The phrase “debasing the currency” is all the rage in the media. Moreover, the debasement narrative is used to support the significant surge in gold and other precious metal prices. We have written a few articles on the subject of debasement, for example: Dollar Debasement and Debasement: What It Is and Isn’t. To help further raise awareness of what we think is a faulty narrative, we turn debasement on its head and consider its opposite: How would the US government go about rebasing the currency?

Debasing is a structural change to the dollar; thus, rebasing the dollar refers to resetting its value or structure. Here are a few ways the government could go about rebasing the dollar:

- Return To The Gold Standard: In 1971, President Nixon removed the currency from the gold standard. We would argue that was a true debasement. If we wanted to rebase the dollar, we could go back to a gold and or silver standard.

- Redenomination: This involves revaluing the currency by changing its nominal value. For example, the Treasury could state that one new dollar is equal to $100 old dollars.

- Pegging To A Commodity Or Asset: Similar to the gold standard, nations have valued their currency versus a commodity, a basket of commodities, or even other currencies. To rebase, we might peg the dollar to oil prices or the euro.

- Digital Currency: Rebasing could involve transitioning to a digital dollar with a new structure.

Now ask yourself: if the government is truly debasing the currency, are they really doing the opposite of any of the rebasing bullet points listed above? If your answer is no, the dollar is not getting debased.

What To Watch Today

Earnings

Economy

Market Trading Update

Yesterday, we touched on the earnings season and why the end-of-year run might be stronger than many think. The market is accelerating to the upside, posting the largest 4-day advance we have seen since the reversal of the "Liberation Day" selloff. However, with the market breaking out of the bullish trend channel and momentum triggering a new "buy signal," the bulls remain in control of the narrative for now.

However, given the sharp increase, it is wise to respect the expansion of growing risk levels in the market. My colleague Doug Kass wrote a great piece yesterday on the market backdrop, which makes some salient points.

"An epic 18-inning World Series game seems consistent with Monday's grandiloquent stock market rally. Despite unexceptional market breadth and high valuations, the S&P 500 has surged since Wednesday's close — with the best three-day skein in six months. Yesterday's market breadth was negative for both of the senior averages — with selected and anointed large-cap technology stocks contributing to all of the market's better-than-1% advance. This is a unique occurrence — something I have not anticipated."

"Valuations (though not a reliable timing tool) are getting more extended — with the Shiller CAPE hitting 41 for the first time since 2000 (and if we adjust for lower tax rates today, the CAPE is near 47(!):"

"The advance occurred despite a sticky inflation print late last week and signposts of slowing global economic growth. The Nasdaq and the S&P index had a full head of steam on Monday despite the S&P Short Range Oscillator well in overbought (4.96%).

I am basically at a loss for words. I and my cousin Sandy Koufax ("the left arm of God") and I applaud both games. But that was Monday, today is Tuesday — we are playing the "long game":

This is crucial commentary to consider. The markets are defying the odds, so to speak, for the time being. However, that will not always be the case. As such, we have to manage the market we have, not the one we want. That market is clearly bullish, and if we are going to experience a "melt-up," this seems to be a good start to one.

Therefore, manage your portfolio and risk accordingly, and pay attention to the game in front of us.

“Why does everyone talk about the past? All that counts is tomorrow’s game.” - Roberto Clemente

Trade accordingly.

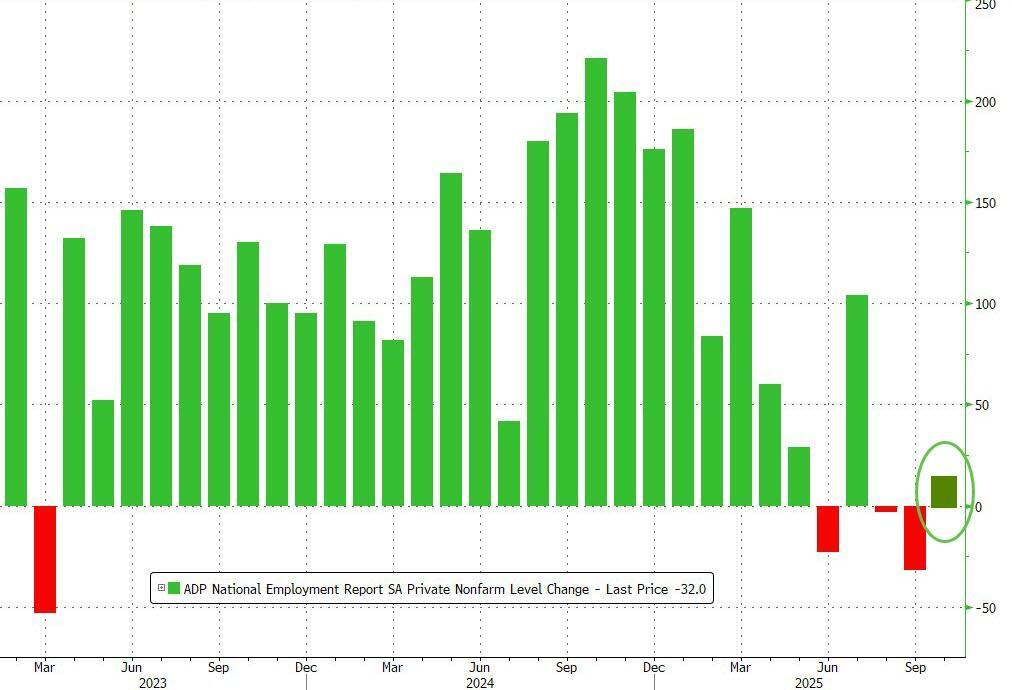

ADP's New Weekly Update Points To Continued Weakness In The Labor Market

On Tuesday morning, ADP announced it would release a weekly summary of its job data going forward. This will provide a more real-time measure of the labor market than their monthly comprehensive report. And with that announcement, ADP also provided the weekly update. Per ADP:

The preliminary U.S. estimate is an average increase of 14,250 jobs in the four weeks ending on October 11, 2025, according to the ADP National Employment

The following quote from its Chief Economist, Dr. Nela Richardson, better explains their motivation for more timely reporting, as follows:

For nearly two decades, we have provided our valuable labor market data to the public at no cost through the ADP National Employment Report. ADP's near real-time employment data, released weekly, will now provide an even clearer picture of the labor market at this critical time for the economy," said Dr. Nela Richardson, chief economist, ADP. "This high-frequency employment pulse, like the monthly National Employment Report, is based on ADP's anonymized and aggregated administrative data on private-sector payrolls, providing a dynamic view of job creation and loss at an unprecedented level of weekly detail."

The graph below, courtesy of ZeroHedge, shows the recent spate of weakness in the labor markets.

Want To Buy OpenAI?

OpenAI, the developer and manager of ChatGPT and other AI models, is a private company. Thus, becoming a shareholder for most non-institutional investors is near impossible. Given its significant earnings potential, investing in this company could prove fruitful. Although most individuals cannot become direct shareholders, they can own OpenAI indirectly. For instance, it was reported yesterday that Microsoft reached an agreement with OpenAI regarding its ownership stake. Under this new pact, Microsoft will now hold a 27% stake in OpenAI. Per the press release, the 27% ownership is valued at $135 billion. This puts OpenAI's valuation at around $550 billion. Nvidia is another investment option. The company intends to acquire a 25% stake in OpenAI through its $100 billion investment.

A shareholder can indirectly hold a substantial stake in OpenAI through Microsoft and Nvidia. However, while the benefits of holding OpenAI could prove significant for those companies, they already have many other sources of revenue and earnings. Thus, even if OpenAI proves to be an excellent investment for those companies, their shareholders may not necessarily benefit. The chart below, courtesy of SimpleVisor, shows that Microsoft opened up about 2.5% on news of the OpenAI arrangement.

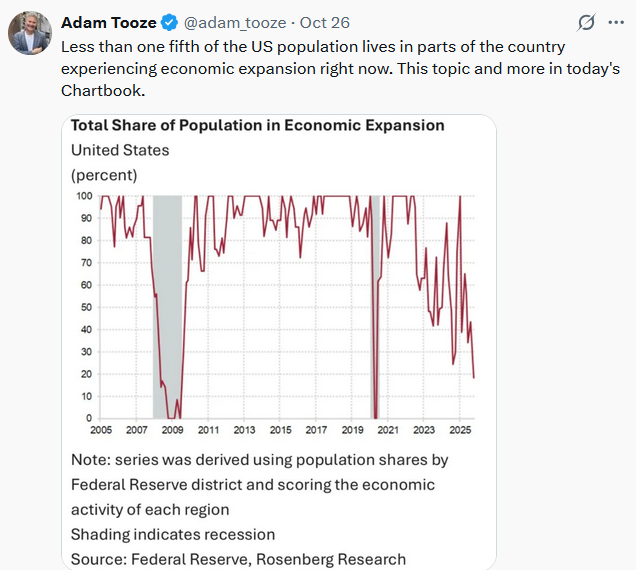

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post Rebasing The Dollar: Another Look At The Debasing Narrative appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter