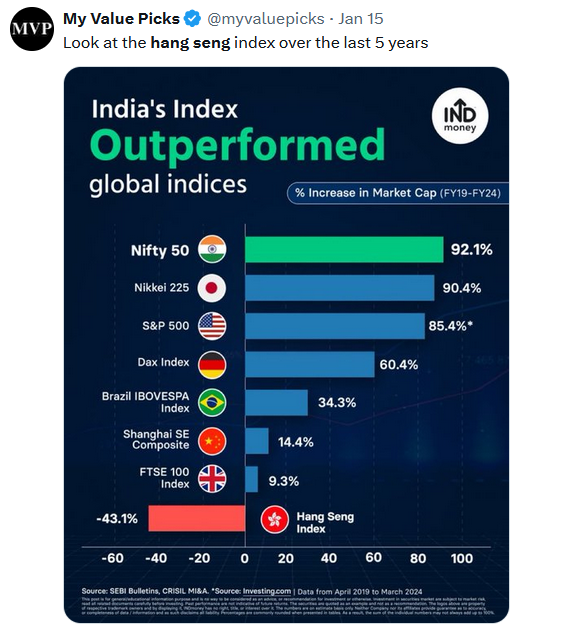

With Donald Trump now officially President, we will learn which campaign promises were rhetoric and negotiating tactics and which he plans to enact. For many economists and nations, tariffs are at the top of the list of importance. China, in particular, closely followed by Canada and Mexico, appears to be at the most risk of seeing their exports to the US fall under new tariffs.

Political leaders and economists are concerned, and investors are now riding the tariff rollercoaster, especially in those countries. The latest news for China is good: Trump is considering a 10% tariff starting as early as February. That is much less than the up to 60% tariffs threatened. Moreover, active discussions with China are ongoing, further adding hope for the Chinese that the tariffs will be minimal.

Despite what appears to be relatively good news, China's key stock indexes fell. The Hang Seng China Index was down about 2% yesterday. It has primarily been slowly trending downward after peaking in October. The peak coincides with oddsmakers and polls, giving Kamala Harris the edge. From then on, Trump's chances of being elected rose, and with it, the odds of new tariffs on China and others increased.

What To Watch Today

Earnings

Economy

Market Trading Update

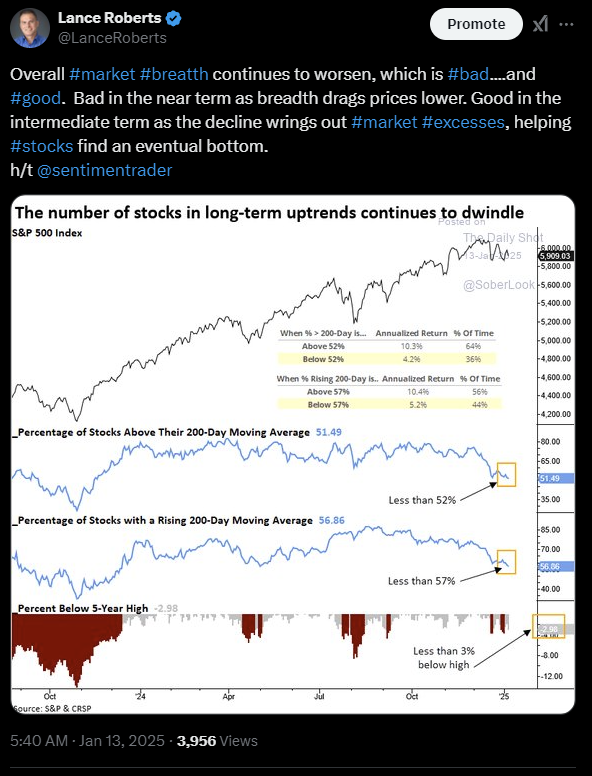

In yesterday's note, we discussed the recent surge in the market, which was supported by a return of share buybacks and foreign inflows. Another support for stocks is the reversal of market breadth. As we noted on January 13th on "X":

As noted, in the near term, poor breadth is a function of falling asset prices and reversals in sentiment. For example, our market sentiment and allocation gauges posted on SimpleVisor both show near-neutral levels that support near-term rallies.

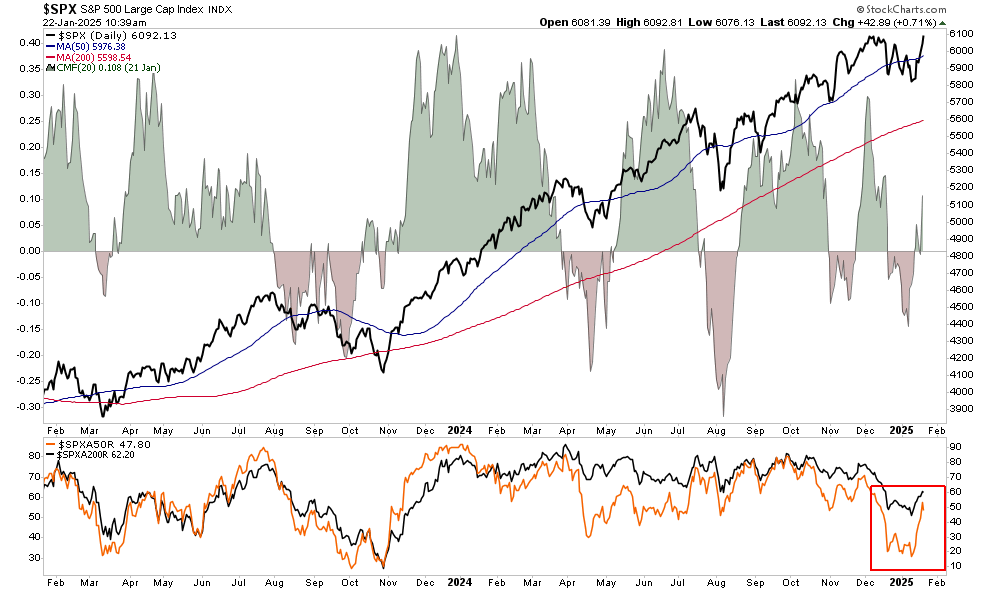

The rally before and after the inauguration is not surprising, given the market's oversold condition from the sell-off since mid-December. The very low levels of breadth, the decline in bullish sentiment, and business-friendly announcements from the new Administration all provided the backdrop for a rally toward all-time highs. As shown, the number of stocks trading above their respective 50 and 200-DMAs has improved along with money flows. Given this improvement, the rally could last longer, but previous oversold conditions are reversing.

If your portfolio was underperforming over the December and early January period, you likely need to use the current rally to rebalance allocations, trim out positions that were not working, and add to market and sectors coming into favor. Overall, the market's bullish trend remains very much intact, but as is always the case, even optimistic bull markets will have continued consolidations and corrections along the way. Manage your risk accordingly.

Home Sale Contracts Called Off

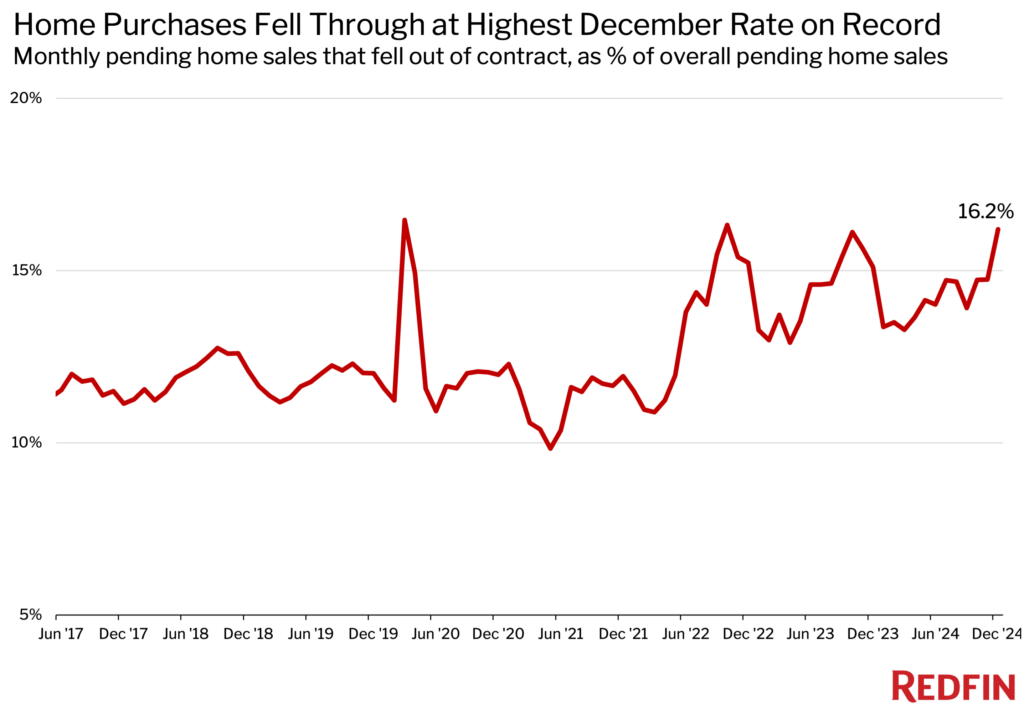

Not surprisingly, with mortgage rates near recent highs, buyers are backing out of home sale contracts. Redfin notes:

Roughly 40,000 home purchases were called off in December, equal to 16% of homes that went under contract—the highest December percentage on record.

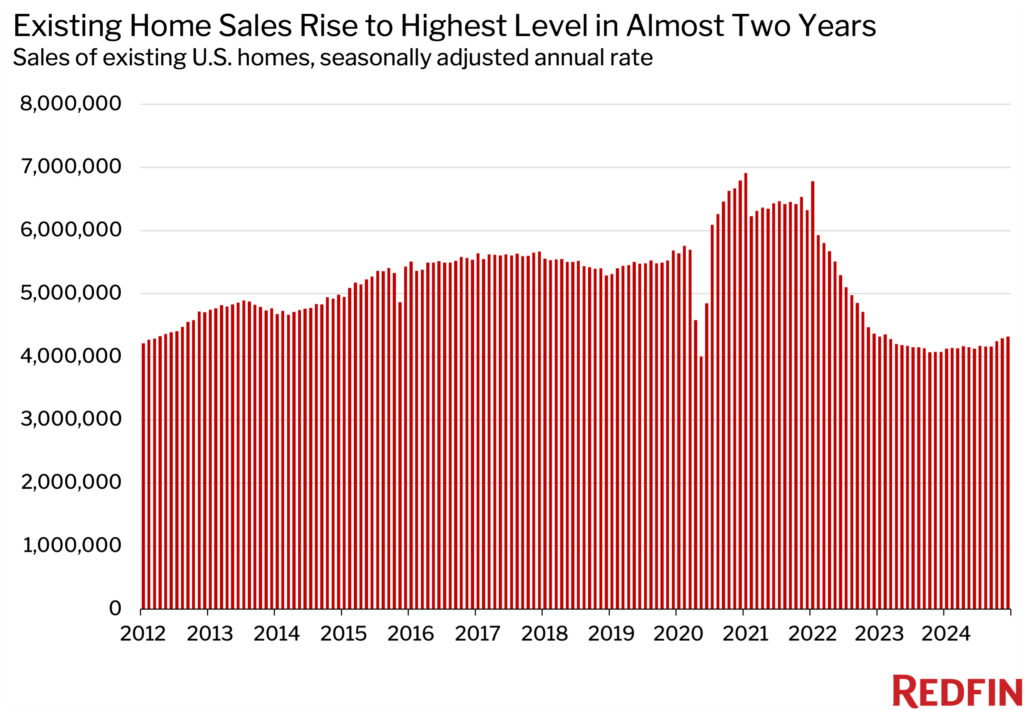

As a result, pending home sales fell 4.5% in December, the largest decline in over two years. The first graph below shows that 16.2% of homes under contract fell through, nearing levels last seen when the pandemic took grip of the world. The second graph paints a more optimistic picture of the real estate market. It shows that existing home sales rose slightly in December and are now at their highest since February 2023. That said, the level is still below the pre-pandemic running rate.

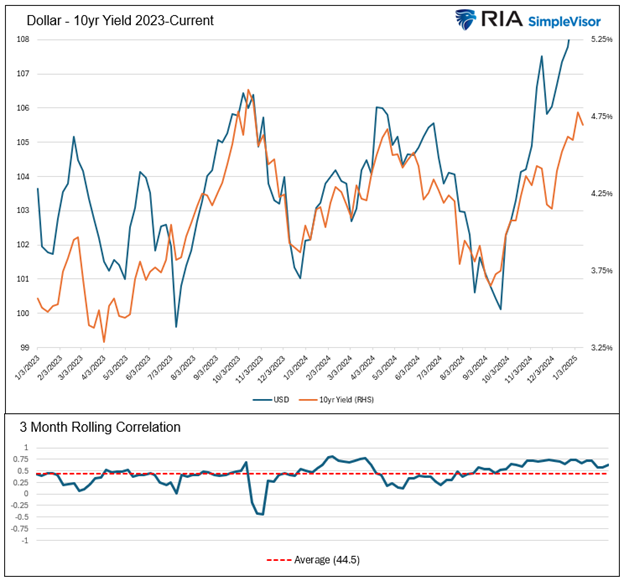

It's The Dollar Stupid

Our recent article, Why Are Bond Yields Rising, explains that the recent 1% increase in yields, as shown below, is almost entirely due to negative sentiment. As we wrote, the bond market calls sentiment the term premium. Of the 1% yield increase, only 10% is due to fundamental factors, leaving 90% a function of bond investor concerns. Consequently, the term premium is at its highest level since at least 1990, and it’s perched three standard deviations above its norm. The article focuses on two culprits driving the premium: rising deficits and inflation.

A Twitter user replied to our article saying, “It’s the Dollar, stupid!” Despite the rudeness, he is correct; the rising dollar is also to blame.

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post The Tariff Rollercoaster appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter