Mergers and acquisitions (M&A) activity in the cryptocurrency sector has surged in 2025, reaching record levels amid accelerating industry consolidation, deeper convergence between traditional finance and digital assets, and a more supportive regulatory landscape.

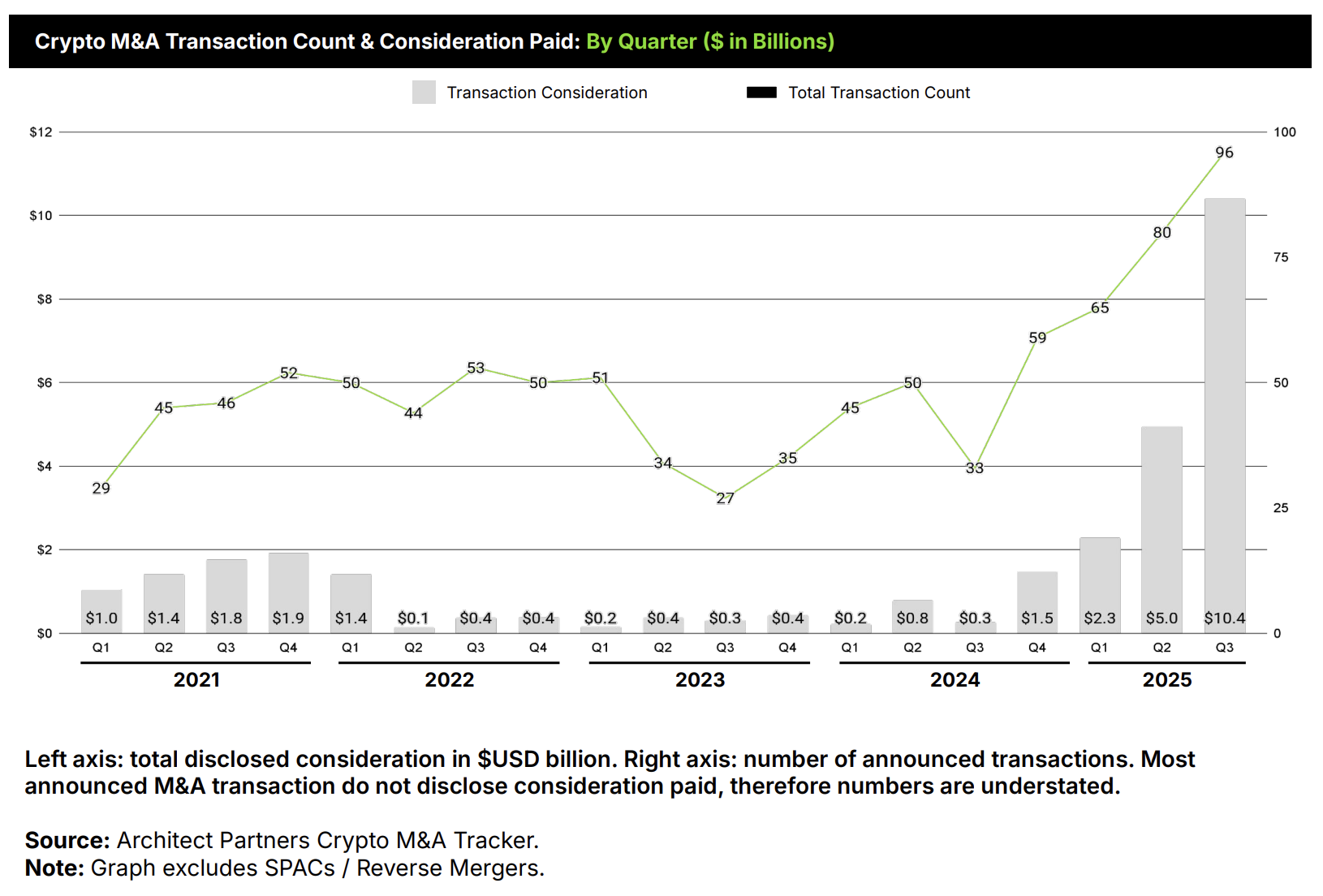

In Q3 2025 alone, the sector recorded 96 announced M&A transactions, totaling US$10.4 billion, according to new data from Architect Partners, a M&A and strategic financing advisory firm specialized in crypto and fintech. These figures represent a staggering 3,367% year-over-year (YoY) increase in M&A value from US$0.3 billion in Q3 2024, and a 191% YoY increase in deal count from 33 deals.

Year-to-date, the sector has posted 271 transactions for the first three quarters of 2025, nearly double the 128 recorded during the same period in 2024. Crypto M&A value has reached US$17.7 billion, up 1,262% YoY from US$1.3 billion.

Convergence of traditional finance and crypto

A key trend in the crypto M&A landscape in 2025 is the growing convergence of traditional finance institutions and the crypto sector.

In September, British online trading platform IG Group acquired Independent Reserve, an Australian crypto exchange, for an initial enterprise value of AUD 178 million (US$116 million). The acquisition aims to accelerate IG’s entry into cryptocurrency markets in the Asia Pacific (APAC) region and complement its ongoing efforts to expand crypto offerings organically in the UK and US.

IG, one of the 250 largest companies listed on the London Stock Exchange (LSE), provides online trading platforms, offering access to about 19,000 financial markets worldwide.

That same month, Solowin Holdings, a Hong Kong-based financial services firm providing solutions to traditional and decentralized finance, acquired AlloyX for US$350 million. Alloyx is a startup focused on cross-border payments and institutional-grade asset tokenization through stablecoin infrastructure. The deal aims to integrate AlloyX’s technology into Solowin’s compliant financial ecosystem, activating its global stablecoin strategy.

Gaining in scale and entering new markets

Another key trend in 2025 is consolidation, with crypto firms acquiring competitors to scale operations and enter new markets.

In July, Cold Wallet acquired competitor Plus Wallet for US$270 million, onboarding over two million users to its platform.

Also in July, Australia-based crypto exchange Swyftx acquired Caleb & Brown, a US crypto brokerage and asset manager focused on high-net-worth (HNW) private investors. The deal, valued in the AUD 100-200 million (US$66-132 million) range, aims to give Swyftx access to the US, one of the world’s leading digital assets’ market.

Caleb & Brown provides crypto brokerage, asset management and research services to thousands of private clients in the US, as well as Australia, managing over AUD 2 billion (US$1.3 billion) in digital assets.

Expanding capabilities

A third major M&A trend in 2025 is capability expansion, with leading crypto firms snapping up younger innovators to expand their capabilities and build more comprehensive digital asset ecosystems.

In July, Coinbase, the largest US crypto exchange, acquired LiquiFi. LiquiFi is a token management platform offering tools for token cap table management, vesting, and compliance. Its acquisition will allow Coinbase to partner more effectively with onchain builders and early-stage teams launching and managing their own tokens.

Over time, Coinbase plans to integrate these capabilities with Coinbase Prime, the company’s institutional-grade crypto exchange platform, to offer a comprehensive, end-to-end platform for token creation, custody, trading, and compliance.

The transaction followed Coinbase’s US$2.9 billion acquisition of derivative platform Deribit in May. Deribit is a leading crypto options exchange by volume and open interest, with roughly US$60 billion of current platform open interest, and over US$1 trillion traded last year.

Another leading crypto firm, Ripple, has also been active on the acquisition front. In August, it announced its US$200 million acquisition of stablecoin startup Rail. The acquisition aims to boost Ripple’s position as a leader in digital asset payments infrastructure, and add capabilities including virtual accounts and automated back-office infrastructure.

This deal followed Ripple’s earlier acquisition of prime broker Hidden Road and corporate-treasury firm GTreasury for more than US$2 billion.

Meanwhile, Talos, a provider of institutional trading and portfolio technology for digital assets, acquired in July Coin Metrics, a crypto data provider. The acquisition will see Talos integrate Coin Metrics’ extensive crypto market data, blockchain analytics and benchmark indexes, to create an integrated data and investment management platform.

Like Coinbase and Ripple, Talos has pursued an active acquisition strategy, previously acquiring Cloudwall, a risk management technology provider; Skolem, an infrastructure platform for institutional decentralized finance (DeFi) trading; and D3X Systems, a portfolio construction platform for systematic investment in digital assets. It aims to build the most comprehensive, one-stop solution for all institutional trading workflows in digital assets.

An improved regulatory landscape

Crypto M&A activity is surging this year on the back of a more favorable regulatory environment. In the US, the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act was signed into law on July 18, marking the US’s first major national cryptocurrency legislation. The bill aims to regulate the stablecoin market, creating a clearer framework for banks, companies and other entities to issue digital currencies.

Earlier, in 2024, the US Securities and Exchange Commission (SEC) lifted the ban on spot crypto exchange-traded funds (ETFs), approving 11 spot bitcoin ETFs. These instruments generated a combined trading volume of US$4.7 billion on day one, reflecting their appeal and convenience.

In the European Union, the Markets in Crypto-Assets (MiCA) Regulation entered into force last year, marking the first comprehensive crypto framework introduced by a major global economy. Key components of MiCA include licensing requirements for crypto-asset service providers, specific travel requirements, as well as rules covering the treatment of stablecoins.

Sustained momentum

Crypto M&A activity is expected to remain strong through the final quarter of 2025, supported by prominent transactions. In late October, FalconX, an institutional digital asset prime brokerage, announced an agreement to acquire 21shares, the provider of the world’s largest suite of crypto ETFs and exchange-traded products (ETPs).

The deal aims to bring together 21shares’ expertise in asset management product development and distribution with FalconX’s institutional-grade infrastructure, structuring capabilities, and risk management platform, addressing the growing institutional and retail demand for regulated digital asset exposure with tailored investment products.

Founded in 2018 and headquartered in Zurich, 21shares specializes in digital asset ETPs and manages over US$11 billion in assets across 55 listed products.

Crypto brokerage FalconX has facilitated more than US$2 trillion in trading volume, serving a global client base exceeding 2,000 institutions.

The firm has been expanding rapidly, acquiring in January crypto derivatives trading firm Arbelos Markets, and taking a majority stake in Monarq Asset Management, a multi-strategy investment firm, in June, alongside expansions in Latin America, APAC, and Europe, the Middle East and Africa (EMEA).

Featured image: Edited by Fintech News Switzerland, based on image by sitthiphong via Freepik

The post Crypto M&A Reaches New Record with Total Value Surging More Than 34-Fold YoY appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Full story here Are you the author? Previous post See more for Next postTags: Blockchain,cryptocurrency,Featured,funding,newsletter