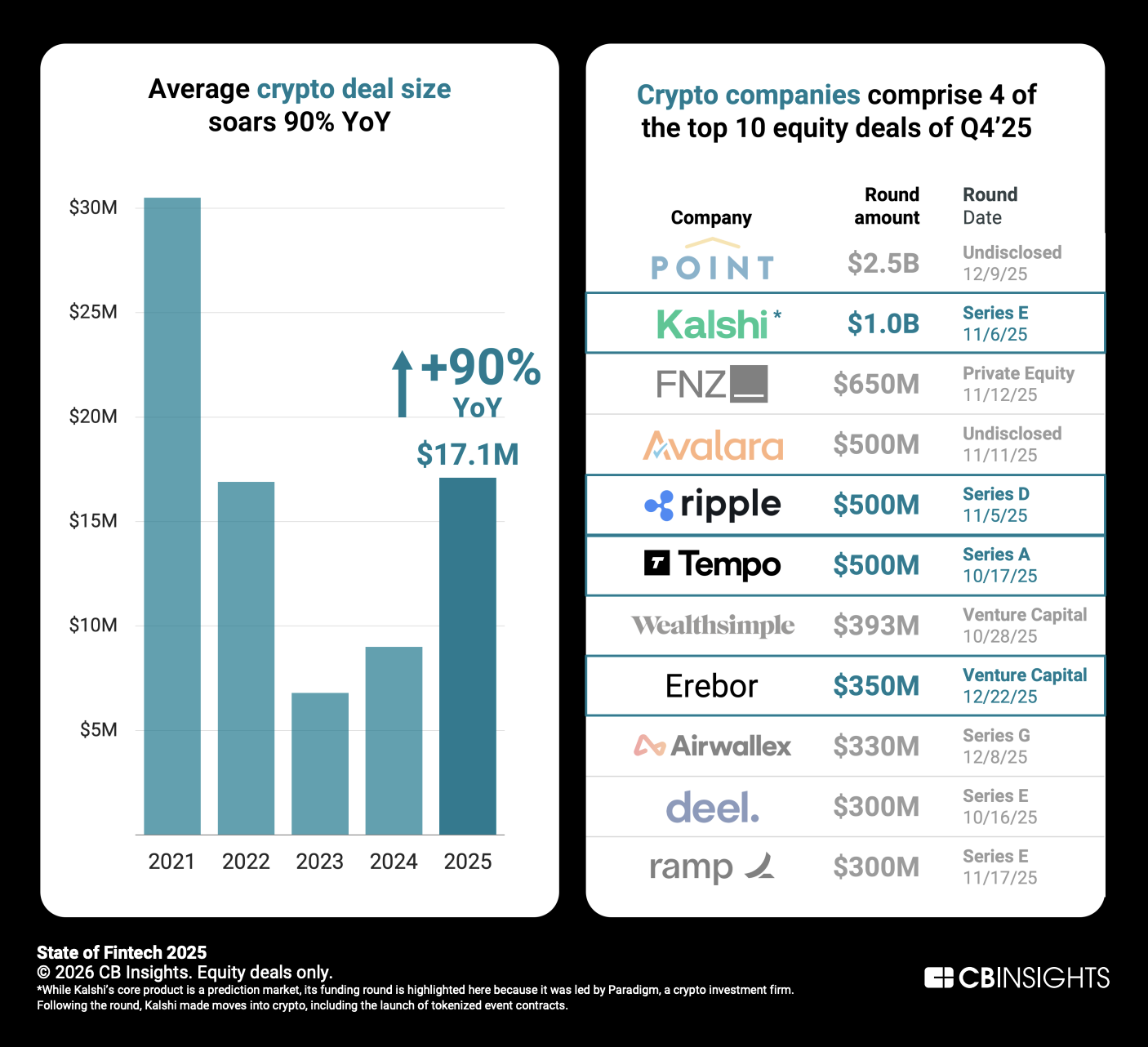

In 2025, the cryptocurrency and blockchain sector attracted some of the largest venture capital (VC) rounds in the fintech industry, reflecting investors’ optimism about the space’s potential to create new financial infrastructure, and deliver high‑growth returns, according to new data released by market intelligence platform CB Insights.

Of the 10 largest VC rounds of Q4 2025, four went to companies operating in digital assets, trading infrastructure, and crypto-enabled financial services, the data show. These transactions involved:

- Kalshi, a US-based prediction market platform which secured US$1 billion in a Series E in December to support further consumer adoption, integration with additional brokerages, partnerships with news organizations, and expansion of product offerings;

- Ripple, a digital assets and infrastructure company which raised US$500 million in November to expand further into payments, custody, and stablecoins;

- Tempo, a payment-focused blockchain platform backed by Stripe and Paradigm which raised a US$500 million Series A round in October; and

- Erebor, a new digital banking startup which secured US$350 million in December.

These transactions, coupled with other significant deals recorded over the rest of 2025 like Binance’s US$2 billion fundraise in March, Kraken’s US$500 million Series D in September, and Phantom’s US$150 million Series C in January, pushed the average deal size materially higher over the course of the year. In 2025, the average crypto transaction surged by a remarkable 90% year-over-year (YoY) to reach US$17.1 million, returning to 2022 levels.

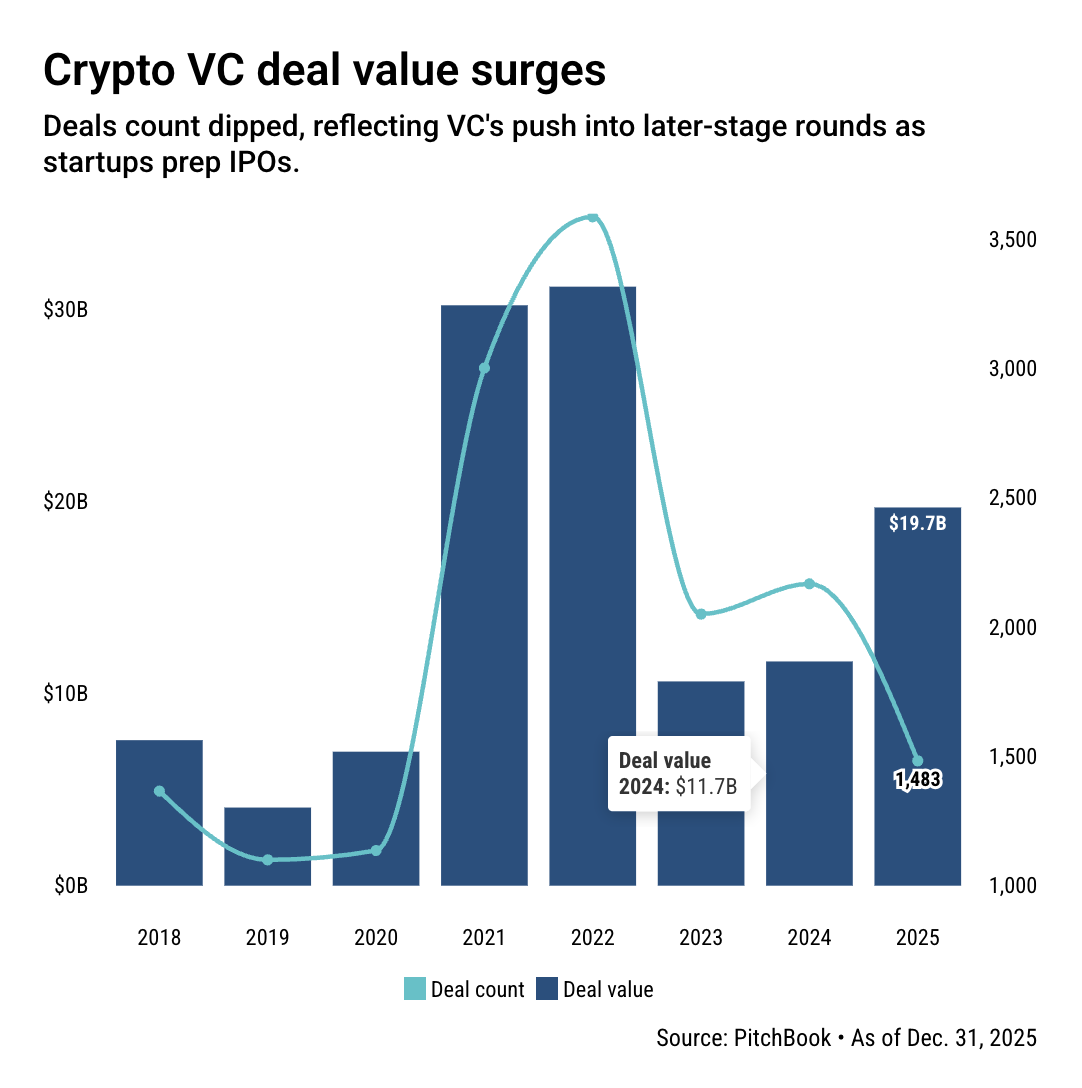

Crypto exits activity accelerates

Globally, crypto VC funding increased 68.4% YoY in 2025, reaching US$19.7 billion, according to PitchBook data.

Crypto mergers, acquisitions, and public listings also surged. M&A activity notched US$7.7 billion in overall deal value across 288 transactions in 2025, compared with 234 crypto M&A transactions totaling US$2.4 billion the year prior.

Prominent crypto M&A deals in 2025 included Coinbase’s US$2.9 billion purchase of derivative platform Deribit, Kraken’s US$1.5 billion acquisition of NinjaTrader, and Ripple’s purchase of prime broker Hidden Road and corporate treasury firm GTreasury for more than US$2 billion.

Public markets reopened strongly, with at least 11 crypto initial public offerings raising roughly US$14.6 billion in 2025, versus just US$310 million from four listings in 2024, the Block reports. Notable public listings in 2025 comprised Circle, the issuer of the USD Coin (USDC) stablecoin, Bullish, a crypto exchange, and Twenty One Capital, a bitcoin-focused financial services firm.

Looking ahead, the global crypto sector is poised for further liquidity in 2026, with several startups preparing for public offerings. Kraken, a leading crypto exchange, filed confidentially for an initial public offering (IPO) in Q4 2025. Meanwhile, Consensys, the Ethereum infrastructure company behind the MetaMask wallet, and Ledger, a French manufacturer of crypto hardware wallets, have reportedly begun listing preparations.

Broader fintech funding trends in 2025

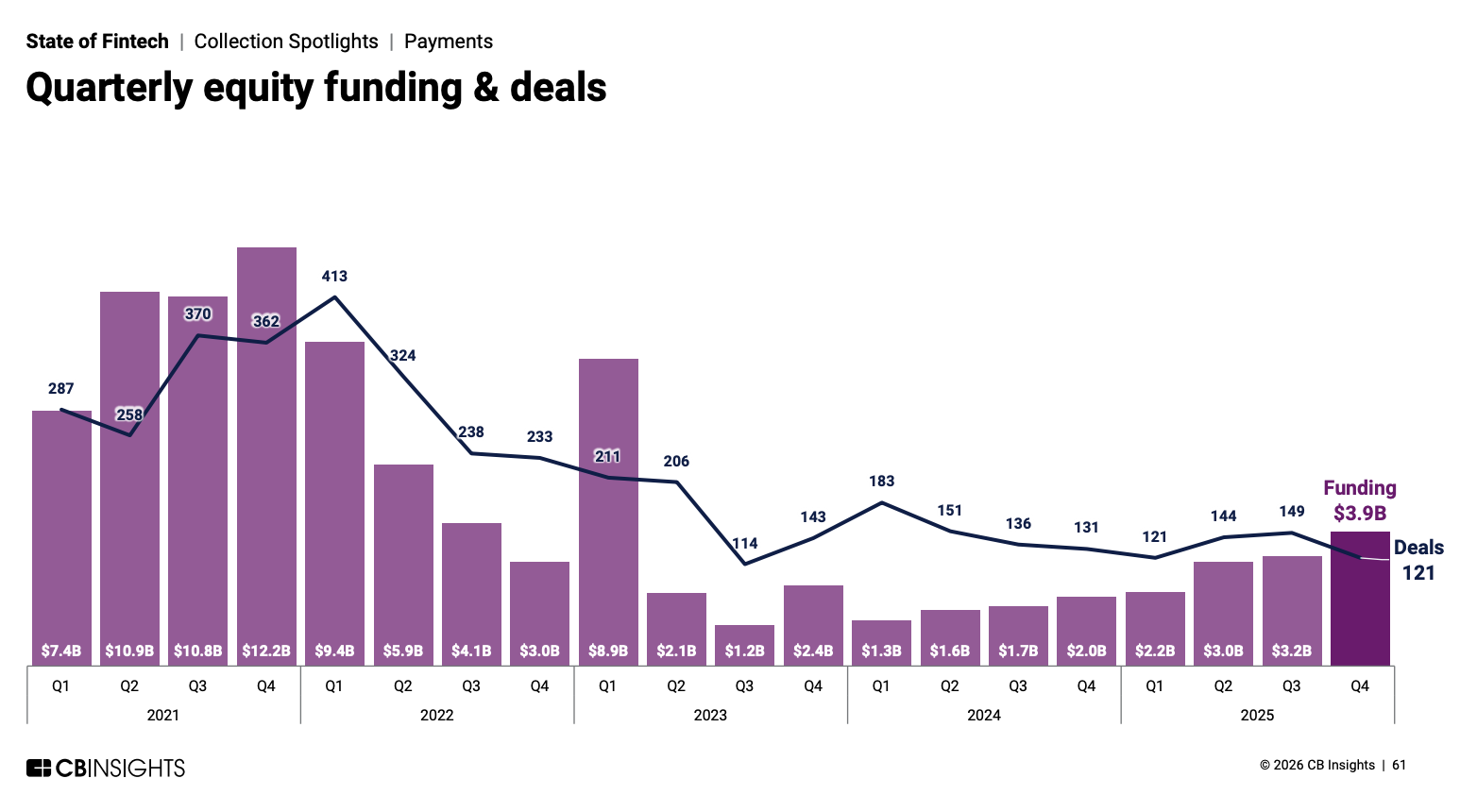

Beyond the surge in crypto deal activity, 2025 witnessed several other key funding trends. Most notably, payment tech was a key area of focus, attracting US$12.3 billion through 535 deals last year and outperforming all other verticals including digital banking, digital lending, and wealthtech.

Investment momentum in payment tech last year was driven by funding to agentic payments startups, end-to-end spend management platforms, and embedded payments APIs, with notable backing for Airwallex, Deel, and Ramp.

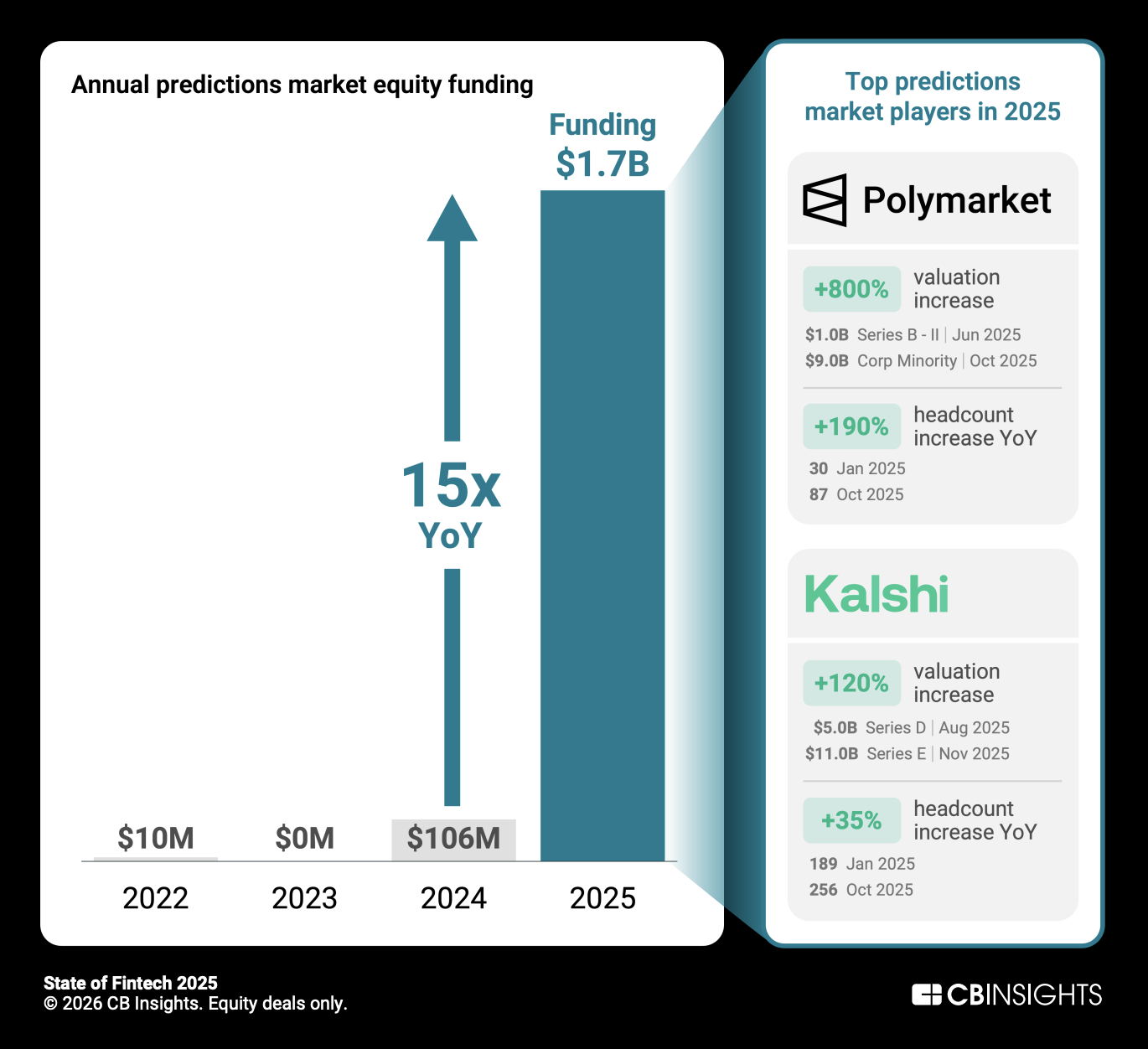

Prediction market startups also experienced a dramatic surge. Last year, companies in the sector secured a total of US$1.7 billion, marking a 15-fold increase. This growth was driven by market leaders Polymarket and Kalshi, which both reached unicorn status. In Q4 2025, Kalshi more than doubled its valuation to US$11 billion following its Series E, while Polymarket’s US$2 billion fundraise propelled its valuation ninefold to US$9 billion.

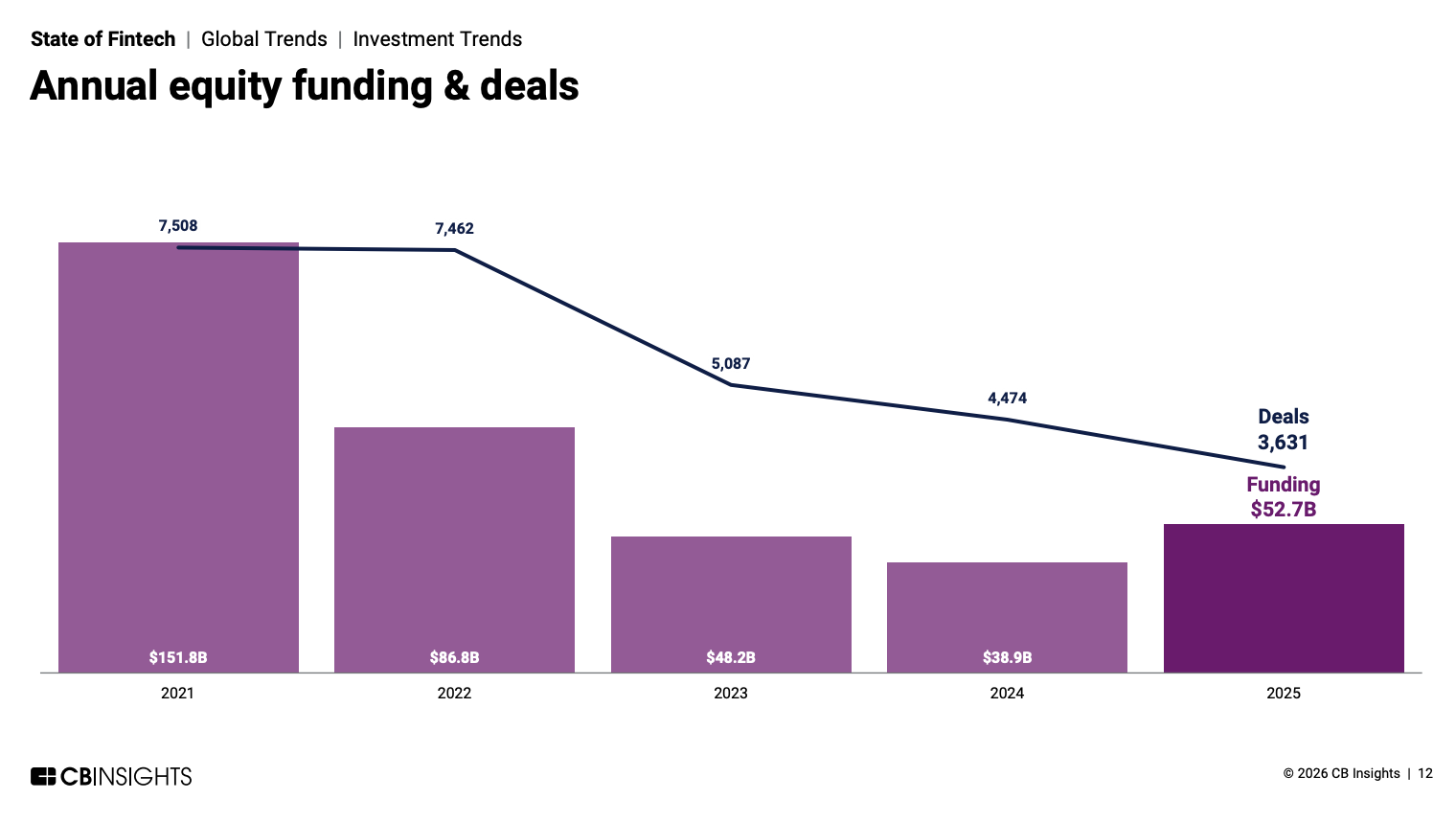

Overall, 2025 was a positive year for the global fintech funding landscape. The sector secured a total of US$52.7 billion, growing 35.5% from 2024 and reaching the highest level since 2022.

Although total deal count fell 19 % YoY to 3,631, the average deal size grew from US $12.9 million in 2024 to US$20 million in 2025, and the median deal size rose from US$3.5 million to US$5 million, implying larger investments into the sector.

Featured image: Edited by Fintech News Switzerland, based on image by freepik via Freepik

The post Crypto Leads Large Fintech Equity Rounds; Exit Activity Accelerates appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Full story here Are you the author? Previous post See more forTags: Blockchain,cryptocurrency,Featured,funding,newsletter