Prediction markets have grown rapidly, driven by regulation, a dynamic fundraising landscape, and rising mainstream adoption, especially in sports.

That momentum is projected to continue as major financial institutions enter the space, and as new markets and decentralized finance (DeFi) technologies push the sector to new heights, according to a new report by Sporting Crypto, a sports and blockchain media and intelligence company.

Prediction markets: an overview

Prediction markets are marketplaces designed to aggregate information and forecast future events by allowing participants to buy and sell contracts based on the outcome of these events. These platforms essentially allow users to “bet” on what will happen, with prices reflecting the collective belief about the probability of each outcome.

Prediction markets have existed in the US for decades but only bursted into the mainstream in the fall of 2024 after Kalshi, a federally regulated derivatives exchange and clearinghouse, began offering contracts based on the outcome of political events. The Commodity Futures Trading Commission (CFTC), then under the Biden Administration, sought to prohibit such contracts, arguing that they resembled gambling and contrary to the public interest. However, Kalshi sued the CFTC in court and won.

Momentum builds in prediction markets

Since Kalshi’s 2024 legal victory, and following other bullish CFTC decisions, the popularity of prediction markets has grown steadily and expected to cover crypto, climate, economic, financial, corporate, and sports events.

Crypto-native platforms have emerged as highly influential, led by players such as Polymarket, a decentralized platform for trading on global events, often using cryptocurrencies; and Augur a decentralized, blockchain-based prediction market. The sector also comprises regulated exchanges like Kalshi, which offers contracts on political, economic, and weather events; as well as PredictIt, a US-based political prediction market, popular for elections.

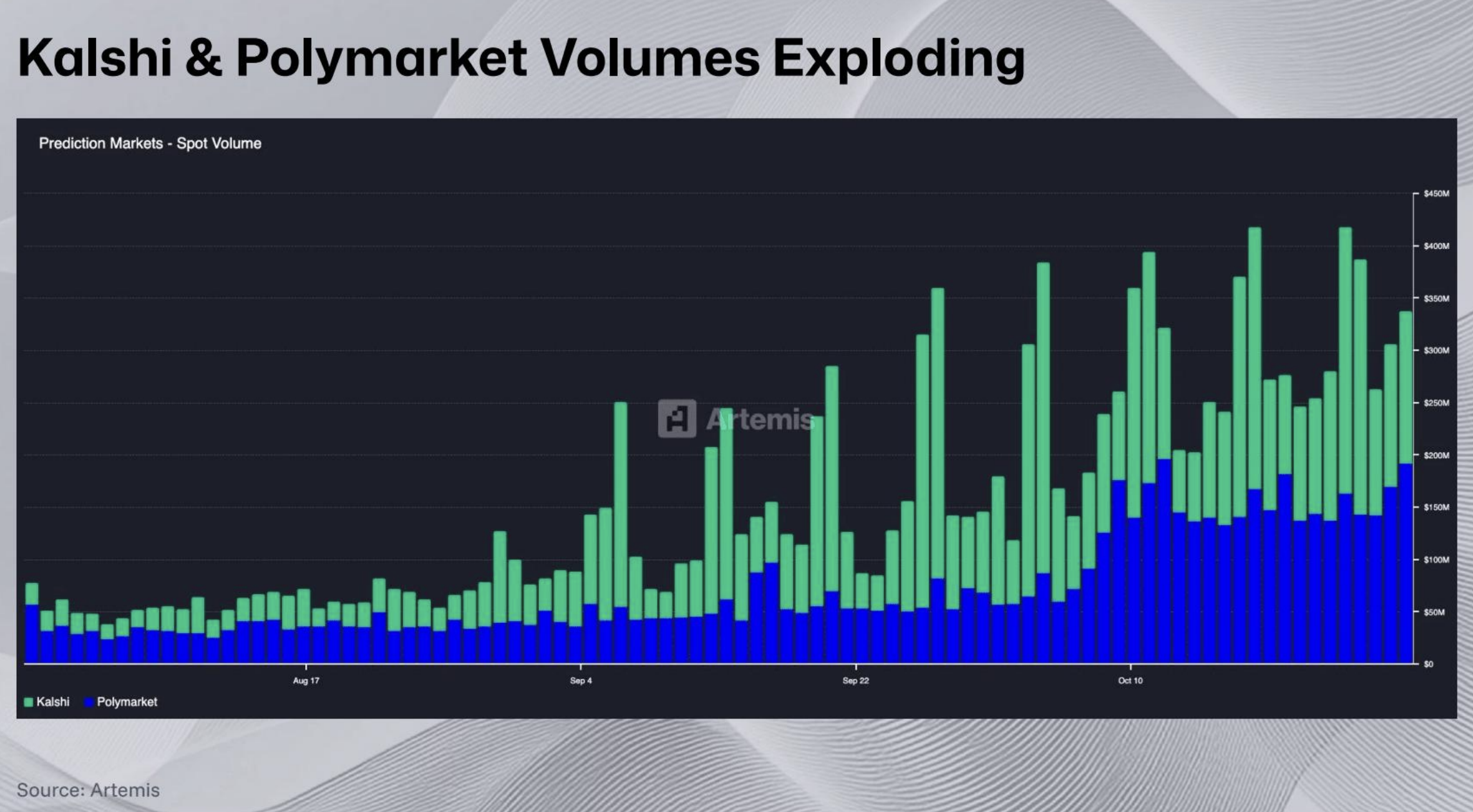

Polymarket and Kalshi currently dominate the market, accounting for 98% of the total volume in prediction markets, according to Sporting Crypto. Volumes have surged over the past year, rising 580% from roughly US$50 million in August 2025 to about US$340 million in November 2025.

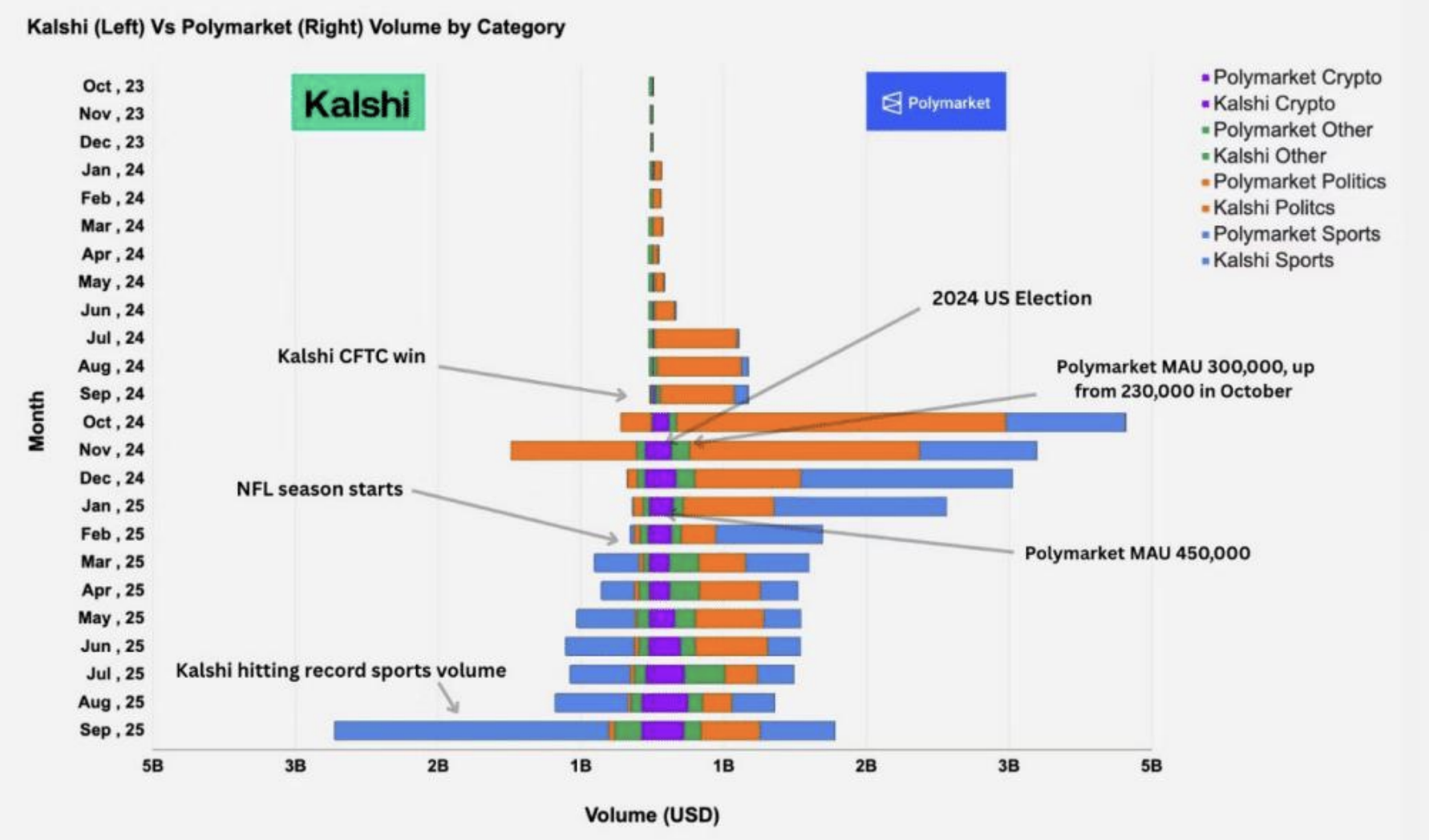

Sports now lead prediction-market activity. Over the last 12 months, Kalshi derived 59.3% of its volume from sports versus just 19.8% from politics. More recent data shows that Kalshi’s sports concentration has surged even higher, approaching about 90% of volume as the company double down on its CFTC-approved sports betting advantage.

Polymarket, meanwhile, has a more diversified distribution, with about 35% from sports and 47% from politics, in addition to meaningful presence across verticals like crypto, reflecting its broader prediction market positioning.

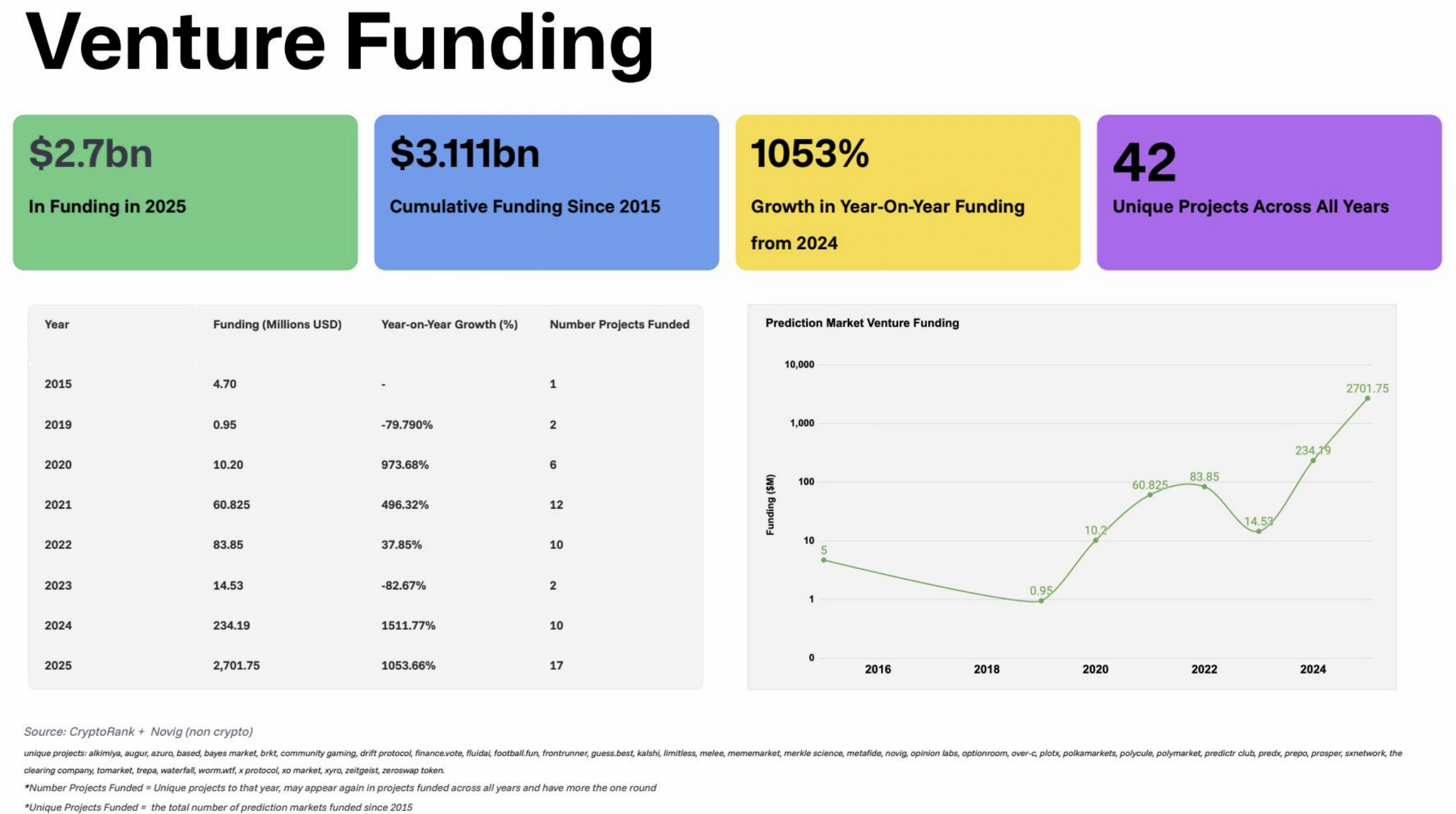

In addition to bullish regulatory developments, venture capital (VC) activity in the sector has also fueled the growth of the prediction markets sector. Since 2015, prediction-market startups have raised US$3.1 billion, with US$2.7 billion, or 87% of that total, raised in 2025 alone. Polymarket (US$2.15 billion) and Kalshi (US$485 million) secured 90% of this year’s funding.

Coinbase Ventures has been the most active investor in 2025, with five deals so far. Major traditional VC firms like Sequoia Capital, Founders Fund, Union Square Ventures, CapitalG, General Catalyst, and Bond Capital, have also been active in the space.

Blockchain poised to boost the sector

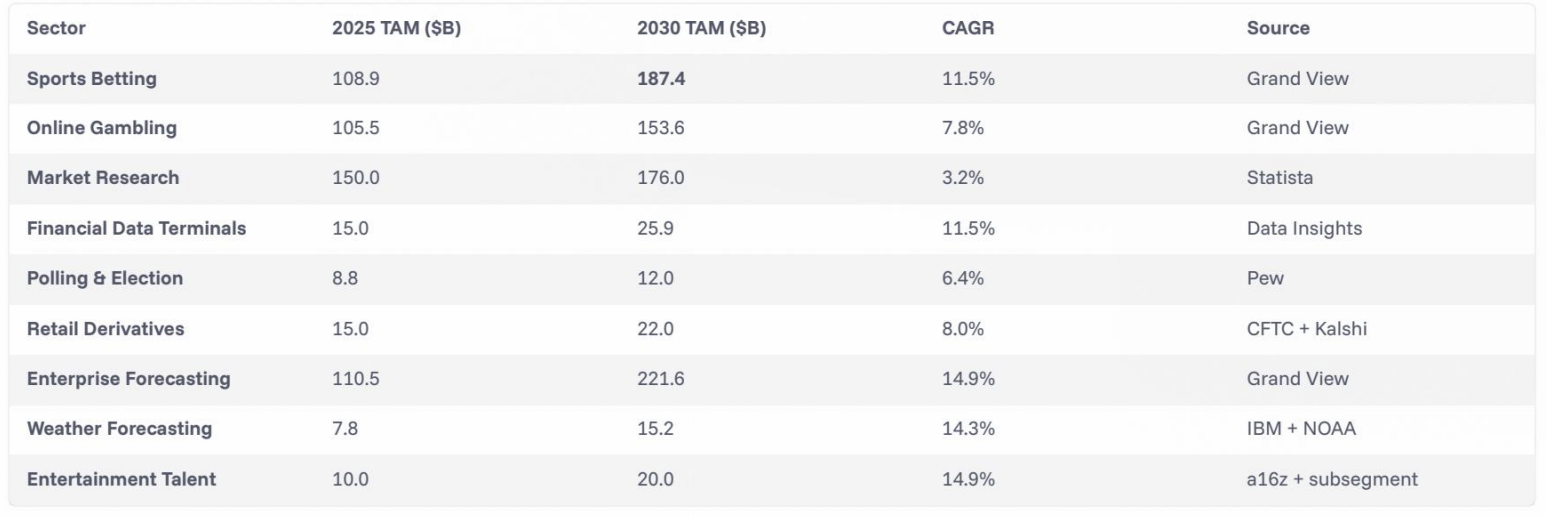

The prediction market had a total addressable market (TAM) of US$1.4 billion in 2024. This figure is projected to grow to over US$95 billion by 2035, driven by regulatory clarity, institutional participation, the expansion into new sectors, and the adoption of blockchain technology.

Permissionless access can help aggregate liquidity across crypto speculators, casual traders, institutional speculators, and professional forecasters, helping them participate simultaneously in the same markets. Smart contracts automate settlement and eliminate intermediaries across the full spectrum of market participants, improving efficiencies, and enabling instantaneous price discovery that reflects real-time shifts in collective probabilities.

Onchain prediction markets also support yield-generating products tied to long-term positions such as election outcomes or sports season results. Meanwhile, smart contracts and oracles enable automated, verifiable settlement. Oracles can verify event outcomes onchain, enabling automatic payouts without manual intervention.

Prediction markets can also provide real-time probability data that artificial intelligence (AI) models can use to improve forecasts and decision-making. By tapping into decentralized, crowd-sourced insights, Al systems can gain more adaptive and accurate signals beyond traditional data.

Emerging sectors

The Sporting Crypto report notes that while politics and sports contracts continue to lead prediction market volumes, several emerging sectors are gaining traction. Enterprise forecasting, weather, and entertainment talent, in particular, are projected to reach TAMs of US$110.5 billion, US$10 billion, and US$7.8 billion, respectively, by 2030, with compound annual growth rates (CAGR) of 14.9%, 14.9%, and 14.3%.

Featured image: Edited by Fintech News Switzerland, based on image by wahyu_t via Freepik

The post Prediction Markets Set to Surge, Fueled by Clearer Regulations, Sector Expansion, and Blockchain Integration appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Full story here Are you the author? Previous post See more for Next postTags: Blockchain,cryptocurrency,Featured,newsletter