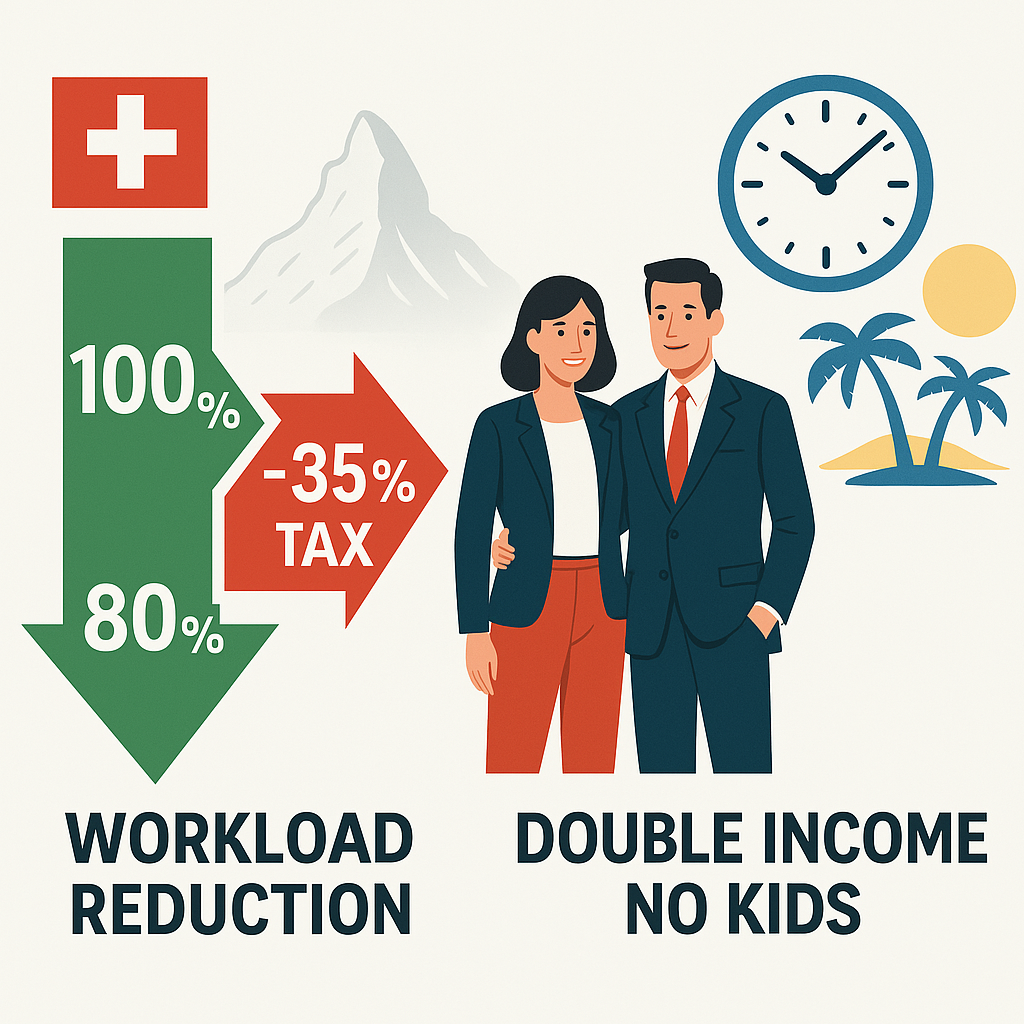

Reducing workload from 100% to 80% leads to a smaller proportional drop in after-tax income than in gross income. That’s a powerful financial lever for those considering part-time work:You’re “buying back time” at a discount, thanks to tax savings.

Reducing workload from 100% to 80% leads to a smaller proportional drop in after-tax income than in gross income. That’s a powerful financial lever for those considering part-time work:You’re “buying back time” at a discount, thanks to tax savings.

Income and Base Data

Let’s imageine the following situation. A married couple living in the city of Zurich. The wife is 45 years old with a gross annual income of CHF 150’000, and the husband is 50 years old with a gross annual income of CHF 140’000. Their combined net worth is CHF 500’000. Neither spouse is affiliated with a religious institution.

| Gross Income | |

| Wife, income, Age 45 | 150’000 |

| Husband, income, Age 50 | 140’000 |

| Net Worth | 500’000 |

| Town | Zurich |

| Status | Married |

| Religion | Other/None |

Main Deductions from Gross Salary in Switzerland

| Deduction Type | % of Gross (Approx.) | Notes |

|---|---|---|

| AHV/IV/EO (Pension/Disability) | ~5.3% | Mandatory old age and disability insurance |

| ALV (Unemployment Insurance) | ~1.1% – 2.2% | On income up to CHF 148’200 (2024); surcharge above this |

| BVG (Pension fund, 2nd pillar) | ~7% – 18% | Depends on age and pension scheme; starts from insured salary (not full gross) |

| Accident Insurance (NBU) | ~1% – 2% | Non-occupational accidents; paid by employee |

| Withholding Tax (if applicable) | Varies by canton and income | Applies to foreigners without a C-permit |

| Income Tax (if taxed at source or directly) | Varies | Federal + cantonal + municipal levels |

Net Income Calculation before Tax

Married Couple in Zurich (2024)

In the following the standard deductions are applied

| Category | CHF (Annual) | Explanation | Deducted by | Paid by.………………… |

|---|---|---|---|---|

| Gross Income (Combined) | 290’000 | 290’000 | ||

| AHV/IV/EO (5.3%) | ~15’370 | AHV/IV/EO are Swiss social insurances for retirement, disability, and income loss. Both employer and employee each pay ~50% | Employer | Employee and Employer |

| ALV (1.1%) | ~3’200 | ALV is Swiss unemployment insurance. It covers job loss. Employer and employee each pay 1.1%. | Employer | Employee and Employer |

| BVG (2nd Pillar, est. 14–18%) | ~36’000 – 45’000 | BVG is the Swiss occupational pension (2nd pillar). It builds retirement savings beyond AHV. | Employer | Employee and Employer |

| NBU (Accident Insurance, ~1%) | ~2’900 | NBU (Non-occupational accident insurance) covers accidents outside work (e.g., at home or during sports). | Employer | Employee and Employer |

| Pillar 3a Contributions | 14’112 | Pillar 3a is a voluntary private retirement savings plan in Switzerland. It offers tax benefits: contributions reduce taxable income, therefore included here for both (up to 7056 per person) | Employee within tax declaration |

Employee |

| Total Deductions | ~71’582 – 80’582 | Total Deductions (no taxes) | ||

| Net Yearly Income | ~209’418 – 218’418 | Net Yearly Income Before Tax | ||

| Net Monthly Income | ~17’450 – 18’200/month | Net Monthly Income Before Tax |

- Exact tax depends on deductions (e.g. work expenses, health insurance premiums), but these estimates are typical.

- The BVG (pension fund): Estimated range based on typical company schemes for ages 45–50 (employee share only).

- Beware that in Switzerland, unlike most European countries, health insurance is not deducted from salary and not included here.

Tax Calculation

We will take the average yearly net income of 213‘918 (CHF 17’826/month) from above and put into the Swiss tax calculator.

Workload reduction from 100% to 80% workload for a married couple in Zurich City without kids (2024):

| Category ———————————– |

100% ——————— |

80% ——————— |

Difference ——————— |

Drop in % ——————— |

Marginal Tax Rate (80% → 100%) |

|---|---|---|---|---|---|

| Taxable Income | 213’913 CHF | 171’130 CHF | –42’783 CHF | –20.0% | – |

| Total Tax Burden | 41’209 CHF | 26’775 CHF | –14’434 CHF | –35.0% | 33.7% |

| └ Federal Tax | 11’004 CHF | 5’453 CHF | –5’551 CHF | –50.5% | 13.0% |

| └ Cantonal Tax | 13’619 CHF | 9’607 CHF | –4’012 CHF | –29.5% | 9.4% |

| └ Communal Tax | 16’538 CHF | 11’667 CHF | –4’871 CHF | –29.5% | 11.4% |

| └ Church Tax | 0 CHF | 0 CHF | 0 CHF | 0.0% | 0.0% |

| └ Wealth Tax | 48 CHF | 48 CHF | 0 CHF | 0.0% | 0.0% |

| Tax as % of Income | 19.26% | 15.65% | –3.61 pts | –18.7% | – |

| Work Days for Taxes | 70 days | 56 days | –14 days | –20.0% | – |

| Marginal Tax Rate – Income | 34.7% | 31.6% | –3.1 pts | –8.9% | – |

| Marginal Tax Rate – Wealth | 0.21% | 0.21% | 0 pts | 0.0% | – |

| Annual Net Income – Taxpayer1 | 113’000 CHF | 90’400 CHF | –22’600 CHF | –20.0% | – |

| Annual Net Income – Taxpayer2 | 100’913 CHF | 80’730 CHF | –20’183 CHF | –20.0% | – |

| Net Worth | 500’000 CHF | 500’000 CHF | 0 CHF | 0.0% | – |

✅ 1. Income Drops by 20%, but Taxes Drop More Sharply

- When both partners reduce their workload from 100% to 80%, taxable income drops by 20% (CHF 42’783).

- However, the total tax burden drops by 35% (CHF 14’434) — thanks to Switzerland’s progressive tax system.

- 💡 Key insight: The system “softens” income loss by taxing less proportionally at lower income levels.

💸 2. Effective Tax Rate Falls from 19.26% to 15.65%

- You now pay 3.61 percentage points less of your income in taxes.

- In practical terms, you get to keep more of each earned franc at 80% workload.

🧾 3. Federal Tax Is Highly Progressive

- Federal tax is where you save the most: a 50.5% drop, which makes up ~38% of the total tax savings.

- This aligns with your marginal income tax rate dropping from 34.7% → 31.6%.

🏛️ 4. Cantonal and Communal Taxes Decrease by ~29.5% Each

- Still significant, but less progressive than federal tax.

- Communal tax remains the largest slice of the pie in both scenarios.

📅 5. You Work 14 Fewer Days “for the State”

- At 100% workload, 70 days/year go to paying taxes.

- At 80%, that number drops to 56 days.

- 💡 This is a helpful psychological and practical framing when considering part-time work.

⚖️ 6. Marginal Tax Rate for the Last CHF Earned Is ~34%

- Your marginal rate (calculated as the tax paid on the extra income) is 33.7% — confirming that <

Tags: Featured,newsletter