In 1850, Economist Frederic Bastiat famously wrote an essay entitled "That which is seen, and that which is not seen.” The first chapter, "The Broken Window," argues that good economics requires considering not just the immediate, visible effects of an action but also the delayed, less obvious (unseen) consequences. Unfortunately, most commentators, when asked about QE, focus on the “seen” or the benefit of improved liquidity. Rare is it that the "unseen" is discussed.

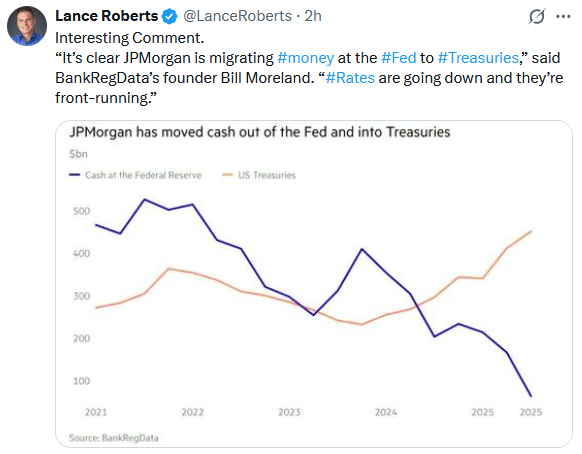

The Fed is "marketing" this round of QE as Reserve Management Purchases (RMP). They claim it's different from QE because it involves buying short-term bills rather than longer-term bonds. Let us set aside the "seen" for a moment and focus on the unseen. Consider the following:

- When Treasury bills mature, the Fed will use the proceeds to purchase new assets to maintain its balance sheet and support market liquidity. Thus, will they continue to buy bills, or might they extend their purchases to notes and bonds? If the latter, this RMP-not QE is a ruse or bookmark for more traditional QE, just delayed.

- Via the Fed, the Treasury has a new buyer of $40 billion of its Treasury bills in each of the next four months. Might they wisely limit longer-term issuance while pushing more bill issuance? Such would be the equivalent of yield curve control.

The "seen", or temporary liquidity boost, is easy to see. The unseen is that this may be a misleading way for the Fed to push longer-term bond yields lower. Doing so would meet the President's recent demands, support the housing market, and possibly prevent further deterioration in the labor market. But make no mistake, the unseen is that RMP is QE.

What To Watch Today

Earnings

- No earnings releases today

Economy

Market Trading Update

Following a 4-day “sell off” into mid-week last week, which broke both supports at the 20- and 50-day moving averages, investors mustered the courage to once again “buy the dip,” reversing early-week losses and pushing the market to 6,835 on Friday. That recovery keeps the broader uptrend intact, but the market is now pressing directly into a zone where prior momentum stalled, making this week critical for determining whether the year-end advance can extend.

From a trend perspective, the index finished the week above its 20- and 50-day moving averages, confirming that sellers failed to regain control after the post-FOMC volatility. However, upside progress has repeatedly stalled at the 6,900 resistance level, which coincides with prior highs and the upper boundary of the near-term consolidation range. Until price can close decisively above that level, upside should be viewed as incremental rather than impulsive. Historically, failed breakouts near year-end often lead to short, sharp retracements rather than prolonged declines, particularly when liquidity thins into the holidays.

Momentum indicators are consistent with that interpretation. Relative strength has improved from the oversold conditions of early December, but is now approaching levels where rallies have stalled. Furthermore, the negative divergence of relative strength since September suggests an increasing fragility to market rallies. Notably, volatility has decreased, with the VIX falling back into the mid-teens, suggesting that complacency is returning. While low volatility often supports higher prices, it also leaves markets vulnerable to abrupt price declines if expectations are not met.

Key Support and Resistance Levels

| Level Type | Price Area | Technical Significance |

|---|---|---|

| Resistance | 6,900 | Previous highs and top of the consolidation range. |

| Resistance | 6,865 | Previous peak in early November during the corrective process. |

| Current Price | 6,835 | Friday close |

| Support | 6,767-6,810 | 20- to 50-day moving averages. |

| Support | 6,647 | 100-DMA / intermediate trend support |

| Support | 6,539 | November reaction low |

Looking into next week and the remainder of the year, support levels are clearly defined and relatively close to current prices. A pullback toward initial support would be technically normal and even constructive if buyers step in near the trend. Conversely, a failure to hold intermediate support would raise the risk that investors once again receive a “lump of coal” for Christmas.

In summary, the technical backdrop suggests that the market remains positioned for a year-end advance, provided bulls can defend near-term support and eventually reclaim the overhead resistance. Without a breakout, the most likely outcome is continued consolidation, accompanied by increased volatility, as investors adjust their positions ahead of year-end.

The Week Ahead

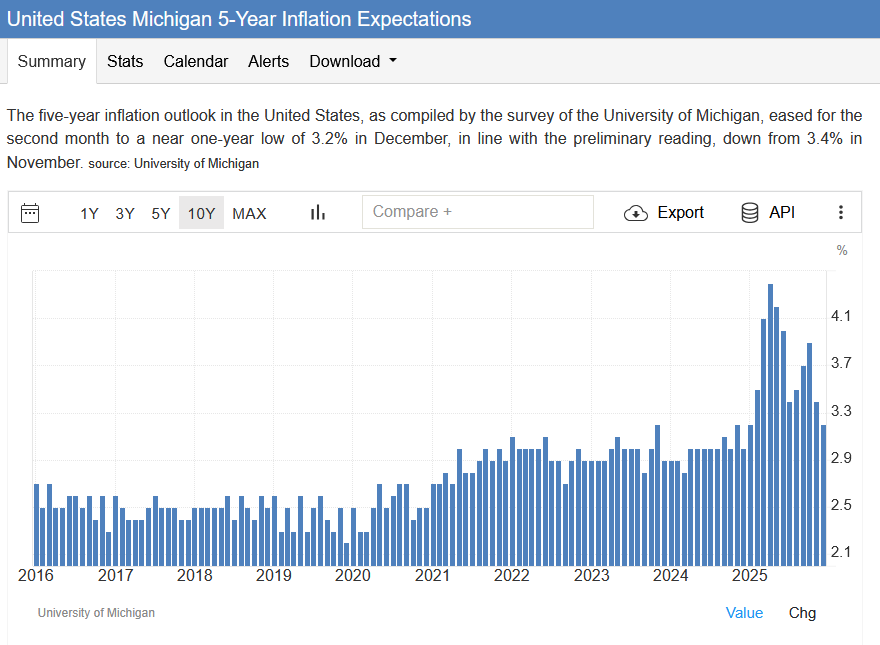

Markets will be closed on Thursday, and trading volumes will likely be very light on Wednesday and Friday. Economic data will also be sparse. On Friday, the University of Michigan Consumer Sentiment survey rose from 51.0 to 52.9. Notably, inflation expectations continue to decline, as shown below. The Federal Reserve places significant weight on inflation expectations. Combined with Thursday's surprisingly low CPI report, we may begin to see some members become slightly less hawkish. To wit, New York Fed President John Williams stated the following on CNBC:

Some of the new data has been encouraging and shows more disinflation

What Inflation Alarmists Missed In Their Warnings

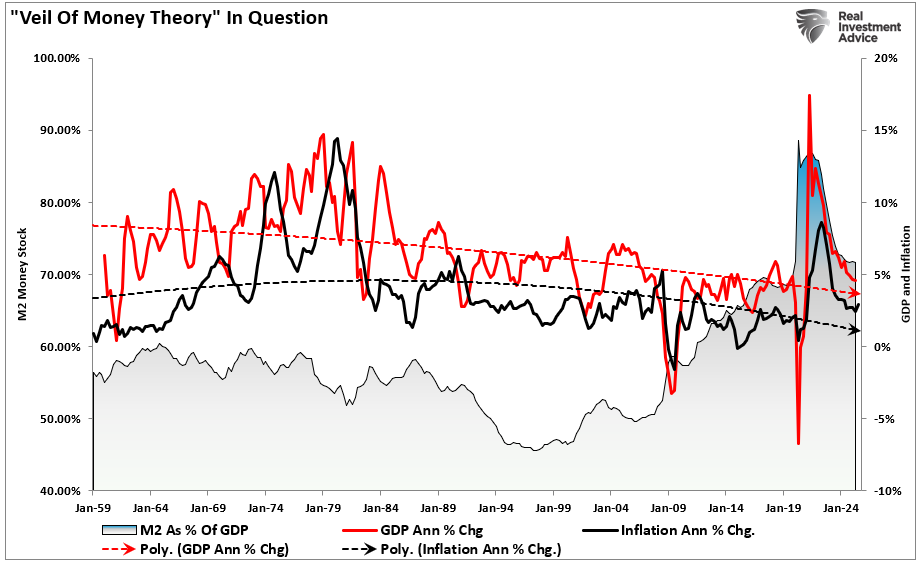

Over the last couple of years, inflation alarmists such as Paul Tudor Jones, James Grant, and Jeff Gundlach have all said that inflation is returning with force. In different ways, they each stated that they would not own Treasury bonds due to the expectation that inflation would rise as the dollar declined due to the ongoing deficits. They have all argued, in some form or another, that ballooning deficits, tariffs, and the “dollar debasement” would drive inflation much higher, with yields of 6% or more on the 10-year Treasury as inevitable.

As Jeff Gundlach noted in June of this year, a “reckoning is coming” for U.S. debt, and yields on long-term bonds could continue to rise as the economy weakens. Paul Tudor Jones said in October 2024 that “all roads lead to inflation.” Lastly, in June 2024, James Grant stated that “persistent inflation” is the new norm.

However, while these are brilliant, well-regarded gentlemen, the forecasts have not panned out, at least so far, as they believed, because they ignored the structural weight of the “3-Ds” (Debt, Deficits, and Demographics) on economic growth, which drives inflation. READ MORE...

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post The Seen And The Unseen Of QE-RMP appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter