Silver has been on a tear, rising fourfold in the last few years. The price is driven by the narrative of dollar debasement. Furthermore, there are indications that limited supply, along with growing industrial demand for silver, warrants higher prices.

As we have stated in recent articles (Debasement, What It Is And Isn’t & Dollar Debasement: Reality Or A Dangerous Narrative), we do not believe the dollar is being debased. Furthermore, while the silver supply-demand imbalance is intriguing, we do not believe it warrants the excessive price increases we have recently seen. Lastly, for silver investors, in Silver Mania And The Predictable Bust, we warned that the CME and the government could easily deflate the bubble, as they have before.

To help silver investors assess whether silver is in a bubble, we take a new approach by examining a recent phenomenon: the recurring pattern of micro bubbles.

What is a Micro Bubble?

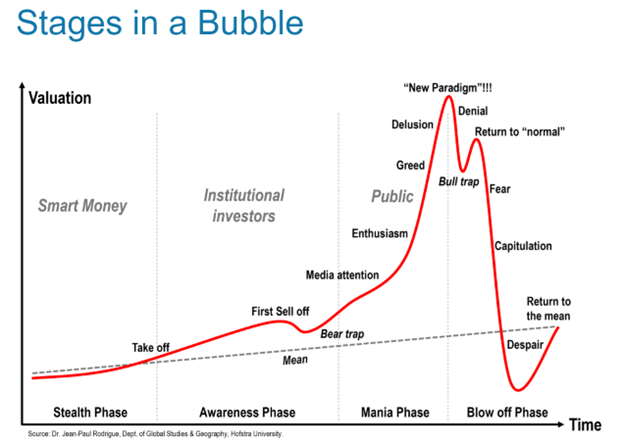

The graph below is a good depiction of the typical price pattern and sentiment transitions of a bubble. Since the massive liquidity injections during the Pandemic, financial markets have experienced a series of rolling microbubble cycles. Unlike the feared macro bubbles, such as the 2008 financial crisis or the dot-com bubble of 2000, micro bubbles are isolated and have little impact on broader financial markets.

Supporting micro- and macro-bubbles are narratives. While narratives often begin with some degree of truth, they tend to become larger-than-life as the bubble expands. These micro-bubbles can be highly profitable for those who spot them early and for those spreading the narratives. However, they are extremely costly for latecomers who buy fully into the underlying narrative.

Post 2020 Micro Bubbles

To provide context for the recent spate of micro-bubbles, we present several examples. As you read about recent micro-bubble instances, compare the narratives and themes with those currently unfolding in silver. Bear in mind that the narratives we present may seem silly today, but many investors bought them hook, line, and sinker at the time.

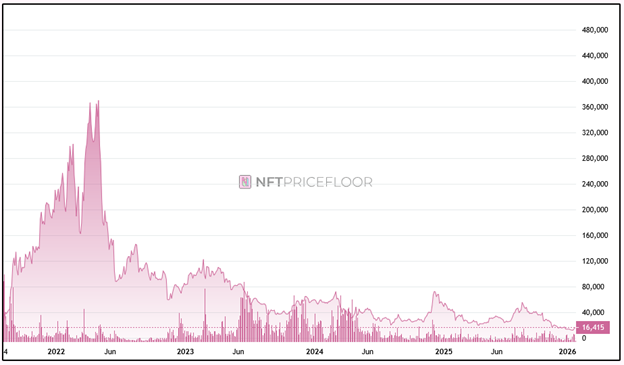

Alt Coins And NFTs

The combination of easy monetary policy, new retail investor inflows, social media narratives, and “fear of missing out (FOMO)” led to parabolic price gains for thousands of altcoins and Non-Fungible Tokens (NFTs). This occurred despite the securities having nearly worthless valuations and, in almost all cases, no utility.

The narrative behind the gargantuan price gains was that crypto, in all its forms, was reinventing the financial system. Moreover, altcoins and NFTs were pitched as “the next Bitcoin,” promising to disrupt traditional banking, payments, gaming, cloud computing, social media, and even fiat currencies. Many promoters stated that their utility would arrive later, thereby justifying extreme valuations.

The graphs below show the relatively short boom-and-bust cycles of two popular altcoins and one NFT. As we will demonstrate throughout this article, the gains were substantial, and the losses were equally striking.

Meme Stocks

The meme stock bubble centered on heavily shorted stocks of fundamentally challenged companies, such as the three shown below- GameStop, AMC, and BlackBerry. These stocks were heavily shorted by professional investors, who widely considered them on the verge of bankruptcy. Retail traders, organizing through social media platforms such as Reddit and Discord, coordinated buying to trigger short squeezes.

The sudden price gains were not attributable to improvements in the companies’ financial position or outlook; rather, they were driven by options leverage, momentum, and forced buying by short sellers. The unwind was equally swift as buying pressure faded, volatility subsided, and investors rotated into other trade ideas.

The dominant narrative cast meme stocks as a populist revolt against Wall Street, pitting retail investors against hedge funds. Buying these stocks was portrayed not merely as speculation but as financial activism intended to punish institutional investors. This moral rationale helped some investors dismiss valuation concerns.

Some speculators, such as “Roaring Kitty,” who bought meme stocks before spreading narratives, profited dearly. Many others saw spectacular gains wiped out and, in many cases, lost substantial sums. Meme stocks collapsed, revealing that the exorbitant price gains were driven by false narratives rather than by economic value.

Crypto Treasury Companies

Some publicly traded companies have transformed their traditional businesses into de facto leveraged crypto-holding companies. Companies such as MicroStrategy and BKKT Holdings, shown below, saw their equity prices increasingly driven not by revenues, operating performance, or even their financial outlooks, but by Bitcoin's price. In many cases, these companies issued debt or equity to leverage their Bitcoin holdings. Doing so created a reflexive loop in which rising crypto prices boosted stock prices, enabling further capital raises to purchase even more crypto.

Underlying the tremendous stock performance was a false narrative that investors would permanently reward companies with Bitcoin exposure. When crypto prices fell, the story unraveled.

Pandemic Winners

Because of the pandemic, “stay-at-home” products from companies such as Zoom, Peloton, Teladoc, Roku, and DocuSign were in high demand. Their stock prices surged as investors extrapolated the temporary demand shock into a permanent structural economic shift. They assigned valuations to these companies as if pandemic-era growth and recent consumer behaviors would persist indefinitely. When normal economic activity and more typical consumption behaviors resumed, revenues slowed, margins compressed, and their stock prices retraced sharply.

Investors were told that these companies were “essential infrastructure” for a post-pandemic world, thereby justifying extreme multiples on the belief they would eventually deliver massive profits.

SPACS

During the pandemic, Special Purpose Acquisition Companies (SPACs) became a popular investment vehicle. SPACs allow retail investors to invest in early-stage companies before they go public. Hundreds of SPACs raised capital without an underlying operating business, relying on the promise of investing in high-growth companies that might otherwise remain private. Many of these “high-growth companies” were valued by SPACs at levels comparable to those of mature public companies. As projections ultimately fell short, many SPACs traded well below their $10 issue price. It became clear that those creating and managing SPACs favored deal completion and their personal bank accounts over underlying fundamentals. Sponsors were rewarded for closing transactions rather than for creating durable shareholder value.

Investors were persuaded by the thesis that SPACs “democratized access” to venture-style investments, allowing public-market investors to participate in the next Tesla, SpaceX, or DraftKings before traditional IPO processes would permit it. Management teams and sponsors were marketed as elite capital allocators whose reputations substituted for proper due diligence.

Et Tu Silver?

The narrative driving silver prices is twofold, stemming from its dual identity as both a precious and an industrial metal.

Silver is considered by precious metals investors as gold with leverage, or as high-beta gold. Simply put, these investors view silver, like gold, as a hedge against currency debasement and its perceived causes, such as rising deficits, unsustainable debt issuance, and loss of confidence in the dollar.

Unlike gold, silver is also promoted as a critical industrial metal, with demand recently increasing due to solar panels, electrification, AI data centers, and power grid expansion. There is some belief that demand is growing much more rapidly than supply, which is constrained and is likely to remain so for some time.

We have refuted the debasement argument, as we linked at the outset. While the supply-demand imbalance is promising, it doesn’t justify the surge in silver prices in our opinion.

We ask you: Does the graph below resemble the left side of the bubble graphs we shared earlier, or does it accurately reflect fundamentals and the possibility of a debased dollar?

Summary

The one theme that holds true for the micro bubbles we discuss, and for others, is that narratives drew in investors and pushed prices well beyond any realistic economic value. When momentum gave out, the narratives collapsed, exposing the truth: price had been driven by faulty beliefs and greed, not by durable economic value.

Can we classify Silver as a microbubble? The answer depends on your belief in the underlying narratives. However, even if the narrative contains some truth, the bubble may still burst if the price greatly exceeds its fair value.

The post The Silver Surge: Micro Bubble Or Reasonable Valuation? appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter