If one weren't paying attention to the cryptocurrency market, one would think that all cryptocurrencies were doing well. For instance, meme coins are all the rage, and Bitcoin has been up about 50% since the election. Donald Trump and his pro-crypto rhetoric help explain the rally. Moreover, Trump has nominated pro-crypto people to serve important financial roles within his administration. However, while most cryptocurrencies do very well, Ethereum is struggling. The graph below shows that Bitcoin (orange) and Ethereum (blue) have tracked each other closely for the last few years. However, ethereum has grossly underperformed Bitcoin since early December.

The graph on the right helps explain the irregular divergence. It shows that short positions in Ethereum are surging. We have yet to find a good rationale for the short positions. In fact, Eric Trump recently tweeted: "Its a great time to add ETH." Moreover, it is now less likely that Ethereum will be classified as a security by the SEC under Trump. The Kobeissi Letter tries to explain the record short positions as follows:

Potential reasons range from market manipulation, to harmless crypto hedges, to bearish outlook on Ethereum itself. However, this is rather strange as the Trump Administration and new regulators have favored ETH.

We have not found an acceptable answer other than speculation. While we don't follow crypto closely, we think a short squeeze could be in the cards for Ethereum.

What To Watch Today

Earnings

Economy

Market Trading Update

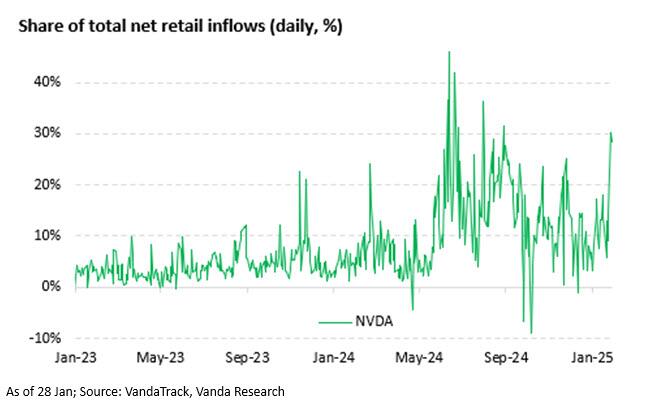

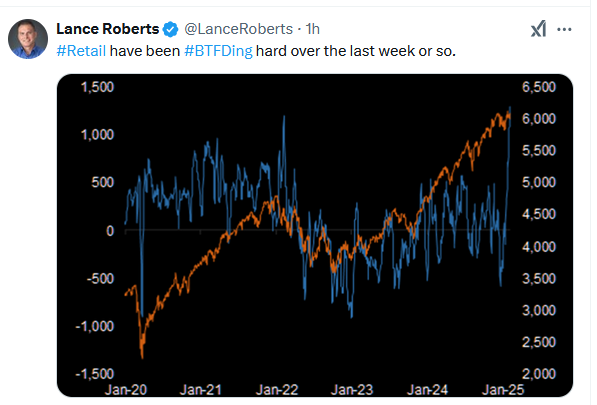

Yesterday, we noted that retail investors have been piling into equity risk lately, particularly in stocks like Nvidia (NVDA), using the pullback to gain exposure. To wit:

"The market defies more negative news because retail investors continue to step in and “buy the dip.” In our recent Bull Bear reports, we discussed the push by retail investors, but looking at retail sentiment is quite remarkable. Since the pandemic, retail investors have never been this bullish on the stock market. At the same time, their optimism about stock market returns is supported by putting their money where their mouth is."

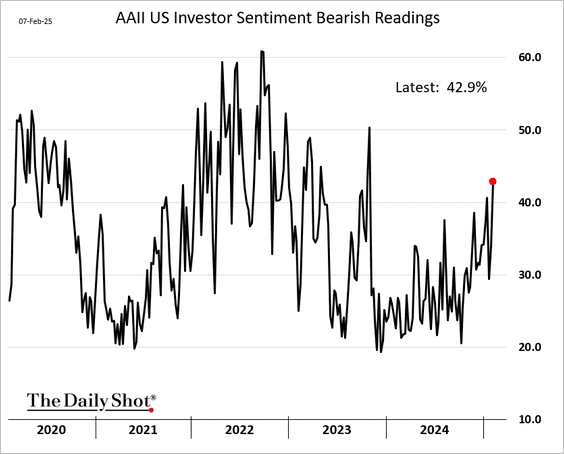

Interestingly, at the same time, they are piling into equity risk and becoming more negative (sentiment-wise) about the market. The chart shows the American Association of Individual Investors (AAII) "bearish sentiment" index. Currently, retail investors are the most bearish they have been in the last two years.

It is an interesting dichotomy that currently exists. Retail investors are afraid of the stock market but are more afraid of "missing out" on further gains. It is worth noting in the chart above that in 2021, bearish sentiment was rising even as the stock market was screaming higher. Then, like today, investors were afraid of missing out on gains. While it is certainly possible the market can continue higher in the near term, with bearish sentiment rising further, such suggests that we may be nearing at least a short-term market peak.

With the market continuing to hold critical support levels, there is little reason to be overly cautious. However, we have seen these divergences previously. Those divergences often suggested increasing risk management protocols, rebalancing allocations, and increasing cash levels. Does that mean selling everything today? No. But just like when you are driving extremely fast, it might be worth tapping the brakes a bit before cresting the next hill. You never know if the police are waiting on the other side.

Seeking Small Cap Value

Last Friday's Commentary, Small Cap Stocks Are Offering Outsized Returns, shared a Wall Street Journal article showing how the undervalued small cap sector could outperform larger cap stocks. We warned readers that large-cap stocks outperformed due to their better growth prospects than smaller-cap stocks. However, we noted that there are profitable small-cap stocks with strong growth expectations. To wit:

The risk of blindly following the analysis is that it does not account for potential growth. The large-cap indexes have a more significant concentration of technology companies growing faster than the economy than small-cap indexes. Conversely, the small-cap index has greater contributions from companies growing at or less than the economy’s growth rate. The takeaway for investors is to do their homework. If you prefer small caps, find the profitable ones with robust expected growth rates. For those leaning toward small-cap stocks, the profitable with growth subset will offer the best rewards versus large-cap stocks.

A reader asked how he might find such small-cap stocks. SimpleVisor has a stock screening tool built to meet this task. Below, we created a simple screen looking for deep-value stocks with low PEG ratios. The table below shows five such companies. The analysis should provide a foundation for further research.

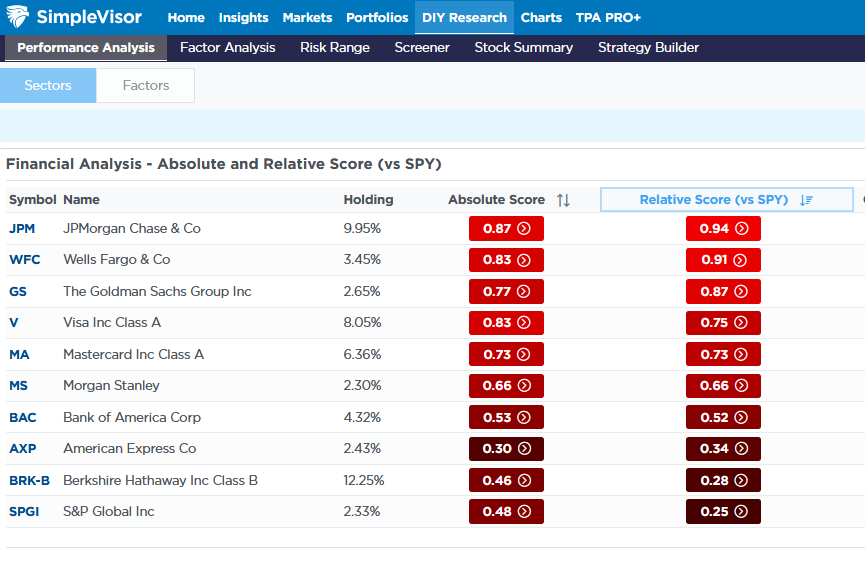

Financials Lead The Way

The easing of financial regulation, including letting banks get more involved in cryptocurrencies and the possible ending of the Consumer Financial Protection Bureau (CFPB), is greatly helping bank stocks. JPM shares as shown in the SimpleVisor analysis, are benefiting the most. The first graphic shows that financial stocks are now the most overbought sector. While the overall relative and absolute scores are not too high, some of its components are. The second graphic shows that JPM and WFC have extremely high relative scores of over 90. Their absolute scores are slightly lower but very high. The sector may stay strong due to the deregulation but, on a relative basis, may give up a little ground as it is grossly overbought.

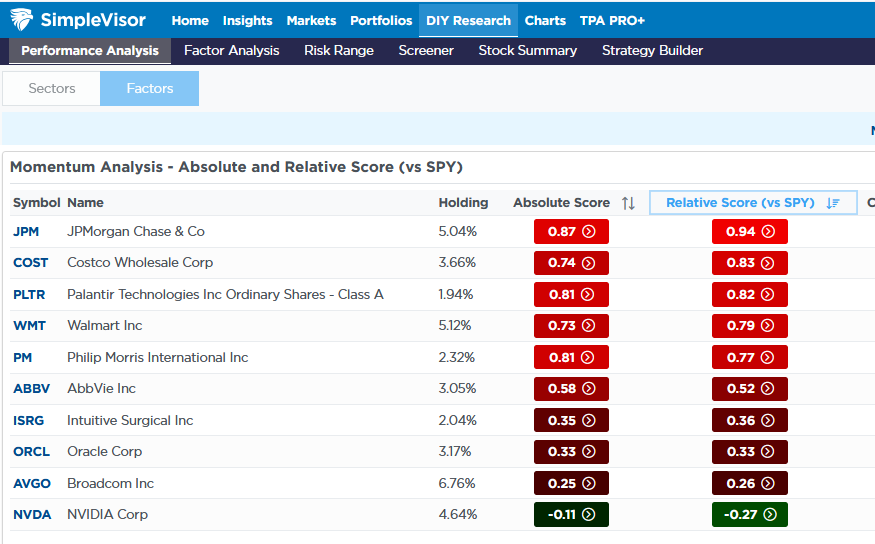

The third graphic shows that the momentum (MTUM) ETF is being led by JPM and other large-cap stocks not in the Magnificent Seven. This helps explain why the equal-weighted S&P 500 has outperformed the commonly followed market cap-weighted S&P 500.

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post Ethereum Falters Due To Massive Short Positions appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter