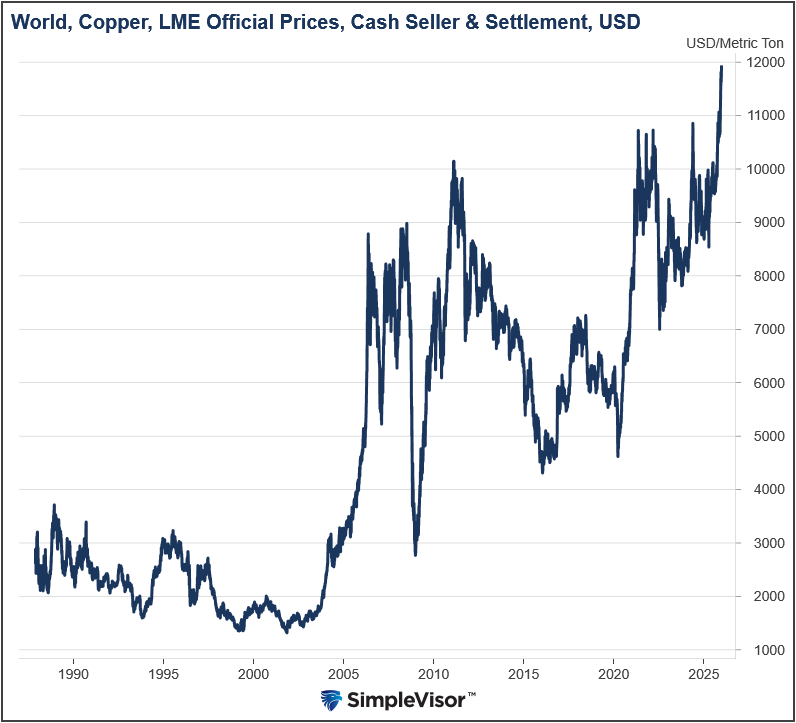

On Monday night, copper prices, as shown below, reached an all-time high of over $12,000 per metric ton. Copper is often referred to as "Doctor Copper" because it serves as a barometer of global economic activity. However, the current surge in prices is not due to sharply rising demand; tariffs and physical dislocation are heavily impacting the supply side. The bullet points below help appreciate why copper is hitting all-time highs.

- Traders are front-running U.S. tariff policy, bringing the metal into the U.S. ahead of potential tariffs. This has distorted global trade flows, tightening inventories elsewhere, and creating artificial scarcity.

- The scarcity is enhanced by inventory stockpiling, not end-user consumption.

- Adding to supply woes, copper mine disruptions, declining ore grades, and years of underinvestment limit miners' ability to meet growing demand quickly.

- Copper trades on the futures exchanges. Accordingly, it is leveraged and traded by speculative momentum traders. As we are witnessing with silver, speculative traders make a living chasing trends.

Because the price increase is primarily supply-related, if tariff threats fade and trade routes normalize, excess inventories could quickly hit the market, causing speculative trades to unwind. In such an instance, copper prices could fall just as fast as they have risen.

What To Watch Today

Earnings

- No earnings releases today

Economy

Market Trading Update

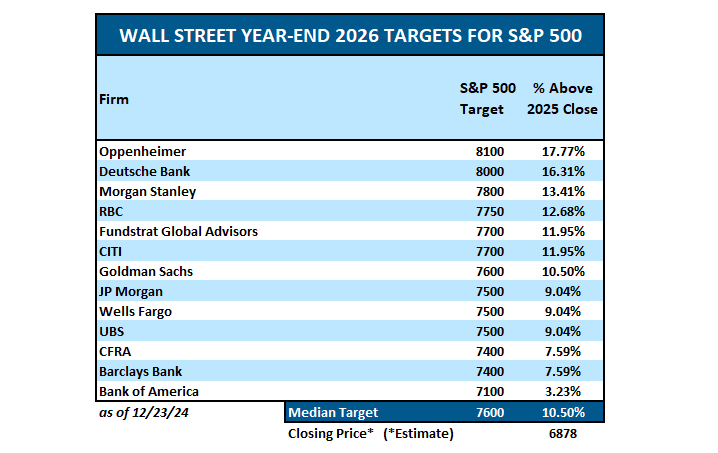

Yesterday, we touched on the outlook for 2026 and to be on alert for a rotation from this year's winners. As we move into year-end, and as discussed in Monday's blog post, expectations are very bullish for 2026. The table below displays the latest estimates for 2026 full-year price targets, along with the percentage change from yesterday's close. With a median target of 7600 and a 10.50% return, analysts remain optimistic.

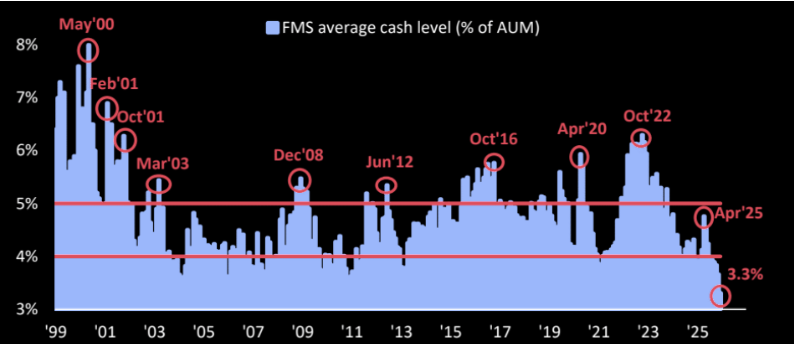

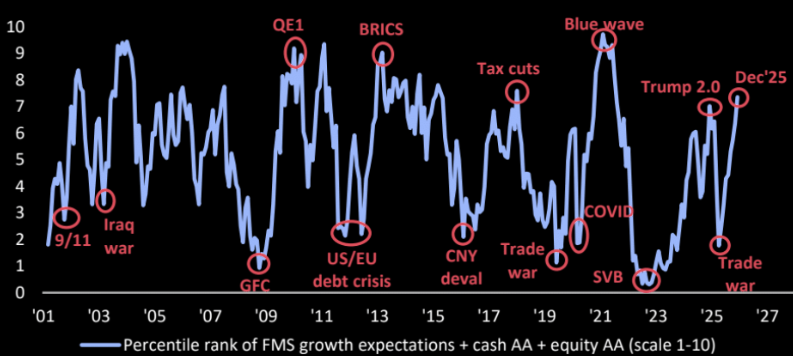

However, there are risks to consider in such an environment where leverage is stretched, investor optimism is elevated, and cash levels are at record lows.

Does that mean the market will crash next year? Not at all. As John M. Keynes once quipped: "The markets can remain illogical longer than you can remain solvent." However, such conditions do suggest that the market is increasingly fragile to disappointment, and reversals next year could be very swift.

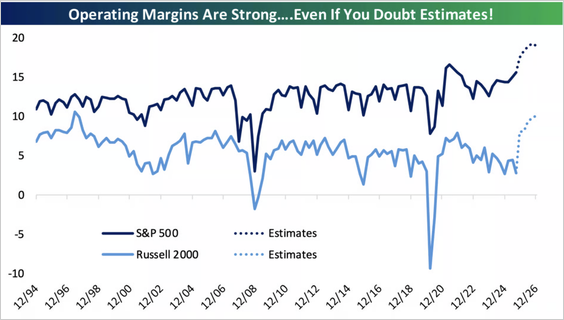

Where could that disappointment come from? My best guess is that it will be derived from earnings and profit margins. As shown, the expectations for 2026 are for a surge in profit margins and revenues, next year, which would have to be derived from the perfect economic outcome: growth with no inflation. That cocktail will be complicated to achieve, and while the Federal Reserve is cutting rates and providing liquidity, that does not resolve the crimp that is showing up in household budgets.

As we wrap up 2025, we continue to think that next year could be a "year of rotation." Does that mean an immediate shift from growth to value, or momentum to income, as discussed yesterday? No. However, it does suggest that both risk management and a strong focus on performance changes will be the main factors in winning the game next year.

Watch The Yen In 2026

As we share below, the yen is again approaching its lowest levels against the dollar since at least 1995. We circle the sharp, short-term increase in the yen occurring in August 2024. This was the market swoon related to the supposed liquidation of the yen carry trade. It is rumored that tens of billions of dollars are propping up US assets, supported by loans made in Japan through the yen carry trade. The relatively low Japanese borrowing rates and a declining yen make such a trade highly attractive to hedge funds and other institutional money managers. Moreover, Japanese citizens and corporations, facing low interest rates, are incentivized to invest their money abroad. By doing so, they can profit from high-yielding assets they cannot access at home and from a depreciating yen.

The depreciating yen fortifies the yen carry trade. However, looking ahead, there are growing rumors that Japan will intervene to support the yen. Japan heavily depends on energy and materials imports. A depreciating yen makes these goods more expensive. As a result, per Bloomberg:

The resulting cost-of-living crunch helped bring down two prime ministers before the current leader, Sanae Takaichi, took office.

Given the domestic economic and political situation, along with pressure from the US, we should expect the Japanese government to take steps to strengthen the yen. If an upward adjustment is done gradually, the impact on financial markets should be minimal. However, if it occurs suddenly, such as in August 2024, volatility could spike. Stay aware of this risk in 2026!

Silver Mania

Today, there are many sound, fundamental reasons for the recent rise in silver prices, as there were in the 1970s and in the post-financial-crisis years. For example:

Monetary & Fiscal Tailwinds: Like in the post-Financial Crisis era, the post-pandemic environment has certainly provided those with a reason to hedge against monetary tomfoolery with precious metals. The monetary debasement narrative certainly adds to the conversation. Moreover, with QE resuming and a few signs that DOGE hasn’t reduced fiscal spending, there does not appear to be an end in sight to the monetary and fiscal problems we face.

Supply Deficit: Silver has been in a multi-year supply deficit, with demand exceeding newly mined supply and silver from recycling.

Surging Industrial Demand: Silver is essential for solar panels, electric vehicles, power electronics, semiconductors, and data-center infrastructure. Given the rapid growth in these sectors globally, silver demand is increasing.

Limited Supply: Roughly 70% of silver production is a by-product of mining for other metals. This means that higher silver prices alone do not incentivize new supply, thereby slowing the market’s ability to rebalance. Moreover, reserve depletion, declining ore grades, mine closures, and underinvestment in exploration and development constrain supply.

However, there is one lesson anyone who owns silver should deeply appreciate:

"Fool me once, shame on you. Twice, then shame on me. But fool me three times…."

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post Copper Prices Surge To All Time Highs appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter