This year, distributed ledger technology (DLT) continues to gain traction in capital markets, with institutions emphasizing asset mobility, digital tokens, and public blockchains to unlock new revenue streams and drive innovation, a new study by the International Securities Services Association (ISSA) found.

The study, conducted in collaboration with the ValueExchange, Broadridge, Accenture and Taurus, surveyed more than 420 respondents globally to track the evolution of DLT and digital assets, examining adoption trends, stakeholder perspectives, and ongoing developments in the sector.

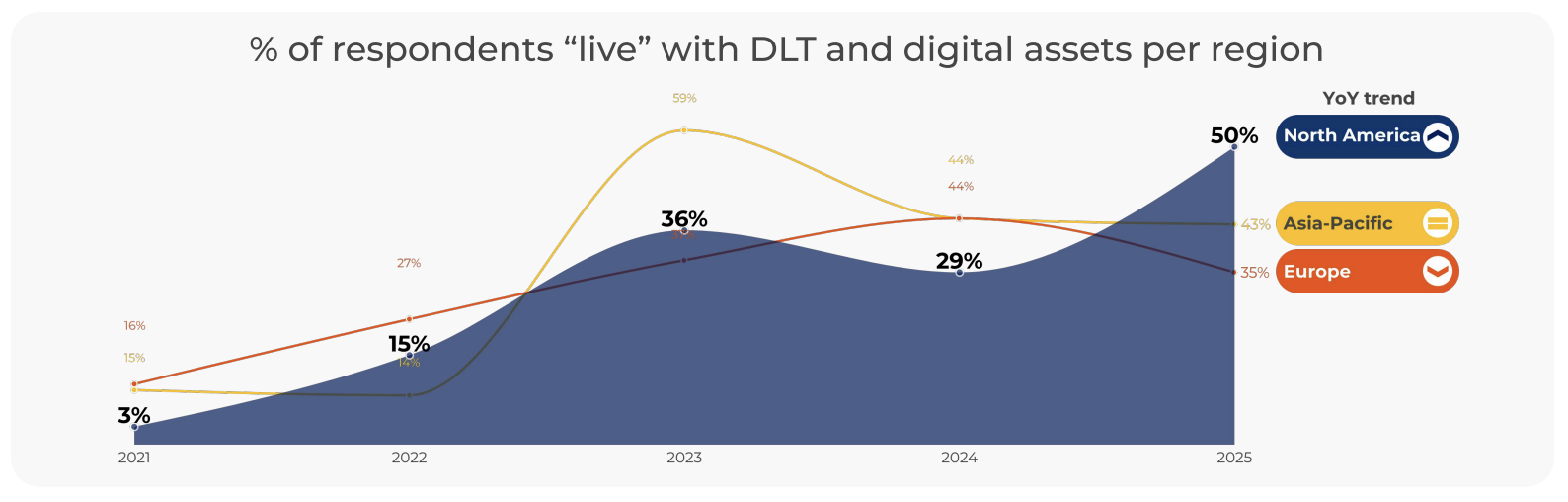

It found that in 2025, 36% of stakeholders had live DLT solutions, marking a 32-point increase from just 4% in 2020. North America is now the most the most active region for DLT and digital assets, with the share of respondents with live DLT and digital asset solutions rising 72% year-over-year (YoY) to reach 50%. This surge was propelled by a pro-crypto US Administration, new legislative action in the Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act), and a unified framework for digital assets from the Securities and Exchange Commission (SEC).

In contrast, momentum in Europe is slowing down, dipping to 35% in 2025 from 44% in 2024. Asia-Pacific (APAC), meanwhile, remains fairly stable at 43% in 2025, against 44% in 2024.

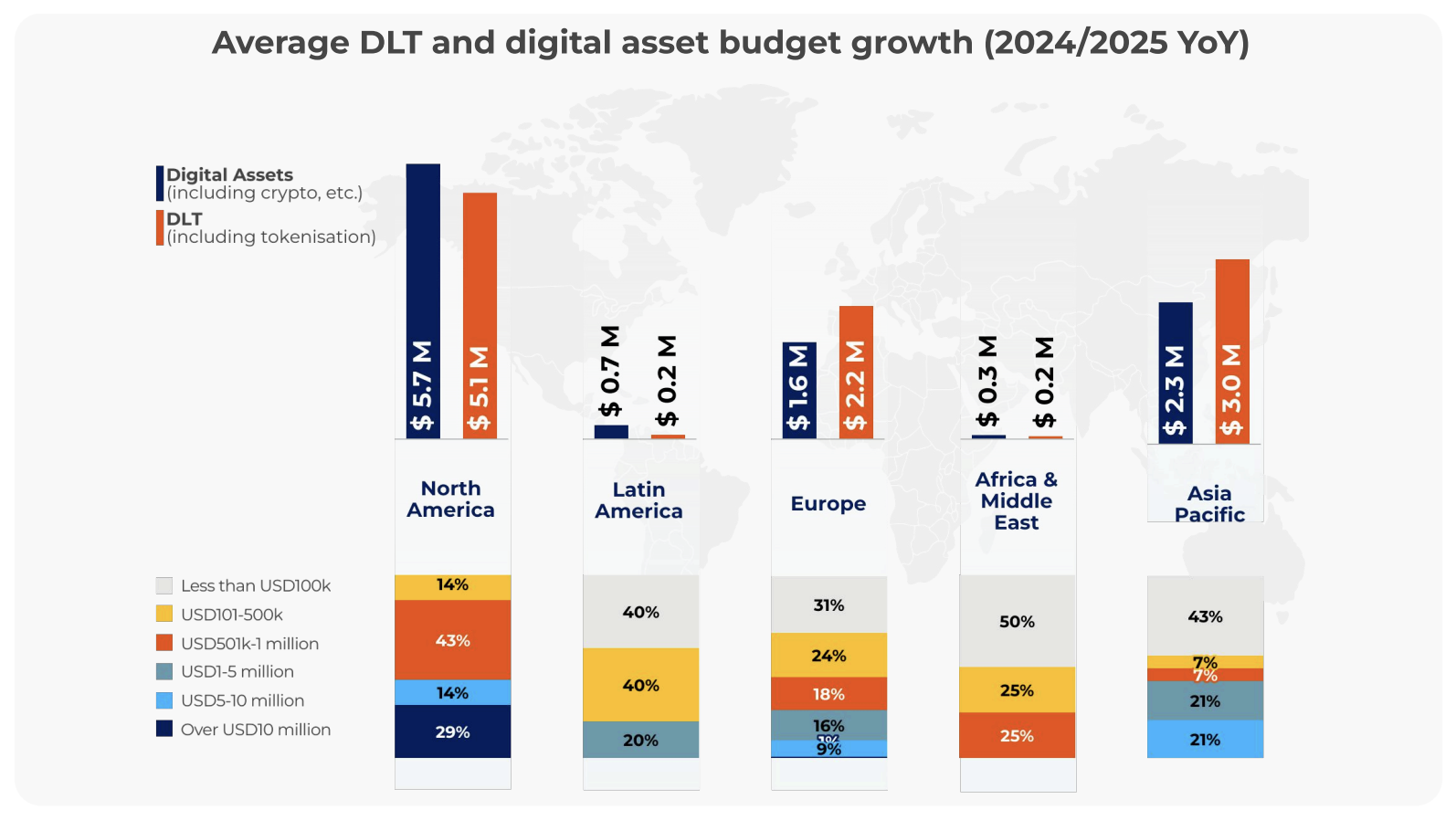

The report shows strong growth in investment in DLT and digital assets. Since 2020, global funding for DLT has tripled, with now an average of US$4 million being allocated to the technology globally. In 2025, annual spending increased 7% YoY globally.

North America now leads DLT and digital asset investment, spending more than Europe and APAC combined. In 2025, North America allocated an average of US$10.8 million on DLT and digital assets, against US$5.3 million in APAC, and US$3.8 million in Europe.

A focus on mobility and liquidity

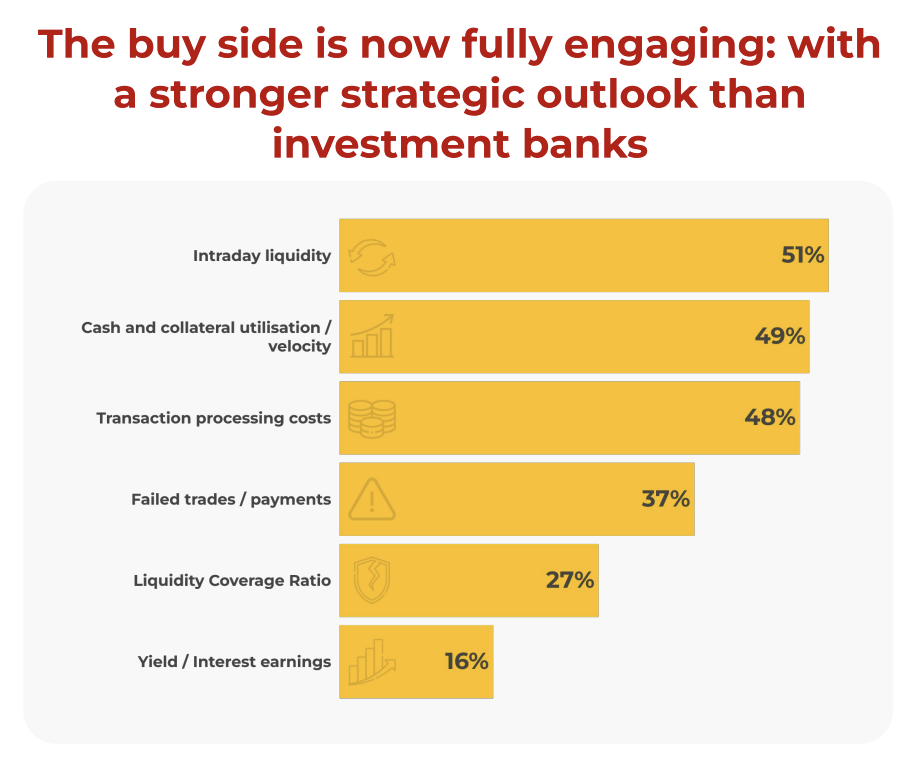

This year, market participants are prioritizing asset mobility. Among buy-side participants, including asset managers, hedge funds, and institutional investors, 51% see liquidity and the shift from overnight to intraday processing as the primary benefit of tokenization and digital cash.

Another 49% emphasized cash and collateral utilization, noting that faster collateralization can reduce financing costs and minimize the risk of over-allocating or locking up assets.

Operational costs are also a key focus, with 48% of respondents still looking to DLT to reduce transaction processing costs. This proves that operational efficiency still remains a core consideration of technology related development in capital markets.

Another key trend this year is the shift away from private blockchains and toward public blockchains. This move aims to avoid fragmented, isolated digital ecosystems.

This year, only 35% of respondents are planning private blockchain projects, down from 60% in 2022. In contrast, 65% are currently pursuing public blockchain initiatives, up from 40% in 2022.

Growing buy-side participation

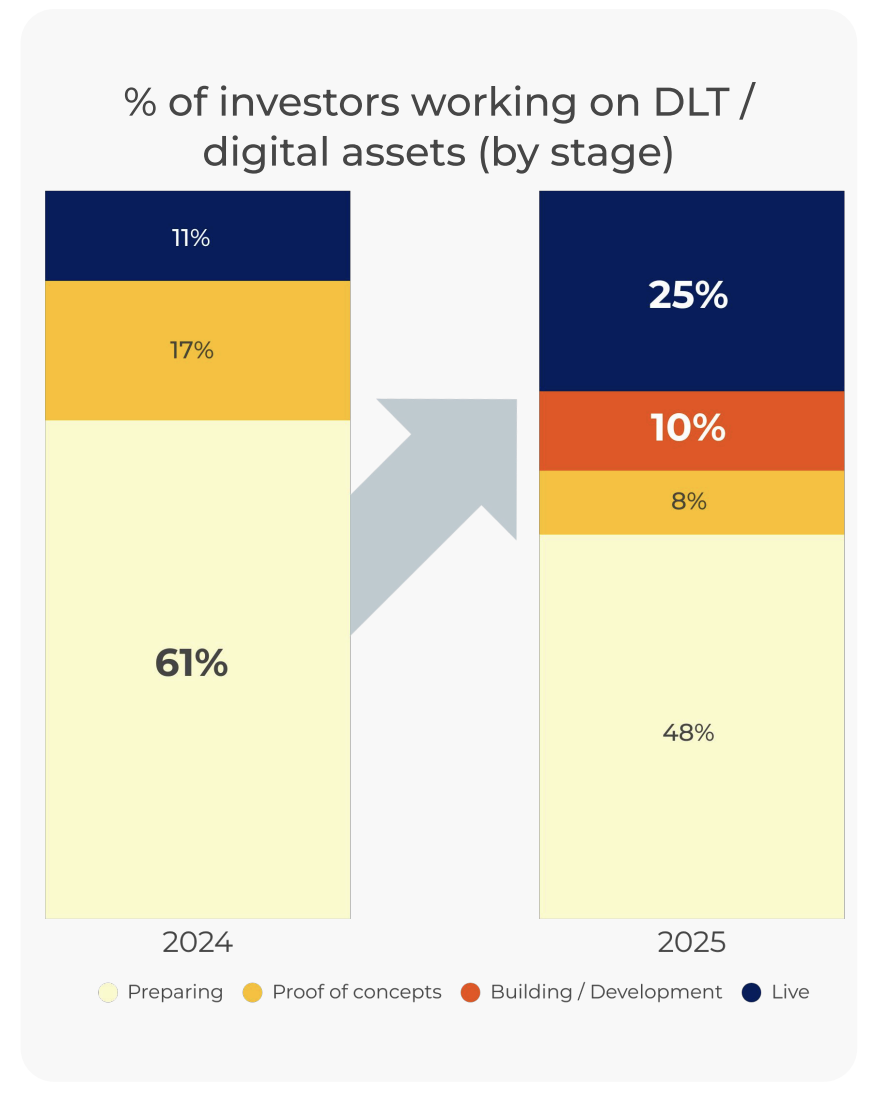

Another significant development is the growing participation of the buy side. In 2025, 25% of investors reported having live DLT and digital asset solutions, up from 11% in 2024. Another 10% were in the development phase, and 8% were conducting proofs of concept.

Beyond direct investments, buy-side firms are leveraging DLT to tokenize real-world assets (RWAs), including securities, funds, and bonds.

An example is the BlackRock USD Institutional Digital Liquidity Fund (BUIDL). BUIDL is a tokenized money market fund that invests in high liquidity, short-term debt instruments, including cash, US Treasury bills, and repurchase agreements. It allow investors to earn yield while holding the token on the blockchain.

Because the shares are tokenized, trades and transfers can happen on-chain anytime, enabling liquidity and 24/7 access. Furthermore, on-chain settlement avoids some of the delays or frictions in traditional fund share settlement, reducing cost and operational overhead. Finally, the on-chain nature also means that holdings, flows, and ownership are more visible than in many traditional setups, increasing trust and auditability.

Tokenized funds have surged dramatically, totaling US$8.4 billion in global tokenized fund assets under management (AUM) in September 2025, according to the Association for Financial Markets in Europe (AFME). This marks a significant 300% increase from US$2.1 billion in 2024,

Digital assets driving adoption

Another key trend outlined is increased focus on digital assets among both banks and investors. For banks and brokers, digital assets are creating new revenue streams across issuance, custody, trading, and more, with 44% of respondents already live with digital asset solutions.

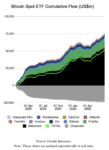

Investors, meanwhile, are embracing digital assets, with participation rising from 11% in 2024 to 30% in 2025. This growth is evidenced by new bitcoin funding products, tokenized funds, and the inclusion of cryptocurrencies in wealth investing.

A survey of 352 institutional investors conducted by Coinbase, in collaboration with EY-Parthenon practice, found that a remarkable 86% of the respondents had exposure to digital assets in January 2025, or planned to make digital asset allocations during the year. Nearly 70% viewed cryptocurrencies as the biggest opportunity to generate attractive risk-adjusted returns.

The study also revealed expanding participation in crypto markets, including decentralized finance (DeFi) use cases such as staking, lending, and derivatives, underscoring the growing sophistication and diversification of institutional strategies within the digital asset ecosystem.

Featured image: Edited by Fintech News Switzerland, based on image by thanyakij-12 via Freepik

The post DLT Adoption Accelerates in Capital Markets, With Growing Focus on Digital Assets, Public Blockchains appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Full story here Are you the author? Previous post See more for Next postTags: Blockchain,Capital Markets,Featured,newsletter