On Monday, the S&P 500 officially made a round trip back to the same levels as election eve. The equity rally that kicked off when Donald Trump won the election has been erased. The financial media blames the recent dump on prospects for wide-reaching tariffs and other policies. The reality is that higher bond yields are the predominant culprit.

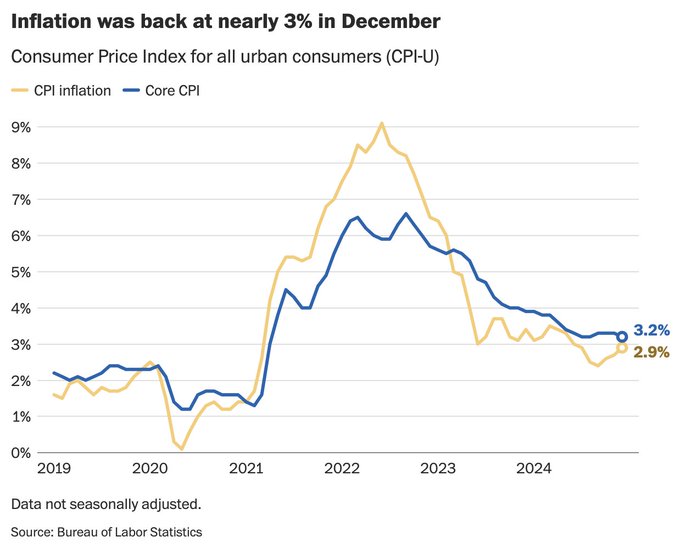

The combination of high stock valuations and the growing potential for economic weakness due to higher interest rates makes equity investors skittish. Since the election, market expectations for rate cuts have been dwindling. Fed Funds futures were expecting at least four rate cuts in 2025. Today, the odds are split between one and two rate cuts. Furthermore, the Fed finds itself in handcuffs due to the recent stickiness of inflation readings and the growing inflation resurgence narrative.

As shown below, the S&P 500 (SPY) closed the gap created by the surge following the election. Gaps are frequently filled before a trend can resume. Therefore, the Trump bump may be back in play. However, a break below the gap may signify more dumps to come.

What To Watch Today

Earnings

Economy

Market Trading Update

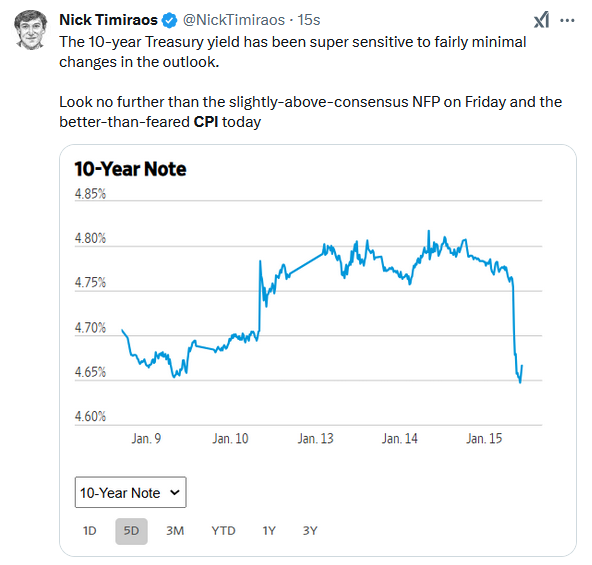

As we noted yesterday, an inline or better CPI report would likely lead to a sharp rebound in the market. Such is precisely the case, and the market had been hinting for the past couple of days that such was likely going to be the case with a steady increase in money flows as the market held support at the 100-DMA. Combined with fairly negative sentiment and a decently oversold condition, the market was prime for a strong reflexive rally; just a catalyst was needed.

Interestingly, I published the following chart a few days ago, in which I laid out the pathway for a reflexive rebound back to overhead resistance. As shown, the market is currently trading that path very well. Currently, the market is testing the upper end of that trading range and is wrestling with the combined resistance of the 20- and 50-DMA. The MACD is also starting to turn up, which is encouraging, along with a positive turn in money flows. If the market can rally again tomorrow and clear that downtrend resistance, the rally should be able to continue into next week.

However, with that said, there is still a good bit of underlying concern in the market short-term, so use this rally to rebalance risk and exposures as needed. With earnings season upon us, the market could get some additional support overall, but we could see increased volatility in individual issues based on "hits" or "misses." Plan and make adjustments so you are not having to react after the fact.

CPI Gives Bonds A Reprieve

The CPI report came in slightly weaker than expected. The headline monthly increase of +0.4% aligns with expectations. However, core CPI, the Fed's preferred CPI reading, only rose 0.2%, a tenth below expectations. While bond yields are trending higher to inflationary concerns, they did provide a reprieve on the favorable inflation news. Furthermore, the CPI further affirms Tuesday's PPI data, which was also slightly below expectations.

The bond market's reaction to the CPI print was positive, with bond yields falling over 10bps. However, we must be careful not to mistake what may only be a bounce with a prolonged rally. We would love to tell you bond yields have peaked, but we would do so with little confidence. We will likely need a few months of tame inflation and weaker economic news to gain confidence. Furthermore, more talk of deficit reduction from Donald Trump would go a long way.

Technical Analysis Is Not Voodoo

If you draw enough lines on a stock chart, one of them is bound to predict the future accurately! Given that technical analysis is perfect in hindsight and flawed in foresight, many investors mock it as arbitrary. Some, like Aaron Brown, link its practice with horoscopes, tarot cards, and crystal balls.

The difference between science and voodoo is rigorous, systematic, skeptical testing. If by “technical analysis” you mean the standard charting dogmas, with constant exceptions to explain every missed prediction, it’s pure voodoo.- Aaron Brown.

Technical analysis is one of many tools we use to manage clients’ wealth. While inconsistent, as with every forecasting model, it is the best means for quantifying investors’ collective behaviors. Simply, historical price and volume data provide a critical context for price levels likely to motivate buyers and sellers.

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post The Trump Bump And Dump appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter