PitchBook has released its Q4 2024 Crypto VC Trends Report, providing an overview of venture capital investment in the cryptocurrency sector.

The report highlights key trends across blockchain infrastructure, Web3, decentralised finance (DeFi), and AI-driven decentralised systems.

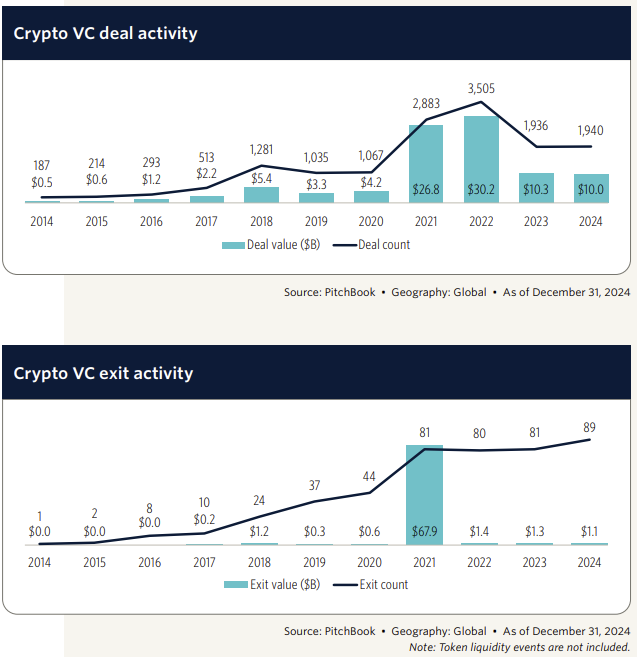

Crypto venture funding saw a modest recovery in the fourth quarter, increasing by 13.6% compared to the previous quarter.

Deal value rose from US$2.2 billion in Q3 to US$2.5 billion in Q4.

However, the number of deals continued to decline, falling from 411 to 351, a 14.6% drop.

For the full year, total crypto VC investment reached US$10 billion across 1,940 deals, close to the US$10.3 billion recorded in 2023.

This stability reflects the sector’s resilience despite macroeconomic pressures and regulatory uncertainty, particularly in the United States.

Funding remained concentrated on projects focused on infrastructure, scalability, interoperability, and developer tools.

Interest in decentralised AI continued to grow, a trend that gained momentum in mid-2024, attracting both crypto-native and traditional investors.

Mergers and acquisitions activity continued in Q4, though at a slower pace compared to earlier in the year.

Acquisitions focused on exchanges, custodians, and decentralised identity platforms, with buyers prioritising complementary technologies rather than simply acquiring smaller competitors.

Robert Le, Senior Emerging Technology Analyst at PitchBook, said:

“In 2024 overall, crypto VC investments demonstrated resilience and adaptability, even as the market contended with macro uncertainty and ongoing regulatory flux, particularly in the US. Valuations soared at the seed and early-stage levels, thanks to investor appetite for high-potential projects in areas such as highly performant blockchains, stablecoins, and tokenisation.”

“Late-stage companies often opted for slightly smaller rounds, balancing growth needs with a more guarded funding environment. In 2025, we anticipate further consolidation among infrastructure providers, exchanges, and custody solutions, along with continued investor focus on next-generation protocols and AI-driven innovation.”

“Although 2024 funding did not match the peak exuberance of the prior few years, its steady totals, robust valuations, and strong interest in emerging subsectors reflect a maturing market that remains poised for long-term growth.”

Featured image credit: edited from freepik

The post Crypto VC Funding Remains Steady at US$10B in 2024 appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Full story here Are you the author? Previous post See more for Next postTags: Blockchain,Featured,funding,newsletter