Swiss bank Credit Suisse, which was taken over by rival UBS, has lost a lawsuit in the United Kingdom against the Japanese investment group Softbank over claims related to Greensill funds. + Get the most important news from Switzerland in your inbox Credit Suisse had been seeking damages from Softbank totalling $440 million (CHF350 million). The London High Court dismissed the claim in a judgement published on Wednesday. Several media outlets first reported on the case on Wednesday evening. The legal dispute concerned claims by the Greensill funds against the now insolvent American construction company Katerra. In the lawsuit, Credit Suisse alleged that Softbank, as Katerra's main investor, had profited from a restructuring of Katerra debt and thus damaged the bank. A Softbank spokesperson told the news agency Reuters that the judgement "fully vindicates Softbank". The accusations were an "unfounded attempt to shift the blame onto others", the spokesperson added. + UBS offers to ...

Full story here

Are you the author?

Previous post

See more for

Next post

Tags: Featured,newsletter

Home › 3) Swiss Markets and News › 3.) Swissinfo Business and Economy › Credit Suisse loses Greensill lawsuit against Softbank

Previous post

Next post

Credit Suisse loses Greensill lawsuit against Softbank

Published on October 16, 2025

Permanent link to this article: https://snbchf.com/2025/10/credit-suisse-greensill-lawsuit-against-softbank/

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

15 days ago -

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Epstein Files: Verschwörungen werden wahr!

-

Coca-Cola Silver: 4 Limited Edition Bars and Rounds (.999 Fine)

Coca-Cola Silver: 4 Limited Edition Bars and Rounds (.999 Fine) -

Let’s Get a Little Perspective!

Let’s Get a Little Perspective! -

Jetzt knallt es im Iran! (Insiderwissen enthüllt)

Jetzt knallt es im Iran! (Insiderwissen enthüllt) -

Swiss companies employ AI tools for social media strategies

Swiss companies employ AI tools for social media strategies -

New Swiss electric cars regain traction but miss targets

New Swiss electric cars regain traction but miss targets -

Sunday’s Election Prospects Weigh on the Yen

-

Enthüllt: Zensur & Wahlmanipulation der EU!

-

Swiss retail trade stagnated in 2025

Swiss retail trade stagnated in 2025 -

The turbulent times of Swiss chocolate maker Barry Callebaut

More from this category

Swiss companies employ AI tools for social media strategies

Swiss companies employ AI tools for social media strategies4 Feb 2026

New Swiss electric cars regain traction but miss targets

New Swiss electric cars regain traction but miss targets4 Feb 2026

- Sunday’s Election Prospects Weigh on the Yen

4 Feb 2026

Swiss retail trade stagnated in 2025

Swiss retail trade stagnated in 20254 Feb 2026

- The turbulent times of Swiss chocolate maker Barry Callebaut

4 Feb 2026

Japan Is Normalizing: Risks To The Yen Carry Trade

Japan Is Normalizing: Risks To The Yen Carry Trade4 Feb 2026

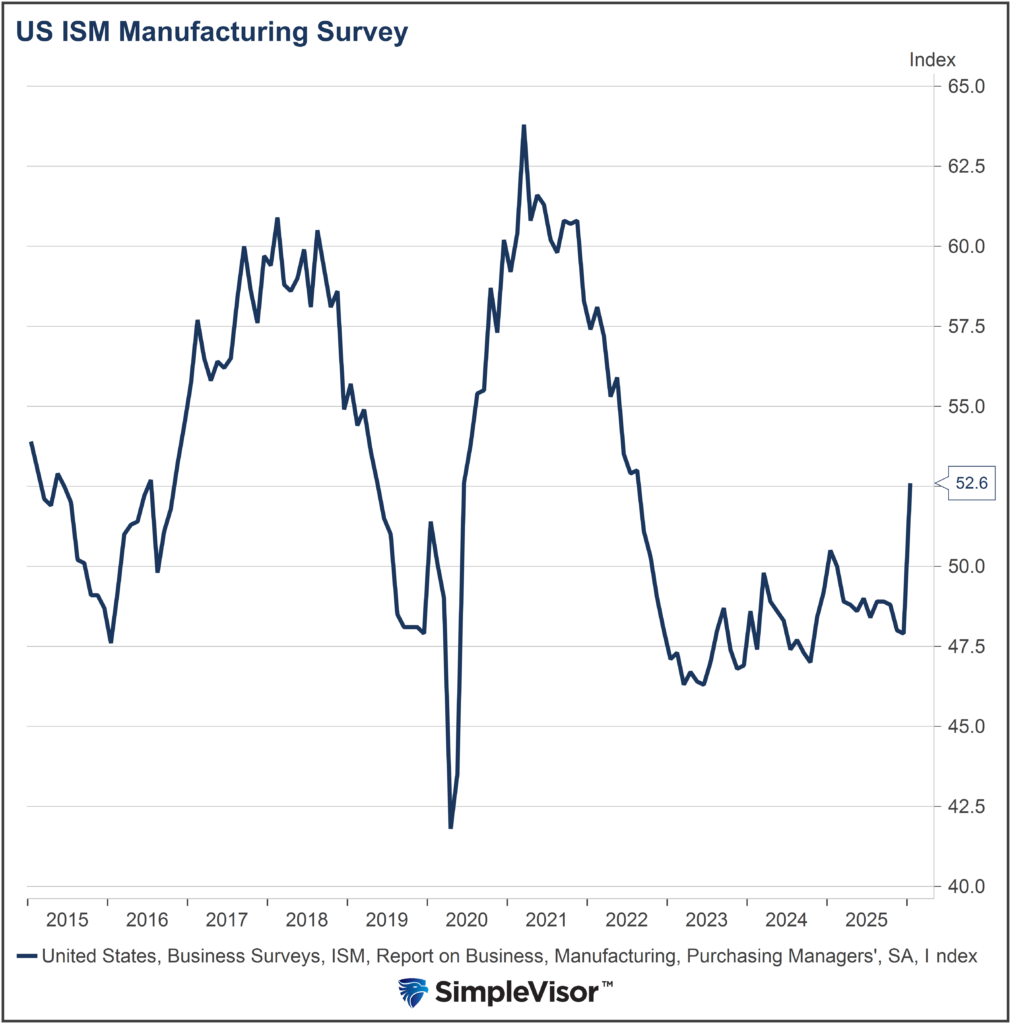

ISM Manufacturing Supports Reflationary Forecasts

ISM Manufacturing Supports Reflationary Forecasts4 Feb 2026

Novartis revenues slowed in last quarter of 2025

Novartis revenues slowed in last quarter of 20254 Feb 2026

US Senate probes 890 alleged Credit Suisse Nazi-linked accounts

US Senate probes 890 alleged Credit Suisse Nazi-linked accounts4 Feb 2026

Swiss bank UBS posts bumper 2025 profits

Swiss bank UBS posts bumper 2025 profits4 Feb 2026

New Nestlé boss plots strategic overhaul to reignite growth

New Nestlé boss plots strategic overhaul to reignite growth4 Feb 2026

Swiss NGO urges Bern to raise its climate ambition as US walks away from accords

Swiss NGO urges Bern to raise its climate ambition as US walks away from accords4 Feb 2026

Reserve Bank of Australia Hikes Rates and Sees Another this Year

Reserve Bank of Australia Hikes Rates and Sees Another this Year3 Feb 2026

Private Credit Funds Falling Out Of Favor

Private Credit Funds Falling Out Of Favor3 Feb 2026

Swiss solar rail project sharing know-how with France

Swiss solar rail project sharing know-how with France2 Feb 2026

Monday Blues: Precious Metals are Less Precious

Monday Blues: Precious Metals are Less Precious2 Feb 2026

Zurich plans hub for sustainable transport routes

Zurich plans hub for sustainable transport routes2 Feb 2026

Audience figures remain stable at Swiss public broadcaster RTS

Audience figures remain stable at Swiss public broadcaster RTS2 Feb 2026

The Market Cycles Potentially Driving 2026 Returns

The Market Cycles Potentially Driving 2026 Returns2 Feb 2026

Warsh To Head The Fed

Warsh To Head The Fed2 Feb 2026