In a recent white paper, The Risk Of Higher US Inflation In 2026, Adam Posen and Peter Orszag argue that inflation could exceed 4 percent by year's end. To wit, they lead the article as follows:

In our view, however, this optimism is premature. We think it is more likely that inflation will surprise to the upside—potentially exceeding 4 percent by the end of 2026.

Given that their 4 percent inflation forecast is well above Wall Street's expectations, let's review their case. In a section below, we rebut some of their arguments.

- Lagged tariff effects: Their belief is that foreign producers and importing firms took on the bulk of the tariff costs, but over time, they will pass them on to consumers.

- Large fiscal deficits: Fiscal deficits running greater than economic growth inject purchasing power into the economy, increasing demand and generating inflation.

- Tight labor markets: Fewer workers, in part due to immigration policies, drive wage growth and fuel service-sector inflation.

- Loose monetary policy: They believe rates are not restrictive enough, as the economy is running hot.

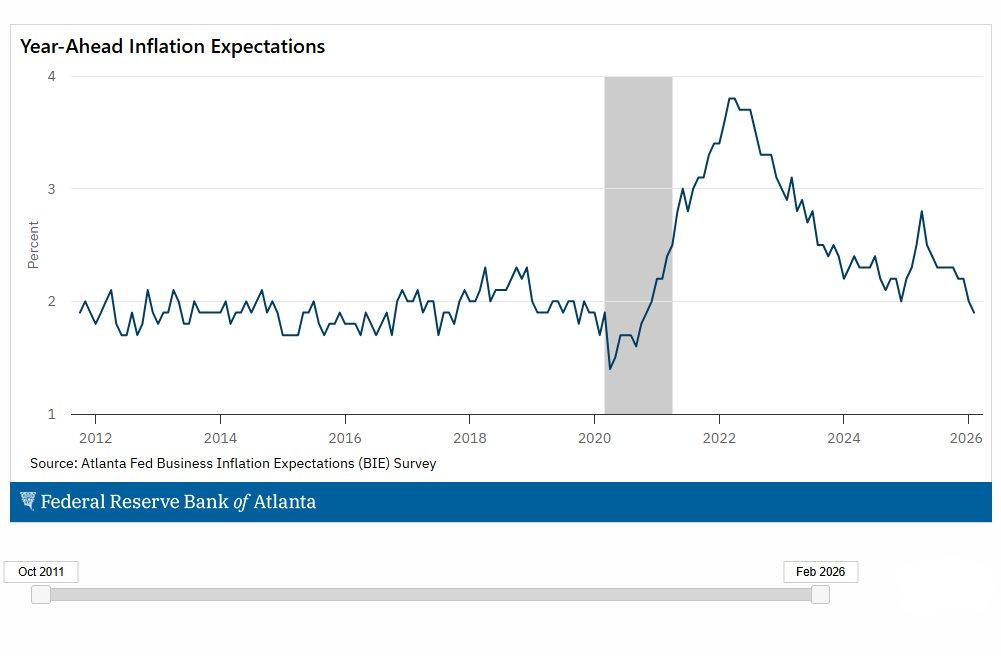

- Inflation expectations rising: If households and businesses expect higher inflation, such expectations change their consumption behavior, which can push prices higher.

Their conclusion:

Taken individually, lagged tariff pass‑through, tightening labor supply, looser fiscal policy, and accommodative financial conditions would each push inflation modestly higher. Taken together—and interacting with increasingly fragile household inflation expectations—they create a macro environment in which inflation rising above 4 percent by the end of 2026 is not only plausible but arguably the most likely scenario.

What To Watch Today

Earnings

Economy

Market Trading Update

Yesterday, we discussed the valuation problem of "value" stocks versus growth stocks and the significant difference between today and the peak of the Dot.com bubble. When it comes to Technology, we have previously discussed the rather significant discount being applied to SaaS (Software as a Service) companies under the impression that AI would render them obsolete.

"A reasonable contrarian fundamental case for select SaaS stocks starts with a simple observation: the sector has been trading like a single “macro + narrative” factor, not a collection of distinct business models. When the market sells a crowded basket indiscriminately, often driven by AI-disruption fears and broad de-risking, you can get temporary mispricing where company-specific fundamentals matter less than positioning and sentiment. That’s often when oversold conditions show up: prices fall faster than underlying recurring revenue streams, and valuation multiples compress even for businesses that still have durable retention, high gross margins, and improving free-cash-flow profiles. As shown, valuations are at some of the lowest levels we have seen since 2020."

In truth, some companies will likely go away due to AI. However, it would be hard to suggest, as the market currently seems to believe, that the entire sector will cease to exist. As we concluded in that previous article:

"The risk is clear: if AI commoditizes a product category faster than vendors can defend their moat, “cheap” can stay cheap. But for companies with real switching costs, data advantages, and provable monetization, compressed valuations plus oversold conditions can set up attractive forward returns."

In yesterday's investment committee meeting, this was our discussion. Retail investors are piling into SaaS companies at a record clip, and I suspect they have the right idea, although they may still be a bit early. Nonetheless, they are putting a bid under the sector currently.

However, when you start digging into the sector's stocks, four names emerge as likely candidates for an eventual recovery.

- Salesforce (CRM)

- DocuSign (DOCU)

- ServiceNow (NOW)

- Adobe (ADBE)

Of the four candidates, I lean toward favoring CRM and ADBE. Here's why:

- CRM has years of development, bug fixes, and customization that will be hard to replicate with AI. Even if AI can develop a crm database, which it can, the reliability, security, and infrastructure of Salesforce will be hard to replicate. As Salesforce moves forward, it will further integrate AI into its application, helping keep a moat around its business.

- ADBE has a moat in its Creative Cloud apps that are deeply embedded as the industry standard—with sticky workflows, file formats, plug-ins, and team collaboration pipelines that make switching costs high for individuals and enterprises. Even as generative AI improves, Adobe can bundle AI into the same end-to-end creation, editing, rights-management, and production workflow customers already pay for, which is harder for stand-alone AI tools to replicate at scale.

From a fundamental perspective, all four candidates have become significantly cheaper:

- CRM trades at a 14x forward PE with a PEG ratio of 1.02. EPS is expected to grow at 13% over the next 5 years with an operating margin of 22%.

- DOCU trades at a 10x forward PE with a PEG ratio of 1.27. EPS is expected to grow at 9% over the next 5 years with an operating margin of 9%.

- NOW trades at a 21x forward PE with a PEG ratio of 1.03. EPS is expected to grow at 21% over the next 5 years with an operating margin of 15%.

- ADBE trades at a 10x forward PE with a PEG ratio of 0.89. EPS is expected to grow at 11% over the next 5 years with an operating margin of 37%.

Just for comparison:

- WMT trades at a 39x forward PE with a PEG ratio of 3.19. EPS is expected to grow at 12% over the next 5 years with an operating margin of 4%.

While we are not pulling the trigger on these positions just yet, we are continuing our research. However, on a fundamental basis, these stocks are becoming much more appealing given the deep discounts the markets are applying to them.

The Case Against 4 Percent Inflation

The following is our rebuttal to the arguments laid out in the opening section warning of 4 percent inflation.

- Lagged tariff effects: Tariffs tend to create one-time price-level adjustments rather than sustained inflation. Furthermore, History shows tariffs are usually disinflationary over time because they weaken growth and demand rather than create inflation.

- Large fiscal deficits: Today’s deficits are increasingly financing interest expense rather than direct payments to consumers, so they are not generating private-sector demand as during the pandemic. Moreover, high government debt levels crowd out private credit creation and tighten financial conditions, thereby negatively affecting growth and dampening inflation.

- Tight labor markets: Statistics such as job openings, temporary hiring, hours worked, continued jobless claims, and wages (shown below) suggest the opposite of the author's concerns.

- Loose monetary Policy: Monetary policy operates with long lags, and the Fed's tightening since 2022 remains historically large. Interest rates are restrictive, as evidenced by debt-sensitive sectors such as housing, credit, and small-business lending.

- Inflation expectations rising: Such is not true, as shown in the second graph below. Market-based expectations, as seen in TIPS breakevens and forward inflation swaps, remain anchored near the Fed’s target range. Consumer and business inflation sentiment are slowly falling.

Our concern is not 4 percent inflation or, as others argue, a return to 1970s inflation, but a continuation of the pre-pandemic trends, including slower nominal growth and periodic disinflation scares.

Blue Owl - The Owl In The Coal Mine?

Retail and institutional investors have been chasing private credit funds as speculative juices run wild in almost all markets. The surge in demand and liquidity pushed yields on the underlying loans to levels that were arguably too low, failing to adequately compensate investors for the risks involved. The recent bankruptcy of two high-profile loans and liquidity issues are raising concerns that some private credit investors may be in trouble. The situation got more dicey on Wednesday when Blue Owl's private credit interval fund halted redemptions for investors. It's worth noting that this fund is aimed at retail investors, not institutional investors. Per FT

Private credit group Blue Owl will permanently restrict investors from withdrawing their cash from its inaugural private retail debt fund.

Did the private loan markets go too far? In other words, did the strong demand for the product result in yields that didn't properly account for the risks? Or, more broadly, are the recent issues a function of dwindling liquidity that could, in time, spread to affect larger, more well-followed markets?

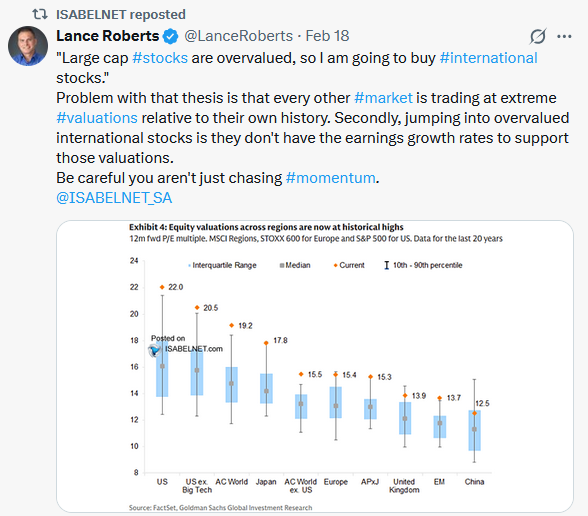

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post 4 Percent Inflation: The Case For And Against appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter