Top 50 Valuation Milestones for 2024:

- The total valuation of the Top 50 entities has increased by 55%, now standing at $593 billion.

- 25 blockchain platforms are valued at $584.33 billion, with 16 based in Zug, contributing 97% of the total platform valuation.

- Blockchain companies’ private valuations stand at $9.11 billion, with 14 companies based in Zug, accounting for 56% of the total valuation.

- New entrants include LCX, Liquity, and Safe by token market cap, and Glue Blockchain, Portofino Technologies, M^0 Labs, Nillion, Rulematch, Wyden, Tea, RedStone, Arf, Molecule, and Relai by private valuation.

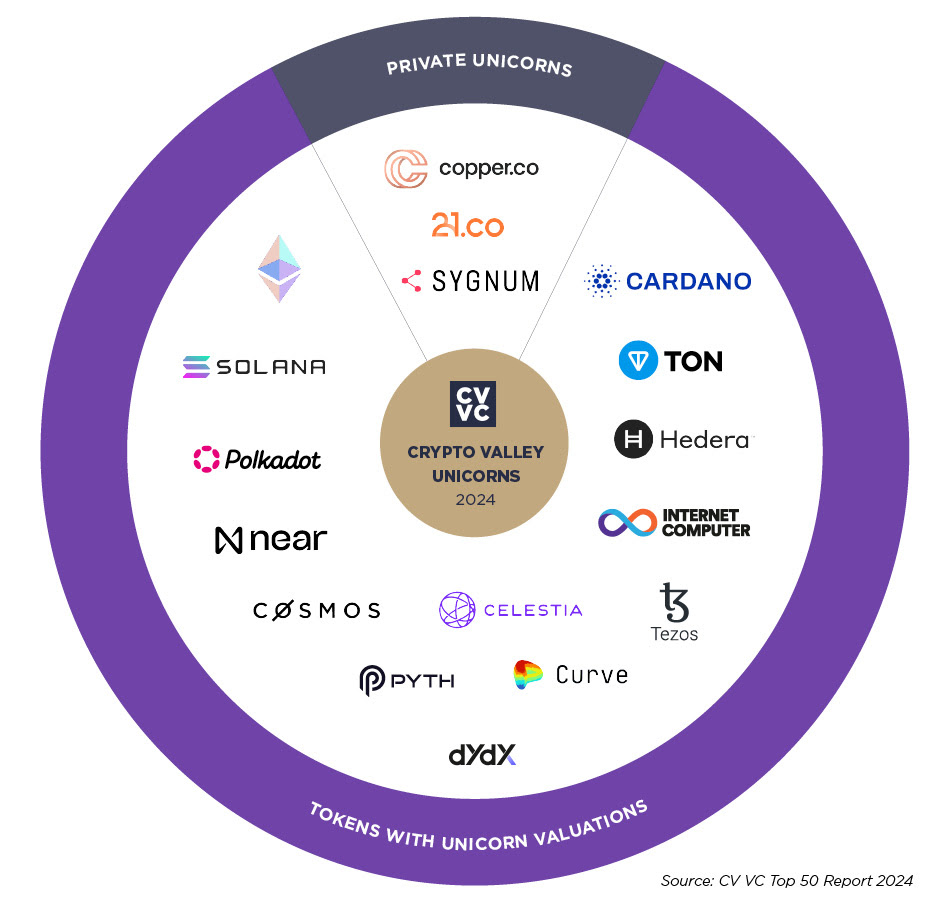

- Crypto Valley now hosts 17 unicorns, including Sygnum, the world’s first digital asset bank.

A new validation framework is being established to reflect industry developments, with results due by the end of Q1 2025.

Key Funding Insights:

- Total funding in Crypto Valley reached $586 million across 56 deals in 2024, an 8% increase, outpacing global blockchain funding growth of 3%.

- Notable deals included Celestia ($100 million), Sygnum ($98 million), TON ($48 million), M^0 Labs ($35 million), and Nillion ($25 million).

- Crypto Valley’s share of global blockchain funding rose to 5.2%, while its share of European blockchain funding reached a record 29.1%, up from 18.7% in 2023.

- The median deal size increased by 70%, now standing at $5.6 million, higher than the global median of $4 million.

Geographic Distribution of Funding:

- Zug accounted for 42% of total funding, with $245.89 million across 28 deals.

- Zürich followed with 34.7%, totalling $203.22 million across 15 deals.

- Liechtenstein contributed 17.1%, with Celestia’s significant deal.

Funding by Industry Segment:

- Centralised financial services accounted for 34% of total funding, followed by blockchain networks at 29%.

- Decentralised finance (DeFi) grew significantly, from 7% to 15%.

- Data management, verification, and analytics surged from 3.5% to 11%.

- Infrastructure and developer tools secured 10%, while gaming and NFTs saw a sharp decline, dropping to 1%.

Heinz Tännler, President of the Swiss Blockchain Federation, stated,

The post Crypto Valley’s Report Shows $593 Billion Valuation appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Full story here Are you the author? Previous post See more for Next postTags: Blockchain,Featured,newsletter