The latest CPI inflation news was OK. The 0.4% headline increase is higher than in prior months but aligns with expectations. Core CPI, excluding food and energy, is .1% lower than the consensus at .2%. The report relieved Wall Street as it did not show a resurgence in inflation. Stocks and bonds are trading much better on the data. However, digging deeper into the report, one will find that CPI may be much better than OK. In particular, there are two things worth appreciating.

CPI, like most other economic reports, is seasonally adjusted. Thus, it is subject to errors due to poor seasonal comparisons from year to year. Marko Bjegovic (@MBjegovic) digs into the non-seasonally adjusted (NSA) CPI data and finds excellent inflation news. To wit:

However, on an NSA basis, core CPI was only +0.02% MoM, the coolest read since Dec 2020. Let me repeat this, core CPI is the weakest in 4 years. Yes, I am talking about NSA and not SA data but when we are talking multiple years, it essentially doesn't matter. I would actually argue that the NSA carries a much better signal than the SA.

The second point, which we discuss routinely, is the lag in CPI shelter prices. Marko continues:

The best part is that this happened with Shelter still well distorting the whole picture (+0.24% MoM NSA vs -0.6% ALNRI), so if we would have actual rents here (and not imputations that have little to do with actual rent inflation), the core CPI figure would be among TOP 5 LOWEST ON RECORD.

ALNRI is the Apartment List National Rent Index. Its latest report shows rents fell by 0.6% in December and year-over-year. As Marko points out, CPI was much better than OK.

What To Watch Today

Earnings

- No earnings releases today.

Economy

- No economic reports today.

Market Trading Update

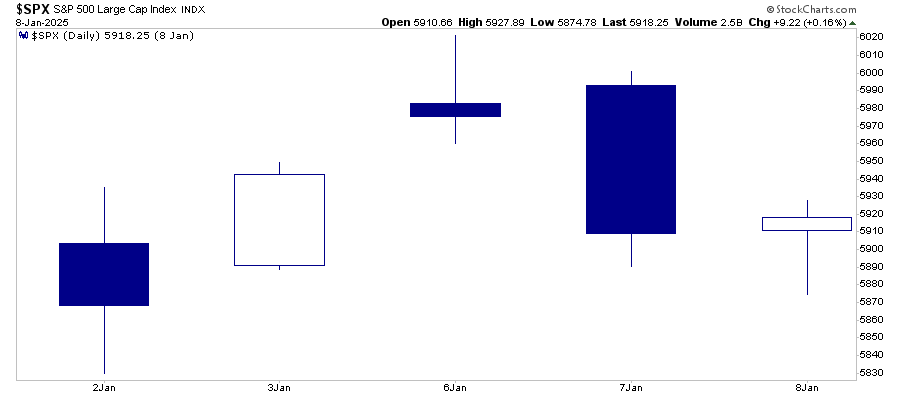

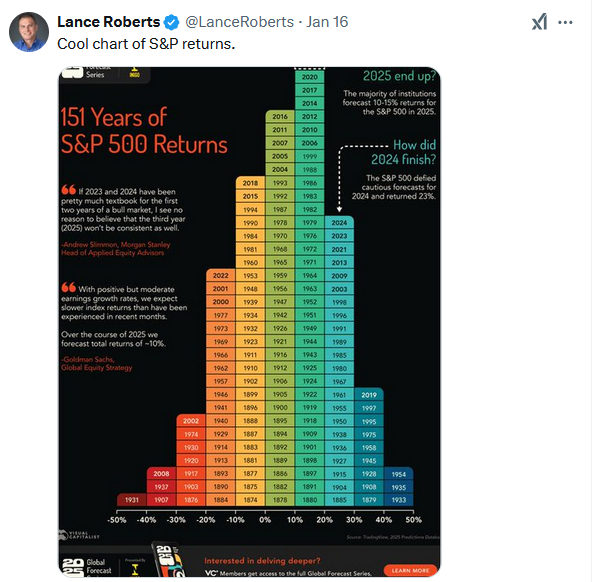

Last week, we noted that while closely watching how the full month of January will turn out, we did generate a positive return during the first five trading days.

"As of Wednesday, which concluded the first five trading days of January, that market did generate a positive return, rising about 0.62%"

As discussed, that was the first of two "January Indicators" that have historically, on average, set the tone for the year.

"Since 1950, the S&P 500 has logged net gains during the first five days of the year 47 times. Of those 47 instances, the index ended the year up in 39 of them. That's an 83% success rate for the first five-day theory. However, don't get too excited. Of the 74 completed years since 1950, the S&P 500 has logged a full-year gain 73% of the time. That is likely because stocks are rising as the growth of the global economy continues despite the occasional stumble."

However, following the first five days, the market stumbled to test support at the 100-DMA. As we noted in last week's newsletter:

"Amost every sector and market, except for Healthcare and Energy, are deeply oversold. This suggests that we will likely see a decent market rally over the next week to rebalance portfolio risks. A weaker-than-expected inflation print or other soft economic data will likely provide the catalysts for the rally."

Such is precisely what happened with the technical bounce in the market following Wednesday's inflation report. As of 11 a.m. CST Friday, the market broke above several resistance levels, including the 20 and 50-DMA and the downtrend resistance from the December highs. That technical bounce and break of the downtrend clears the way for a potential retest of those market highs. Furthermore, on the bullish side of the ledger, that technical bounce has reversed the MACD "sell signal" and improved overall relative strength, which should support a rally into next week.

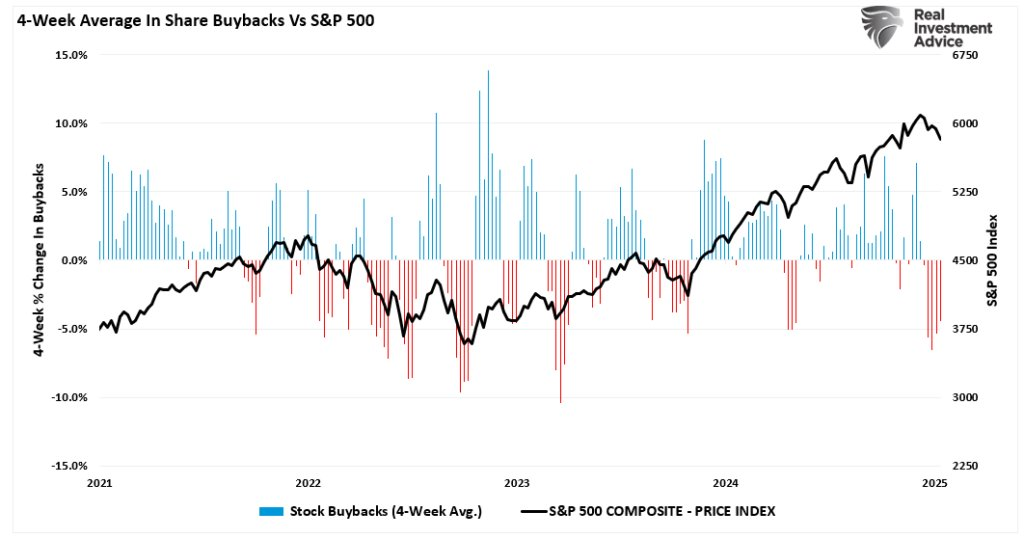

While the recent rally is a positive, we are not likely past the recent increase in volatility. There remain numerous concerns ahead for the market, but in the near term, markets will be supported by the return of share buybacks as we progress further into the Q4 earnings season. Such was a point I made Friday morning on "X."

"Speaking of share buybacks, in today's trading update I published the following two charts showing the correlation between the ebbs and flows of buybacks vs the market. Given we have been in a blackout period over the last few weeks, the market weakness was unsurprising. In 2025, the market is expected to set a record of $1 Trillion in repurchases."

We should continue to manage risk accordingly, but the near-term correction since the beginning of the year is likely over for now.

The Week Ahead

Fourth-quarter earnings reports will increasingly impact the markets over the next few weeks. While the largest market cap companies do not report this week, we will get reports helping us assess broad economic health, such as 3M, DR Horton, KeyCorp, GE, and Union Pacific. Thus far, bank earnings are beating expectations. However, a slew of regional banks will report this week. We may find that the smaller banks could not perform as well as the larger ones.

The markets are closed on Monday for Martin Luther King Jr. Day. Economic data will be light this week, and the Fed will enter its self-imposed media blackout heading into its meeting next Wednesday.

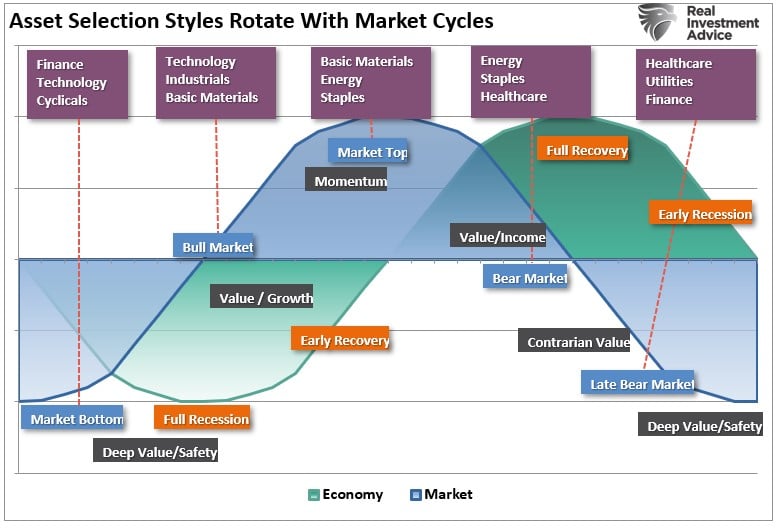

Gardening Guide To Better Portfolio Returns In 2025

Over the long term, investors’ most prominent mistake is failing to manage investment risk.

Individuals tend to do an excellent job of “buying” stocks. However, they are terrible at “selling” them. Of course, since the media only tells you to “buy,” such should not be surprising. However, “buying stocks” is only one-half of the investment transaction. Unfortunately, individuals tend to “sell stocks” only after accumulating significant losses. Such is the very nature of the “buy high, sell low” syndrome.

Over the years, I have found that our “gardening guide” resonates with individuals in managing their portfolio and investment risks.

In the “Spring,” it is time to till the soil and plant your seeds for your summer crops. Of course, one must water, fertilize, and pull the weeds; otherwise, the garden won’t grow. As the “Spring turns into Summer,” it’s time to harvest the garden’s bounty and rotate crops for the “Fall” cycle. Eventually, even those crops must be harvested before the “Winter” snows set in.

While many investors are skilled at planting gardens, they often forget to harvest the “bounty” they produce. Of course, if the garden’s production is not harvested, it will rot on the vine. Being a good gardener, or “having a green thumb,” is not a function of “luck,” but rather carefully planned actions to ensure the garden grows, the bounty gets harvested, and the garden is replanted.

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post Was CPI Better Than Good appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter