underscoring a growing imbalance where most smaller banks still lack in-house blockchain talent.

In recent years, the demand for blockchain expertise has grown significantly. SkillPanel, a human resources (HR) tech startup, reported that demand for blockchain-skilled professionals grew by 552% in 2022.

According to Bitget, a leading crypto exchange and Web3 company, the global blockchain workforce could grow from approximately 300,000 today to over 1.5 million by 2030 if adoption of the technology follows a trajectory similar to artificial intelligence (AI).

Featured image: Edited by Fintech News Switzerland, based on images by osikugamen and EyeEm via Freepik

The post Blockchain Reaches Operational Maturity at Swiss Banks, with Stablecoins Becoming the New Strategic Priority appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Full story here Are you the author? Previous post See more for Next postTags: Blockchain,cryptocurrency,Featured,newsletter,Switzerland